![]()

1

National Systemic Risk Management

Introduction

In order to manage systemic risk in an organization, such as a state, three points of reference must be established, that is a micro- organizational (households, companies), a macro-organizational (the state institutional system, the socioeconomic system of a country), and a mega-organizational one (global relationships). The most important in this case is the macro-organizational point, as looking at the executive of the state institutional system allows to assume a holistic perspective on risk within the framework of shaping the immediate systemic environment and neutralizing the threats posed by a distant systemic environment. In turn, any human activity, especially if related to trade, is connected with taking risks and the possibilities of incurring potential losses, particularly in legal and financial terms. There is also a global perspective on top of that, which should not only be taken into account but perpetually born in mind as it may pose both opportunities and threats. This is because every type of risk, systemic or incidental in nature, assumes its own significance or generates cyclical or stable costs that must be incurred in order to regain the efficiency of operation chiefly in economic terms.

The nature of any risk is always dynamic, irrespective of the fact that it might remain stable at some points in time. As far as management is concerned, it must first be identified, and subsequently its real or estimated weight must be defined, which will make regular control possible and allow the adoption of appropriate security measures. Next, human skills must be used in a broad-minded way and not merely on an individual, sector-, or department-based scale. Therefore, this chapter presents an introduction to the abundance of approaches that one might take to systemic risk, while at the same time showing how to achieve a compromise between exposition to risk and its aversion when it comes to decision-making.

1.1 Managerial grounds for risk and making strategic decisions

Although risk has existed on Earth since any human activity was first documented, regular academic interest in various categories of risk started to be evinced only in the early 20th century. A. Willett saw it as “the objectified uncertainty as to the occurrence of an undesired event. It varies with the uncertainty and not with the degree of probability” (Willet, 1951). In the seventies, risk and its management were directed at incidental and credit risks; in the eighties, market risk was added; and in the nineties, operational, strategic, and financial risks were also being developed (Cican, 2014, 280). If, in turn, we refer to the decision theory in its classical form, the greater the dispersion around the expected values of variance distribution of profit and loss, the higher the risk (Kubińska and Markiewicz, 2012, 45). Whereas risk management is intended to make people conscious of what risk is involved in a given activity so that it can be managed, from the perspective of an individual (household), a state institutional system, and a company, it is supposed to improve financial results and bring about conditions that will allow to keep loss at a level not higher than specified earlier (Dziawgo, 2011, 314). The best principle of risk management in history was written down in the Code of Hammurabi (about 1772 BC). It read, “If a builder build a house for some one, and does not construct it properly, and the house which he built fall in and kill its owner, then that builder shall be put to death” (Taleb, 2015, 244). The death penalty mentioned in this passage might as well be replaced by money damages, if its amount would in fact compensate for the incurred loss (although it is hard to claim that any amount of money could be a substitute for the life of a person).

Risk has many synonyms, and is interdependently related to many terms, such as chance (the positive aspect of risk), systemic risk (common for a given group), unique risk (specific), shock (negative or positive change that may be either evolutionary or unpredictable), exposure to risk (shocks and vulnerability to risk), susceptibility (to losses generated by negative shocks), resistance to shocks, crisis (emerging under the impact of the negative effects of risk), and uncertainty about the future (World Development Report, 2014, 61).

In general, risks may be categorized as follows:

a) according to the categories of decisions made for the purpose of achieving goals (risk as uncertainty with respect to future events or the outcomes of decisions), and the results brought about by those decisions may either be loss or profit,

b) according to the sources of risk (uncertain information or a decision made on the basis of a not optimal choice),

c) according to the manifestations of risk (deviation from the expected value of the goal that has been set),

d) according to probabilistic or statistical measures as the subjective probability of one-time events (including ones that have never taken place) (Tyszka and Zaleśkiewicz, 2010, 58–60).

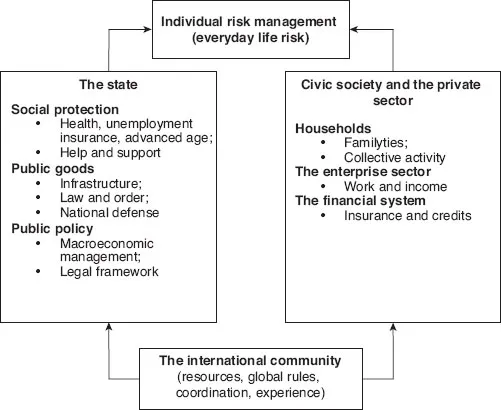

The risk involved in an individual’s actions is always to some extent dependent on the external environment and may be examined from the perspective of numerous overlapping correlations that eventually affect decisions (Figure 1.1).

In this system, an individual (a human being) will always receive the necessary support, starting from a household, which protects its members and has the possibility of making use of the combined total resources, through companies, which ensure income and allow the absorption of shocks, to the state, which, through to an institutional system, is capable of exerting local, national, or international influence and serves as the last resort in ensuring that the fundamental rights are observed (World Development Report, 2014, 19).

