![]()

Chapter 1

Fundamental Versus Technical Analysis

Technical analysis involves the use of past and current market price, trading volume, and, potentially, other publicly available information to try and predict future market prices. It is highly popular in practice with plentiful financial trading advice that is based largely, if not exclusively, on technical indicators. In a perhaps belated testament to this fact consider the following quote from the New York Times issue dated March 11, 1988: “Starting today the New York Times will publish a comprehensive three-column market chart every Saturday... History has shown that when the S&P index rises decisively above its (moving) average the market is likely to continue on an upward trend. When it is below the average that is a bearish signal.” More formally, Brock, Lakonishok and LeBaron (1992) find evidence that some technical indicators do have a significant predictive ability. Blume, Easley and O’Hara (1994) present a theoretical framework using trading volume and price data leading to technical analysis being a part of a trader’s learning process. A more thorough study of a large set of technical indicators by Lo, Mamaysky and Wang (2000) also found some predictive ability especially when moving averages (MAs) are concerned. Zhu and Zhou (2009) provide a solid theoretical reason why technical indicators could be a potentially useful state variable in an environment where investors need to learn over time the fundamental value of the risky asset they invest in. More recently, Neely, Rapach, Tu and Zhou (2010, 2011) find that technical analysis has as much forecasting power over the equity risk premium as the information provided by economic fundamentals. The practitioners literature also includes Faber (2007) and Kilgallen (2012) who thoroughly document the risk-adjusted returns to the MA strategy using various portfolios, commodities, and currencies. In addition, Huang and Zhou (2013) use the MA indicator to predict the US stock market while Goh et al. (2013) apply the same idea to government bond risk yields and premia. Motivated in part by the predictive power of the MA indicator, Han and Zhou (2013) and Jiang (2013) construct a trend factor with considerable cross-sectional explanatory power and substantial historical performance.

The main findings of this study are as follows. First, I present evidence that the returns to a simple MA switching strategy dominate in a mean-variance sense the returns to a buy-and-hold strategy of the underlying portfolio. Second, I demonstrate that the switching strategy involves infrequent trading with relatively long periods when the MA strategy is invested in the underlying assets and the break-even transaction costs (BETC) are on the order of 0.05% to 0.25% per transaction. Thirdly, even though there is overwhelming evidence of imperfect market-timing ability of the MA switching strategy for portfolios, that is not the case for individual stocks. Furthermore, cross-sectional differences remain between the portfolio and individual stock abnormal returns. These differences persist when controlling for the four-factor Carhart (1997) model for portfolios formed on past price returns and are mostly driven by differences in the volatility of portfolio and stock returns. Fourthly, conditional models explain to a certain degree the MA abnormal returns but do not completely eliminate them. Fifth, I show that the lagged indicator regarding the switch into or out of the risky asset has substantial predictive ability over subsequent portfolio returns over and above the predictability contained in standard instrumental variables, like the stock market’s dividend yield, the short-term risk-free rate, and a recession dummy variable.

This study is similar in spirit to that of Han, Yang and Zhou (2013). However, several important differences stand out. First, I use daily value-weighted returns of decile portfolios constructed by various characteristics like size, book-to-market, momentum, past returns, and industry classification.1 Value-weighted portfolios at a daily frequency should have a smaller amount of trading going on inside the portfolio compared to the daily equal-weighted portfolios investigated by Han, Yang and Zhou (2013). Secondly, the cross-sectional results in this study are just an artifact of the decile portfolios and not the main focus of this paper while the study by Han, Yang and Zhou (2013) is mostly concerned with the inability of standard empirical tests to account for the MA strategy average returns differences across portfolios. I argue that this is largely due to using the wrong benchmark pricing model. Using a dynamic market-timing tests and conditional asset pricing models with macroeconomic state variables leads mostly negative or statistically insignificant risk-adjusted returns for the MA strategy. In light of this, my take on the performance of the MA strategy is that it is not an anomaly but instead a dynamic trading strategy that exposes investors to potential upside returns derived from risky assets via its market-timing ability. This performance is more pronounced the more volatile the returns of the underlying risky assets are. A final caveat I need to make is that the performance of the strategy is investigated using historical returns rather than actually trading in financial markets. It is likely that in reality there may be adverse price impact of liquidating and initiating large positions, especially for less liquid assets with lower trading volumes. This possibility is in the spirit of limits to arbitrage as another potential explanation for the performance of the MA strategy. The nature of this empirical study is such that this potential explanation cannot be eliminated.

