This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

Aimed at practitioners who need to understand the current fixed income markets and learn the techniques necessary to master the fundamentals, this book provides a thorough but concise description of fixed income markets, looking at the business, products and structures and advanced modeling of interest rate instruments.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Interest Rate Derivatives Explained by J. Kienitz in PDF and/or ePUB format, as well as other popular books in Business & Financial Risk Management. We have over one million books available in our catalogue for you to explore.

Information

I

MARKETS AND LINEAR PRODUCTS

1 | Clearing, Collateral, Pricing |

1.1 Introduction and objectives

In this first chapter we describe the infrastructure of the interest rate market with a focus on the changes after August 2007. Especially, we stress the fact that main parts of the market moved from OTC (over the counter) markets to regulated markets. We think that two developments, namely clearing and collateralization are essential to be covered first. Both mechanisms represent the new regulated markets we are currently facing. We wish to outline the rationale for moving to such regulations and we discuss the process in some detail. The new setting caused banks and financial institutions to restructure the business and set up new units to cope with the changes. After addressing the new markets we wish to outline a new pricing theory taking into account the new issues of collateralization and funding. We review the exposition from Bianchetti (2013). Finally, we briefly cover the pricing paradigm that the price of a financial contract can be seen as an expected value with respect to some pricing measure. Since we work in the interest rate markets we briefly outline the Change of Numeraire Approach. This will prove useful when dealing with options in Chapters 6 and 7.

1.2 Netting and collateral

In this section we consider a way of reducing the counterparty credit risk in a bilateral trade. Take two parties A and B involved in trading. We consider the value of all possible cash flows until some time T. Such cash flows can be for instance payments from fixed income securities. We suppose that at each (possible) cash flow date we are allowed to sum positive and negative flows making an overall (possible) cash flow. If this amount is positive for party A it has a positive exposure against B. Otherwise it has a negative exposure against B. This notion will be made rigorous later and is called the credit exposure. This is due to the fact that cash flows might not fully be paid if the counterparty defaults.

In the sequel we consider some methods to reduce this exposure. To this end we examine Netting and Collateral Management. The latter is also often called Margening.

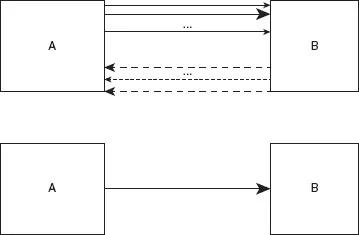

We consider the concept of Netting illustrated in Figure 1.1. Counterparties A and B have different trades with each other. The trades lead to cash flows of different sizes from A to B and vice versa. This is depicted in the top part of Figure 1.1. If both parties have a netting agreement in place they can aggregate the cash flows and calculate one cash flow called the net cash flow and the procedure is called netting of cash flows. The net cash flow then determines the counterparty credit exposure between A and B.

Figure 1.1 No netting applied (top) and netting applied (bottom)

Now, we can ask ourselves what can be a reasonable instrument to reduce the counterparty credit exposure. Both parties can enter into a Collateral Agreement and do the trades within this legal framework. In a collateral agreement it is specified how the counterparty credit exposure is reduced by posting financial instruments to the other party. Several nitty-gritty things have to be specified when setting up the collateral management process. This is the process of keeping track and controlling the collateral. We consider

•Netting agreement

The netting agreement is at the heart of the collateral management process. In such an agreement it is specified which type of trades can be taken as a legal unit such that all trades in the unit are considered as one position. Often many different netting agreements exist. All trades falling into one such netting agreement are called the netting set.

•Uni- or bilateral collateral agreement

Here it is specified whether only one or both parties take part in the collateral process. In interbank markets the collateral agreements are usually bilateral. If a firm trades with a bank often unilateral agreements are found.

•Collateral/Margening frequency

This is the frequency at which margin calls take place. This means posting or calling collateral.

•(Minimum) Transfer amounts

If the exposure has changed and a party should post more collateral the minimum transfer amount specifies at which level this happens. For instance let this amount be 50.000 units of currency and the exposure has changed such that 43.000 units in addition to the current amount of posted collateral would be necessary no further collateral is transferred. If the amount increases to for example 50.500 this amount has to be posted.

•Calculation agents

A party doing the necessary calculations.

•Type of collateral

This specifies the type of collateral and can be for instance cash in domestic or s...

Table of contents

- Cover

- Title

- Introduction Goals of this Book and Global overview

- Part I Markets and Linear Products

- Part II Markets and Non-Linear Products

- Part III Counterparty Credit Risk Adjustments

- Bibliography

- Index