This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Emerging Economies and Firms in the Global Crisis

Book details

Book preview

Table of contents

Citations

About This Book

Comprised of chapters that explore the impact of the global crisis on emerging economies and firms and their response to it. The ways in which the leading emerging economies of Brazil, Russia, India and China are dealing with the challenges of the crisis are complemented by the methods applied by countries and firms in Central and Eastern Europe.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Emerging Economies and Firms in the Global Crisis by Marin Marinov,Svetla Marinova in PDF and/or ePUB format, as well as other popular books in Business & International Business. We have over one million books available in our catalogue for you to explore.

Information

1

The Global Crisis and the World: The Cases of Emerging and Developed Economies

Introduction

The global crisis represents a worldwide economic downturn that started with the financial crash of the US housing market. The price of housing reached unprecedented heights in 2005 then all of a sudden started crashing in 2006 (Perkins, 2009). The collapse was accompanied by deterioration in other sectors of the US economy. In a matter of months the financial breakdown spread throughout the entire US economy. Due to the interrelated and interdependent functioning of the world economy, within a year the crisis impacted to varying degrees the national economies of all countries around the globe (Krugman, 2009). The effect of the global crisis started to appear in the macroeconomic indicators of most countries, reaching its across-the-board climax soon afterwards.

The current global economic crisis has huge significance and has been compared to the Great Depression (see e.g. Harman, 2009; Wessel, 2010) that began in 1929 and lasted for at least a decade (Garraty, 1986). The cyclical nature of the functioning of the economy has accounted for its ups and downs or regional economic collapses. Thus in 1997 the countries of Southeast Asia experienced a colossal financial blow instigated by global banks and investors, determining that this region was an insecure context on which to capitalize and hastily withdrawing their financial assets (Rodrik, 2011). Consequently, the economies of the region were hit hard, prompting the Asian crisis, which rapidly engulfed the then weak Russian economy and eventually bringing economic dismay to Latin America.

The causes of the current global economic crisis are being investigated by many scholars. It is a common belief that US public monetary policy and the functioning of private financial institutions have impelled the crisis. US mortgage practices had been decentralized, lacked control, and were based on ever declining standards and the application of highrisk lending (Faiola et al., 2008). The uncompromising competition among mortgage lenders for market share and possible profits represented the spark that ignited the fire of the crisis. The cause of the crisis is also attributed to the debt inflicted in an exorbitant manner on the US economy.

The crisis resulted in the worsening of a series of macroeconomic indicators, which pointed to deteriorating economic performance first in one country and then on a global level. The real gross domestic product (GDP) started diminishing on a global scale in 2008, and in 2009 its fall was so significant that it matched the decline that was characteristic of the world economy during the Great Depression of the 1930s. Capital investment in domestic and foreign markets declined substantially, especially in the key investing countries from the developed world. Demand was plummeting and customer confidence evaporating. In the period 2006–2008 about US$15 trillion of the value of global firms from the Western world was wiped out.

In an attempt to stabilize the financial situation in 2008 and 2009, a number of banks were partially and temporarily privatized. Providing rescue plans for the national banking systems in particular, and the entire financial system in general, massive bailouts were implemented in most developed countries and to a lesser extent by several emerging economies.

Among the first victims of the crisis, apart from the US, was Iceland, which was followed by many other countries. Over time the global crisis brought financial instability and unpredictability to the US and also to most of the advanced economies. A clear example is the European Union (EU), where the crisis caused real problems in the Eurozone, in which 17 EU Member States share a currency (the Euro), which is the second most important currency after the US dollar. Hence, financial institutions in most of the Eurozone countries were downgraded. Some countries, such as Greece, are in a disastrous financial state having defaulted on their external debt.

While Poland has been the only EU Member State to circumvent shrinking of its GDP, many countries started experiencing economic recession even in 2008, including Estonia and Latvia. From the largest world economies, only China and France experienced a positive GDP change in 2008. Meanwhile at the beginning of 2009, the National Bank of Ukraine announced a 20 per cent decline in national GDP due to the excessive dependency of the Ukrainian economy on export revenue.

