eBook - ePub

Port Management

About this book

Port Management brings together a collection of seminal papers from Palgrave's journal Maritime Economics and Logistics. It is a dynamic volume, containing contributions from leading authors with different disciplinary backgrounds, representing a vast regional diversity. The volume provides authoritative and timely investigations into key topics in port economics, including research on: global supply chains, port networks, choice modelling, port infrastructure, competition, port pricing, efficiency in European seaports, and an analysis of Chinese container ports. It is essential reading for professionals, scholars, and researchers interested in port economics.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

Containerization, Box Logistics and Global Supply Chains: The Integration of Ports and Liner Shipping Networks

In 2016, container shipping will celebrate its 60th anniversary as an innovation that had a tremendous impact on the geography of production and distribution. Production became globalized by a better usage of comparative advantages while distribution systems where able to interact more efficiently. This paper analyses the mounting pressures on box logistics in light of global supply chains.

It will be demonstrated that the basic principle of containerization remained the same notwithstanding scale increases in vessels and terminals and a clear productivity increase in container handling. Although the container was an innovation initially applied for maritime transportation, the emergence of global supply chains has placed intense pressures to implement containerization over inland freight distribution systems. Box – containerized – logistics is increasingly challenged to deal with the ever increasing time, reliability and costs requirements of global supply chains. Imbalances in trade flows and accessibility and capacity constraints are among some of the developments that are making it increasingly difficult to reap the full benefits of containerization.

Revised from Maritime Economics & Logistics, 10, 152–174, 7 March 2008, 10.1057/palgrave.mel.9100196, ‘Containerisation, Box Logistics and Global Supply Chains: The Integration of Ports and Liner Shipping Networks’, by Theo Notteboom and Jean-Paul Rodrigue. With kind permission from Palgrave Macmillan Ltd. All rights reserved.

Introduction

Looking back at more than half a century of containerization

In 2016, container shipping will celebrate its 60th anniversary as an innovation that had a tremendous impact on production and distribution. It is only with containerization that production became truly globalized by a better usage of comparative advantages while distribution systems where able to interact more efficiently, reconciling spatially diverse supply and demand relationships. Yet, even after more than half a century, the role of containers in global trade, production and distribution is just starting to be acknowledged (Levinson, 2006). According to UNCTAD (2013), between 1970 and 1990 trade facilitation measures accounted for 45% of the growth in global trade while membership to global trade organization such as GATT/WTO accounted for another 285%. The container accounted for an additional 790%, exceeding all the other trade growth factors put together.

Container volumes around the world have seen tremendous growth in the last fifty years, with an accelerated growth since the mid 1990s. The total number of full containers shipped on worldwide trade routes (excluding transhipment) amounted to 155.0 million TEU for the year 2012, compared to just 28.7 million TEU in 1990. Volumes on the east-west trades (i.e. Transpacific, Transatlantic and Asia/Europe) and north-south trades are expected to increase at an average rate of around 6% per year. Intra-regional trades, however, are expected to show significantly higher growth of around 7.5% mainly as a result of booming intra-Asian trades, but also because of the setting of hub ports acting as points of transhipment for regional markets. The total throughput handled by the world’s container ports (not to be confounded with the trade route volumes mentioned above) increased from about 236 million TEU in 2000 to 601 million TEU in 2012 (including empties and transhipment), representing an average annual growth rate of 8.1%. Transhipment traffic has been the driving force behind growth in container handling in the last decade.

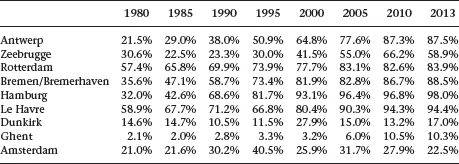

In most developed regions around the world, the container has a high share in the maritime related import and export flows of general cargo. Table 1.1 presents the containerization degree in a number of North European ports, expressed as the share of containerized cargo in total general cargo handled in the port (so dry and liquid bulk excluded since these commodities have shown limited potential so far, outside niche markets, to be containerized). The data points to a logistical curve of diffusion which is common for many technological innovations. Not all ports have embraced or were in a position to embrace containerization. Early adoption appears to imply no guarantee of further containerization. These findings are in line with the spatial models of Hayuth (1981), Barke (1986) and Notteboom and Rodrigue (2005) on the development of container port systems. Hence, these models suggest that not all ports, which invested early in container infrastructure, become major container centres. The resulting port concentration can cause degradation of minor ports in the network. Taking into account the ‘degree of containerizability’ (not all general cargo can be put in containers), it is expected that the worldwide degree of containerization could reach a maximum of 75%.

