This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Bank Stability, Sovereign Debt and Derivatives

Book details

Book preview

Table of contents

Citations

About This Book

The latest scholarly developments in research on banking, financial markets, and the recent financial crisis. This selection of papers were presented at the Wolpertinger Conference held in Valletta, Malta, 2012 and provide insights into bank performance, banking risk, securitisation, bank stability, sovereign debt and derivatives.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Bank Stability, Sovereign Debt and Derivatives by J. Falzon in PDF and/or ePUB format, as well as other popular books in Business & Gestione di rischi finanziari. We have over one million books available in our catalogue for you to explore.

Information

1

On the Relationship between Bank Business Models and Financial Stability: Evidence from the Financial Crisis in OECD Countries

Laura Chiaramonte, Federica Poli and Marco Oriani

1 Introduction

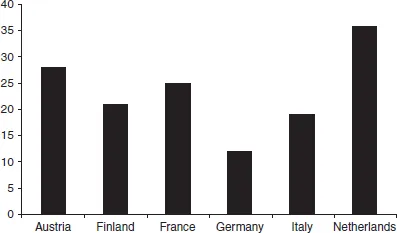

The cooperative credit sector represents an essential sector of the banking structure of many financial systems, especially in Europe where, in Austria, Finland, France, Germany, Italy and the Netherlands, the cooperative banks have a high market share (see Figure 1.1). In advanced economies and emerging markets outside Europe, cooperative banks generally have a lower share, but there are some countries where they play a non-negligible role, as in Japan and Canada, where in 2010 the share of the cooperatives was 15.72 per cent and 3.49 per cent, respectively.

During the recent worldwide financial turmoil, some authors (see Ayadi et al., 2010; Boonstra, 2010; Groeneveld, 2011; Mottura, 2011) and the European Association of Co-operative Banks, (EACB, 2010) argue that cooperative banks have fared relatively well, due essentially to a business model which pursues a healthy attitude to risk (with limited exposure to toxic assets), a longer-term perspective, a much stronger stakeholder focus and substantial capital buffers. These characteristics should reduce instability in more mutualized banking systems. However, the contribution of cooperative banks to the stability of the financial system in which they operate is still a controversial matter. Groeneveld and Sjauw (2009), Llewellyn (2009), Ayadi et al. (2010), EACB (2010), Stefancic (2010), Groeneveld (2011), and Stefancic and Kathitziotis (2011) show that the presence of cooperative banks enhances financial stability in certain countries. Hesse and Cihák (2007) find that a higher cooperative bank market share improves the stability of the average bank in the same banking system; however, they also argue that if cooperative banks are widespread, their presence may weaken commercial banks, particularly those that are already weak. Contrary to these findings, Barth et al. (1999), Brunner et al. (2004), Goodhart (2004) and Fonteyne (2007) maintain that cooperative banks tend to increase the fragility of their respective financial system for different reasons: firstly because their inefficiency may ultimately undermine their soundness, and secondly because cooperative banks are more vulnerable to shocks in credit quality and interest rates.

To date, no empirical studies have investigated the contribution of cooperative banks to bank stability, taking into account the recent financial crisis.

The mixed empirical results of the impact of cooperative banks on financial stability warrant further investigation, especially after the onset of the financial crisis. Based on a sample of cooperative, savings and commercial banks from OECD countries over the period 2001–2010, this chapter examines the contribution of cooperative banks to the stability of other banks, with particular attention to those of a larger size. Bank soundness is proxied by a very popular accounting measure: the Z-score (Boyd and Runkle, 1993).

To account for changing contributions made by sample mutual banks in varying macroeconomic and financial conditions, the analysis is carried out both in the pre-crisis period (2001–2006) and in the crisis period (2007–2010).

Figure 1.1 OECD countries with the highest cooperative banks’ market share in 2010

Notes: The share of cooperative banks is calculated as the ratio of the sum of the total assets of all cooperative banks in the country to total assets of all banks – cooperative, savings and commercial banks – in the same country. Values on cooperative banks’ total asset are collected from the European Association of Cooperative Banks (EACB); while values on all banks’ total asset are collected from the Organisation for Economic Co-operation and Development (OECD). Data in the figure are in percentages.

