eBook - ePub

Cross-border Oil and Gas Pipelines and the Role of the Transit Country

Economics, Challenges and Solutions

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Cross-border Oil and Gas Pipelines and the Role of the Transit Country

Economics, Challenges and Solutions

Book details

Book preview

Table of contents

Citations

About This Book

With frequent discoveries of energy resources in remote and undeveloped areas, the importance of transnational oil and gas pipelines is set to grow ever more prominent. This study dissects the diplomacy and bargaining power of the transit country and the shifting economic relations involved in cross-border energy transportation.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Cross-border Oil and Gas Pipelines and the Role of the Transit Country by E. Omonbude in PDF and/or ePUB format, as well as other popular books in Politics & International Relations & Trade & Tariffs. We have over one million books available in our catalogue for you to explore.

Information

1

Introduction

Abstract: The past two decades have witnessed a significant increase in cross-border trade in oil and gas. It is anticipated that there will be an increase in the number of oil and gas pipelines as a result of the discovery of reserves in remote and land-locked locations and the depletion of reserves close to established markets. A number of problems arise from cross-border oil and gas transportation via pipeline. These problems are more acute in the case of pipelines passing through a transit country. Present and future pipelines face the risk of continuous conflict over legal, economic, and political issues. This book analyses cross-border oil and gas pipelines involving transit countries, with a view to addressing the problem of pipeline disruptions by the transit country. It focuses on the behaviour of the transit country prior to the commencement of operation of the pipeline and on how that behaviour changes after the pipeline has been built and put into operation.

Omonbude, Ekpen James. Cross-border Oil and Gas Pipelines and the Role of the Transit Country: Economics, Challenges, and Solutions. Basingstoke: Palgrave Macmillan, 2013. DOI: 10.1057/9781137274526.

1.1Introduction

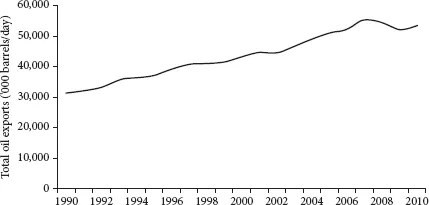

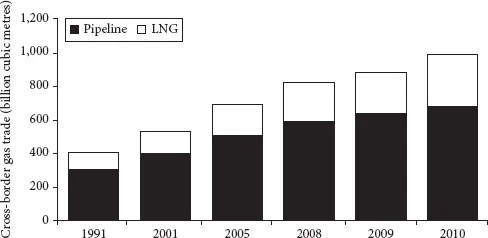

The past two decades have witnessed a significant increase in cross-border trade in oil and gas. Oil exports from the Middle East, for example, grew by approximately 65% between 1991 and 2010, and exports from the Asia-Pacific region (excluding Japan) and the former Soviet Union grew by 175% and 360%, respectively. Figures 1.1 and 1.2 illustrate this growth.

It is anticipated that there will be an increase in the number of oil and gas pipelines as a result of the discovery of reserves in remote and land-locked locations and the depletion of reserves close to established markets. For example, Azeri oil and gas reserves are far from sea ports or major Western European markets. Statistics show a significant increase in million tonnes of oil equivalent exported from the former Soviet Union in the past decade. This can be argued to demonstrate the increasing role of pipelines in linking markets to the predominantly land-locked reserves of this region. Transporting energy commodities to various locations from such land-locked regions is dependent in some cases on pipelines passing through one or more transit countries. The implementation of successful transit pipeline projects is, therefore, crucial for the security of supply of these commodities. In the case of natural gas, the closest substitute for piping gas is transportation in the form of liquefied natural gas (LNG), which is dependent on coastal access for the LNG shipment. The economics of pipelines compared with the costly LNG process suggest that only at distances in excess of 3,000 miles would the LNG option be more competitive (Avidan, 1997).

FIGURE 1.1 Growth in international oil trade, 1990–2010

Source: Adapted from BP Statistical Review of World Energy 2011.

FIGURE 1.2 Growth in cross-border gas trade, 1991–2010, by transport mode

Source: BP Statistical Review of Energy 2011.