Table 1.1 Degree of containerization in a selection of North European mainland ports (sorted according to degree in 2012)

Source: calculations based on data respective port authorities.

Long-term patterns of international trade are influenced by product innovation and subsequent diffusion also in transport and logistics. Life cycle theory suggest all innovations are evolving following a pattern of a pioneering (or introduction) phase, a growth phase, a maturity phase, a saturation phase and finally a phase of decline triggered by obsolescence. This could ultimately lead to the disappearance of the initial innovation from the market. The duration of each stage of the cycle varies with the type of innovation, the management supporting it as well as its level of market penetration. Nakicenovic (1987) demonstrated life cycle theory can also be applied to transport modes and vehicle propulsion systems. Maritime transport by seagoing vessels and barges has always played an important role throughout history. We can refer to the many Chinese, Spanish/Portuguese, English and Dutch explorations aimed at setting up new trade routes (Fernandez-Armesto, 2006). In the second half of the 19th century rail became the dominant mode of land transportation, but it was overtaken by road transport in the second half of the 20th century. In terms of propulsion, we evolved from sail and manpower to steam and since the 20th century diesel, gas and electric engines. However, improvements in maritime propulsion technology over the last half century implied marginal speed improvements, but significant cost and reliability ones.

Given the inevitable fact that all technologies have a life cycle, the question arises what will happen to the container system as we know it in the decades to come, in particular when considering the requirements imposed on the system by global supply chains. Among the most significant questions that such an expectation puts forward are: What is the ultimate market potential of containerization in terms of volume and market penetration (usage)? What shapes and structures in respective maritime and inland containerized freight distribution this potential may imply? When a phase of maturity is likely to be reached? What could seriously undermine future containerization developments in terms of economic and technical issues? Although absolute answers to these questions cannot be provided, some elements shedding light in possible future development will be discussed.

Towards a phase of maturity

The container market is fast reaching a maturity phase characterized by a wide diffusion of the technology around the world and technical improvements which are more and more becoming marginal. Ships are getting larger and more efficient, but in essence the container technology driving the business altogether is basically the same as some 40 to 50 years ago. Shipping lines are deploying ever larger container vessels on the main trading routes driven by the promise of cost savings through achieve economies of scale (at sea), as evidenced by Cullinane et al (1999), Lim (1998) and Notteboom (2004). The technical concept of a container vessel has not altered dramatically during the evolution from first generation vessels to the latest “Triple-E” container carriers of more than 18,000 TEU capacity. Economies of scale are likely to be pushed as far as it is technically and economically feasible.

Container terminals have witnessed a series of innovations aimed at improving quay and yard productivity. Container gantry cranes now have longer outreaches (up to 23 containers wide), more lifting capacity (ZPMC developed cranes with up to 120 tons lifting capacity) and the spreaders have become more sophisticated (double lift, twin lift and tests by ZPMC for triple lifts). But again, the basic design of a gantry crane and spreader remained unchanged since the first developments by Sea-Land and Matsons in the early 1960s. The development of straddle carriers, RMG (rubber-tyred gantry cranes), RTG (rail-mounted gantry cranes) and other yard equipment really took off in the early 1970s. The use of AGVs (automated guided vehicles) is of more recent date, i.e. a first application at Delta Terminal Rotterdam in the early 1990s. But also here the basic principle remained unchanged: loading/discharging a container vessel (vertical movements) and stacking the containers one by one on the terminal (vertical/horizontal movements). Modern terminal equipment is becoming widespread and more standardized with the emergence of global terminal operators (HPH, PSA, APM Terminals and DP World to name but a few) and with leading equipment manufacturers (ZPMC, Kalmar and others) having customers all over the world. This has made it increasingly difficult for terminal operators to achieve a competitive advantage solely through the terminal equipment used. Productivity gains have more than ever become a matter of terminal management skills (software and know how) and of course hinterland size instead of hardware.

Technology gains in equipment for moving containers inland are also becoming marginal. Push convoys have been around for quite some time now and although inland barges on the Rhine now reach capacities of close to 500 TEU, their design is quite standard (Notteboom and Konings, 2004). Rail shuttle technology dates back to the early days of containerization and even the double stack trains in North America were conceived as early as the 1980s (Thuong, 1989).

To summarize, the world is still embracing a decades old concept – the container – to deal with the challenges of contemporary global supply chains. And although globalization and the associated profound changes in worldwide manufacturing and distribution processes to a large degree have been made possible by containerization, the same global supply chains are now exerting strong pressures on the container concept, leaving the players in container markets with quite some challenges.