Sources: EACB and OECD, authors’ calculations.

The empirical study is conducted using a random effect panel regression and focuses on bank-specific variables, on a set of dummy variables which account for specialized business models adopted by banks and on country-specific factors concerning macroeconomic and bank-industry specific factors. In addition to the traditional variables used by the related studies as country-specific factors, we also considered a banking systemic stability indicator: the aggregate Z-score (Beck et al., 2011).

The results of the empirical analysis indicate that cooperative banks become a significant determinant of the financial stability only during a period of crisis. Moreover, our results indicate that only during financial crisis does a greater presence of cooperative banks exert a positive and increasing influence on the stability of large banks in the same banking system. Hence, it seems that banking systems characterized by a strong presence of cooperative banks will be able to face future periods of financial distress in a better way.

Section 2 of this study reviews the relevant literature. Section 3 describes data sample and the variables used in our analysis. Section 4 presents the empirical methodology and summarizes the main results, while Section 5 shows the robustness tests. Finally, Section 6 concludes the chapter.

2 Literature review

The empirical publications examining the role played by cooperative banks within the banking stability puzzle is still limited, mostly because of their marginal importance in many developed countries, in comparison with that of commercial banks. Research, despite its scarcity, has thrown up mixed results in the last two decades.

Some empirical evidence points to cooperative banks generally having fewer incentives to take on risks, due to the lack of profit-maximization targets and the absence of many of the factors that lead rational managers in joint-stock banks to adopt short-term horizons (see Rajan, 1994; Hansmann, 1996; Chaddad and Cook, 2004). Hesse and Cihák (2007) use a well-known indicator of individual bank risk, the Z-score, and thus provide evidence that cooperative and savings banks are more stable than commercial banks, adding that the much lower volatility of the cooperative banks’ returns more than offsets their relatively poorer profitability. Garcia-Marco and Robles-Fernandez (2008), Beck et al. (2009), Groeneveld and de Vries (2009), Beck et al. (2010), EACB (2010) and Liu et al. (2010) have since maintained that both cooperative and savings banks appear safer than their commercial counterparts. Iannotta, Nocera and Sironi (2007) evaluate the impact of alternative ownership models in 15 European countries, and find that mutual banks are of higher quality and have a lower asset risk than both private and public sector banks.

Moving from studies comparing the soundness of different business models with others focused on the appraisal of mutual banks’ contribution to financial stability, there is evidence indicating that a greater presence of cooperative banks increases the stability of the average bank in the same banking system (Hesse and Cihák, 2007). Groeneveld and Sjauw (2009), Llewellyn (2009), Ayadi et al. (2010), EACB (2010), Stefancic (2010), Groeneveld (2011), and Stefancic and Kathitziotis (2011), although starting out from different datasets, time periods and countries, all argue that cooperative banks actually promote the stability of national banking systems by contributing to the diversity of business models and ownership structures adopted by bank intermediaries. They suggest that this makes the system more stable as a whole.

Despite the above-mentioned positive contributions attributable to cooperative banks, one line of research suggests that cooperative banking may increase the fragility of financial systems for several reasons. Firstly, explicit and implicit advantages granted to public or semi-public banks such as cooperative banks may exert downward pressures on the interest margins in traditional banking, thus pushing private sector banks to engage in more risky activities (see Barth et al., 1999; Goodhart, 2004). In addition, Hesse and Cihák (2007) argue that a large presence of cooperative banks apparently weakens commercial banks, in particular those commercial banks that are already weak. Secondly, other authors suggest that cooperative banks may have more difficulty adjusting to adverse circumstances and changing risks (see Brunner et al., 2004). Finally, cooperative banks are regarded as more vulnerable to sudden changes in credit quality and interest rates, as they are more focused on traditional credit intermediation than are other institutions, and therefore have higher exposure to credit and interest rate risk (see Fonteyne, 2007).

