eBook - ePub

South Africa's BPO Service Advantage

Becoming Strategic in the Global Marketplace

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

South Africa's BPO Service Advantage

Becoming Strategic in the Global Marketplace

Book details

Book preview

Table of contents

Citations

About This Book

Since 2007, South Africa has been one of the world's upcoming Business Process Outsourcing (BPO) offshore destinations. This book is based on the authors' most recent research into high performance BPO globally and new research streams specifically on South Africa.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access South Africa's BPO Service Advantage by Leslie P. Willcocks,Mary C. Lacity,A. Craig in PDF and/or ePUB format, as well as other popular books in Business & Management. We have over one million books available in our catalogue for you to explore.

Information

1

The Global BPO Market: South Africa in Context

Introduction

A long-term trend in business is the growth in offshoring and outsourcing of organizational work. Outsourcing is the handing over of the management of a function, assets, people, or activity to a third party for a specified cost, time, and level of service. As we shall see, there are other ways of using external services, including buying in resources to operate under internal management control.1 The global IT outsourcing (ITO) market has increased each year since 1989, when global ITO was only a $US10 billion market. On conservative estimates, looking across a range of reports and studies, global ITO revenues exceeded $US290 billion in 2012. Business process outsourcing (BPO) revenues exceeded $US175 billion in the same year, with offshore outsourcing representing more than $US85 billion of these combined revenue figures.

These developments from 1989 to 2012 have made it very clear that, with its 20-year-plus history, outsourcing of IT and business services has become an almost routine part of management, representing for many major corporations and government agencies a significant and ever growing percentage of back-office expenditures. Moreover, since 2012 all projections we looked at, or made ourselves, suggested continued market growth. Our own synthesis of the reports from Everest, Gartner, NASSCOM, and IDC suggests that in the period of 2012–16, ITO global growth is expected to be in the range of 5–8% per annum, with BPO rising by 8–12% per annum, and, subsumed within these, offshore outsourcing is growing at an even faster annual rate.

The year 2012 was quite a landmark for the South African BPO sector. In that year client organizations continued to have a strong appetite for contracting with domestic, offshore, and global BPO providers, and offshoring remained strong despite some re-shoring pressures in developed countries.2 The year 2011 had seen a slowing of BPO growth in many markets, but with a pickup later in 2012. Some, but by no means all, offshore destinations, including South Africa, then started to experience growth rates above 12% per annum.

In practice, offshoring and outsourcing often retain their scale through recessionary as well as growth periods, making them attractive businesses for growing economies. A highly competitive global services market presents opportunities and revenues for countries able to offer the right mix of strong cost, reliable service, and secure location. By 2012 South Africa certainly seemed to possess such characteristics, and, as we shall see in Chapter 2, many other positive attributes. It seemed very well placed indeed to profit from the global predilection for offshoring and outsourcing.

South Africa and the developing global marketplace 2012–18

In 2010 the BRIC countries (Brazil, Russia, India, and China) became BRICS with the inclusion of South Africa. For 2012 a range of reports suggested the BRICS offshore ITO/BPO market share was 6% for Brazil, 4% for Russia, 68% for India, 6% for China, and 1% for South Africa. In 2012 India held the chair of the BRICS group, with the next BRICS summit taking place in South Africa in 2013. According to NASSCOM, ITO/BPO export revenue (excluding hardware) for India exceeded US$69 billion in 2013, serviced by something like a 2.2 million workforce. This represented a growth of 16.3% compared with 2011. The BPO segment was expected to grow by 12% to reach US$16 billion in 2012.3

Brazil was the next most frequent nearshore destination, in this case for US-based large companies. However, on our analysis at that date, Brazil and China could do more to leverage their potential, while Russia, despite a lack of government support, was succeeding in finding high-value, albeit niche, work. All the BRICS countries sought (and in 2015, still sought) new business, but over 120 non-BRICS countries were now in competition. However, as of 2015, BRICS, including South Africa, still remained well placed to offer BPO, information communications and technology (ICT), and back-office services.

A range of reports suggested a non-BRICS global market share of around 15% in 2012. In BPO, the Philippines led (and still did in 2015). Based on BPAP data,4 its BPO industry earned US$11 billion in 2011. In the same year, the Philippines IT-BPO industry employed 638,000 full-time employees, representing a 22% increase from 2010.

