This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

Peak Load and Capacity Pricing lays out clear pricing strategies for understanding peak load and capacity pricing structures, further cementing electricity's role as an asset class with fixed and variable costs.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Peak Load and Capacity Pricing by C. Harris in PDF and/or ePUB format, as well as other popular books in Business & Corporate Finance. We have over one million books available in our catalogue for you to explore.

Information

1

INTRODUCTION

In this book we consider the development of the theory and practice for the pricing of goods delivered by assets that do not run continuously, whether for demand reasons (periodic and/or stochastic) or production reasons (planned periodic cycling and/or technical availability). The focus is on electricity, and much of the analysis can be applied to other goods. The pricing of electricity at the peak is closely bound with the pricing of capacity.

Our practical purpose is to inform

1.efficient production and consumption choices for both private and state actors

2.efficient construction of markets, market arrangements, and capacity obligations, using market disciplines, especially those of traded derivatives

3.efficient construction of policy that explicitly recognizes the requirement to recover fixed costs and the moral hazards on the part of market actors, regulators, and governments

At some risk of oversummary, peak load pricing emphasizes long run equilibrium through the recovery of fixed costs through prices, and marginal cost pricing emphasizes short run efficiency and minimization of deadweight losses in welfare and in doing so ignores some fixed costs in price formulation.

Variable cost pricing remains the majority view in regulation, the media, politics, and commentators, and is also prevalent in the academic literature. We will show how the two methods can be reconciled in equilibrium conditions.

Consideration of peak load pricing has a long history in the theoretical literature. The recent development of thought could be viewed as having four key phases:

1.Pre-1950s: A long history of the structure of costs through moral philosophy and political economics, with key moments such as Adam Smith’s Wealth of Nations in 1776, the physiocrats, Dupuit and the French “econo-engineers”1 of the mid-nineteenth century, and the growth of marginal microeconomics in the 1890s. The peak load versus variable cost debate still turns on the relative importance of sustainable equilibrium in classical economics and the marginal (and market) price in neoclassical economics.

2.1950s–early 1970s: The theoretical foundations were developed for predominantly state-run electricity systems, commonly with tax subsidies in the fuel or other parts of the value chain. The broad academic consensus, resting on the heritage of marginal/neoclassical economics, was that most prices should be based on marginal variable costs rather than peak load pricing in which the fixed costs are loaded onto prices. It was during this period that the economic science2 of peak load pricing began as an optimization problem.

3.Late 1970s–2000s: The development of liberalization, with increasing private ownership and operation and the advent of markets and market disciplines. Discrete pricing of capacity was introduced and developed, and the economics of peak load pricing matured at the beginning of this period, and essentially completed, within the standard paradigm of separable fixed and variable costs. At the end of the period, the science of peak load pricing began to borrow from the science of market derivatives.

4.2000s and forward: Following the California electricity crisis in 2000/2001, collapse of Enron in 2001, and the ensuing demise of similar firms, and then the banking crisis of 2008, a return to state intervention and planning, this time without state ownership. The tension between consumer protection and competition in the areas of essential goods grew, with the result of price caps and protection of the socialization of capacity and public goods. In this period, the approach to capacity came under the influence of the evolving role of geopolitics, the growth of behavioural economics, experience of application of capacity mechanisms, and the integration of power systems and markets on a continental scale. In this period, there has been little debate on what was called the marginal cost controversy between the peak load and variable cost approaches.

The literature of the 2000s and beyond rests largely on the consensus for short run marginal cost pricing, which since we split into fixed and variable cost, we call variable cost pricing. Here we study the original texts, mainly in the middle period of the late 1970s to the 2000s, in order to examine the sensitivity of the conclusions to changes in explicit and implicit assumptions. We find that although there is an apparent tension between the peak load and variable cost approaches, that under equilibrium conditions, a careful working through of the original papers shows that they can be reconciled.

Our approach here is essentially welfarist, resting on the theories of welfare economics, and in particular the second theory, that maximum welfare can be delivered by redistribution of wealth outside the microeconomy, and free market forces inside the microeconomy. In this instance, the microeconomy is the electricity sector and the redistribution of wealth is addressed in the macroeconomy of general taxation.

We work through the key elements of peak load pricing. As well as being the natural method for “energy only” markets (i.e., a normal commodity market without an imposed capacity mechanism), it also corresponds to the method for the natural development of the installed capacity obligation regulatory model—reliability options. These modelling features should therefore be attended to be the administrator/planner of the system.

2

THE MODELING FRAMEWORK

2.1 NOMENCLATURE

For ease of comparison with the reference works, we have generally used the same nomenclature.