The global economic crisis has caused political volatility and unpredictability. The heads of states or governments in many Western countries have either been ousted from power or lost elections. Thus, in November 2011 the Greek prime minister, Papandreou, was overthrown from power as a result of the extremely negative consequences of the global crisis on Greece, and the former French president, Sarkozy, lost the confidence of the electorate in the second tour of presidential elections to victorious Hollande in May 2012.

The global crisis has caused huge protests in many countries as a reaction to the negative effects of the worsening economic and social conditions. Events such as the Arab Spring and the Occupy Wall Street Movement are clear indicators of the economic and social consequences of the global crisis. Countries such as Libya, Syria, and Bahrain have been through mass protests. In Libya these resulted in a regime change and the killing of the former leader of the country, Colonel Qaddafi. Having started in the autumn of 2011, the Occupy Wall Street protest was renewed in 2012. Such protests have not been confined to the developed world. Communist supporters and other opposition members gathered in Moscow in 2011 and 2012 to protest against the economic policy of the government, as well as the lack of orderliness and legality of the parliamentary and presidential elections in Russia. Due to a drastic fall in exports to the developed world, a significant increase in unemployment in some parts of China has resulted in massive social unrest since 2010.

Developed and emerging economies in the global crisis

A solution to the negative trends of economic performance caused by the global crisis has proved to be difficult to find and implement. There is a view that dealing successfully with the large macro imbalances and altering the downward trend of demand on the developed economies represent the greatest challenges in overcoming the global crisis. After a period of insubstantial and irregular recovery, growth of the world economy has presaging and dubious growth perspectives. Economic feebleness in key developed countries causes slogging worldwide economic recovery, which jeopardizes future recovery prospects. It seems that there are no fast and efficient solutions for the economic complications in the advanced economies, especially due to the devastating aftermath of their financial crises.

The largest developed economy, that of the US, has been struggling to get out of the longest and most severe recession that it has experienced since the Great Depression. The rate of its recovery has been much slower than anticipated and marred by inconsistencies. Registering a mere 2.6 per cent growth rate in 2010, the US economy growth rate was still lower in 2011. At such indeterminate recovery rates, the level of GDP is still struggling to return to its pre-crisis level. The economic performance in the crisis period of another key developed economy, that of the UK, is significantly more worrying. Being in recession in 2008 and 2009, the UK economy had a very tiny positive GDP growth in 2010. However, in the last quarter of 2011 it contracted by 0.3 per cent and in the first quarter of 2012 by 0.2 per cent, indicating that the country is in a double-dip recession.

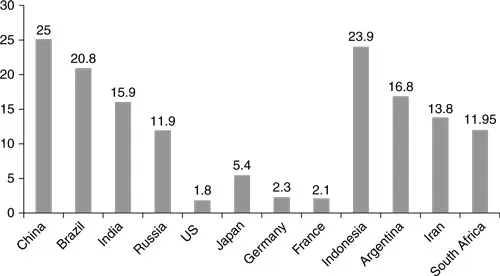

It is uncertain whether the fiscal consolidation plans that have been announced so far by governments of developed countries will impact positively on GDP growth in the period 2012–2015. The picture becomes less clear cut when considering the strong GDP growth in many emerging economies (see Figure 1.1) despite the crisis. Figure 1.1 presents the annualized GDP growth rates in percentage terms for three groups of economies for the period 2007–2011. The first group consists of the four largest emerging economies (Brazil, Russia, India, and China, known as the BRIC countries). The second group comprises the four most significant developed economies (the US, Japan, Germany, and France). The third group includes four sizable emerging economies (Indonesia, Argentina, Iran, and South Africa) with good growth rates of their annualized GDP during this period.

Figure 1.1 Annualized GDP growth rate, 2007–2011 (%)

Source: Authors, using raw data from the statistics of International Monetary Fund.

