eBook - ePub

Credit Portfolio Management

A Practitioner's Guide to the Active Management of Credit Risks

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Credit Portfolio Management

A Practitioner's Guide to the Active Management of Credit Risks

Book details

Book preview

Table of contents

Citations

About This Book

Credit Portfolio Management is a topical text on approaches to the active management of credit risks. The book is a valuable, up to date guide for portfolio management practitioners. Its content comprises of three main parts: The framework for managing credit risks, Active Credit Portfolio Management in practice and Hedging techniques and toolkits.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Credit Portfolio Management by Michael Hünseler in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.

Information

Part I

Charting the Course – Credit Risk Strategies

The intense challenges for financial institutions arising from the lasting difficult market conditions call for a systematic, proactive and sustainable approach to credit risk management. The public perception of the value that banks contribute to a society has been shaken and needs to regain confidence. Ever more demanding regulators push banks to measure, manage and monitor their risks in a prudent and consistent way, with the objective being to safeguard the firm’s capital adequacy. A comprehensive framework for taking acceptable risks, the risk appetite, and derived credit-risk strategies aim at a coordinated and stringent approach to risks. Since the transformation of traditional banking into a credit risk structuring and distribution approach has effectively reversed, emphasis is again put on sound credit risk origination, management and control processes in order to meet stakeholder expectations and to guarantee the future of the organization. Part I of this book deals with the framework that charts the course in which credit risk is originated and managed. It is comprised of three chapters: the first provides a brief description of the role that credit risk played in the financial crisis and thereafter; the second deals with the credit risk strategies which aim at optimizing the risk/return profile of the portfolio under the condition of adequate capital; and finally the third chapter provides an introduction to stress tests which support a proactive and forward-looking approach to portfolio management by letting the improbable become quantifiable.

1

The Case for Credit Portfolio Management

The unprecedented dynamics of credit markets as well as reinforced regulatory and shareholder pressure requires banks to reassess their conventional methods of transacting business and often leaves them in an enduring transition phase. With investors again in search of yield enhancements and portfolio managers in need of hedging and return on capital improvement, a new equilibrium with generally lower liquidity but improved transparency and counterparty risk management seems to be found. Additionally, the formerly distinct loan, corporate bond and credit derivative markets increasingly merge as alternative sources for acquiring credit risk and for refinancing, serving the needs of both investors and borrowers. A record-setting new issuance of corporate bonds in 2010, 2011 and again in 2012 bears witness to the decision of corporate treasurers to prefer reliability of available funds over flexibility in terms and conditions that only loans offer. As a Bloomberg article1 noted, the amount that firms borrowed in the form of syndicated loans and credit lines fell by a hefty 13 per cent for the U.S. and 25 per cent for Europe in 2012 compared to same period in 2011, while corporate bond issues in Europe now account for 52 per cent of the €467 bn total new funding volume, overtaking loans for the first time in history. This is certainly also owed to the increased reluctance of banks to provide sufficient liquidity to corporates when they needed it the most during the financial crisis. On the other hand, with some banks having to turn to central banks for last resort lending, the traditional monetary supply transmission mechanism appears to be disturbed. Consequently, an integrated approach to credit and liquidity risk management has become one of the major objectives of portfolio management at financial institutions. While the details of Basel III and Solvency II were still under development, banks started to anticipate the rules with effects already coming through. Standard and Poor’s predicts that Eurozone corporates will bear the brunt of additional debt costs when borrowing at banks, with estimates ranging from €30 bn to €50 bn per year when the new regulations are fully implemented in 2018.2 Regardless how accurate Standard and Poor’s prediction of the rise of the cost of debt is, the cornerstones of Basel III will very likely lead to a more restrictive lending and in particular will make certain credit products economically less attractive. For instance, banks have to put in place capital and liquidity for credit commitments even when those loans remain undrawn and are likely to pass on the extra costs to their clients wherever possible. Hence, corporate treasurers will have no choice but to pay the price. In turn, they are expected to increasingly tap financial markets for funding. Banks may find a new niche in advising those clients that think about alternative sources of funds, thereby leveraging on their role as the borrowers ‘agent’ with the lending relationship serving as a kind of certification of credit worthiness for other capital market investors.3 While the prospects for debt capital markets business appear to be rosier, the perspectives for proprietary and non-proprietary trading are not as bright. Significant additional capital charges for over-the-counter derivatives will eat up a reasonable chunk of the return on equity for trading, with possibly pronounced negative implications for the liquidity of secondary markets for debt securities and derivatives. The round trip of investor-initiated trades, which usually ends up with one of the bulge bracket investment banks before finally being passed on to another investor at a later point of time, may have seen its best time. All these developments accumulate in a changed landscape in which portfolio managers operate. They may respond by reviving credit risk mitigation techniques other than credit derivatives, i.e. guarantees or sub-participations to fine tune their credit portfolios. At the same time, European corporate debt pricing will probably soar when the debt market catches up with its U.S. counterpart which still accounts for a dominant share of the global corporate bond market. In addition, the concerns about the European sovereign indebtedness currently contribute to a hefty increase in risk premiums. As a consequence, if the gap between loan margins and hedge costs widens further, it is increasingly unlikely to be closed by client revenues generated from cross-selling. However, the convergence of bank loans and debt capital market instruments will not only create feedback loops for pricing of loans. The connectivity of credit-risk prices will also enhance the ability to value credit instruments based on markets risk premiums, even though client relationship managers for obvious reasons tend to dismiss profitability measures based on shadow prices derived from financial markets. A cross debt asset classes view permits a dynamic credit portfolio management by adopting an asset-manager-like approach. Determining relative value and finally deriving the optimal portfolio composition even for less liquid credit risks may sound challenging but it is a unique advantage that integrated credit markets offer – and implicitly underpins the role of an active credit portfolio management of a bank.