Amount delivered | S = min(D,Z) |

Capacity | Q, q, Z |

Call option premium | C |

Cost | f () |

Cumulative probability | F() |

Demand | D |

Event probability | λ |

Fixed costs | B, occasionally β |

Marginal probability | f (), P(S) |

Price | P, S for forward price distribution, F for current forward price |

Quantity, volume | Q, q |

Rationing cost | R |

Shock | u |

Strike price | K |

Subperiod length | w, H |

Surplus | S |

Variable Costs | b, occasionally γ |

Welfare | W |

Willingness to pay | X–1 (D), WTP, inverse demand |

“Suppliers” means retailers, rather than load serving entitities

2.2 BASIC MODELING OF CONSUMPTION

Here we describe the modeling of consumption that is required to model peak load and capacity pricing.

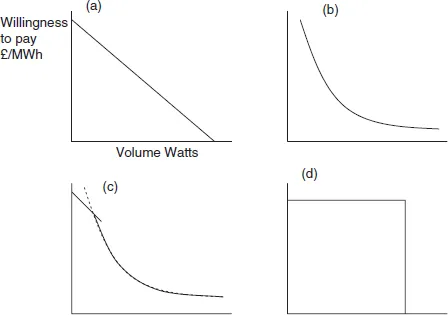

Figure 2.1 Four useful demand functions. Function C can be splined to make the slope continuous.

2.2.1 Willingness to Pay and the Demand Function

Willingness to pay is the price at which the consumer is indifferent to consuming and nonconsuming.

There are four demand functions of interest, namely: i) linear (quadratic utility in relation to volume, figure 2.1[a]), ii) linear log log (figure 2.1[b]), iii) two part (figure 2.1[c]), and iv) constant to a limit, called right angled (figure 2.1[d]). A particular challenge for electricity is that we need a demand function that can encompass a price range over at least six orders of magnitude while at the same time having a finite limit.

2.2.2 Utility

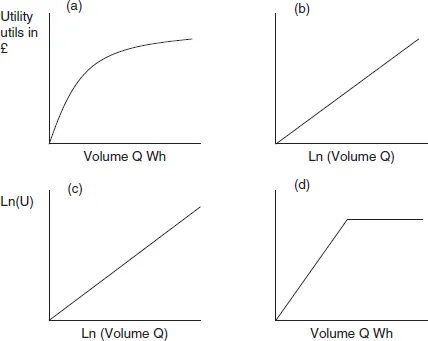

Utility is the worth of an endowment of a good to an individual, in the money metric. The willingness to pay is equal to the slope of the utility function. The main functions in use are shown in figure 2.2.

For the ex ante utility of a risky endowment, we apply the basics of the approach of Von Neumann and Morgenstern (1944) (VNM). So the ex ante utility of a total wealth that is stochastic is equal to the probability weighted average of the ex ante utilities of each wealth state. This makes a number of assumptions, the most important of which for present purposes are:

Figure 2.2 Some utility functions (a) Quadratic (b) Log (c) Log log (Cobb Douglas) (d) Linear to a limit.

1.probability distributions are stationary (constant distributional form and coefficients) for the past and future

2.probability distributions are determinable from nonparametric actuarial analysis and ideally reconcile to parametric forms constructed from the economic and engineering fundamentals and modeled using a Bayesian approach

3.probability distributions are intuitively understood even for extremely unlikely events and risk aversion increases monotonically with risk amount

4.utility is not path dependent (i.e., the level of wealth uniquely determines utility)

Each of these assumptions is fragile and important and should be controlled for where relevant.

2.2.3 Surplus

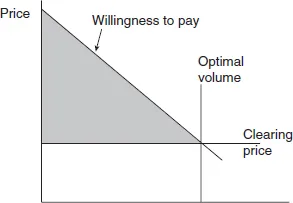

For an individual, the net surplus is equal to the utility minus the cost. It is commonly expressed as the area under the inverse demand function as shown in figure 2.3.

Figure 2.3 Consumer’s surplus.

It is also common in economics to blur the distinction between consumer’s (i.e., the individual’s) and consumers’ (i.e., society’s) surplus. Figure 2.3 can apply to either, but we cannot regard the consumers’ surplus as the function to be maximized, unless to recognize policy requirements, we apply some constraints...

Table of contents

- Cover

- Title

- 1 Introduction

- 2 The Modeling Framework

- 3 The Framework and Development of Peak Load Pricing

- 4 Relaxing the Hard Capacity Constraint

- 5 Modeling Capacity Using Derivatives

- 6 Capacity Mechanisms

- 7 The Power Complex

- 8 Final Comments

- Notes

- References

- Index