Here we study the role played by cooperative banks, using a sample of cooperative, savings and commercial banks from OECD countries over the period 2001–2010. To account for the varying roles taken by mutualized entities over time, specifically after the onset of the financial crisis, we have split our analysis into two sub-periods, the first covering the pre-crisis period, 2001–2006, and the second covering the period of crisis, 2007–2010.

3 Data sample and descriptive statistics

3.1 Data description

The study focuses on sample banks belonging to OECD countries operating according to three different business models: commercial, cooperative and savings banks.1 Our sample covers the following countries: Australia, Austria, Belgium, Canada, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, South Korea, Luxembourg, the Netherlands, New Zealand, Poland, Portugal, Spain, Slovenia, Sweden, Switzerland, the United Kingdom and the United States. Eight countries – Chile, Estonia, Iceland, Israel, Mexico, Norway, the Slovak Republic and Turkey – were excluded from the analysis because BankScope Database does not provide data on cooperative banks in these OECD countries.

We used only unconsolidated bank statements (BankScope Database consolidation codes U1 and U2), since most of the data concerning the sampled banks is unconsolidated. Hence, domestic and foreign subsidiaries are included as separate entities.2

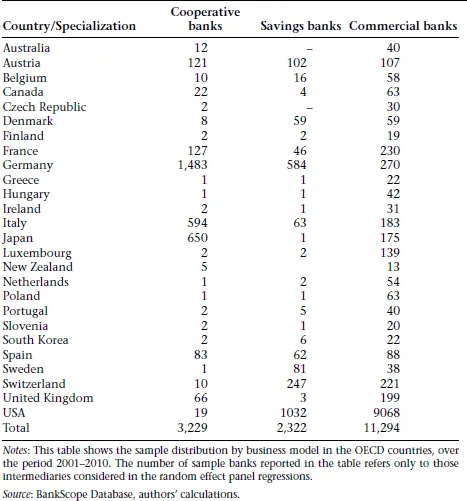

Table 1.1 Sample distribution by business model (2001–2010)

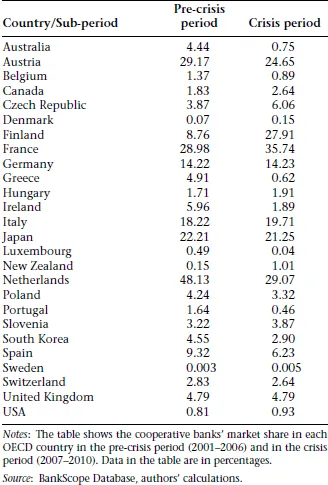

Table 1.2 Descriptive statistics of cooperative banks’ market share in sample OECD countries

The final sample consists of 16,845 OECD banks, out of which 11,294 are commercial, 3,229 are cooperative and 2,322 are savings banks. See Table 1.1 for sample distribution by business model in each country; the data collected is end-of-year observations, from 2001 to 2010.

For each banking system in the sample, we calculat...

Table of contents

- Cover

- Title

- Introduction

- 1 On the Relationship between Bank Business Models and Financial Stability. Evidence from the Financial Crisis in OECD Countries

- 2 Cooperative Banking in Poland: A Post-Crisis Record of Stability and Efficiency

- 3 Credit Development, Quality Deterioration and Intermediation Model: Does Bank Size Matter? Evidence from Italy between 2006 and 2010

- 4 Credit Supply and the Rise in Sovereign Debt Risk in the Eurozone

- 5 Credit Guarantee Institutions, Performance and Risk Analysis: An Experimental Scoring

- 6 The Role of Trade Credit and the Cost of Capital

- 7 Accounting for the Level of Success of Firms in Achieving Their Objectives for Using Derivatives

- 8 The Management of Foreign Exchange Exposures

- 9 Risk Governance in Pension Funds: Management Control in Dutch Pension Funds

- 10 A New Risk-Adjusted Performance Approach for Measuring the Value of Securities Exchanges

- 11 Does Private Equity Investment Positively Impact on Firm Profitability and on the Growth of the Target Company?

- Index