1.1 Evolution and innovation: ups and downs of credit

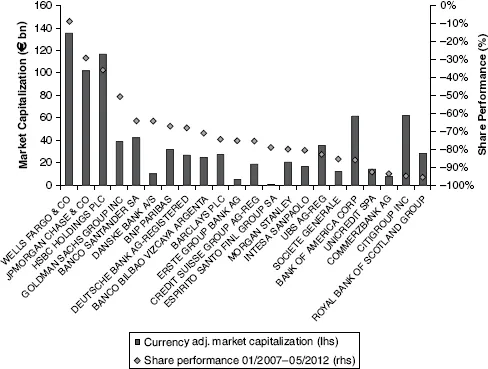

Credit risks remain the dominant challenge for regulators as well as for risk managers. The regulatory framework for credit risk is in continuous revision mode since it was introduced in 1988. According to the Financial Times, financial services companies were confronted with an average of 60 regulatory changes every working day in 2011.4 Numerous initiatives accompany the Dodd-Frank Reform Act and Basel III, but international and domestic approaches appear to be not well coordinated. After decades of spectacular growth, the new Basel III rules will let the banks tighten their belts. An estimated additional core Tier 1 capital of $1.3 trn has to be raised by banks worldwide until 2015 to comply with the standards. If no new capital is available or is available but too expensive, lenders will have to shed assets. Cutting risk-weighted assets, or optimizing the balance sheet as banks prefer to call it, often takes place by adjusting models and parameters rather than squeezing the asset base or raise equity when share prices are battered. Consequently, it receives close scrutiny by regulators since it represents a cheaper way of improving the capital ratio while not necessarily enhancing the ability to absorb losses. However, even within models and ratings there is (economically justifiable) room for discretion. The complexity of measuring credit risks to determine appropriate amounts of capital to hold for losses and to manage portfolios of credit risks still attracts a great deal of scientific research. Although the activities of credit portfolio managers who are engaged in selling, hedging, structuring, securitizing and repackaging became a highly profitable business for investment banks, the post Lehman default era will see a back-to-the-roots reversal of the practices of financial institutions to manage their credit risks. The prevailing and unsettling uncertainties over the future and function of banking and finance and the corresponding implications for the global economy make it paramount for both business and risk managers of financial institutions to take responsibility. Part of that responsibility might be expressed by a change in the mental attitude towards models, fundamental assumptions and risk in general. The sophisticated quantification of risks by means of probability distributions and correlations more than ever needs to be complemented by experience, intuition and expert judgement, with regular questioning of risk and return to become a usual habit when the lessons taught by the financial crisis should have any effect. The in many cases disappointing performance of bank shares over the last couple of years confirms that the financial industry faces challenging times.

Figure 1.1 Performance of bank shares and market capitalization5

Data source: Bloomberg.

1.2 The age of credit crises

These days, one of the most penetrating phrases of Wall Street trading rooms is the ‘black swan’ event, depicted by the 2007 bestseller of Nassim Taleb. In his book The Black Swan: The Impact of the Highly Improbable, the former option trader got the timing right. Only shortly after publication of the book in May 2007, the subprime crisis devastated the global financial landscape, with banks suffering from at least $188 billion of writedowns and shockwaves still roiling markets many years later. For some it might look as a flock of black swans found their new home in global financial markets. A black swan event is rare by definition and for sure it’s not meant to happen regularly and frequently, but once or twice in a lifetime like an eclipse of the sun. The low probability of occurrence combined with a high impact makes for the definition of tail risk. However, large-impact events became more frequent during the last decade with the subprime crisis, the Lehman default and Greek tragedy being the most prominent ones. Statistically, tail risk is understood to become reality with a 2.5 per cent chance under the standard normal distribution. And not all these once-in-40-years events may fulfil the big impact criteria. The scope of the high impact rare events, known as fat tails in quantspeak because this is what the bell curve shape is similar to when plotted, causes some distress in self-confidence of risk managers. It basically raises the question whether there is a way of accurately predicting risks or if stress tests – designed to describe and forecast risks – and models are flawed by definition, utterly useless and consistently underestimating risks which might eventually break financial institutions. Or as a senior executive at a European bank puts it: ‘Normal distribution is man made. Life is negatively skewed.’ A permanent change from the low-volatility environment to more unstable and uncertain conditions seems to be confirmed by the distribution of daily price moves of the larger banks and brokers. For decades, the majority of daily stock price moves have been small with the bulk of them concentrated around +/–1 per cent. Since 2008, when the subprime crisis fully unfolded, the distribution of changes in equity value shifted significantly to larger moves, reflecting the increased volatility and risks in the financial industry.

One of the reasons for this paradigm shift is the overwhelming growth of difficult-to-value assets and investments during the last decade, which turned into unprecedented losses during the financial crisis. Many financial experts and highly skilled professionals were forced to realize that they knew little about what they took for granted: the ability to assess and corr...

Table of contents

- Cover

- Title

- Part I Charting the Course – Credit Risk Strategies

- Part II Credit Portfolio Management in Practice

- Part III Hedging Techniques and Toolkits

- References

- Index