This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

This book explores the ways in which the adoption of new paradigms, processes, and technologies can lead to greater revenue, cost efficiency and control, as well as improved business agility in the insurance industry.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Digital Insurance by Bernardo Nicoletti in PDF and/or ePUB format, as well as other popular books in Business & Financial Services. We have over one million books available in our catalogue for you to explore.

Information

1

Innovation in Insurance

Introduction

The focus of this chapter is on innovation in the digital insurance context.

This chapter starts by discussing innovation and innovation modes in general. The following sections apply the general concept of innovation to the specific case of insurance companies. We call such transformation digital insurance. Digital insurance refers to the provision and operations of insurance and connected financial services with the help of digital solutions. The scope of the services may include transactions to make insurance or personal investments, administer policies, and access customized information.

The main challenge standing in the way of innovation in the financial services industry, in general and in insurance companies in particular, is the conservative nature of many such institutions. The less they change, the better, their executives feel. Consequently, mainly outsiders have introduced innovations:

•A small financial institution in the Netherlands pushed for online banking. It became a global leader in internet banking: ING Direct.

•An outdated post office launched a prepaid card in Italy and became a leader in that market with almost 12 million cards: Poste Italiane.

•A telecom operator launched a person-to-person (P2P) money-transfer service using mobile phones. It became a market leader in Kenya: Safaricom.

Insurance companies for several reasons, including Solvency II regulation, will need additional equity. These requirements imply substantial cuts in operating costs to free needed funds.

It is time for insurance companies to take the lead in innovation and make their processes leaner and digitized. It is possible to do this profitably in almost all the financial sectors, including in insurance companies. Most of insurance companies have been static for a long time. It is now time to change under the push of four disruptive factors: urbanization, technology, demographics, and globalization.1 The requirements are clear:

•There is a need for new product innovation. Since insurance companies essentially manage information, this should be relatively easy and not very expensive.

•There is a need for agility, for instance, in inquiries and especially in processing the claims from the customers. Speed is the name of the game. If a customer needs a policy or should make a claim, he/she would like to submit and get them immediately. Risks should be managed, but with the right balance between customer satisfaction and loss avoidance.

•There is a need for continuous and secure operations. This should be pursued by moving to a multichannel strategy based on lean agencies, online insurance, or entirely digital insurance. Security is at a premium. It should not delay the speed of the operations. Digitization can help quite a bit. In this case, a middle office can provide support in taking the burden off the front office.

•There is a need to slim the back office. This should be reduced and possibly outsourced or offshored.

Innovation

Definitions

The importance of innovation for organizational success can be traced back to Joseph Schumpeter. He defined innovation in the following way:2

changes of the combinations of the factors of production as cannot be effected by infinitesimal steps or variations in the margin. They consist primarily in changes in the methods of production and transportation, or in the production of a new article, or in the opening up of new markets or of new sources of materiel.

This definition of innovation has stood the test of time. Ideas like entrepreneurship and similar (highlighted in this chapter) have emerged in more recent times, yet the essence of innovation remains the same. Peter Drucker, almost 50 years later, generalized what Schumpeter had written, defining innovation as3

the means by which the entrepreneur either creates new wealth-producing resources or endows existing resources with enhanced potential for creating wealth.

Over time, innovation management has changed.4 It is interesting to examine the basics and the evolution of innovation management and how it is possible to apply them to digital insurance.

Invention and innovation

Innovation is the only way to obtain competitive advantages. Lean management and information and communication technologies (ICT) can give a powerful impetus to innovation by supporting the business strategy with solutions for improving processes and digitizing applications.

Not innovating can be dangerous, since there is the equation “evolve or die” synthesized in the sentence attributed to Charles Darwin:5

It is not the strongest of the species nor the most intelligent who will survive but those who can best manage change.

“The Dinosaurs” were strong, but they have disappeared. In contrast, the human species thanks to their adaptability have survived and expanded. This statement is true for the animal species as well as for the organizations. They need to innovate. Organizations need to strive to add value to their customers and to the organizations themselves, eliminate waste, and drive competitive advantages.

Before proceeding, it seems important to define some words. In the Oxford English Dictionary, invention is defined as the means for creating or devising something new. Invention is also regarded as devising new ways of attaining given ends.

An invention must satisfy the following conditions:

•It results in something new.

•It involves some inventive (new) step.

•It is useful.

Innovation is different. The Oxford English Dictionary defines innovation as the means for introducing something new. Innovation can be said to be the introduction of a new product or service, process, organization, or business model into the marketplace.

The National Innovation Initiative (NII) of the United States defines innovation as the intersection of invention and insight, leading to the creation of social and economic value.6

Innovation is important. Frank Gens, VP and IT adviser at IDC states that7

The industry’s drastic and disruptive shift to its 3rd Platform for innovation and growth (built on cloud, mobile, social, and big data solutions) will accelerate: Spending on these technologies and solutions – growing at 13 percent – will account for one-third of all industry revenue and 100 percent of growth.

