eBook - ePub

European Real Estate

Asset Class Performance and Optimal Portfolio Construction

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

European Real Estate

Asset Class Performance and Optimal Portfolio Construction

Book details

Book preview

Table of contents

Citations

About This Book

This book provides a thorough overview of the European real estate Market. It evaluates the performance difference between countries and sectors, and what implications this has for optimal investment strategy within real estate asset classes.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access European Real Estate by Dilek Pekdemir, Gianluca Mattarocci in PDF and/or ePUB format, as well as other popular books in Business & Financial Services. We have over one million books available in our catalogue for you to explore.

Information

1

European Real Estate Markets Comparison

Dilek Pekdemir

1.1 Introduction

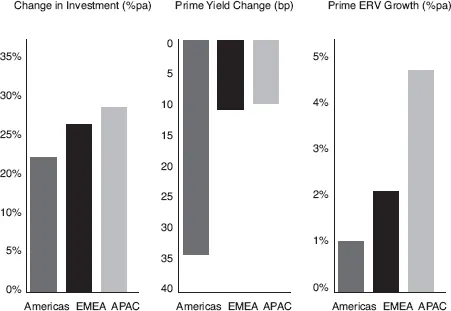

Recent published reports on the real estate investment market stated that the global investment market activity has expanded significantly, and the growth is becoming more visible in the last a few years (Axa Real Estate, 2013; CBRE Global Investors, 2014; DeAWM, 2014a; DTZ, 2014; Cushman and Wakefield, 2014a; RCA, 2014). Indeed, the highest global total recorded since 2007, delivering an annual total transaction volume of USD 1.18 trillion in 2013 with investment activity and values picking up as recessions ended, business sentiment rallied and increased liquidity lapped the shoreline of the most global markets (RCA, 2014). This strong position helped to increase rents and capital values and to push prime yields back down to the pre-crisis levels. Globally, all regions saw a positive trend over the recent few years, but developments within each region became more diverse (Figure 1.1).

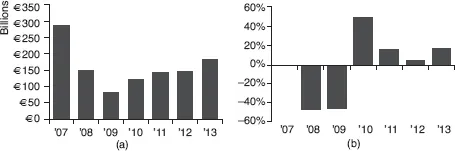

European transaction activities expanded significantly; however, total transaction volume is still almost half of the peak level recorded in 2007. As of 2013 year-end, European transaction volume reached USD 246.3 billion with 23% up on the previous year (Figure 1.2a and b). This transaction volume represents a post-crisis record. Some European economies appear to be moving from contraction into recovery while some are moving through recovery into expansion where stronger economic growth is translating into greater demand and improving real estate fundamentals, displaying diversification by geographically.

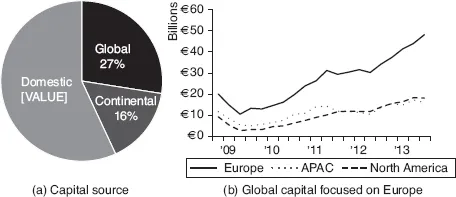

Growth in Europe has been driven by increased cross-border flows and by a strengthening domestic market (Figure 1.3a). The global capital has been focusing particularly on Europe with an increasing volume since 2010. Flows from global investors, transacting EUR 48.9 billion (27% of total volume) in 2013, is represented by a peak level recorded by RCA during the period 2007–2013 (Figure 1.3b). The most significant source of global capital remains investors from North America with a total of EUR 21.4 billion, but flows from Asia Pacific (APAC) investors tripled in volume, and those from the Middle East (ME) doubled. APAC and ME investors have increased their investment activities with a particular interest in larger assets in the core markets. Domestic capital represented 57% of total volume with EUR 101.1 billion, which became more significantly active in the CEE region and showed a declining appetite for core ‘safe haven’ markets in Western Europe. Also, the UK domestic investors came back into the market, increasing their activity in particularly on the retail sector.

Figure 1.1 Trends in the global market, 2013

Note: Rent and yield excluding multi-family.

Figure 1.2 European transaction volume (billion EUR) and annual growth (y-o-y)

Source: RCA data processed by the author.

Figure 1.3 Capital source in Europe

Source: RCA data processed by the author.

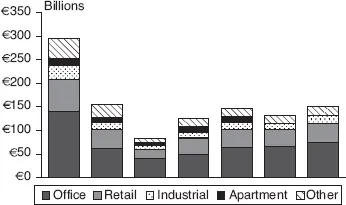

The remarkable level of investment activity has been recorded in all sectors with the improvement in business environment. In 2013, all sectors saw a new record level since 2007, with the exception of residential sector, which almost doubled compared to the pre-crisis level (Figure 1.4). In the office sector, corporate confidence is improving, and this is slowly being reflected in tenant demand. Top cities London, Paris and Frankfurt are leading the market where an undersupply of modern office space is pushing rental growth, but also secondary cities offer opportunities. In the retail sector, improving consumer confidence is boosting markets, but the growth in e-commerce is keeping a sharp focus on the best locations. Retail saw a smaller increase in investment in top cities than the wider market, reflecting a natural tendency for retail investors to consider a broader range of cities. Core logistics space is also benefitting from the growth of e-commerce, and with quality modern space limited in core markets, rents are under pressure, particularly in transport hubs and international hubs, as well as domestics in larger countries. An increasing interest for apartment investment has been observed with the contribution of Germany (six of top 10 markets).

