eBook - ePub

International Debt

Economic, Financial, Monetary, Political and Regulatory Aspects

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

International Debt

Economic, Financial, Monetary, Political and Regulatory Aspects

Book details

Book preview

Table of contents

Citations

About This Book

Written by a group of international experts, this book focuses on three interdependent themes: (a) origins and consequences of the current debt crisis; (b) the systemic nature of the crisis; (c) national and international policy efforts to avoid a global collapse and bring about lasting reforms in the Euro zone and in the financial system.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access International Debt by Constantine Stephanou, O. Hieronymi in PDF and/or ePUB format, as well as other popular books in Business & Corporate Finance. We have over one million books available in our catalogue for you to explore.

Information

1

The International Monetary System and the Debt Issue

Introduction

The crisis of “global finance” that broke into the open in 2008 has not been resolved so far. There is a broad consensus that it is in the interest of all countries to find a solution that will prevent a drastic erosion of the value of financial assets—people’s savings—and will allow a return to sustained growth. This solution will have to be based on reliable theoretical concepts and up-to-date data and analyses. Above all, it will need political cooperation, innovation and reforms. A key task in this context is the rebuilding of a stable international monetary system.

The present chapter is divided into six sections:

1. The debt crisis as “Stage II” of the crisis of the international monetary and financial order

2. The international monetary system as a “balancing” or a “destabilizing” factor

3. The “40-year crisis,” a period of recurring international debt crises

4. The current debt crisis and the crisis of the Euro zone

5. The role of economic theories and societal models and the future of the model of the “social market economy”

6. The necessary conditions for finding “the way out.”

1.1 The debt crisis: “Stage II” of the crisis of the international monetary and financial order

The circumstances, the mood in the world economy, the financial, monetary, economic and political uncertainty, and the fear of a global collapse in the autumn of 2008 eerily resemble the situation prevailing in the spring of 2012. The “international debt crisis,” which began to capture the attention of both markets and policy makers in the spring of 2010, represents “Stage II” of the crisis of the international monetary and financial system that broke fully into the open with the demise of the investment bank Lehman Brothers in September 2008. The extent and suddenness of Stage I—the so-called subprime crisis—had caught the markets, the authorities and the general public off-guard and induced widespread fear of a meltdown of the international banking system with unprecedented consequences for the world economy. Stage II—the debt crisis—should have been less “unexpected.” Its emergence had some common causes with the “subprime crisis” (which obviously was also a “debt crisis”). At the same time, it was and remains the logical sequence and consequence of (1) the subprime crisis itself and (2) the panoply of emergency measures adopted to avoid a free fall of economic activity and the unraveling of the entire “global finance” system.

At the time of writing, it seems that the crisis of the international monetary and financial system is far from over. For one, despite the important and courageous efforts undertaken, and the remarkable degree of cooperation between national and international authorities and the private sector, no fully reliable and acceptable solution of the short- and the long-term debt problem has been found so far. It is also clear that a real threat of “Stage III” and “Stage IV” of the global crisis is looming on the horizon.

These new potential stages can best be highlighted with two sets of questions:

1. How and when will the main Organization of Economic Cooperation and Development (OECD) economies return to “real interest rates”? Will or can there be a “soft-landing”? What will be the consequences for savers, borrowers and for economic activity? Who will be the winners and the losers? Will there be equitable burden sharing?

2. What happens if the financial and monetary crisis and in particular the debt crisis and the solutions being adopted to deal with it lead to a significant and lasting reduction of the growth rate of the OECD economies? How will this affect the individual countries (the “weak ones” and the “strong ones”), and what will be the impact on the already excessive gap between a well-off minority and a struggling majority? Will the loss of momentum in the “real economy” aggravate the financial and monetary crisis and jeopardize the solution of the debt problem?

Stages III and IV are not part of this chapter nor of the book as a whole. They are mentioned here essentially because they will have to be dealt with sooner or later if the threat of “Stage III” and “Stage IV” is to be avoided. One of the factors responsible for the gravity of the “debt crisis” was the “short-termist view” that prevailed before and after the Lehman Brothers explosion. A second reason, closely connected to the first one, is that a principal cause of the “subprime crisis,” the “debt crisis” and the fragility of the global financial system is the absence of a properly working international monetary order. This is the topic of the present chapter.