As Figure 1.1 illustrates, the move toward economic recovery has been led by the BRIC economies and some other populous economies of Asia, Latin America, and Africa. Increasing domestic demand and wellperforming exports have facilitated an appropriate response to and a quick recovery from the global economic downturn by many emerging economies.

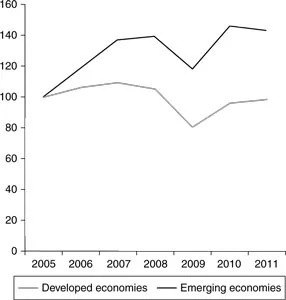

With a fast rebound since the second quarter of 2009, resilient emerging economies have pioneered the recovery of international trade (see Figure 1.2), building on trade ties between themselves and with other parts of the world through global value chains. As seen in Figure 1.2, by the end of 2010, trade originating from emerging economies had surpassed the pre-crisis level. The same was true for their manufacturing production. It is, however, uncertain whether the emerging economies will be able to sustain their vigorous growth rate in the future. The intensified trade ties among these countries are not sufficient to guarantee sustainability. The emerging economies are still very reliant on demand in the developed parts of the world to realize their exports. If emerging economies fail to continue their robust economic development, this will jeopardize prospects for economic recovery in the developed world as well as globally. It is, however, expected that the large and prosperous economy of China with its ever-growing domestic demand can take the lead in getting the world out of the current economic slump.

Figure 1.2 Volume of world trade by developed and emerging economies, 2005–2011 (volume of trade in 2005 = 100%)

Source: Authors, using data from Bureau for Economic Policy Analysis, CIB, the Netherlands.

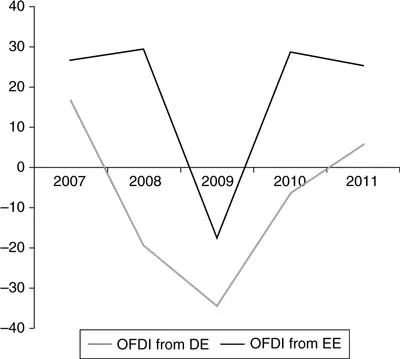

Initially, the global economic crisis had a negative impact on emerging economies’ outward investment. Thus in 2009, foreign direct investment (FDI) originating from emerging economies fell by 28 per cent after having reached a record level of US$207 billion in 2008. On a comparative scale, this deterioration was considerably less than the almost halved FDI outflows from the developed economies in 2009 vs. its level in 2008. Being major providers of FDI, the BRIC economies remain indisputable leaders, having provided, by the end of 2011, more than 70 per cent of the cumulative FDI from emerging economies (UNCTAD, 2011). Considering the FDI location of cross-border mergers and acquisitions (M&As) and greenfield investment, more than 60 per cent of the outward foreign direct investment (OFDI) flows from emerging economies has ended up in other emerging economies, mainly via greenfield investment, whereas emerging economy FDI into the developed world is primarily in the form of M&As (UNCTAD, 2011). As a consequence of the severe drop in OFDI originating from developed economies since the start of the global crisis, the prominence of OFDI from other emerging economies and mostly the so-called South– South FDI has become more than a third of the total investment flow in 2010 (UNCTAD, 2011).

Despite the continuing economic turmoil, the global FDI in 2011 rose by 17 per cent in comparison with its level in 2010 (UN New Centre, 2012). The dynamics in the fluctuation of OFDI originating from developed and developing countries using year-on-year change in percentage terms in the period 2007–2011 is presented in Figure 1.3.

In a pre-crisis introduction to a special issue of the Journal of International Business Studies, Luo and Tung (2007) present the solid foundations, motives, strategies, external and internal forces, and challenges and remedies for the internationalization of firms from emerging economies. Many authors (e.g. Enderwick, 2009; Gammeltoft, 2010; Marinova and Marinov, 2011) express their belief that emerging economies and their firms will provide a trigger to economic advancement and provide key assistance in exiting from the global crisis.

Figure 1.3 Year-on-year percentage change in OFDI from developed and emerging economies, 2007–2011

Source: Authors, based on data from UNCTAD.

