This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

This book analyses calendar anomalies in the real estate industry with a focus on the European market. It considers annual, monthly and weekly calendar anomalies looking at a representative sample of European REITs and highlights the main differences amongst the countries.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Anomalies in the European REITs Market by G. Mattarocci in PDF and/or ePUB format, as well as other popular books in Business & Servizi finanziari. We have over one million books available in our catalogue for you to explore.

Information

1

Real Estate Investment Trusts

1.1 Introduction

While the first REITs, as we know them today, were only created in 1961, after the promulgation of the Real Estate Investment Trust Act (Bailey, 1966), the current real estate investment trusts (REITs) originated from the business trust that first appeared in Massachusetts around 1850. The great market success of REITs can be ascribed to their low correlation with the performance of other financial instruments (mainly bonds and shares) and the link between their performance and that of direct real estate investments (Giliberto, 1990).

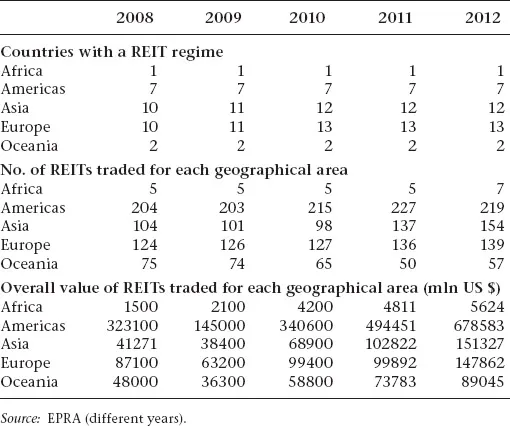

Nowadays the REIT market is significantly developed and the number of countries with a REIT regime is significant in almost all geographical areas and is even increasing in some markets (Table 1.1).

The sizes of the markets are not comparable in terms of both the number and the market value of the REITs traded in each market: American REITs represent, on average, 40 percent of the global market when based on the number of securities traded and 60 percent when based on the market value of securities, while the weight of the African REIT market is, on average, less than 1 percent (for both the numbers and sizes of the REITs traded).

The huge development of the REIT market outside the United States (the main reference country based on both the number of securities and their overall value) makes it necessary to determine if there are significant differences, between the instruments traded, in other markets.

Table 1.1 REIT regimes in different geographical areas

This chapter considers the full sample of countries that have adopted a REIT regime. It focuses on differences in the type of business entities and shareholder requirements (Section 1.2) and the main constraints applied to asset and liability choices (Section 1.3), and also provides a comparison with alternative indirect real estate solutions (Section 1.4). The last section summarizes the conclusions and implications.

1.2 REIT definition and types

As specialized indirect real estate investment opportunities, REITs are the main instrument used worldwide for investing in the real estate sector. They are intermediaries that collect money from (qualified or retail) shareholders for investing in the real estate market. Depending on the regulatory framework, they can be organized as a trust, a corporation, or even an association (Fiore, 1993).

Frequently REITs are structured as partnerships in which income is taxed only at a personal level to avoid double taxation (at the corporate and individual levels) (Jaffe, 1991). The aim of the tax advantage offered in some countries is to increase the demand for the securities and reduce the systematic risk exposure for REITs; to support the development of these markets; and to increase the amount of financial resources invested in the real estate sector (Sanger, Sirmans, and Turnbull, 1990).

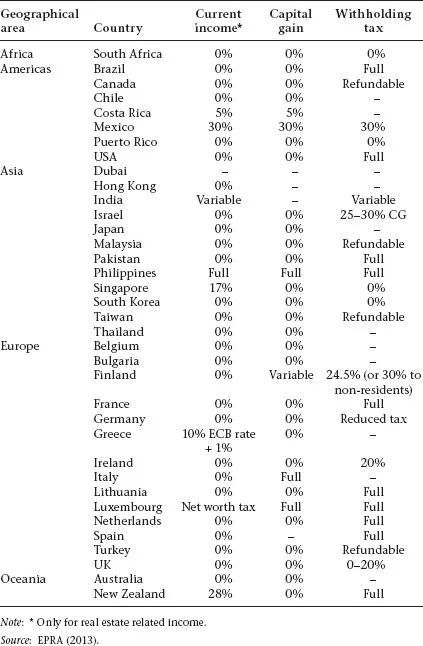

A comparison of tax advantages related to REIT investment worldwide identifies interesting differences between countries (Table 1.2). In almost all countries (around 75 percent), REITs are subject to zero income and capital gains tax rates. Except for the Philippines, countries with no tax exemption almost always apply a special discount to the amount of taxes requested on the income return, while capital gains are fully taxed in only three of the ten countries that have a capital gain tax (Italy, Luxembourg, and the Philippines). Only a few countries adopt a tax regime that avoids the risk of double taxation for investments in foreign REITs, or for investments by foreigners in domestic REITs.