The first and most important issue here—and in fact in the entire book—is the extent to which “international monetary systems” are a “balancing factor” or a “factor of destabilization.” The common view is that they can be both, depending on the international monetary system and national monetary orders and policies. The conclusion of the authors of this book is that the current fragmented international monetary system is responsible for the present and previous financial and debt crises, and the main source of concern about the future. The connection between the debt problem and the defects of the international monetary system can be illustrated by the facts that (1) the United States, the largest and richest economy, is facing considerable difficulty to reduce its large balance-of-payments deficits and halt its growing external indebtedness; and (2) the debt problems of Greece, one of the smaller member countries of the European Union and the Euro zone, are threatening the very survival of the Monetary Union and the European project itself.

This book is a follow-up to an earlier volume also published by Palgrave Macmillan in 2009, under the title Globalization and the Reform of the International Banking and Monetary System. Unfortunately, some of the conclusions and warnings that were raised in that earlier book seem to have been proved correct. The announcement of Webster University’s November 2011 conference (which led to the preparation of the present volume) stated:

One of the conclusions of the 2008 Webster conference and of the 2009 book was that the crisis of global finance threatens to become the crisis of globalization itself. It was also clear that correcting the root causes of the 2007 and 2008 crisis and overcoming its consequences will be a long-term process that will require both political consensus and national and international solidarity. Four years after the outbreak of the “subprime” mortgage debt crisis and three years after the collapse of the investment bank Lehman Brothers, the debt issue remains today at the center of national and international political and economic preoccupations. The massive injections into the world economy of central bank liquidity and of government funds helped prevent a collapse of the international banking system, but as expected, they have aggravated rather than eased the issue of excessive indebtedness.

1.1.1 Why “Stage II” of the crisis?

The following related groups of factors have been responsible for the nature and the magnitude of the “second wave” of the crisis: (1) structural shortcomings of the Euro zone system; (2) reckless policies in some of the member countries and policy divergences throughout the Union; and (3) the exorbitant cost of dealing with the impact of the “first wave” of the crisis and in particular the solutions chosen to prevent bankruptcies in the banking and financial system. Considering the magnitude of these challenges and the risks involved in both action and inaction, European governments and institutions have done quite well in stemming the crisis and finding common solutions and compromises under great time pressure. Compared with the brinkmanship that has prevailed in the United States—especially on the side of the Republicans—since September 2008 in fiscal, monetary and regulatory respects, the performance of European leaders and institutions has been quite remarkable.

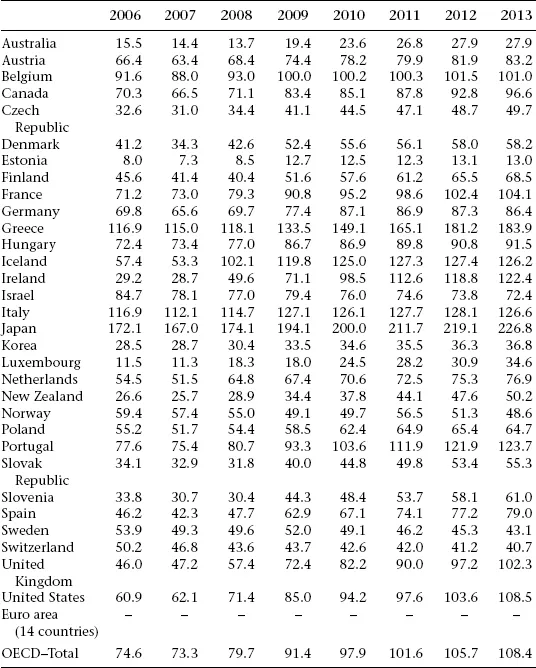

Table 1.1 Government debt of the OECD countries, 2007–13: General government gross financial liabilities as a percentage of GDP

Last updated: 5 December 2011.

