eBook - ePub

Microcredit Guarantee Funds in the Mediterranean

A Comparative Analysis

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

This book offers a comprehensive comparative analysis of the microcredit guarantee funds adopted in three South European countries and in three North African countries. It focuses on three keys areas: analysis of the regulatory framework, mapping of microcredit institutions and analysis of the main features of guarantee funds.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Microcredit Guarantee Funds in the Mediterranean by P. Leone,P. Porretta in PDF and/or ePUB format, as well as other popular books in Negocios y empresa & Servicios financieros. We have over one million books available in our catalogue for you to explore.

Information

Topic

Negocios y empresaSubtopic

Servicios financieros1

Introduction

Paola Leone and Pasqualina Porretta*

1.1 Microfinance: definition, products and services

There is no internationally accepted definition of microfinance; however, the term is used to indicate a range of financial services/products (of small amounts) offered to low-income/non-bankable customers and micro-enterprises. Microfinance covers a wide range of financial services that include savings, credit, insurance and remittance. Microfinance targets those people who are denied credit by formal financial and banking institutions because of lack of knowledge as well as formal rules which they have to follow to get a credit from these institutions.

In fact, microfinance, according to Otero (1999, p. 8) is “the provision of financial services to low-income poor and very poor self employed people”. These financial services generally include savings and credit but can also include other financial services such as insurance and payment services. Schreiner and Colombet (2001, p. 339) define microfinance as “the attempt to improve access to small deposits and small loans for poor households neglected by banks”.

Generally, microfinance1 is associated with developing countries, where large segments of the population need to access these types of financial services, although microfinance includes a variety of activities that extend to developed countries, where – especially after the international economic and financial crisis – an increasing number of people face poverty due to factors such as immigration, unemployment, inactivity and marginalization.

Traditionally, those people who benefit from microfinance are citizens of developing countries who struggle to provide for themselves; they are known, unfortunately, as “the poorest of the poor”. Within this category, women are of particular significance since they constitute the group that is most affected by financial exclusion in many developing countries. More recently, microfinance has turned its attention to self-employed workers and individuals in charge of small, often family-owned businesses which are unable to obtain bank credit. For micro-entrepreneurs, microfinance represents an alternative to credit given by lenders, and often constitutes a way out of the money-lending system (La Torre and Vento, 2006, p. 3).

From this perspective, it’s important to underline that at the EU level, a definition for microcredit focuses on microbusiness and entrepreneurs who have limited access to conventional banking loans. The Commission Communication “A European initiative for the development of microcredit in support of growth and employment” has stated this definition (ESBG, 2009, p. 1). The EC did not clearly define their target groups, and did not focus on start-ups and micro-enterprises or on financially excluded2 enterprises or individuals. Those two target groups have different requirements and call for different, and therefore adapted, financial solutions.

Microfinance defines an area of activity that includes all those economic/financial relationships that financial institutions may establish with their customers. In particular, the term refers to a range of financial products and services, often accompanied by social intermediation services, offered to customers who struggle to access the traditional banking system because of their weak economic and social conditions. Microfinance is thus broadly viewed as an activity that can be potentially carried out by a wide array of institutions providing financial services such as lending, deposits, insurance and so on. Microfinance institutions (MFIs) is simply a generic term including an estimated diverse entities such as commercial banks, non governmental organizations (NGOs), credit unions, financial companies and so on. In some countries, the term “microfinance institution” is used to refer to NGOs or other entities whose main activity is the delivery of microcredit, or entities requiring a minimum level of microfinance activity from a specialised microfinance provider.