A number of problems arise from cross-border oil and gas transportation via pipeline. These problems, which are more acute in the case of pipelines passing through a transit country, fall into three broad categories: reconciling the interests of the different parties involved, the lack of an overarching legal regime to regulate activities, and rent-sharing among the parties (ESMAP, 2003). Specifically, transit oil and gas pipelines face potential disruption by the transit country. Recent developments in the gas dispute between Russia and Ukraine demonstrate the role of transit pipelines in the security of energy supply, as well as the importance of a sufficient understanding of fundamental transit pipeline economics.

Present and future pipelines face the risk of continuous conflict over legal, economic, and political issues. Once the pipeline has been built and put into operation, the risk arises of disruption of the pipeline by the transit country over disputed transit terms. This is due to two key factors: first, bargaining power shifts in favour of the transit country upon construction and operation of the pipeline; second, price changes that result from changes in the value of the throughput can affect the behaviour of the transit country. This is defined as the obsolescing bargain – a term coined by Raymond Vernon (1971). In the literature, the obsolescing bargain is a situation in which bargaining power shifts from a multinational company (MNC) to a host country government after investments have been made in a project and the project has started operations (Vernon, 1971). The concept explains the relations between the MNC and the host country as a function of the goals and resources of each party and the constraints it faces. It argues that relative gains are positively related to the relative bargaining power of the parties; that is, the greater one party’s bargaining power, the greater that party’s share of the gains (Eden et al., 2004). The literature suggests that the party with more resources, fewer constraints, and greater coercive ability gains more from the bargain. According to the original definition of the concept, relative bargaining power at first favours the MNC, which has the initial advantage of being able to invest in several locations – that is, it has alternatives and is, therefore, mobile. The host country offers incentives to attract foreign investment because of the MNC’s initial bargaining advantage. According to Eden et al. (2004), this bargain then obsolesces over time. Once the investment has been made, the MNC can be held hostage by an opportunistic host country. The longer the MNC is in the host country, and the more profitable the investment is, the more likely it is that the government’s perception of the benefit–cost ratio offered by the MNC will worsen. Other factors (e.g. technological spillovers and economic development) encourage the host country to become less resource dependent on the MNC over time. Such behaviour by host governments was evidenced in the wave of nationalisations in developing countries during the 1970s.

Transit oil and gas pipelines are susceptible to the obsolescing bargain because they are characterised by very high fixed costs and relatively low operating (variable) costs (Stevens, 1996). The bygones rule states that even a loss-making project will continue to operate for as long as operating costs are met and some fixed costs can be recovered. The implication is that the transit country can continue to increase its demands so long as the pipeline continues to meet its operating costs. In addition, pipelines are inflexible. The cost and security of supply implications of disruptions to an operating transit pipeline are huge, particularly in the case of gas. This enhances the bargaining position of the transit country and tempts it to extract more from the pipeline.

1.2Objective of the study and main questions

This book analyses cross-border oil and gas pipelines involving transit countries, with a view to addressing the problem of pipeline disruptions by the transit country. It focuses on the behaviour of the transit country prior to the commencement of operation of the pipeline and on how that behaviour changes after the pipeline has been built and put into operation. It also looks at the problems associated with such pre- and post-construction behaviour. Given the nature of the obsolescing bargain as it applies to transit pipelines, and the problem of arbitrary disruption of the pipeline by the transit country as a sovereign state, this research aims to answer two questions. The first is how to define the characteristics of the transit fee in cross-border oil and gas pipeline agreements. The second is how to address the consequences of shifts in power to the transit country. More specifically:

1Is it possible to have a pipeline agreement that supports the principles of reasonableness, objectiveness, transparency, and non-discrimination such that the transit country will not disrupt the pipeline in the future?

2How can the shifts in bargaining power among the parties to a cross-border oil and gas pipeline agreement be managed such that the potential for disputes is reduced or removed and security of supply is sustained or enhanced?

This book, therefore, consists of two parts. The first part analyses the economic characteristics of cross-border oil and gas pipelines and the behaviour of the parties prior to construction and after the pipeline has been built and put into operation. The second part uses actual transit pipeline cases to investigate how the consequences of shifts in bargaining power might be mitigated.