Source: OECD Economic Outlook No. 90, OECD Economic Outlook: Statistics and Projections (database).

Source: OECD Economic Outlook No. 90, OECD Economic Outlook: Statistics and Projections (database).

In contrast to the financial and monetary crises of the 1980s and the 1990s (the post-oil shock international debt crisis, the second Mexican debt crisis, the Asian and Russian financial crises), the current crisis is centered on the OECD economies: the United States, the small and large Western European countries (and the Euro area as a whole) (Table 1.1). The countries directly concerned also include Japan, where, faced with a debt to GDP ratio of 200%, the authorities, the banks and the corporations remain clueless in trying to bring their economy back to the path of its impressive past performance. The crisis also reached Switzerland where the authorities had to resort to extraordinary measures to ward off speculative currency inflows and the resulting overvaluation of the Swiss currency.

1.1.2 Principal conclusions

The conclusions of this chapter1 can be summed up in the following points:

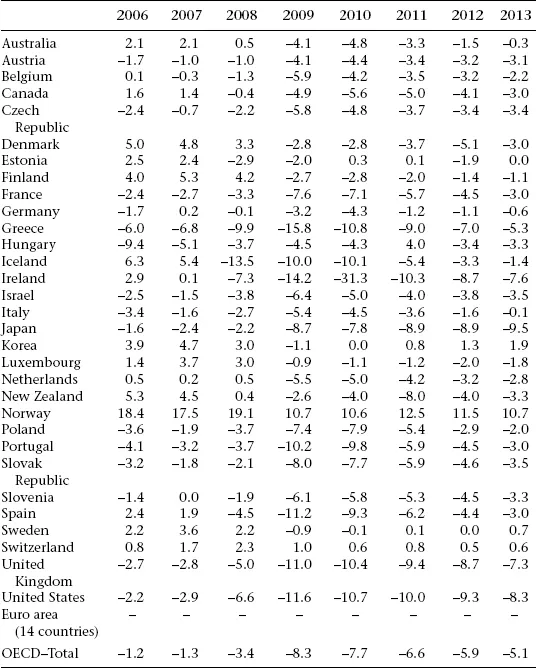

The breakup of the Monetary Union has to be prevented: Preventing the breakup of the Monetary Union has to remain the first priority not only of the European Union but also of the other leading OECD countries—the United States and Japan (Table 1.2). The rules of the Euro zone are far from perfect. In particular, the lack of explicit rights and duties of the European Central Bank (ECB) to show concern for the external value of the common currency and for the level of economic activity represent serious shortcomings in the initial design and in the actual record of the ECB. However, without the Euro zone the international monetary and financial crisis would have been even more difficult to manage than was the case in the period since 2008. The de facto exclusion of the country that looks like the “weakest link” at present (which happens to be Greece) could sooner or later have a domino effect. Moreover, the negative impact on the so-called strong economies (in particular Germany) would be much larger than expected by those—within the European Union and outside—who are not only predicting but also advocating the end of the “experiment with the common currency.” The international consequences could be comparable to the aftermath of the Camp David decisions of August 1971 or following the collapse of the Austrian Creditanstalt in the early 1930s.

Table 1.2 Government deficit of the OECD countries, 2006–13: Net lending/net borrowing as a percentage of GDP, surplus (+), deficit (–)

Last updated: 5 December 2011.

Source: OECD Economic Outlook No. 90, OECD Economic Outlook: Statistics and Projections (database).

Source: OECD Economic Outlook No. 90, OECD Economic Outlook: Statistics and Projections (database).

