This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

Monetary Policy, central banking, and international norms and regulations; a discussion far from new, nor applying exclusively to the world's most advanced economies. A sound monetary policy and a well-enforced regulatory regime is provided, in explanation of developing nations to channel financial resources more efficiently into investments.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Monetary Policies, Banking Systems, Regulatory Convergence, Efficiency and Growth in the Mediterranean by R. Ayadi,S. Mouley in PDF and/or ePUB format, as well as other popular books in Business & Corporate Finance. We have over one million books available in our catalogue for you to explore.

Information

1

Monetary Policy and Central Banking Independence

The recent global financial crisis coupled with the post Arab spring instability effects have called for a rethinking of monetary policies and the role of central banking in the Mediterranean region. This chapter assesses the challenges of the conduct of monetary policies and central banks’ independence. It also explores new elements towards the rethinking of the central banking role and evolving rules in the aftermath of the recent crisis and changing macroeconomic environment in Mediterranean countries. It outlines important lessons for monetary policies and central banking, in particular with respect to inflation targeting. The contribution makes a case in favour of central banks’ independence from budgetary authorities and the importance of this independence to achieve inclusive growth.

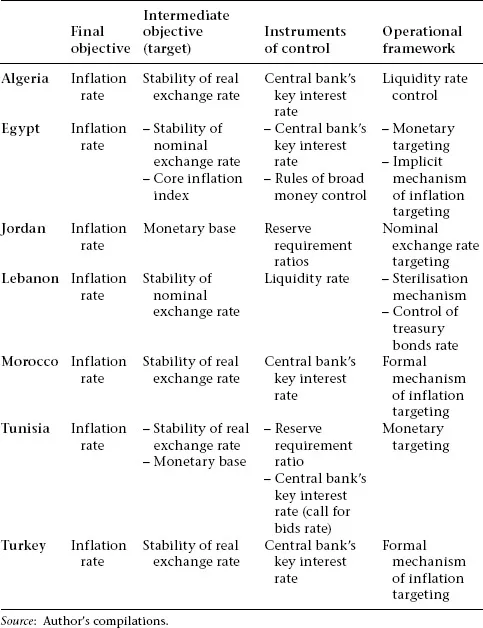

1.1 Operational frameworks of monetary policies conduct

An analysis of the tools for the implementation of monetary policies by central banks in Mediterranean countries reveals an apparent homogeneity in their operational frameworks, albeit with differences in details and varying degrees of progress. Although price stability remains the announced final objective, weaknesses in terms of regulation and control of interest rates as an operational objective mean that the monetary authorities are required to adopt quantitative approaches based on targeting monetary and credit aggregates as intermediate objectives.

Differences are nevertheless discernible in the oil exporting countries (Algeria and Libya in particular) with restrictive monetary policies in place to control the monetary base and absorb the structural liquidity surplus in the banking system. In other countries, restrictive monetary policies are used by raising key interest rates in order to maintain a positive real interest rate in the money market. Generally, we can discern a lower level of interest rate in the dynamics of growth, except in the case of crisis exit strategies (Tunisia, Egypt), and measures for diversification of the instruments of monetary policies, with gradual recourse to underlying and core indicators.

Limited operational independence and slow migration to systems for formal inflation targeting characterise most of the central banks, with the exception of Turkey and Morocco. The excessive use of subsidy and price control mechanisms seems to be the main obstacle to the adoption of explicit inflation targets.

Regarding exchange rate policies, targeting the real effective exchange rate is the operational rule in the case of countries choosing managed floating schemes, while fixed anchoring of the nominal exchange rate is the primary instrument in the pegging regimes to the dollar or to Special Drawing Rights.

In this context, reforms of the monetary and financial systems in these countries have certainly progressed, but are still characterised by latent deficiencies. In particular, although there has been some improvement, the levels of intermediation are relatively low, lying below the average of those in the East Asia and Pacific Region or the levels in the advanced economies of OECD countries. Overall, contributions of capital markets are weak but are progressing in some countries (Turkey, Morocco, Lebanon and Egypt) (see Chapter 2).

Programmes aimed at restructuring of banking systems (supervision, prudential norms and so on) for better resilience have been initiated, but recurring vulnerabilities remain concentrated on the portfolios of nonperforming loans with insufficient provisioning (except in the particular case of Morocco) (see Chapter 3). In addition, the attractiveness of foreign investment in most countries is lessened by several constraints, in particular the slow pace of capital accounts liberalisation and the lack of management structures for systemic liquidity.