The performance of REITs is significantly heterogeneous due to the huge differences in the investment policies adopted by each manager, which can affect the risk assumed. The main classifications proposed in the literature for identifying the different levels of risk assumed by investors distinguish REITs in terms of the type of exposure assumed by the investors and the type of investment (Danielsen and Harrison, 2007).

When looking at the type of exposure, the literature distinguishes between equity, mortgage, and hybrid REITs. Equity REITs own and operate income-producing real estate; mortgage REITs offer direct loans to real estate owners and operatives, or invest in mortgage-backed securities; and hybrid REITs adopt mixed investment solutions (Drob, 1976). Mortgage REITs normally use more leverage and use derivatives to reduce their interest rate market exposure. They are perceived as riskier by investors, especially those investing in mortgage-backed securities.

An alternative classification of the REIT industry can be based on the type of real estate asset in which the manager prevalently invests, because the strategy is normally focused on one of a few property types in order that advantages related to the manager’s expertise can be obtained (Ro and Ziobrowski, 2011). The main classification normally distinguishes between, at the least, residential, office, industrial, and retail assets (Miles and McCue, 1982), but the increasing complexity of the real estate industry has stimulated the growth of REITs specialized in smaller real estate market segments, such as storage, healthcare, and lodging (Newell and Peng, 2006). Empirical analyses demonstrate a correlation in the performances of REITs that invest in certain property types, especially in a market characterized by a high institutional market share (Chiang, 2010), and the property-type classification allows distinctions between securities characterized by different market trends and volatility.

Table 1.2 Tax rules for REITs in different geographical areas

1.3 Legal status and capital requirements

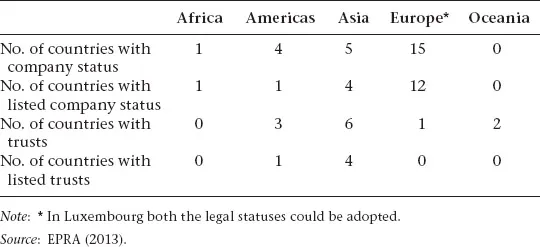

When based on the regulatory framework adopted in each country, REITs can have different legal statuses. The most common solution is the limited liability company, or trust, but there are differences, depending on the legal framework of each country (Table 1.3).

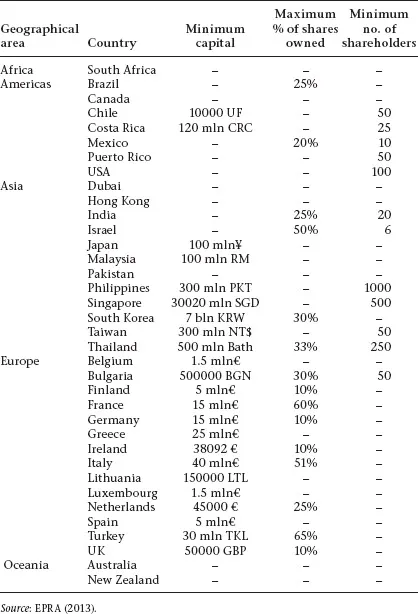

Trusts are adopted in important real estate markets, especially in Asia, while limited liability companies are most frequently adopted in European countries. There are also differences in listing constraints and frequently a listing solution is required only for REITs that are offered to unsophisticated investors, with no listing requirements for institutional investors. Irrespective of the legal status used, regulators have tried to prevent the REIT status from being used only for tax advantages; they want to ensure that ownership is widespread and that the instrument represents an Undertakings for Collective Investment in Transferable Securities investment opportunity. The rules defined in each country affect either the minimum amount of capital requested, the maximum amount of shares owned by each stock or quota holder, or the minimum number of investors (Table 1.4).

Table 1.3 Legal status of REITs in different geographical areas

Table 1.4 Capital requirements for REITs in different countries

Few countries require minimum capital requirements, and these are only in Europe. The amount requested varies significantly between countries and higher constraints are normally applied to markets in which REITs are also offered to unsophisticated investors.

Only around the 40 percent of countries with a REIT regime impose constraints on the maximum percentage owned and, on average, in these countries the maximum amount of shares owned by an individual, or firm, cannot be higher than 33 percent, but the threshold can vary significantly, from 10 percent (in Finland, Germany, and Ireland) to 65 percent (in Turkey).

Constraints on the minimum number of subscribers are applied more prevalently in Asia and the Americas, and the average number of investors required is under 200. The rules defined in each country are significantly heterogeneous, with the minimum number varying from six (in Israel) to 1000 (in the Philippines). Normally, more subscribers are required for REITs that are mainly offered to unsophisticated investors.