1.3Significance of this book

There are four major reasons why this study is important. The first reason is connected to the obsolescing bargain and the increasing involvement of transit countries in oil and gas pipelines. Compensation to transit countries takes the form either of a transit fee or of an off-take of the commodity, or both (Vinogradov, 2001). A problem arises when transit countries arbitrarily seek to renegotiate transit terms in the pipeline agreement. This leads to disruption of the pipeline, with implications for costs and security of supply. This situation is not helped by the lack of agreement concerning the economic basis for setting the transit fee. Vinogradov (2001), for example, suggests that the transit fee is compensation paid to the transit country for allowing right of way. The fee, in this view, is a reward to the transit country for sacrificing its sovereignty. The defect of this definition is that provided the transit country signed the agreement willingly, it cannot be argued to have lost its sovereignty. Another view is that the fee is compensation for the negative impact (or externalities) of the pipeline. However, the externalities created by the pipeline can be internalised, and usually the land used for the pipeline is paid for after negotiations between the company and the landowner (ESMAP, 2003; Stevens, 2009). The underlying fact is that there is value attached to the pipeline, and the transit country, by virtue of its contribution to the creation of this value, deserves some share of it. How such contribution to value is created, and how to ensure that the transit country does not damage the pipeline in pursuit of its perceived reward, remain unclear. Shifts in bargaining power to the transit country after the pipeline has been built and put into operation could encourage the transit country to seek to renegotiate transit terms on the basis of its perception of its value to the project. The resolution of this problem is, therefore, important to the success or failure of oil and gas transit pipelines.

Second, there have been attempts to address the problems of cross-border oil and gas pipelines using international instruments or institutions such as the General Agreement on Tariffs and Trade (GATT) and, more specifically, the Energy Charter Treaty (ECT). There is a specific provision in Article 7 of the ECT that addresses the transit of energy. The importance of energy transit is further reflected in the Energy Charter Secretariat’s proposed Protocol on Energy Transit (ECTP). The ECT requires that all transit pipeline agreements be characterised by reasonableness, objectiveness, transparency, and non-discrimination. As noted in Chapter 5, these are tenets taken from other legal instruments for international trade (notably GATT). These characteristics are vague at best, simply because of the nature of transit pipelines (as analysed in Chapter 2 and 3). Also, the ECT does not specify the context in which such agreements can be defined as required. The Energy Charter Secretariat appears, therefore, to be struggling with this problem, as there are differing views as to a clear and definitive basis for transit fees.

Third, there is very little literature on the subject of cross-border oil and gas pipelines involving transit countries. Most of the available studies deal with the technical aspects of pipelines (e.g. Masseron, 1990; McLellan, 1992; Mansley, 2003); some deal with the legal aspects (Vinogradov, 2001); and a very few focus on the economic and policy aspects (Stevens, 1996, 2000b; ESMAP, 2003). A few studies have acknowledged that the disruption of the pipeline by transit countries is a bargaining problem (ESMAP, 2003; Hubert and Ikonnikova, 2003; Omonbude, 2007, 2009). It is argued in some of the available literature that the specifics of each pipeline require that cross-border oil and gas pipeline problems be treated on a case-by-case basis. However, fundamental issues that are common to these projects suggest a broad solution to the problem of transit countries disrupting the pipeline as a result of renegotiating the transit terms.

The fourth source of the importance of this study lies in oil price volatility. The implication of vola...

Table of contents

- Cover

- Half Title

- Other Pivot titles

- Title Page

- Copyright

- Contents

- List of Illustrations

- List of Abbreviations

- 1 Introduction

- 2 The Economics of Cross-border Oil and Gas Pipelines Involving Transit

- 3 The Role of Bargaining in Oil and Gas Transit Pipelines

- 4 Bargaining Positions of the Parties to a Transit Pipeline: Four Case Studies

- 5 The Role of the Energy Charter Treaty: A Critique

- 6 A Case for Mutual Dependencies

- 7 Concluding Remarks

- References

- Index