eBook - ePub

Financial Communications

Information Processing, Media Integration, and Ethical Considerations

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Financial Communications

Information Processing, Media Integration, and Ethical Considerations

About this book

Financial Communications showcases why it is crucial for financial institutions to enhance key communication processes, rebuild trust with its customer base, improve relationships, and derive better brand awareness amongst key stakeholders within the industry.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

Information-processing Model of Financial Communication

A financial communication here refers to any kind of communication that conveys messages regarding financial dealings and topics. For example, financial marketers such as banks, insurance companies, credit card issuers, and investment firms spend tremendous amounts of money on creating and delivering financial communications to consumers in the forms of advertising and news. A financial communication can also be a specific investment prospectus, a financial disclosure in a financial advertisement, or a financial term in a direct mailing. For example, credit card solicitations and mortgage loan documents all include messages that need to be conveyed to consumers via various forms of financial communication.

Because financial offerings are sometimes complex, financial marketers look for ways to make financial communications more accessible to a vast array of customers. To do this, financial marketers utilize a wide spectrum of media in managing their communications. However, a financial communication might not always be informative and effective. This is because marketers might not be able to find the right approaches in designing the most effective messages and targeting their communications to various market segments at the same time. To further complicate the situation, policies and regulations have also put restrictions on the content designs and formats of certain financial communications related to different financial products and services. This has occurred in a financial environment that has been characterized in recent years by economic turmoil in the following categories:

1.After the subprime mortgage crisis began, home prices dropped significantly (Coy 2008). Foreclosure and bank-owned properties also became difficult issues for homeowners and banks. Although prices are rising in 2013 and the sale of new homes in March 2013 ended the best quarter of new home sales since 2008 (Coates 2013), more than three-quarters of Americans believe the worst of the housing crisis is yet to come (Reckard 2013). In fact, Coates (2013) acknowledges that there are still many foreclosures in the pipeline and that nearly 14 million homeowners still have mortgages that are underwater.

2.There is a credit card crisis, and debt has become a tremendous burden for many consumers globally. Credit card holders might not have sufficient knowledge to understand the terms and conditions in credit card solicitations and could mismanage credit cards (Wang 2011a, 2012a, 2012b).

3.There are issues with investment disclosure in that financial communications regarding fees and conflict of interest might not always be conveyed to investors effectively. Misunderstanding of important investment disclosures could be costly for investors (Wang 2010a, 2011b, 2012c).

4.Almost two-thirds of direct-deposit-advance or payday-loan users had at least one overdraft during the 12-month period, compared to just 14 percent of nonusers (Bell 2013). Payday-loan users paid $574 on average in fees over the course of a year, suggesting that this type of loan could create a financially dangerous cycle for consumers (Bell 2013). In fact, King and Standaert (2013) suggest that policymakers need to employ strong enforcement by using available legal tools to address the problems caused by abusive lending.

The above examples are just some of the areas in which financial communications may play an important role in informing consumers of important messages regarding financial dealings. While policymakers can require financial marketers to employ specific formats in financial communications and to disclose specific content to consumers, understanding how to enable consumers to process financial communications effectively may help all parties involved in the process. That is, policymakers, financial marketers, and consumers can all benefit from clarity and transparency in financial dealings through financial communications. Thus, this chapter presents an overview of the information-processing model of financial communication and identifies important variables in the process.

The chapter begins by integrating relevant variables to create an information-processing model of financial communication. Then, the chapter discusses each variable’s role in processing a financial communication. Depending on a consumer’s level of ability and motivation to process a financial communication, he or she may tend to allocate different levels of cognitive resources to process such a communication. Depending on the purpose of a financial communication, such as creating awareness of a financial service, persuading consumers to consume a financial product, or keeping the brand at the top of a consumer’s mind, a financial communication can provide consumers with different meanings and information utilities. Thus, understanding the roles that various variables may play in a consumer’s processing and understanding a financial communication can help financial marketers set realistic objectives for designing, implementing, and delivering their financial communications and measure the effectiveness of these communications against the objectives.

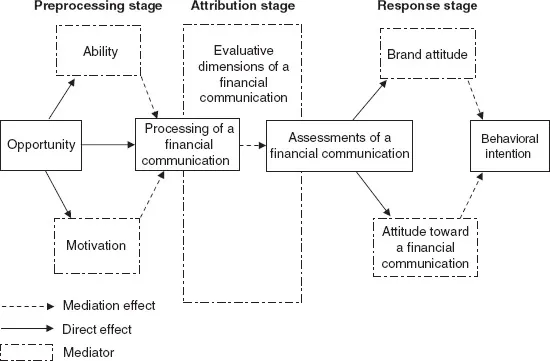

The proposed model, which is based on the consumer information-processing literature, describes the processes and outcomes of a financial communication based on a three-stage model: preprocessing, attribution, and response. Each stage in the model, presented in Figure 1.1, consists of several variables. The preprocessing stage includes ability, motivation, and opportunity to process a financial communication (MacInnis and Jaworski 1989; Petty and Cacioppo 1986). The attribution stage includes evaluative dimensions and assessments of a financial communication. The response stage includes attitude toward a financial communication, brand attitude, and behavioral intention.

