eBook - ePub

Governance in Family Enterprises

Maximising Economic and Emotional Success

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Governance in Family Enterprises

Maximising Economic and Emotional Success

Book details

Book preview

Table of contents

Citations

About This Book

Presents a comprehensive overview of governance in family enterprises including practical management knowledge in easy-to-use frameworks and interviews with renowned family enterprise owners and managers. Readers will benefit from the book's systematic approach and the opportunity to learn from the experience of other family enterprises.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Governance in Family Enterprises by A. Koeberle-Schmid,D. Kenyon-Rouvinez,E. Poza,Kenneth A. Loparo in PDF and/or ePUB format, as well as other popular books in Business & Business Strategy. We have over one million books available in our catalogue for you to explore.

Information

part I

Structures for Family and Business: Family Business Governance

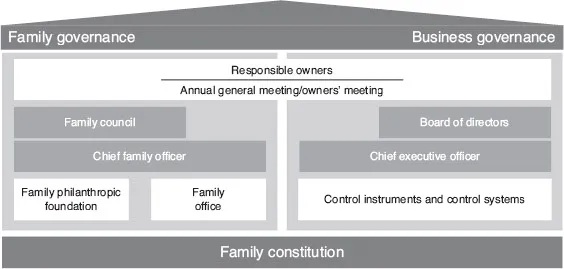

This figure illustrates the family business governance model and acts as a navigational tool for the reader.

chapter 1

Maximizing Success through Professional Family Business Governance*

”Family-owned businesses need to align their governance with that of public companies to some extent.”

Interview with Dr. Jürgen Heraeus, Chairman of Heraeus Holding, Hanau, Germany

Dr. Jürgen Heraeus, chairman of the board of directors at Heraeus Holding, gives an account here of how the most important aspects of leadership, control, and family structures are implemented in his company. Heraeus is a globally active precious metal and technology group based in Hanau, near Frankfurt in Germany. The company has been family-owned for more than 160 years. With more than 12,200 employees, Heraeus generated product revenues of €4.2 billion and precious metals trading revenue of €16 billion in 2012.**

Alexander Koeberle-Schmid: Dr. Heraeus, governance in family-owned businesses differs from that in publicly-held companies. In your opinion, what is the most significant difference?

Jürgen Heraeus: The most important difference is the time factor, really. Owners usually have a planning horizon that is measured in generations, whereas to managers and shareholders of listed companies quarters and quarter figures matter the most. This fundamentally different perspective of family-owned businesses has a major impact on the requirements for and the development of governance.

A family enterprise that has reached a certain size needs to have its own family business governance. To what extent is this true for your company?

We first established a family governance code within our company in 2006, on the basis of which we then adopted the Heraeus family code in June 2011. In its function as the code of the shareholder families, it forms a common basis for all shareholders and furthermore provides a knowledge base to all young and new shareholders.

The board of directors takes a special position within the governance system. What significance does this board have in your company?

True to our motto, “Good governance at Heraeus,” we think it is important that the board is as professionally staffed as it would be in a public company. Also, we decided that owners must play an active part in our company’s boards, thus taking on a great deal of responsibility for the company. In order to be eligible, candidates must comply with a range of criteria such as suitability and qualifications as well as commitment and acceptance within the ranks of owners. You see, we have set the bar very high.

we think it is important that the board is as professionally staffed as it would be in a public company

You have about 200 shareholders. This results in some shareholders becoming less attached to the company as well as an increase in heterogeneity. How do you handle this situation?

Our dividend payout corresponds to our system of values and is most appropriately characterized by the term “modest.” Therefore, the links that bind shareholders to the company are more emotional than monetary. There is a considerable vested interest in the company and its development. In addition to our annual shareholders’ meeting, we organize special activities such as young shareholders’ meetings, family weekends, and education days.

How do you proceed if a shareholder wants to drop out?

Our share price, a so-called ceiling price, is determined annually. This price is announced at our shareholders’ meeting. If a shareholder wants to sell his shares, he has the option of choosing a buyer from within the family or otherwise the shares are tendered. Should no shareholder be able to buy the shares, our asset-managing holding company will need to buy them.

It is your wish that family members be represented within management. How do you ensure that the managing director in your family enterprise is suitably qualified?

Before they can hold a position in the family company, family members must have proven themselves in other companies. They can then apply for a position two levels below group management level. The shareholder committee will determine whether that family member is a good match for the company in terms of character and experience. They must be capable of leading the company but also of communicating with the family.

They must be capable of leading the company

What can be done if there is more than one candidate from within the family for a certain position in management?

It is obviously easier if only one family member is applying than if there are several applicants for a position in the company. If there is more than one it might be preferable not to allow any of those family members to join the management team, in order to avoid conflicts. So far we haven’t had this situation.

Especially in times of crisis, a family enterprise needs to be able to rely on its management. We have seen family businesses overcome numerous crises over time. Do family enterprises cope with crisis situations more successfully?

The best prerequisites for overcoming a crisis are sufficient liquidity, a sound equity basis, a broad, globally competitive business portfolio, and tailor-made governance. Speaking on behalf of Heraeus, I’m confident that, being an internationally operating family-owned group, we meet the most important requirements for coping with future crises.

What kind of advice would you give to an entrepreneurial family wishing to further develop their governance?

Family-owned businesses need to align their governance with that of public companies to some extent; that is, complying with those regulations stipulated by the German Corporate Governance Code that make sense. That being said, some of those regulations don’t make sense for family businesses, in my opinion. For example, a retiring managing director should not have to take a two-year cool-off period before joining the supervisory board. If he is a family member, he should be allowed to join the supervisory board immediately to ensure the same standards continue because, after all, it is his own or his family’s money that is at stake.

Family enterprises are special

Three brothers jointly run their businesses.1 They form a unit; a powerful team. They have divided up the tasks among themselves. One is responsible for finance, controlling, and human resources. The other runs the internet companies. The third takes care of the manufacturing businesses. The situation today is clear. But in the next generation, six cousins – the children of the three brothers – take up roles in the business. The brothers ask the following governance questions: Will all children inherit the shares equally? Which of the six cousins will manage the enterprise in the next generation? What happens when conflicts arise? How should the children be best prepared for their future role as owners? How can we ensure cohesion between the cousins?

Here is another example. An entrepreneur has five children from two marriages. He plans to retire from management in three years’ time. A daughter from his first marriage and a son from his second marriage are interested in taking on a management role in the company. The company is just big enough for two managing directors and owners. The daughter, aged 35, has already made a career outside of the family enterprise and would like to start in a year’s time as managing director. The son, 23, has just completed a university degree. The father considers the following governance questions:

A third family runs a mechanical engineering firm. It has developed a technology with great potential. The entrepreneur has ambitious plans: sales are expected to rise over the next five years from €150 million to €500 million. For expansion in France and the establishment of subsidiaries in the USA, India, and China, an external minority investor has joined forces with the company. The relevant governance questions for this family enterprise are:

These three enterprises have the common features that they are under the dominant ownership of one or more families, with a dynastic intention or generational approach.2 However, the ...

Table of contents

- Cover

- Title

- Part I Structures for Family and Business: Family Business Governance

- Part II Structures for the Business: Business Governance

- Part III Structures for the Family: Family Governance

- Part IV Documentation of Governance Structures: Constitution

- Notes and References

- About the Authors