![]()

CHAPTER 1

The Balance of Payments and Exchange Rate

In our open economies, domestic residents can engage in a variety of international transactions involving the purchase or sale of goods, services, and assets. US residents buy European cars and US airplane manufacturers sell commercial jets to Australian airlines. Vineyards in California purchase the services of Mexican workers, while American universities sell their educational services to Saudi Arabian students. At the same time, US investors open Swiss bank accounts, and US multinational corporations are raising funds by selling stocks and bonds to foreign investors (Chinese and Japanese). These are the legal transactions that the balance of payments (BoP) intends to register. BoP accounts are an accounting record of all monetary transactions that have taken place during a given period between a country and the rest of the world.1

These transactions include payments for the country’s exports and imports of goods, services, financial capital, and financial transfers. The BoP accounts summarize international transactions for a specific period, usually a year, and are prepared in a single currency, typically the domestic currency of the country concerned. The BoP accounting system reveals whether countries are in surplus or deficit on trade or capital transactions with the rest of the world. Sources of funds for a nation, such as exports or the receipts of loans and investments, are recorded as positive or surplus items. Uses of funds, such as for imports or investment in foreign countries, are recorded as negative or deficit items.

When all components of the BoP accounts are included, they must sum to zero with no overall surplus or deficit (BoP = 0). Thus, the BoP is always in balance. For example, if a country is importing more than it exports, its trade balance will be in deficit, but the shortfall will have to be counterbalanced in other ways, such as by funds earned from its foreign investments, by running down central bank reserves, or by receiving loans from other countries.

The information given by the BoP is very useful for business managers, economists, government officials, and academics for many reasons. First, the BoP helps to forecast a country’s market potential, especially in the short-run. A country experiencing a serious trade account deficit is not likely to import as much as it would if it were running a surplus. It may welcome investments or use policies to stimulate exports and reduce its trade deficit. Second, the BoP can be used as an important indicator of pressure on a country’s foreign exchange rate (or on other domestic prices, if the country does not have its own currency, e.g., Eurozone members) and thus, on the potential for a firm trading with or investing in that country to experience exchange rate losses or gains because the country could be forced to depreciate or appreciate its currency (or to pursue a “domestic depreciation” on cost of production). Finally, the BoP is also important to government officials because it influences a nation’s GDP, employment, prices, exchange rate, interest rate, and public policies.

1.1 Measuring the Balance of Payments

The BoP accounts are a systematized procedure for measuring, summarizing, and stating the effects of all economic, financial, and accommodating transactions between residents of a country and residents of the rest of the world during a particular time period. Hundreds of thousands of international transactions are recorded every year on this international accounting system. If expenditures abroad by residents of one nation exceed what the residents of that nation can earn or otherwise receive from abroad, that nation is generally deemed to have a “deficit” in some account of its BoP. However, if a nation earns more abroad than it spends, that nation incurs a “surplus” in a sub-account of its balance of payments. BoP accounts are intended to show the size of any deficit or surplus and to indicate the manner in which it was financed—that is, settled by the central bank of the nation.

1.1.1 Debits and Credits of the Accounts of the Balance of Payments

Since international transactions involve transactions between the residents of the country and the rest of the world, the first thing to clarify is the notion of a “resident.” The concept of a resident is intended to encompass individuals, institutions, and the government of one nation. For example, when we speak of the transactions of US residents, we refer not only to the transactions of individuals in the United States, but also of US firms and the US government at all levels.

There are, however, enormous difficulties in accurately measuring international transactions. For instance, nobody knows exactly how many foreign temporary legal workers are in the country and are even less certain how many illegal workers there are and how much they earn. Also, no one knows how much illegally earned capital is deposited outside of a country by its residents.2 Determining the residence of multinational corporations is another problem. It is difficult to assign residence to a firm located in a number of countries.

The basic rule of BoP accounting is that any transaction giving rise to a receipt from the rest of the world is considered a credit (+) and appears as a positive item in the account; these are transactions in which the country earns foreign currency or assets. Any transaction giving rise to a payment to the rest of the world is a debit (–) and appears as a negative item; with these transactions, the country expends foreign assets. In general, international sales of a nation, whether in the form of goods, services, or assets, are regarded as credits; they generate “capital inflows.” Conversely, international purchases, whether in the form of goods, services, or assets, are regarded as debits. They generate “capital outflows” for the country).

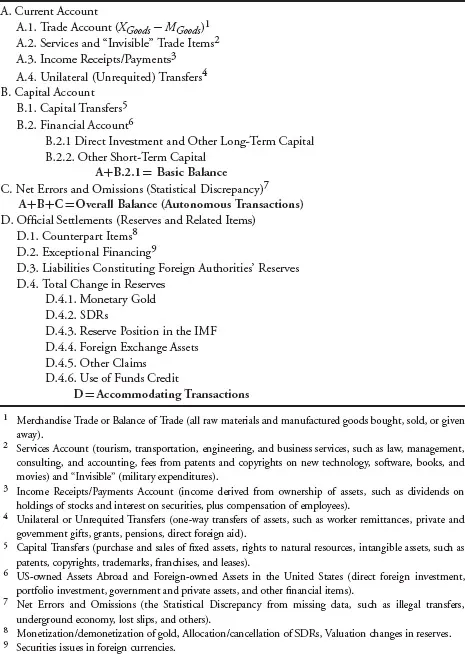

A common rule of thumb for BoP accounting is “follow the cash flow.” The BoP is composed of three basic groups of accounts: the current account (CA), the capital account (KA), and the official settlements (reserves) account (OS); each one of them is divided into some subaccounts.3 Exhibit 1.1 provides a summary of the accounts of the balance of payments.

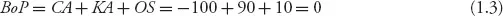

The overall BoP accounts will always balance when all types of payments are included; imbalances are possible on individual elements of the BoP, such as the current account or the capital account, excluding the central bank’s OS, or the sum of the two. Imbalances in the latter sum can result in surplus countries accumulating wealth, while deficit nations become increasingly indebted. The term “balance of payments” often refers to this sum (OS = 0):

A country’s balance of payments is said to be in surplus (equivalently, the balance of payments is positive) by a certain amount if sources of funds (such as exported goods sold and bonds sold) exceed uses of funds (such as paying for imported goods and paying for foreign bonds purchased) by that amount. The central bank settles the BoP to zero by accumulating foreign assets, or “gains” (OS < 0).

Exhibit 1.1 Balance of Payments (Summary)

There is said to be a balance of payments deficit (the balance of payments is said to be negative) if the CA is less than the KA. In this case, the central bank pays for the deficit by offering foreign assets, or “losses” (OS > 0).

Under a fixed exchange rate system, the central bank accommodates those flows by buying up any net inflow of funds into the country or by providing foreign currency funds to the foreign exchange market to match any international outflow of funds, thus preventing the funds’ flows from affecting the exchange rate between the country’s currency and other currencies. Then, the net change per year in the central bank’s foreign exchange r...