Figure 1.1 The Conceptual Model

In the first stage, preprocessing variables form the backbone of the model that influences how consumers react to a financial communication. It is suggested that the translation of preprocessing into attribution is influenced by the evaluative dimensions of a communication. In this stage, assessments of a financial communication are attributed to the evaluative elements of a communication. The final stage highlights the attitudinal and behavioral responses that explain the relations among assessments of, attitudes toward, and acceptance of a financial communication.

Preprocessing Stage

Researchers have devoted considerable attention to identifying the variables that may impact information processing and elaboration since the elaboration of a communication usually has sequential effects on the acceptance or rejection of a communication (MacInnis and Jaworski 1989; Petty and Cacioppo 1986). A communication such as a financial disclosure usually requires consumers to devote at least an attentive level to process and understand it before they make any financial decisions. Thus, it is important to understand the variables that may influence consumers’ levels of processing and comprehending a financial communication so that financial marketers can formulate message and media strategies to improve their communications effectively. Researchers have reached a consensus that three broad variables serve as antecedents to information processing and elaboration: ability, motivation, and opportunity (Greenwald and Leavitt 1984; MacInnis and Jaworski 1989; Petty and Cacioppo 1986). These variables not only can direct the attention paid to processing a financial communication but also influence how consumers select, organize, and interpret messages in such a communication.

Greenwald and Leavitt (1984) outlined four levels of processing based on motivation: preattention, focal attention, comprehension, and elaboration. MacInnis and Jaworski (1989) also offered a similar six-stage model that includes the analysis of message features, categorization of the message, meaning analysis, integration with personal experience, mental rehearsal, and elaboration. Hallahan (2000) suggested that ability, motivation, and opportunity provide theoretical frameworks to enhance effective public relations messages. Overall, research based on the information-processing literature indicates that consumers engage in progressive levels of processing, ranging from superficial to deep processing (Greenwald and Leavitt 1984; Hallahan 2000; MacInnis and Jaworski 1989; Petty and Cacioppo 1986). Based on these different levels, consumers may or may not elaborate fully on messages in a financial communication.

In the same vein, consumers may also comprehend messages in a financial communication differently according to the various levels of processing. If consumers engage in progressive levels of processing, they may be more likely to comprehend the message in a communication. In essence, the progressive levels of processing messages in a financial communication may depend on consumers’ ability and motivation to process a communication. The progressive levels of processing messages in a financial communication may also have to do with consumers’ opportunities to process such a communication. On the one hand, policymakers and financial marketers hold the key to the extent of the opportunity given to consumers to process a financial communication. On the other hand, consumers control the cognitive aspects of processing such a communication because they allocate different levels of cognitive resources and use different knowledge structures in processing this information.

Ability to Process a Financial Communication

“Ability” in this chapter refers to a consumer’s proficiency in interpreting messages in a financial communication (Hallahan 2000; Wang 2006; Wang 2011b, 2012a, 2012c). Consumers who are able to process a financial communication can digest the messages more efficiently and schematically than those who are unable to process such a communication. Experienced or knowledgeable consumers are likely to engage in more than superficial processing because they have the ability to process a financial communication and have experience with financial topics (Alba and Hutchinson 1987). As a result, ability and experience improve a consumer’s processing of a financial communication, the elaboration of messages in such a communication, and the likelihood that the consumer will understand the terms conveyed by such a communication (Alba and Hutchinson 2000).

However, consumers with greater experience and higher levels of ability to process a financial communication usually also have previous experience and knowledge that can generate inferential biases, manifested as goal-consistent overestimation or underestimation of the value of a financial communication (Herr, Kardes, and Kim 1991). In this case, consumers with more experience and higher levels of ability may also reject a financial communication due to inferential biases that cause them to underestimate the value of it. Following the same line of reasoning, inferential biases invoked by experienced and knowledgeable consumers may be attributed to previous dissatisfaction with and distrust of financial products or services (Wang 2006; 2012a, 2012c). That is, consumers who are experienced may offer counterarguments to specific messages in a financial communication and therefore resist changing their attitude toward these messages.