In many countries, a variety of institutional types engage in microfinance; many of these operators are supervised by banking regulators and authorities. In line with their different activities, these entities are characterised by different licensing and prudential standards; some institutions may not be supervised at all. In particular, the following can operate in the microfinance sector:

•Banks, the definition includes traditional commercial banks and similar financial institutions (for example savings bank). Generally speaking, the extent of the banks’ engagement in microfinance varies considerably within and across countries. In particular, commercial banks have been increasingly active in micro-lending over time, which may reflect enhanced competition, social responsibility concerns, government policies, or a combination of these. In some countries, this situation may simply reflect that the bulk of the retail market is low-income;

•Co-operative, such as credit co-operatives, co-operative banks, construction companies, mutual savings and loans associations and so on. Co-operatives that engage in business with non-members are normally prudentially regulated and supervised, just like co-operatives that lend to and take deposits only from their members (member-only) in high-income countries, regardless of their size. In low and middle-income countries, the regulatory and supervisory system for member-only co-operatives varies, but tends to fall under non-prudential regulators. Financial co-operatives that engage in business only with their members tend to be licensed or registered by a government agency other than the banking authority or the central bank, such as the ministry of finance, ministry of labour or ministry of co-operatives, and normally are not prudentially supervised;

•Microcredit Institutions (MCIs), these are entities whose sole activity is lending to low-income individuals and small or micro-enterprises3 and they are not allowed to take deposits. These entities are subject to a wide variety of supervisory systems, ranging from simple registration requirements to prudential supervision. They may take on a variety of commercial (for example limited liability or joint stock companies) and non-profit (for example associations, foundations) forms. Few countries impose a licensing or authorization requirement to MCIs. In some countries, the license is issued by a public agency or authority other than the banking authority, Central Bank or Ministry of Finance, and in two of them there are no minimum licensing criteria, only simple registration procedures. (BCBS, 2010, p. 36–38)

Microfinance can be seen from three different angles: its social component, which means tackling social and financial exclusion, reducing unemployment and helping the reintegration of excluded citizens into the community; its economic component, which defines microfinance as an economic tool potentially enabling economic growth; the provision of aid, an instrument used in developing countries.

Microcredit is often confused with microfinance, but it is actually only one of the products of the latter (though the most important), which also includes a number of other financial products/services that can be synthetically grouped in the following areas:

•Small loans (microcredit)

•Micro-insurance products/services

•Micro-leasing instruments/products

•Social housing products/services

•Forms of deposit collection and management

•Payment services

•Remittance services

Over the past decade, many changes have taken place in the overall microfinance landscape.

Microfinance has strongly expanded in many countries, assisted by technological advances, new opportunities emerging alongside the traditional microcredit model and new players entering the industry to capitalise on these opportunities. Today’s situation is characterised by increasing involvement by Development Finance Institutions, investment funds and other institutional investors in microfinance business (European Commission, 2008).

Microcredit, and microfinance in general, could be seen as a political tool in some countries, tempting politicians to demand forbearance or forgiveness of loans granted to poor customers during times of economic stress. Microfinance can be an appropriate solution to tackle financial and social exclusion, as it provides lending, financial management and other financial products or services. For instance, the EU has set up several policies on social inclusion, which highlight the role and benefits of micro-loans in reducing poverty, boosting economic growth and creating jobs.

The beneficiaries of microfinance products/services constitute a category which generally includes economically and socially vulnerable subjects. The target varies according to practices followed by the MFIs and the countries they operate in. However, the recipients are usually low-income individuals or people with irregular income, the unemployed, non-homeowners, migrants, residents in depressed or marginal areas and/or women (especially in developing countries), all subjects who have one characteristic in common: financial exclusion.4 Microfinance offers products/services that often allow for or facilitate their financial inclusion, which the European Commission defines as “[ ... ] The process by which people are able to access and/or use financial services/products in the mainstream market that are appropriate to their needs and enable them to lead a normal social life in the society in which they belong” (European Commission, 2008). The European Commission, therefore, regards financial exclusion not just as a lack of access to financial instruments, but also the inability/impossibility to actually use them.