Non-BRICS locations are interesting. First, some non-BRICS locations offer nearshoring opportunities – for example, Czech Republic for Germany, and Mexico for the USA. Non-BRICS locations offering a workforce of people with good education often provide excellent BPO platforms, leaving the ICT “engine rooms” for India or China. Second, from 2012 to 2015, India and China have been turning to non-BRICS locations for some solutions, for example to secure lower costs or labour availability. As of 2015, amongst the top contenders globally, and for different markets, were Romania, Bulgaria, Poland, Slovakia, Czech Republic, Belarus, Morocco, Tunisia, Costa Rica, Mexico, Venezuela, Vietnam, Egypt (despite the 2011 “revolution”), and the Philippines. Third, non-BRICS locations offer different risk-reward ratios and, given Indian dominance, have sought to identify niche offerings – by service, geography, or industry, for example. South Africa has itself gone down the niche route, leveraging not just service excellence, but also, as we shall see in Chapter 2, multiple-location attractiveness factors.

By the end of 2013 global outsourcing contract value for business and IT services was about $US648 billion (BPO $304b., ITO $344b.) and by the end of 2014 exceeded $US700 billion. On some estimates the market will see 4.8% compound annual growth as far as the end of 2018 as more is outsourced and new service lines and delivery locations are added.5 Within this period, offshore outsourcing, which exceeded $100 billion in revenues in 2013, is estimated to grow at 8–12% per year from 2013 to 2018.6 In 2013, IT and finance and accounting administrative processes dominated outsourcing plans. Enterprises were still very focused on achieving operational effectiveness when they outsourced. According to 2013 research, cost reduction (87%), greater scalability of operations (82%), and process standardization (74%) were the key motivations behind ITO and BPO. Core areas of strategic focus when outsourcing included accessing better talent and technology, and improving analytics capabilities.7

From 2012 to 2015, and historically, outsourcing has been notably better at delivering operational effectiveness than strategic goals, and it has been light on innovation. BPO engagements have been outperforming ITO engagements throughout this period.8 For buyers of services, across 2013 and 2014 change dominated as the key topic of interest – specifically change management, moving from cost to value creation, and accomplishing innovation in operational processes. These trends passed through domestic into offshore outsourcing in the 2012–15 period, which also saw large enterprises become particularly focused on creating global business service frameworks.9 As an attractive offshore location, South Africa has been influenced, and has needed to respond to these changing patterns, indicating the importance as a location of defining its operating niches carefully while remaining pre-emptive, engaged and responsive to global sourcing and buyer trends.

Sourcing options: meeting the challenges

At this point it is useful to take a step back and consider what sourcing options executives have, and the issues they raise, before we look at why captive offshore outsourcing would be embarked upon and what the challenges are, not least for a country like South Africa.

Sourcing options

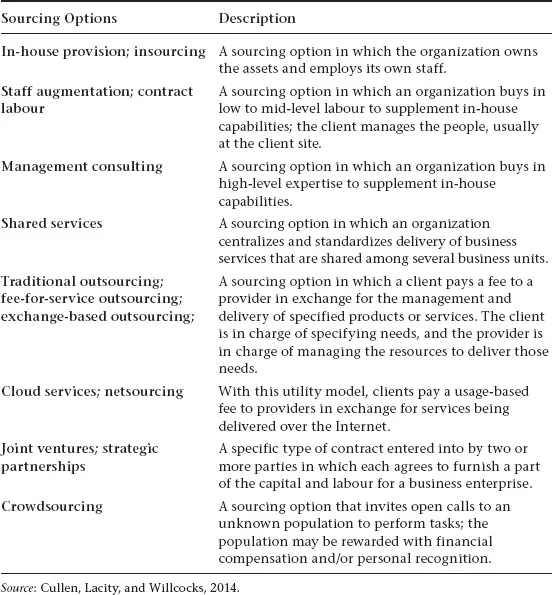

Executives have multiple sourcing options to consider, as shown in Table 1.1.10 These choices have different benefits and risks, and each requires a specific mix of management practices to ensure positive outcomes. The sourcing options are not mutually exclusive, and many clients use hybrids. For example, many internal shared-service organizations rely heavily on external providers. Typically, and especially in large global organizations, client executives have to operate a portfolio of sourcing options. Therefore, they will draw upon several, many, or even all of the eight options shown in Table 1.1 to match the (ever changing) business needs. In the South African context, all eight options are used, but the dominant ones for 2015, in rank order, are as follows: in-house provision, staff augmentation, traditional outsourcing, and shared services.