The highlights of this study are the superior performance of the MA portfolios relative to buying and holding the underlying portfolios, the infrequency of trading and positive BETC, the fact that the switching strategy returns resemble an imperfect at-the-money protective put, and that cross-sectional differences are not a new anomaly as maintained in Han, Yang and Zhou (2013) but are due to volatility differences in the underlying portfolios and stocks. An asset with 10% higher standard deviation of returns will experience on average between 1.6% and 3.5% mean return improvement between the buy-and-hold and the MA strategy. The returns of the MA strategy relative to the buy-and-hold strategy exhibit a lot of convexity and, hence, will be hard to explain using standard linear asset pricing models. The anomalous risk-adjusted performance relative to standard models appears to be largely due to omitting market-timing factors in a simple piece-wise linear framework that captures the MA strategy’s convexity. Furthermore, the MA strategy appears to be antifragile in the sense of Taleb (2012), meaning that for securities with more volatile returns there is a greater improvement of the moving average returns relative to buy-and-hold returns.

![]()

Chapter 2

Investment Performance

In this chapter I use daily value-weighted1 returns of sets of ten portfolios sorted by market value, book-to-market, momentum, short-term and long-term price reversal, and industry classification. The data is readily available from Ken French Data Library. The sample period starts on January 4, 1960, and ends on December 31, 2013.

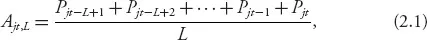

The following exposition of the moving average (MA) strategy follows closely the presentation in Han, Yang and Zhou (2013). Let Rjt be the return on portfolio j at the end of day t and let Pjt be the respective price level of that portfolio. Define the moving average of portfolio (MAP) j Ajt,L at time t with length L periods as follows:

Throughout most of the chapter, I use an MA of length L = 20 days. My reasons for selecting an MA length of L = 20 days are threefold.2 First, I want to keep the MA length using a daily frequency similar to the MA length used by Han, Yang and Zhout (2013). Secondly, I am interested in using a reasonably long length of the MA in order to avoid excessive trading which would have eroded the performance of the strategy. Thirdly, I only report my findings for L = 20 because I would like to avoid any objections concerning potential data mining. In the first run of the experiment I used L = 20 and I will continue reporting all empirical findings for L = 20. Later on, in the section dealing with robustness checks I also present results for all sets of portfolios with lags of 5 days, 10 days, 60 days, 120 days, and 250 days. According to Brock, Lakonishok and LeBaron (1992), the MA in its various implementations is the most popular strategy followed by investors who use technical analysis. The way I implement the MA strategy in this paper is to compare the closing price Pjt at the end of every day to the running daily MA Ajt,L. If the price is above the MA this triggers a signal to invest (or stay invested if already invested at t − 1) in the portfolio on the next day t+1. If the price is below the MA this triggers a signal to leave the risky portfolio (or stay invested in the risk-free asset if not invested at t − 1) in the following day t + 1. As a proxy for the risk-free rate, I use the daily return of the 30-day US Treasury Bill.

More formally, the returns of the MA switching strategy can be expressed as follows:

in the absence of any transaction costs imposed on the switches. The alternative specification for the case of positive one-way transaction cost of τ leads to the following four cases in the post-transaction cost returns:

depending on whether the investor switches or not. Note that this imposes a cost on selling and buying the risky portfolio but no cost is imposed on buying and selling the Treasury bill. This is consistent with prior studies like Balduzzi and Lynch (1999), Lynch and Balduzzi (2000), and Han (2006), among others. Regarding the appropriate size of the transaction cost, Balduzi and Lynch (1999) propose using a value between 1 and 50 basis points. Lynch and Balduzi (2000) use a mid-point value of 25 basis points. As a baseline case, I use a zero transaction cost of τ = 0. This leads to a straightforward comparison of the BETC with the actual transaction cost that an investor would experience when trading.

I construct excess returns as zero-cost portfolios that are long the MA switching strategy and short the underlying portfolio to determine the relative performance of the MA strategy against the buy-and-hold strategy. Denote the resulting excess return for portfolio j at the end of day t as follows:

The presence of significant abnormal returns can be interpreted as evidence in favor of superiority of the MA switching strategy over the buy-and-hold strategy of the underlying portfolio. Naturally, the MA switching strategy is a dynamic trading strategy so it is perhaps unfair to compare its returns to the buy-and-hold returns of being long the underlying portfolio.

2.1 Profitability of MA Portfolios

In this section, I present summary statistics for the underlying portfolio performance, the performance of the MA switching strategy, and the excess MAP returns for seven sets of ten portfolios sorted by market value, book-to-market ratios, momentum, short-term reversal, long-term reversal, and industry classification. Next, I present single-factor capital asset pricing model (CAPM) of Sharpe (1964), three-factor Fama-Frenc...