This edited collection aims to provide a critical and theoretically informed assessment of the nature, extent and types of structural change presently occurring in the Irish welfare state. Ireland’s economic crisis garnered widespread international attention and has been the subject of much debate and analysis of what went wrong in the economy, how to remedy it and how to steer economic recovery. Yet the crisis has also potentially had a deep-seated impact on the Irish welfare state which to date has been predominantly debated in fiscalised terms, reflecting a tendency to understand social policy as an adjunct to economic and fiscal policy and related goals. Scrutiny of the purpose and scope of the Irish welfare state has long been problematic, not least because of a tradition of political, and often wider sociocultural, reluctance to articulate economic and social policy preferences in unambiguous terms (Lynch 2010; Kirby and Murphy 2011). Addressing the challenge of analysing the nature of the Irish welfare state’s problems and the possibilities it faces requires closer examination of Ireland’s evolving welfare state and its welfare future. This book, therefore, aims to present an in-depth, comprehensive and critical assessment of how the Irish welfare state has been impacted by the crisis, with a particular emphasis on structural change and the social, political, as well as economic, implications of this change as Ireland enters a post-crisis period.

The book’s concerns are also located within the growth of interest, particularly since the 1990s, in welfare state literature on how and to what extent welfare states are changing. Though a vast area of research exists with diverse perspectives and approaches to this topic, the prospects for the welfare state have generally over time been downgraded from a golden, to a silver, to a bronze age (Arts 2013). The financial crisis of 2008 and the subsequent economic crisis prompted a new round of discussion and research on the nature and extent of welfare state change and the consequences of the crisis are only beginning to be more fully analysed and understood as we now enter a post-crisis phase. Ireland, as one of the countries with the most severe crises in Europe, has since encountered almost a decade of economic and social stress. This has made for policymaking conditions which have posed serious challenges and constraints, paving the way for potentially significant structural reform of its welfare institutions.

The immediate context for examining challenges and change to Ireland’s welfare state is the austerity the country has endured in response to its economic crisis. As the implications of the global credit crunch began to make themselves known in the autumn of 2008, Ireland became the first in the Eurozone to enter a recession in September of that year and in total real GDP, fell by approximately 9% between 2007 and 2010, with a second smaller recessionary dip in 2012. Much has been written about Ireland’s liberal economic model and, in particular, developments in the 2000s, which meant that Ireland’s economy, already very globalised, became increasingly financialised (Hay and Wincott 2012; Ó Riain 2014). Economic growth became severely unstable and unbalanced, fuelled by excessive growth in housing and construction, procyclical policy preferences and a lightly regulated banking system. Ireland’s peripheral status and its existence as the sole liberal economy in the Economic and Monetary Union (EMU) meant these domestic factors were exaggerated by the structure of EMU under which Ireland had little control of a monetary policy generally set to favour the economic cycle of the larger core European economies and from which credit flowed to the periphery. These conditions set the scene for the sharp decline in the size of the economy and the consequent fiscal stress which saw dramatic increases in the fiscal deficit and overall government debt. The latter had the most dramatic rise in the Eurozone over the course of the crisis. Ireland’s attempts to rescue its simultaneously collapsing banking sector led to the most costly banking crisis amongst advanced economies since the 1930s (Laeven and Valencia 2012), contributing approximately one-third of the increase in debt (IFAC 2014). Despite strenuous efforts at fiscal austerity starting as early as July 2008, by autumn 2010 Ireland’s crisis had become a sovereign debt crisis. Ireland followed Greece to become the second country in the Eurozone to require a loan conditional on more fiscal austerity, structural and financial sector reforms, along with direct supervision from the European Commission/International Monetary Fund/European Central Bank (hereafter referred to as the Troika) during the disbursement period of the loan spanning late 2010 to late 2013.

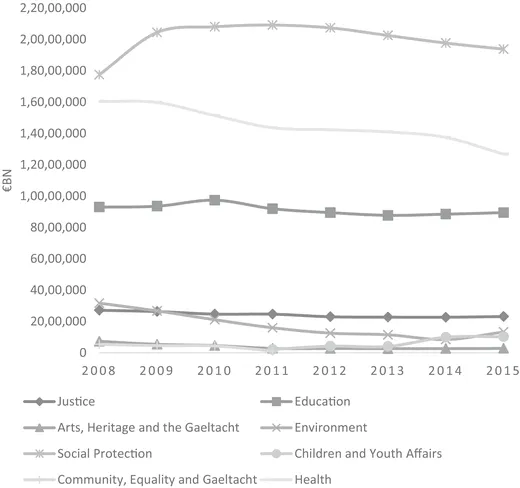

In total, between 2008 and 2014 fiscal austerity of approximately 18% of GDP was undertaken with the balance set between approximately one-third tax increases and two-thirds spending cuts. Figure