Table 1.1 Sourcing options

Insourcing is still the most common option. In practice, outsourcing typically represents only about 28–34% of the average organization’s business service budget, with variations depending on such factors as economic sector, geography, and organization size. However, we have seen the threat of outsourcing often used to galvanize internal back-office performance.

Shared services has been an important trend, with the recent economic downturn intensifying pressure on government and commercial organizations to reduce costs and staff numbers and generally “do more with less”. However, the promises of lower costs, tighter controls, scalability, and improved performance measurement have not always been realized. Change management is the most lacking, but the most needed, practice for implementing shared services.11

With staff augmentation a client buys in labour to supplement in-house capabilities. This can be expensive in urban areas in developed countries but is one of the least expensive options if bought offshore or from non-urban (rural) areas. Clients use staff augmentation to meet demand fluctuations in work, access scarce technical skills, and avoid human resource regulation issues associated with permanent employment. It is a popular option – for example, in any Fortune 500 headquarters up to 40% of the IT staff may be domestic contractors working alongside employees.

Management consulting is usually a short-term – because invariably expensive – option that looks to bring in energy and skills, signal clear commitment to a strategic initiative, and reduce political resistance. The two most significant risks we have found with the management consulting option are (1) cost escalation and (2) lack of sustainability of the solutions proposed, even when they have been implemented.

Joint ventures/strategic partnerships are not very common, at best representing about 5% of total outsourcing spending in any one year, though their scale and scope have garnered much media attention historically, especially in the 1990s. Earlier such IT deals tended not to work, but more recently we have found more success in other areas, including in procurement, HR, and policy administration.12

Traditional outsourcing is the most common form of outsourcing and has grown each year it has been tracked over the last 25 years. Its success levels are mixed, with the performance slightly better globally for the more mature area of ITO than for BPO. In BPO, as of 2015, we estimate some 20% of arrangements are “world class” (cost savings delivered, end-to-end process delivery, dynamic innovation achieved, high client satisfaction); 25% are “good” (cost savings delivered, service-level agreements met, good client satisfaction); 40% are “doing OK” (marginal costs delivered, acceptable service performance, marginal client satisfaction); and 15% are “poor” (no cost savings or costs increased, poor service performance, and low client satisfaction).13

Our research over many years demonstrates that what makes the difference in performance are management practices. We have been able to identify 54 essential practices that make for effective outsourcing, and a further 9 that push effective outsourcing into world-class standard.14 In Chapters 5 through 11 we provide detailed case studies that illustrate a rich set of such management practices utilized in outsourcing, captive centres, and shared services in the South African context.

In Table 1.1 we note two further sourcing options. Cloud sourcing can be private, public, or hybrid Cloud, and can also be outsourced or done in-house. Essentially it involves transacting activit...

Table of contents

- Cover

- Title

- 1 The Global BPO Market: South Africa in Context

- 2 Country Attractiveness: International Comparisons

- 3 South Africa BPO: Performance and Prospects 2011–18

- 4 In Their Own Words

- 5 South Africa BPO Case Studies: An Overview

- 6 Case One: British Gas Selects WNS South Africa for Call Centre Services

- 7 Case Two: From Down Under to Over Yonder – iiNet and Merchants

- 8 Cases Three and Four: Launch Pads and Landing Strips – Full Circle Navigates Two Newcomers to South Africa’s BPO Industry

- 9 Case Five: TalkTalk and CCI Transform a Supplier into a Partner

- 10 Case Six: Radiant Law Rethinks Legal Services

- 11 Case Seven: The Value of South Africa’s Shared Services

- 12 Lessons and Conclusions

- Appendix A: Research Base and Methodology

- Appendix B: BPO Best-in-Class Practices

- Notes

- Index