If consumers possess lower levels of ability and less experience with financial products or services, this may also be detrimental to their processing and elaboration of a financial communication. Compared to consumers with more experience and higher levels of ability, those with less experience and lower levels of ability may be more susceptible to persuasive messages presented in a communication. On the one hand, financial marketers may have an easier time using appealing messages in a communication to persuade consumers with less experience and lower levels of ability in their processing of a financial communication. On the other hand, marketers may also encounter undesirable consequences when these consumers misunderstand important messages in a communication, such as financial disclosures. Chapters 2, 7, and 8 will further discuss several related issues to illustrate the effects of financial ability and socialization on the processing and elaboration of a financial communication or a financial disclosure.

Motivation to Process a Financial Communication

“Motivation,” as used here, refers to an activated or enhanced level of involvement in processing a financial communication (Wang 2006a, 2009a, 2011c, 2012d). Schwartz’s (1977) model of altruistic behavior offers significant insights regarding what factors can enhance the translation of motivation into enhanced attribution based on a financial communication. One perspective describes that the translation is moderated by the activation of the individual’s awareness of the messages in a financial communication. Functionally, heightened motivation represents a predisposition to allocate higher levels of cognitive resources to processing the messages in such a communication. Motivation, represented in audience involvement, may also moderate the linkage between exposure, cognitive processing, and attitude formation (Greenwald and Leavitt 1984; Johnson and Eagly 1989; Leippe and Elkin 1987; Wang 2009a). Consumers with higher levels of motivation to process a financial communication may pay more attention to processing and elaborating on the communication.

When consumers are motivated to process a financial communication, their cognitive structures guide the interpretation and integration of any messages in the document (Petty and Cacioppo 1986; Wang 2009a, 2011c). Thus, consumers’ level of motivation to process a financial communication is likely to influence how they select, organize, and interpret the messages contained therein, and consequently affect how they assess the evaluative dimensions of such a communication. Chapter 3 will further discuss the effects of consumer motivation on the processing and elaboration of a financial communication. Chapters 5 and 6 will also discuss the relationship between levels of motivation related to processing a financial communication and media integration of financial communications.

Opportunity to Process a Financial Communication

“Opportunity” here refers to the characteristics that favor information processing of a financial communication (Hallahan 2000; Wang 2009a, 2011c). Opportunity focuses on executional factors such as source, message, and media strategies. Learning about financial matters such as personal finance, wealth management, retirement planning, or investing means learning how to select, organize, and interpret various sources of financial information to make financial decisions. Conventional wisdom suggests that individuals need to be responsible for watching over their financial matters closely rather than relying on others to oversee their financial concerns. Thus, it is imperative that consumers learn as much as they can and become as knowledgeable about financial matters as possible in order to make sound financial decisions. Therefore, Chapter 4 examines the source effects of financial communications that may influence consumers’ behaviors. Specifically, Chapter 4 examines what sources of financial communications may likely impact consumers’ attributions of financial communications and how consumers consider various sources of financial information in making decisions about financial matters.

Financial marketers can look for ways to make financial communications more available to a vast array of customers. To do this, marketers can utilize a wide range of media, targeting their communications at unique market segments. Thus, Chapter 5 examines the delivery mechanisms, communication modes, and media integrations of financial communications. At a time when massive changes are occurring in media and a plethora of new media are emerging, financial marketers need to take advantage of both message and media strategies to disseminate financial communications effectively.

While financial marketers increasingly promote their products and services by using various media platforms, they need to enhance consumers’ media engagement with their communications (Wang 2009a, 2011c). One of the factors that can enhance consumers’ engagement with a financial communication is media integration. Using media integration to deliver financial communications is way of leveraging the convergence of different media to enhance consumer’s opportunities to process financial communications effectively (Wang 2009a, 2011c). The information-processing literature regarding repetition effects and multiple sources has provided theoretical foundations that support the cross-channel integration effect on the processing and comprehension of financial communications (Bettinghaus and Cody 1994). Information utility theory may also provide a means of exploring the delivery mechanisms of financial communications based on media integration (Harkins and Petty 1987).

When financial communications are presented by multiple media, consumers may consider messages in financial communications as independent bits of information and treat the media as different viewing enviro...

Table of contents

- Cover

- Title

- Chapter 1 Information-processing Model of Financial Communication

- Chapter 2 Financial Ability, Socialization, and Communication

- Chapter 3 Consumer Motivation and Financial Communication

- Chapter 4 Opportunity and Financial Communication

- Chapter 5 Media Integration of Financial Communications

- Chapter 6 Digital Media and Financial Communication

- Chapter 7 Financial Communication and Corporate Social Responsibility Practice

- Chapter 8 Financial Disclosure and Communication

- Chapter 9 The Future of Financial Communication

- References

- List of Previous Publications

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Financial Communications by S. Wang in PDF and/or ePUB format, as well as other popular books in Business & Corporate Finance. We have over one million books available in our catalogue for you to explore.