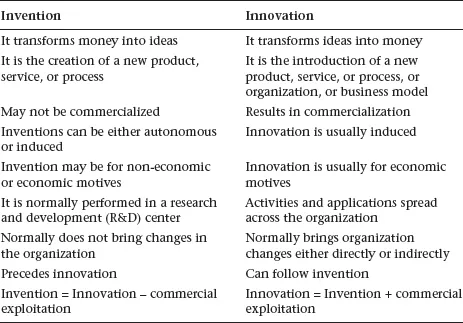

The main differences between invention and innovation are synthesized in Table 1.1.

Innovation models

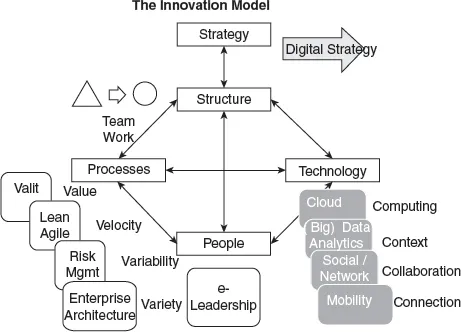

Innovation should be approached in a holistic way. To meet this challenge, it is possible to refer to the combination of the Chandler model of connecting strategy and structure,8 and the Leavitt diamond model,9 by considering four connected variables:

Table 1.1 Differences between innovation and invention

•structure (organization)

•processes

•technology

•persons

An example of this approach, applied to digital strategy, is shown in Figure 1.1.

Innovation and financial services

The current economic crisis is still hitting Europe especially. There is a need to come out of this situation as soon as possible, particularly in order to increase the employment of the younger generations. The most effective way to this is through innovation. It is important to analyze in more depth how it is possible to innovate.

Figure 1.1 A model for an integrated innovation strategy

Classifications of innovation

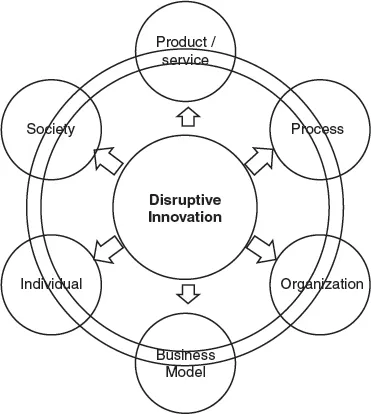

Innovations can be of several types:

•open and closed

•incremental and radical

•incremental – sustaining

•evolutionary

•radical, altering, disruptive (see Figure 1.2)

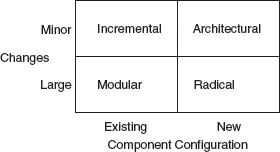

•modular and architectural

•generic and epochal

•technovation/technological

•spontaneous/autonomous and induced

•individual, systematic, systemic, semantic

Figure 1.2 The impact of disruptive innovation

These types can be combined in different ways (see, for instance, Figure 1.3).

The components of innovation can be

•a hardware component, consisting of material or physical aspects of the innovation;

•a software component, consisting of an information and decision base that is needed to use the innovation;

•an evaluation component that is useful for assessing the decisions related to the adoption of the innovation.

Innovation levels

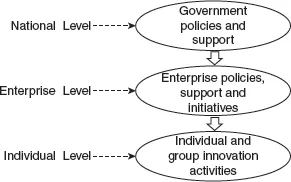

The innovation process needs support at three levels (see Figure 1.4):

•At the macro level, that is, at the national level, innovation in a nation directly depends upon the national government’s policies and support.

Figure 1.3 Classification of innovations

Figure 1.4 Levels of support for innovation

•At the enterprise level, innovation in enterprises depends upon top management’s support and commitment.

•At the bottom level, that is, the individual level, organizations should create multifunctional teams and encourage individuals involved in the innovation process.

Types of innovation from the point of view of the motivation (“why”)

From the point of view of the motivation, there are three types of innovation:

•customer-driven

•technology-driven

•design-driven

In customer-driven innovation, the change is born out of the specific needs or requirements of the customers. It can help resolve some urgent needs for which customers require solutions.

In the second case, innovation is driven by technology. The initial push to make changes is connected with exploiting some new types of technologies.

The third case is more complex. Design-driven innovation is obtained through the introduction of products and services that have a radical new meaning.10 They might provide a completely new reason for customers to buy the products. The typical example is the iPhone. Customers did not ask for it. The technology was available for a long time and used in different ways. Steve Jobs launched an entirely different product that created a completely new and huge market.

There are not many examples of design-driven innovat...

Table of contents

- Cover

- Title

- Introduction

- 1 Innovation in Financial Services

- 2 The Management of Digital Insurance

- 3 The Digital Insurance Basic Systems

- 4 Advanced Solutions

- 5 Governance

- 6 Regulatory Framework

- 7 Digital Insurance Throughout the World

- 8 The Future

- Conclusions

- Notes

- References

- Glossary

- Index