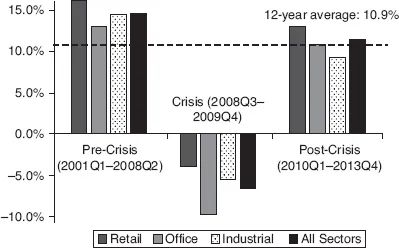

Total return for real estate markets has improved in line with strengthening economic and capital market fundamentals, following the negative impact of the 2008 global financial crisis and the Eurozone crisis in 2010. Between 2001 and 2013, the real estate market (all sector) in Europe has achieved an average annual return of 10.9%. If the pre-crisis (2001–2008Q2), the crisis (2008Q3–2009Q4) and the post-crisis (2010Q1–2013Q4) periods are examined separately, the average total return for all sectors was 14.5% in the pre-crisis level, and it decreased to 9.7% in the crisis period and followed by recovery period with an average of 11.3% total return in the post-crisis level. The deterioration in the total return of the office sector was relatively greater than the other sectors with an average of −9.7% while it was limited in the retail sector with −4% for the same period. Looking closely at the post-financial crisis period, average annual property return for all sectors was 11.3%, and the best-performing sector was retail with an average of 12.9% total return, followed by office (10.8%) and industrial (9.2%) during the same period, respectively (Figure 1.5).

Figure 1.4 European transaction by property types, 2013

Source: RCA data processed by the author.

Figure 1.5 The average total return in Europe by periods

Source: Cushman and Wakefield data processed by the author.

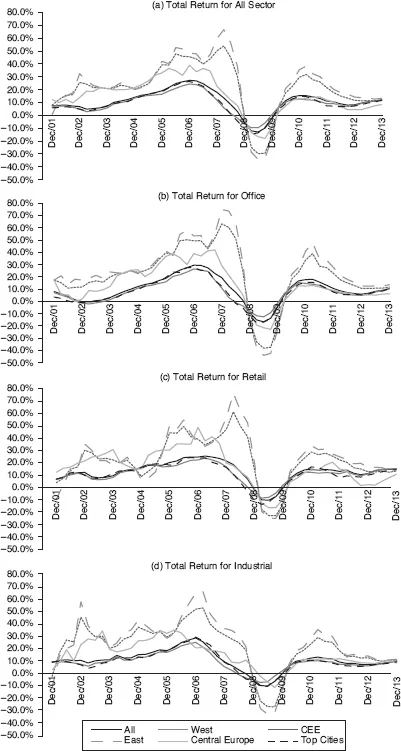

The performance of the European market, in terms of the average total return, is examined by region and by sector for 2001–2013 period, as presented in the Figure 1.6. It is clear that ‘Top Cities’ and Western Europe determined the general performance trend of all Europe (All); the performance of both regions followed almost the same pattern. Central Europe also provided the same return level with slight differences regarding the sectors. On the other hand, ‘CEE’ and ‘East’ regions displayed more volatility in all sectors, providing the highest return in the pre-crisis period and the biggest hit during the crisis period. Looking closely at the post-financial crisis period, improvement in the total return is clearly seen in all regions and sectors; however, less variations among the regions are observed in the performance of all sectors compared to the pre-crisis period.

Figure 1.6 Regional total return by sectors

Note: Definition of regional groups is given in the Appendix 1.

Source: Cushman and Wakefield data processed by the author.

As the Eurozone economy starts to recover, real estate investments are looking increasingly attractive across Europe. The healthy levels of transactions are set to increase driven largely by cross-border investments. The financial crisis may not be over, but a rapid change in the investment sentiment and a reduction in downside risk are generating a new phase of opportunities in the European investment market. Although the prolonged period of illiquidity is continuing in parts of Europe, transaction activity is spreading south to Spain as well as to second tier cities across the regions (E&Y, 2014; RCA, 2014; CBRE Global Investors, 2014).

Investigating the performance of the European investment market, returns to real estate vary substantially across subregions, countries and within the cities. The detailed analysis of the performance of the main geographical areas within Europe is given in the following sections.

1.2 Building location and impact on performance

It is an often quoted cliché that the three most important factors affecting real estate performance are ‘location, location, location’, but it does illustrate the importance of location in the real estate industry. Real estate assets are heterogeneous and have strong attributes relating to physical characteristics of the building and locational influences. The location of the building is also crucial from the investment point of view and its influence should be taken into account.

Not only do economic factors such as inflation and interest rates have an impact on the performance of an investment property but so does location. Location is indicated as one of the relevant value drivers (Hendrikse, 2003). Good location can support demand to provide some leverage to adding a premium to existing market-related rentals, and higher rentals would have a positive effect on the return of the investment. A good location would attract consumers, ensuring a high turnover, and tenants would be willing to pay above-average market-related rentals (Jensen, 2005).

Location has always been an important determinant of a property’s value. Traditionally, monocentric model of land prices predict that the land closest to the city centre has the highest value (Figure 1.7a). Commercial and residential uses compete for the limited central space, and hence, drive up central land prices, while prices gradually decrease with the distance to the city centre (Figure 1.7b). Conversely, modern models focus on how to estimate the effect of location on land values by str...

Table of contents

- Cover

- Title

- Introduction

- 1 European Real Estate Markets Comparison

- 2 Global Cities vs Other Cities in Europe

- 3 Residential Real Estate: Single and Multi-family Buildings

- 4 Commercial Real Estate in Europe: The Role of the Retail Market

- 5 Industrial and Logistic Sector

- 6 European Indirect Investors and Asset Allocation

- 7 Performance Comparison among Real Estate Asset Types and Geographical Areas

- 8 Optimal Asset Allocation for European Real Estate

- 9 Asset Allocation Strategy and Market Return for Real Estate Institutional Investors

- Conclusion

- Index