Overview of this book

Chapter 2 by Geraldine McAllister and Karl P. Sauvant presents an analysis of OFDI by emerging economy multinationals, putting in focus the way in which they deal with the challenges that the global crisis presents to them. Revealing the changing cross-border patterns of investment flows, the authors bring to our attention key issues, such as the formation of a ‘New Triad’ and the new sectoral composition of foreign investment. The coping strategies of emerging economies in the global crisis are investigated, placing emphasis on the specifics of the BRIC economies. Furthermore, the authors deal with the future challenges concerning strategic issues as well as issues of home and host country policy, facing global firms from emerging economies amid the insecurity of economic upheaval. The chapter ends with recommendations concerning the aspects of sustained OFDI by emerging economy multinational firms.

In Chapter 3, Fabio Bertoni, Stefano Elia, and Larissa Rabbiosi address the trends and patterns of OFDI by BRIC economies via M&As in developed economies. They present the characteristics from 417 acquisitions in developed countries, made by Brazil, Russia, India, and China. Various investment strategies and motives of market-seeking, asset-seeking and resource-seeking nature are uncovered, and underlying horizontal, vertical, related, and conglomerate investments have been identified. The authors have conducted a detailed analysis of a subsample of 115 Western European firms acquired by multinationals from BRIC economies, which reveals that Chinese multinational firms tend to follow aggressive acquisition strategies by taking over poorly performing firms. Moreover, target firms involved in conglomerate and horizontal investments appear to be the largest among those studied, whereas horizontal and vertical investments are on average aimed at better-performing targets than conglomerate and related investments. By exploring the specifics and the motives of BRIC acquisitions in developed economies, this chapter concludes that acquisitions by BRIC economies of firms in developed countries are expected to increase significantly in the future, spurred by the effect of the global crisis on foreign investment patterns.

In Chapter 4, Witold Wilinski focuses his attention on the internationalization of countries and firms in Central and Eastern Europe during the global crisis. He reveals the main financial and investment aspects of the internationalization of national economies and their multinational firms from the region. Micro level strategies and internationalization drivers are put under scrutiny. The chapter concludes by showing that the global crisis has affected investment strategies of multinationals from Central and Eastern Europe in terms of volume and location of investments, whereas investing firms from Asian emerging economies have benefited from the crisis by intensifying their OFDI, spreading their international expansion aggressively.

In Chapter 5, Thomas Borghoff reveals the role of globalization in building up international activities, including four sub-processes in the globalization of small and medium-sized enterprises (SMEs) from China, India, New Zealand, and Singapore in the crisis. The first sub-process has been identified as ‘global found...

Table of contents

- Cover

- Title Page

- Copyright

- Contents

- List of Illustrations

- List of Contributors

- 1. The Global Crisis and the World: The Cases of Emerging and Developed Economies

- 2. Foreign Direct Investment by Emerging Economy Multinationals: Coping with the Global Crisis

- 3. Outward FDI from the BRICs: Trends and Patterns of Acquisitions in Advanced Countries

- 4. Internationalization of Central and Eastern European Countries and their Firms in the Global Crisis

- 5. Information and Communication Technologies in the Globalization of Small and Medium-Sized Firms during the Global Crisis: An Empirical Study in China, India, New Zealand, and Singapore

- 6. An Analysis of the Macroeconomic Determinants of Indian Outward Foreign Direct Investment

- 7. Influence of Cultural Distance on Chinese Outward Foreign Direct Investment

- 8. Russia’s Emerging Multinationals in the Global Crisis

- 9. Internationalization of Chinese Car Manufacturers

- 10. Location Determinants of Polish Outward Foreign Direct Investment and the Impact of the Global Crisis

- 11. Reactions of Slovene Multinational Firms to the Global Crisis

- 12. Impact of the Global Crisis on the Internationalization of Estonian Firms: A Case Study

- 13. Servicing Local Customers for Entering Foreign Markets: Internationalization of Russian IT Firms

- 14. Longitudinal Internationalization Processes of Born Globals: Three Chinese Cases of Radical Change and the Global Crisis

- Index