The dimensions of risk management, from the broad to the very specific ones, may be presented as follows (Improving the Management ... , 2011, 5):

a) risk management (organizational principles, effective risk prediction):

• placing an emerging strategy of risk management within the framework of organizational strategic decision-making,

• explaining the roles and responsibilities of the particular members of an organization.

b) risk culture (an active culture of risk management oriented at supervision, absorption, and assessment of information):

• developing incentives to exercise supervision and prizes,

• Removing barriers to becoming involved in supervision,

• adopting various points of view.

Figure 1.1 The influence of the socioeconomic system on individual risk management

Source: World Development Report, Risk and Opportunity – Managing Risk for Development, World Bank, Washington 2014, p. 19.

c) training and developing the potential for/capabilities of:

• supervising and scheduling/forecasting,

• informing about the problems that arise and holding a dialogue with the chief interested parties,

• working and cooperating with others for the purpose of understanding the problems and threats that arise.

d) adaptation planning and management (stress placed on communication and identification of risk):

• predicting and preventive preparation in case of adverse effects,

• drawing up of a list of options and priorities in order to ensure flexibility and a possibility to change a decision,

• formulating a strategy for resistance and response to the emerging threats.

As far as the economy is concerned, risk is an inscrutable factor, a random one, which is very often seen through the prism of the possibilities of stabilization and reduction across time by way of dispersion. However, not all such factors may be stabilized or dispersed, and reduction in the level of accompanying uncertainty may also have a merely subjective character, if there are no sufficient grounds for objective appreciation. The unexpected character of certain events is rather a consequence of insufficient knowledge on a given subject. But why is it that having, as we believe, quite extensive knowledge, we are still surprised by the lack of certainty, if we are empirically proven wrong (Hadyniak, 2010, 13–14)?

Since J. von Neumann and O. Morgenstern elaborated on the D. Bernoulli’s expected utility principle, this rule has governed decisions involving risk, as it offered guidelines on which path to choose. Further development of this theory on the basis of experiments that were conducted has led to the formulation of the so-called conventional theory (Kopańska-Bródka, 2012, 133–134). “These theories study the preference relationships inevitable to explain the sources of inconsistencies with the independence axiom. In such extensions, the axiom system of the theory of expected utility is accepted. However, the functional on a set of risky decisions is not an expected value but a decision-weighted transformation of the utility of possible outcomes. This new principle has not led to such inconsistencies as the principle of expected value maximization” (Kopańska-Bródka, 2012, 134). Nevertheless, even these theories did not prove quite useful, which led to the development of alternative theories known as unconventional ones as well as prospect, dual, or generalization theories. In general, each instance of strategic decision-making should be – from the point of view of the state or the market – dependent on the mutual infiltration and complementation of prescriptive and descriptive approaches (i.e., the so-called conventional and unconventional ones), which would mean taking into account individual reasonableness associated with the subjectivity of the act of making a choice (Kopańska-Bródka, 2012, 134, 146–147).

Therefore, a taxonomy of the threats and risks to macroeconomic growth, which must be taken into consideration when making strategic decisions, especially related to finances, includes the following units that may be examined from the perspective of insurance companies, corporations, financial risk managers, and political decision-makers (Coburn et al., 2013, 20–24, Coburn, 2014, 7–8):

a) financial shocks:

• market crash,

• insolvency and potential bankruptcy of a state,

• speculative (asset) bubbles,

• financial irregularities,

• run on banks, that is, a mass withdrawal of deposits from banks.

b) commercial disputes:

• labor dispute,

• trade sanctions,

• customs war,

• nationalization,

• collusion (e.g., between manufacturers with respect to product prices in a given year).

c) geopolitical conflict:

• conventional warfare,

• asymmetric warfare,

• nuclear warfare (local or global),

• civil war,

• influence of external forces.

d) political violence:

• terrorism,

• separatism,

• riots,

• assassinations,

• organized crime.

e) natural disasters:

• earthquakes,

• hurricanes/storms,

• tsunamis,

• floods,

• volcanic eruptions.

f) climate disasters:

• drought,

• freezing/low temperatures,

• the heat,

• atmospheric discharges (thunderstorms),

• tornado and hail,

g) environmental disasters:

• rise of the sea level,

• oceanic changes,

• atmospheric changes,

• pollution,

• fire.

h) technological disasters:

• nuclear disasters,

• industrial emergencies,

• infrastructural failure,

• technological incidents,

• cyber catastrophes.

i) epidemics:

• epidemics affecting humans,

• epidemics affecting animals,

• epidemics affecting plants,

• zoonoses,

• water epidemics.

j) humanitarian crises:

• famine,

• no access to water,

• refugee crisis,

• failure of or no social protection system,

• child poverty.

k) outer space:

• meteors,

• solar storms,

• satellite systems failures,

• ozone layer depletion,

• threats from the outer space.

l) other threats.

Such a multifaceted and multidimensional list of factors that is taken into account in risk management builds awareness that not only sector-related risks, which are characteristic for a given market segment or a broader socioeconomic structure, are important, but also the risks that seem far away.

A certain mood of the decision-maker can affect their decisions that are made in uncertain conditions. Research conducted by A. Bassi, R. Colacito, and P. Fulghieri demonstrates that even the weather can exert an influence on risk aversion. By affecting people’s moods, good weather encourages the taking of risk, while...