1.1 provides some indication of expenditure patterns over core social policy areas between 2008 and 2015. While social protection expenditure noticeably increased due to rising demand, substantial decreases are evident in health and the environment in particular. Environment group expenditure fell by 73% from 2008 to 2014, with reductions in capital expenditure (primarily social housing) falling by 82%, responsible for the bulk of this reduction. Health expenditure fell by 21% over 2008–2015. Arts, Heritage and Gaeltacht, responsible for funding some community sector initiatives also suffered major cuts; its budget fell by 63% between 2008 and 2013 (DPER

2015).

Much has been written on where these austerity measures have fallen and how services and various groups of people have been impacted (Oxfam

2013; Community Platform

2014; IHREC

2015). The crisis has taken its toll on people, for example, in terms of rising poverty and a significant increase in deprivation rates (see Table

1.1), increased rates of suicide and self-harm (Corcoran et al.

2015), and issues relating to homelessness, and personal and housing debt (addressed in Chaps. 10 and 4). Moreover, cuts have impacted severely on groups such as Travellers (Harvey

2013), women (IHREC

2015) and cuts on carers and lone parents (addressed in Chaps. 7 and 3).

Table 1.1Poverty, deprivation and equality 2008–2014

At risk of poverty rate | 14.4 | 14.1 | 14.7 | 16.0 | 16.5 | 15.2 | 16.3 |

Deprivation rate | 13.7 | 17.1 | 22.6 | 24.5 | 26.9 | 30.5 | 29.0 |

Consistent poverty rate | 4.2 | 5.5 | 6.3 | 6.9 | 7.7 | 8.2 | 8.0 |

Gini coefficient | 30.6 | 29.3 | 31.4 | 31.1 | 31.2 | 31.3 | 31.8 |

Income quintile share ratio | 4.5 | 4.3 | 4.8 | 4.9 | 5.0 | 4.8 | 5.0 |

While not wanting to downplay the very serious effects of austerity and retrenchment on people, the book’s primary focus is on policy change. Moreover, the analysis extends beyond the nature of quantitative changes/adjustments in the various policy areas that make up the welfare state, to the ways in which changes potentially indicate deeper and more enduring change to its structure. As Herman (2014:112) observes ‘structural reforms differ from regular austerity measures inasmuch as they, not only and sometimes not even, reduce public spending; rather, the main goal of these reforms is to change parts of the institutional base of national economies’. Such change is, therefore, not simply undone by reversing cuts to expenditure and its effects can alter the longer-term course of policymaking post-crisis. While the crisis and austerity policy might be the immediate catalyst of structural reform, the book does not view the present period in isolation. Rather it views structural change as a longer-term process which requires analysis of welfare developments prior to the crisis in terms of how they bear influence on the policy decisions taken during the crisis and the nature and extent of subsequent structural change across different areas of the welfare state.

Accordingly, we widen the scope of the book’s focus to include not only the crisis in the public finances as a precursor to reform but link it to a broader set of drivers of structural change, including globalisation, financialisation, neo-liberalisation, privatisation, marketisation and (post) new public management, and to the political context in which these drivers unfold. These drivers, it may be said, were already influential to varying degrees in Ireland prior to the crisis but have potentially deepened and diversified in their impact on the Irish welfare state post-crisis. Moreover, these drivers are compounded by the new ways transnational actors such as the EU and the IMF, have become influential during and since the crisis. In particular, in the case of European actors, new rules and monitoring procedures mean less fiscal discretion for Eurozone member countries in the post-crisis period. Under these drivers, structural change, potentially evident in distributional, welfare and social service reforms including new modes of funding, management, regulation and delivery of services is, moreover, accompanied by shifting conceptual and operational narratives around the role and functions of the welfare state. As such the influence of austerity and consolidation is not just confined to technical adjustment but is intertwined with ideas about the role of the state and state expenditure, and the state’s economic and social policy goals.

The book develops an overarching framework to conceptualise and analyse welfare state change and its political, economic and social implications. Dealt with in more detail in Chap. 2, the framework revolves around four key questions: (a) What is welfare for? (b) Who delivers welfare? (c) Who pays for welfare? (d) Who benefits? With the exception of the first question, each question is designed to capture a central element of h...