To further support growth of containerization and to avoid a phase of saturation or even decline, major innovations are needed in the way containerized logistics systems are managed. Smarter management of the container system and its related networks is a prerequisite for a sustainable deployment of the container concept in global supply chains in the longer term.

This paper thus analyses the mounting pressures on box logistics in light of global supply chains. The first section looks at the changing role of containers in global supply chains. The second part of this paper analysis to what extent existing liner service networks are adapted to cope with supply chain challenges in the medium and longer term. Ports and terminals are the central focus in section three, while section four discusses the mounting pressures on inland distribution.

The role of containers in global supply chains

Logistics and the velocity of freight

Container shipping has changed the scale and scope of global freight distribution. By enabling a greater velocity in freight distribution, it has opened up new global markets for export and import as a greater quantity of space could be traded with a similar, if not lower, amount of time and often at a lower cost. This velocity is much more a function of time than of speed as containerization mostly improved the function of transhipment (Rodrigue, 1999). Thus, it is not that freight is moving faster along the respective modes servicing supply chains, but that the efficiency of transport terminals has dramatically increased the velocity of transhipments and, consequently, of supply chains. The concept of transhipment is here taken in a large sense to include activities taking place when the freight is not in circulation, namely warehousing which has adapted to provide a higher velocity to freight in the form of distribution centres. While prior to the introduction of the container, a standard break-bulk cargo ship could take weeks to be loaded or unloaded, a similar quantity of containerized freight can be transhipped in a matter of hours (Cudahy, 2006). It can be argued that the velocity of freight from a modal perspective has been achieved for more than half a century, but that containerization, through the transhipment function, truly permitted a multiplying effect for this velocity. Once a specific velocity threshold is reached, a time-based management of production becomes a possibility as logistics moves from a push (supply-based) to a pull (demand-based) structure, reaping significant distributional benefits.

Containerization has provided the mechanism to expand to international markets while improving the reliability, flexibility and costs of freight distribution. The convergence of these factors permitted the setting of global supply chains, many based on the principle of “just-in-time” which is an integration of the velocity of freight with production and distribution strategies.

Containerized global production networks

Global Production Networks (GPN) represent a functionally integrated network of production, trade and service activities which includes all the stages in a commodity chain, from the transformation of raw materials, through intermediate manufacturing stages such as assembly, to the delivery of goods to the markets (Henderson et al. 2002; Coe et al. 2004). Within this framework, global production networks have made many manufacturers contemplate global logistics strategies rather than simply relying on conventional shipping or forwarding activities. Most actors in the transport chain have responded by providing new value-added services in an integrated package, through freight integration along the supply chain. Thus, it has become widely acknowledged that the functional integration of commodity chains goes beyond the function of manufacturing, but also includes governance and transportation (Gereffi and Korzeniewicz, 1994, Gereffi, 2001, Chopra and Meindl, 2001, Appelbaum, 2004, Rodrigue, 2006).

The competitiveness of global production networks is to a large part determined by the performance of the logistics networks as they link production, distribution and consumption (Hesse and Rodrigue, 2004). These logistics networks are highly dynamic as a result of mass customization in response to product and market segmentation, lean manufacturing practices and associated shifts in costs as production and distribution assets are repositioned within global supply chains. The container is at the same tim...

Table of contents

- Cover

- Title

- Copyright

- Contents

- List of Figures and Tables

- Notes on Editor and Contributors

- Introduction

- 1 Containerization, Box Logistics and Global Supply Chains: The Integration of Ports and Liner Shipping Networks

- 2 A New Approach to Port Choice Modelling

- 3 Coordination in Hinterland Transport Chains: A Major Challenge for the Seaport Community

- 4 An Optimization Model for the Inland Repositioning of Empty Containers

- 5 The ISPS Code and the Cost of Port Compliance: An Initial Logistics and Supply Chain Framework for Port Security Assessment and Management

- 6 Governance in Seaport Clusters

- 7 The Size Economies and Network Efficiency of Large Containerships

- 8 Port Infrastructure: An Access Model for the Essential Facility

- 9 Concession Agreements and Market Entry in the Container Terminal Industry

- 10 Competition, Excess Capacity and the Pricing of Port Infrastructure

- 11 The Efficiency of European Container Terminals and Implications for Supply Chain Management

- 12 An Alternative Approach to Efficiency Measurement of Seaports

- 13 Efficiency in European Seaports with DEA: Evidence from Greece and Portugal

- 14 An Application of AHP on Transhipment Port Selection: A Global Perspective

- 15 A Competitive Analysis of Chinese Container Ports Using the Analytic Hierarchy Process

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Port Management by H. Haralambides in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.