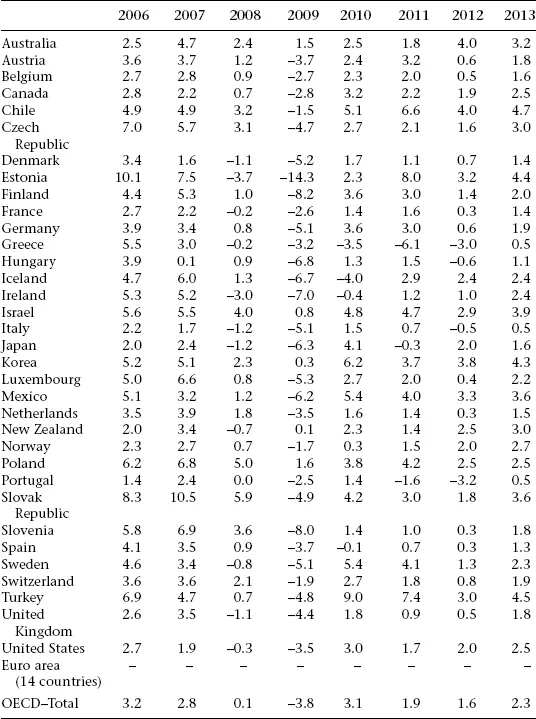

Table 1.3 Real gross domestic product of the OECD countries, 2006–13: Percentage change over previous period

Last updated: 5 December 2011.

Source: OECD Economic Outlook No. 90, OECD Economic Outlook: Statistics and Projections (database).

Source: OECD Economic Outlook No. 90, OECD Economic Outlook: Statistics and Projections (database).

Absence of international monetary order: The so-called subprime crisis that threatened a global financial meltdown was not just an overblown, unexpected bubble due to real-estate mortgage debt manipulation and speculation. It was likely to happen and should have been expected. It was the latest and most dangerous in the long series of avoidable crises that the world has known since August 1971—that is, ever since a common or global international monetary order has been lacking.

Monetary nationalism vs financial and economic globalization: There has been a dichotomy between financial and economic liberalization, marketization and globalization, on the one hand, and the prevailing monetary nationalism and refusal of central banks and governments to recognize the importance of a stable, flexible and rule-based international monetary order, on the other. This and the refusal to assume the responsibility to design, negotiate and implement such an order would remain the main obstacles to rebuilding an equitable and liberal financial system.

Short-term agitation and the unbalanced reform-agenda: Although there was massive response to the “subprime” and “Lehman Brothers” crises, this response and the “reform agenda” were dangerously unbalanced. They were reactive and marked by short-termism. They focused almost exclusively on “banks” (according to their definition of “banks”) and neglected domestic as well as international monetary issues. Especially there was no attention paid to the reform of the international monetary system and scant attention to the consequences of massive short-term rescue spending and liquidity creation. Today’s “debt crisis” and “Euro zone crisis” are reminders of yesterday’s short-sightedness.

The need for close cooperation between the US, Europe and Japan on the reform of the international monetary system: In order to manage both Stage II (the debt crisis) and the possible Stages III and IV mentioned previously, a closer cooperation between the three pillars of the liberal international economic system—the United States, Europe and Japan—is indispensable not only in short-term crisis management, but also on the important longer-term task of creating a rule-based international monetary system (Table 1.3). The architects of this new system should learn from the shortcomings both of the gold exchange system and of the instability and excesses of the “non-system” that has prevailed for the last 40 years.2

1.2 The international monetary system: Balancing or destabilizing?

1.2.1 The functio...

Table of contents

- Cover

- Title

- Copyright

- Contents

- List of Figures and Tables

- Notes on Contributors

- Acknowledgments

- Introduction

- 1 The International Monetary System and the Debt Issue

- 2 The Dual Debt Problem in the Us and in Europe: are Policy Makers Addressing the Right Issues?

- 3 The Illusion of Monetary Sovereignty

- 4 Building Firewalls: European Responses to the Sovereign Debt Crisis

- 5 The Case for a Sovereigns’ Bankruptcy Procedure

- 6 The Impact of the Current Euro Zone Fiscal Crisis On the Greek Banking Sector and the Measures Adopted to Preserve its Stability

- 7 Options, Decisions and Implementation under Extreme Market Conditions: Economic Policy in Greece the Day After

- 8 Quo Vadis Global Financial Governance?

- 9 International Debt and Globalization

- 10 Conclusions and Outlook

- Appendix: The Information Crisis and the Need to Improve the Availability and the Use of Relevant Statistics

- Bibliography

- Index