1.4 Asset and liability constraints

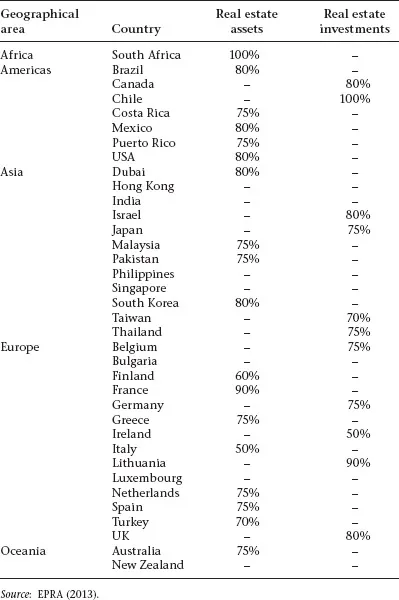

For a firm to be recognized as a REIT, its core business must be related to direct or indirect real estate investment and the main source of income must be ascribed to investments in that sector. The main investment normally involves real properties, real property interests, and real estate securities (Schulkin, 1971) and regulators define the minimum thresholds of income required for these investments to obtain REIT status. A comparison of the current legal frameworks of countries with a REIT regime determines some interesting differences (Table 1.5).

Based on current market law, a REIT has to invest at least 50 percent in real estate assets (Italy) or, more generally, in real estate investment opportunities (Ireland); in some countries (Chile and South Africa), REIT status is assigned only if the asset classes owned are related exclusively to real estate (in South Africa, direct real estate; in Chile, indirect real estate). The average constraint applied for both direct and indirect investments is around 75 percent and higher thresholds are normally defined for American and African countries than for other areas.

Table 1.5 Investment constraints for REITs in different countries

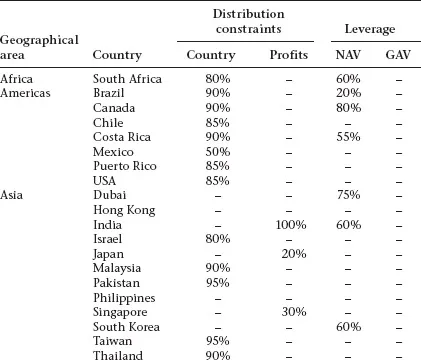

Regarding the liabilities assumed by the REITs, constraints are normally applied to the degree of leverage and the amount of self-financing allowed each year (Table 1.6).

REITs are almost always characterized by a mandatory income distribution that reduces the free cash flow available each year, thus decreasing the agency problem that especially affects firms without income distribution constraints (Ghosh and Sirmans, 2003). Based on worldwide statistics, on average, more than 85 percent of portfolio incomes, or more than 50 percent of net profits, must be distributed to investors, but the rules differ significantly from country to country.

Table 1.6 Liability constraints for REITs in different countries

Leverage can be measured by different proxies of REIT size: the gross asset value (GAV) or the net asset value (NAV). The GAV represents the overall value of assets at the end of the year, while the NAV represents the difference between the value of assets invested and the debt assumed (Biasin and Quaranta, 2012). On average, the maximum amount of debt is around 50 percent of assets (measured using GAV or NAV), but there is a huge difference in the rules defined by each country, especially for NAV-based constraints (which vary from 10 percent to 80 percent).

1.5 Main differences in comparison to other indirect real estate investments

The main indirect real estate investment opportunities can be identified in REOCs or real estate mutual funds (REMFs). The REOCs are public listed or unlisted firms that specialize in the real estate sector and pay dividends each year, which are based on earnings generated from projects and investments (Niskanen and Falkenbach, 2012). With respect to REITs, these firms focus on only a particular business and can experience higher growth due to the lack of minimum dividend distribution requirements and lower constraints on asset and liability composition (Delcoure and Dickens, 2004).

The REMFs are mutual funds that offer the opportunity to invest in the real estate sector using the anticipated greater knowledge and skills of the fund manager in selecting (direct and...

Table of contents

- Cover

- Title

- Introduction

- 1 Real Estate Investment Trusts

- 2 The European REIT industry

- 3 The Day of the Week Effect

- 4 The Role of the Weekend Effect in European REITs

- 5 Monthly Calendar Anomalies

- 6 The Impact of the Turn of the Month on European REIT Markets

- 7 The Time of the Month Effect for European REIT Investors

- 8 The Holiday Effect and REITs in Europe

- 9 The Friday 13th or Friday 17th Effect for European REIT Investors

- 10 Yearly Calendar Anomalies

- 11 The January Effect in European REITs

- 12 Is there a Halloween Effect in the European REITs Market?

- Conclusion

- Appendix

- Notes

- References

- Index