Generally, economic and financial governance in these countries is clearly an incomplete process, as evidenced by the widespread deficiencies in business and investment climate and weakness in the quality of institutions.

In Algeria, a cautious monetary policy has been pursued over the last few years, in line with the official objective of controlling inflation. Hence, the Bank of Algeria has continued to absorb the structural liquidity surplus of the banking system through auctions to counterbalance budgetary stimulation and the rapid growth in bank deposits by the national oil company. The expansion of credit in the economy has slowed significantly.

Table 1.1 Operational framework for monetary policy in southern Mediterranean countries

Egypt had an extremely high rate of inflation, reaching 16.2 per cent in 2008–9 before falling to 11.7 per cent in 2009–10. Inflationary pressures appeared in the summer of 2006, accelerating at the end of 2007, and especially in the spring of 2008, because of the rise in the price of wheat, increases in salaries and a partial reduction of subsidies on fuels. At the end of August 2008, the consumer price index (CPI) reached a peak of 23.6 per cent on a year-on-year basis. Monetary policy was thus accommodative and reactive, as it was during the global financial crisis when in 2009 the central bank introduced six increases of the key interest rate to contain inflationary pressures and ensure macroeconomic stability. In fact, since 2003 monetary policy has undergone in-depth restructuring with the enactment of a law modernising the conceptual and operational framework, by steering it towards price stability and by strengthening the autonomy of the central bank. The central bank has also begun a gradual process of migration towards a formal system of inflation targeting by developing new monetary instruments to allow a new target rate to be set. In 2009 the central bank launched a core inflation index based on the unadjusted CPI.

In Jordan the annual average inflation rate, determined by the CPI, stabilised at 4.1 per cent during the last decade (6.3 per cent in 2006 and 13.9 per cent in 20081), and responds mainly to the trend in oil and food prices. Also, the depreciation of the US dollar observed since 2006 partially contributed to the increase of the inflation rate during this period, due to the pegging of the local currency to the dollar. In order to manage inflationary pressures, the Central Bank of Jordan adopted a monetary policy based on price stability.2 In 2009 it lowered its key interest rate three times (by 0.5 per cent each time), decreased the reserve requirement rate and suspended the depositary certificate’s issues to strengthen the liquidity of the country’s financial system.

During the first half of the last decade Lebanon had low inflation rates. However, due to the hike in world food and oil prices observed since 2006, inflation rose sharply to reach 10.8 per cent in 2008 before dropping to 4.5 per cent in 2010. The Central Bank of Lebanon is pursuing a monetary policy totally oriented to stabilising the exchange rate of the local currency against the dollar by controlling the volume of liquidity. Against this backdrop a downward trend in the level of interest rates was recorded, combined with measures to combat the inflationary effects of capital inflows. The monetary sector performed well, reflecting the positive trend in the real sphere and recording a massive reconversion of assets into local currency, estimated at more than 10 thousand million dollars in 2009 (against 8 thousand million in 2008), resulting in a de facto reduction in the dollarisation rate of deposits at 63.2 per cent in 2010 (the lowest level for 10 years). Moreover, these reconversions considerably strengthened the foreign currency assets of the central bank, which reached an envelope of 29.6 thousand million dollars in 2010 (10.3 months of imports and roughly 80 per cent of GDP) against 28.3 thousand million in 2009 and 19.7 thousand million in 2008. However, this generated an abundance of liquidity in Lebanese pounds, hence lowering the interest rates on local currency deposits. The banking system is structurally supported by the increase in deposits at a steady pace (approximately 11 per cent in 2010) due to the attractiveness of the remu...

Table of contents

- Cover

- Title

- Introduction

- 1 Monetary Policy and Central Banking Independence

- 2 Overview of the National Banking Systems and Reforms

- 3 Convergence of Banking Sectors Regulations

- 4 Analysis of Banking Efficiency and Convergence

- 5 Impact of Monetary Policy and Bank Regulations on Efficiency

- 6 Impact of Bank Regulations on Growth

- 7 Conclusions

- Notes

- References

- Annex 1 The Autoregressive Moving Average Model (ARMA)

- Annex 2 Construction of the Capital Account Liberalisation Indicator

- Annex 3 Flexibility – Cons – Credibility: Solution via a Contract with a Punitive Dismissal Threat

- Annex 4 Optimal Contract with Linear Reward on Inflation

- Annex 5 Credibility versus Flexibility

- Index