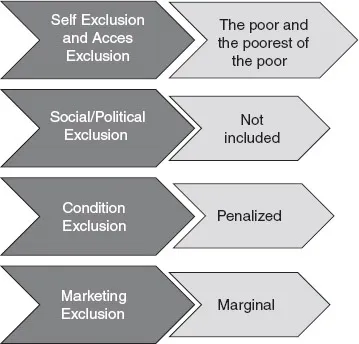

Different reasons may lead to financial exclusion (La Torre and Vento, 2006, p. 4). First of all, there is so-called self-exclusion, which mainly originates from a perception of inadequacy of the single individuals to meet the requirements set forth by the financial intermediaries; this category includes the poorest of the poor. We then define access exclusion as resulting from a risk assessment process conducted by financial intermediaries on customers, which indicates their poor creditworthiness; this category includes the “poor”. The “poor” and the “poorest of the poor” are two categories that have traditionally represented the targets of microcredit programmes.

However, financial exclusion may also result from an exclusion from the social-political system; this is the so-called political exclusion, which usually affects migrants and all those subjects who are not bankable, as they are not included in the census.

Then, there are subjects whose existence is known but who fail to gain access to the financial system because they cannot afford the costs and conditions of the financial products offered; in this case, we can speak of “penalised” subjects, affected by the so-called condition exclusion. Finally, we can identify a form of financial exclusion affecting customers who are considered “marginal” by the financial intermediaries (mostly small entrepreneurs), as they represent a low-value target according to traditional customer valuation models; in this case, we can talk about marketing exclusion (Figure 1.1).

1.2 Microcredit: a brief overlook

As mentioned above, microcredit is one of the instruments used by microfinance to meet the need for access to credit by so-called non-bankable subjects. The term is normally used to indicate two types of financial activities: the social microcredit (mainly aimed at the social inclusion of excluded subjects by supporting their current expenditure and providing social services, training courses, and so on) and microcredit for businesses (supporting start-ups and self-employment initiatives), which obviously have different objectives.

Figure 1.1 Forms of financial exclusion

Source: Author’s elaboration based on La Torre and Vento, 2006, p. 4.

This microcredit market segment goes by the definition of nearly bankable, and in this perspective, microcredit services are seen as highly important to stimulate economic growth, create jobs and tackle financial exclusion.

Microcredit can be provided in any of the technical formats used for ordinary credit. Yet, when compared to ordinary credit, microcredit shows a number of peculiarities that can generally be defined as follows:

•Reduced size of the loans. Loans are usually very small, short-term and unsecured, with better repayment rate and higher interest rates if compared to traditional bank loans. Many microcredit providers charge higher interest rates to offset higher operational costs involved in the labour-intensive micro-lending methods;

•Support lending with non-financial services (tutoring, monitoring, technical assistance, and so on). Supporting loans with a number of ancillary and instrumental services is key for the success of any microcredit programme. Effective links need to be put in place between providers of these support measures, both within schemes where support services are integrated in a single programme and in those focusing uniquely on lending;

•Beneficiaries are non-bankability or financial exclusions. Microcredit providers usually cater to low-income customers, both underemployed individuals and entrepreneurs running informal family businesses (e.g., petty traders). Borrowers are typically concentrated in limited geographic areas, social segments or entrepreneurial sectors;

•Creditworthiness assessment should take into account the peculiarities of the borrowers (absence of credit history, absence of collaterals to be provided to financial intermediaries, no written accounting practices, no solid business plans, no information databases showing an adequate business structure and significant statistical data). Loan documentation is largely generated by the microcredit provider officers through visits to the borrowers’ business and home. Borrowers often lack formal financial statements, so loan officers may help in the preparation of documents by using expected cash flows and net worth to determine the amortisation schedule and the amounts of loans. The borrower’s personality and willingness to repay is also assessed during field visits. Credit bureau data are not always available for low-income clients or all types of microfinance providers, but when they ex...

Table of contents

- Cover

- Title

- 1 Introduction

- 2 Regulatory Framework and Supervisory Authorities in Microcredit Sector: A Comparative Analysis

- 3 Mapping Microcredit Institutions/Operators: A Comparative Analysis

- 4 The Microcredit Guarantee Funds and Institutions: A Comparative Analysis

- 5 Nearly Conclusive Considerations

- Bibliography

- Index