![]()

1

Financial Analysis

Financial analysis involves reading a company’s financial statements and trying to squeeze the juicy details out of them: how old the captain is, the age of the machines and the overall performance of the business. This requires a minimum skill set and a great deal of ingenuity. Financial analysis is often one of the first steps in business management: a prerequisite for making good decisions is having first understood what the business is all about.

Accounting

A lot of people will never overcome their aversion to accounting. A discipline that is generally deemed to be a bit sad and dreary, accounting is nevertheless – on the scale of human endeavour – what the lone star tick (amblyomma americanum) is to the world of living things: something repulsive to the eye, but in reality a marvel of inventiveness. So you will have to set aside your preconceived notions: to work in finance you can get by just fine without any knowledge of the lone star tick, but if you want to survive, you need to understand the mechanics of business accounting.

Financial statements

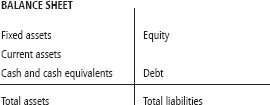

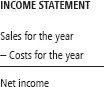

Every year companies publish several financial statements in their annual report. These statements show what has happened during the year. The two main statements are the balance sheet and the income statement (P&L account). Here is a brief presentation:

Figure 1.1 Balance sheet

Figure 1.2 Income statement

The income statement shows the operations that have occurred during the year, so it is like a post-game summary (both half-times1) and the bottom line (positive or negative) is the final score of the game. The balance sheet represents the state of affairs at the end of the year when the accounts are closed. This is the final standing – the championship ranking.

VIGNETTE

Mario Imbroglio sets out across Europe in his red Ferrari Testarossa. The ‘balance sheet’ at the end of the day refers to the final state of the car. For example, the seats, stereo and steering wheel are still there. The tyres are a little worn. There are 22 litres of petrol in the tank and the small tray under the dashboard contains £5.60 in small change, two £100 speeding tickets, and 53 toll receipts. The income statement corresponds to a tally of Mario’s exploits: he went to an ATM 12 times, withdrawing a total of £1,250, which he used to pay for 7 fill-ups (£700), 5 overpriced roadside snacks (£200) and 53 tolls (£344.40).2

VIGNETTE 2

Last year, the author of this book earned £65,000 in salary and book royalties and spent £63,000 on trifles (housing, food, clothing, transportation, holidays, taxes and so on). This is his income statement. On 31 December his current account balance was −£212, his stock market portfolio was worth £4,578 and his house was valued at £300,000 (with £299,000 of principal left to pay on his mortgage). That’s his balance sheet.3

Now we’re going to set up a concrete illustration that will guide us through this chapter.

Droids Co. make machine tools. Their customers are automobile factories with specific needs. Their suppliers are small subcontractors (electronic and mechanical components, steel, cables and so on) as well as utilities and service providers (energy, insurance and so on). We will read their financial statements and learn how to interpret them as we go along. Serious readers can repeat this process every time they want to read a company’s financial statements.

Income statement

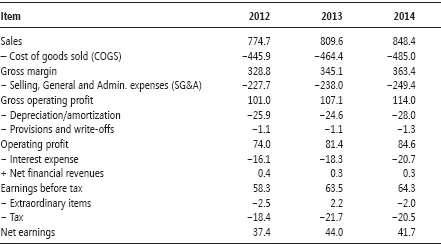

Table 1.1 Income statement

FINANCIALESE4

Sales represents sales revenue (volume sold × selling price). COGS (cost of goods sold) is the expenses invoiced by suppliers: raw materials, energy, rent, outsourced work and various other costs. Gross margin therefore represents the margin on sales after paying for supplies.

SG&A (selling, general and administrative) expenses include all staff salaries (shop floor workers, salespeople, executives) as well as other payroll costs such as social security contributions. Gross operating profit is therefore the margin on sales after paying production costs and overheads.

A word about depreciation/amortization and provisions

Depreciation and amortization are accounting entries which, unlike other items in the income statement, do not correspond to monetary operations. Specifically, depreciation/amortization5 is the process of spreading the cost of a past investment over time. Companies are not allowed to write off an investment as a one-time expense; that would be the equivalent of charging the entire cost of an asset to the accounts of a single year, even though that asset will be used for several years. The accounting solution is to deduct the expense gradually, in instalments, over the useful life of the asset. Some people say that depreciation reflects the wear and tear on the asset, but mainly it is an accounting device to spread out the cost of the investment over time.

| DIALOGUE |

| Rosencrantz: | On Droids Co.’s income statement we see £24M to £28M of depreciation per year. What does that mean? |

| Guildenstern: | Those amounts correspond to an investment of £250M spread over ten years. The investment actually did occur, but you are not allowed to record −£250M in one go on the income statement. So the expense is spread over time and the accounting representation of this operation is −£24M to −£28M per year over ten years. |

Provisions are accounting entries for potential losses such as inventory write-downs or doubtful debt. For example, if an outstanding customer payment is unlikely to be received, a provision is recorded to reduce the net earnings. Should the payment be made after all, the provision is cancelled, thereby increasing the net earnings (see the analysis of the asset side of the balance sheet below).

FINANCIALESE

The operating profit, therefore, is what is left of sales revenue after operating costs have been deducted and investment costs and asset depreciation have been spread over time.

Finance costs include the interest payments on debt and any foreign exchange losses. Financial revenues may be earnings from (short-term) investments, foreign exchange earnings or earnings from shares held in other companies. The sum of these two lines is the net financial expense/income...