eBook - ePub

Value-Based Working Capital Management

Determining Liquid Asset Levels in Entrepreneurial Environments

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Value-Based Working Capital Management

Determining Liquid Asset Levels in Entrepreneurial Environments

Book details

Book preview

Table of contents

Citations

About This Book

Value-Based Working Capital Management analyzes the causes and effects of improper cash flow management between entrepreneurial organizations with varying levels of risk. This work looks at the motives and criteria for decision-making by entrepreneurs in their efforts to protect the financial security of their businesses and manage financial liquidity. Michalski argues that businesses exposed to greater risk need a different approach to managing liquidity levels.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Value-Based Working Capital Management by G. Michalski in PDF and/or ePUB format, as well as other popular books in Business & Corporate Finance. We have over one million books available in our catalogue for you to explore.

Information

1

Working Capital Management in the Business Context

This chapter discusses the objectives and nature of enterprises in the context of their risk sensitivity, as well as the relationships between the objectives of enterprises and the characteristic features of their businesses. Enterprises operate in various business environments, but generally speaking, they all have one main aim: wealth creation for their owners. The realization of that aim depends on an idea of business in which the enterprise is an instrument to collect money from clients of the enterprise’s services and products. Business environment is crucial not only for future enterprise cash inflows from the market but also for risk and uncertainty (Asch, and Kaye 1997; Copeland, and Weston 1988; Fazzari, and Petersen 1993). According to the author, it is necessary to include an understanding of that risk and uncertainty of future in the rate that reduces the net size of free cash flows for the enterprise owners, beneficiaries, or more generally stakeholders.

Enterprise value creation is the main financial aim of the firm in relation to working capital components (Graber 1948; Jensen, and Meckling 1976; Lazaridis, and Trifonidis 2006). Working capital management is a part of a general enterprise strategy to its value maximization (Laffer 1970; Kieschnick, Laplante, and Moussawi 2009; Lyland, and Pyle 1977). In an ideal world, with no risk or uncertainty, there is almost no need of working capital, except for working capital tied in to work-in-progress inventories. The main role of working capital is to hedge the firm from the risk of a lack of its elements during the realization of the operating cycle. Likewise, working capital management is also linked with the anxieties of the managing team about potential shortages of working capital components in the face of the real needs of the business. Working capital includes raw materials, work-in-progress materials, finished-goods inventories, accounts receivable, and operational (precautionary, speculative, and transactional) cash balances (Meszek, and Polewski 2006; Mueller 1953; Nobanee, Al Shattarat, and Haddad 2009). We start by presenting the main relations of working capital with a firm value in the risk and uncertainty context, with the example of raw materials. Next we will show elements, and finally a more integrated approach will be presented, including all components of working capital.

Businesses in which raw materials are widely available, with no risk of interruption to availability, have no need to stockpile their materials. In practice, very few businesses have access to this kind of comfortable situation. Varied business characteristics and the typical risks that accompany uncertainty often result in a lack of guaranteed unconstrained access to raw materials. Usually, there is a need to tie up money in raw materials, which is linked with both the financial cost of capital and the operational cost of managing raw-material inventories, or that cost is swapped with firms that specialize in logistics and deliver materials just in time, in exchange for their own profits.

This type of business, with that level of risk and uncertainty, in terms of the safety of the supply of raw materials, influences (Michalski 2008):

- the level of costs (both cash expenses [CE] and noncash expenses [NCE]) and

- the level of the cost of raw-inventory financing (cost of capital [CC]).

Of course, enterprise managers can evaluate a contrasting scenario with no raw-material inventories. That situation is usually connected with:

- a possible interruption in production flow,

- possible contractual penalties, and

- possible loss in market share.

These are not the only potential incidents or events. Decisions about raw-material inventory levels should involve comparing expected costs and benefits of having or not having inventories with expected costs and benefits of holding and managing raw-material inventories (Michalski 2010).

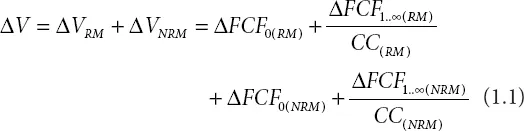

To decide which option is more appropriate, it is necessary to use key indicators measuring firm value growth (Modigliani and Miller 1958; Narware 2004; Nobanee and Hajjar 2009b; Opler, Saron, and Titman 1997). Equation 1.1 can be used to calculate the influence of raw-inventories investment levels on the value of an enterprise. That influence is also illustrated in Figures 1.1, 1.2, and 1.3.

where ∆V = enterprise value growth, ∆FCF = free cash flows increase or decrease (could be positive, with increase, or negative, with decrease), NOPAT = net operating profit after tax (NOPAT = [CR − CE − NCE] × [1 - T]), T = income tax rate, CC = rate of cost of capital financing of the firm; indices: NRM = consequences of a shortage of raw materials, RM = consequences of holding raw materials.

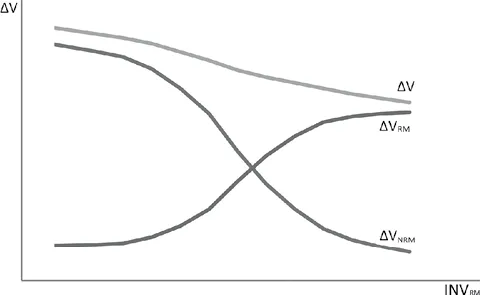

Enterprises that operate in conditions with lower levels of risk in terms of a shortage of raw materials and firms that face lower-than-average sensitivity to risk in terms of a shortage of raw materials will have higher benefits and higher firm value creation with lower levels of raw inventory. (Illustrated in Figure 1.1.) Risk sensitivity is not only a result of business-sector characteristics. It is possible that firms from the same sector—and even with the same product—but with different target clients can face other levels of sensitivity to risk in terms of a shortage of raw-materials inventories.

Figure 1.1 Relation between raw-materials level and its influence on value creation in case of smaller-than-average sensitivity to risk in terms of a shortage of raw materials, where ∆V = the value of the sum of consequences of raw-materials holdings at level INVRM, ∆VNRM = the value of the consequences of a shortage of raw materials, and VRM = the value of the consequences of holding raw materials

Source: Author’s proposal.

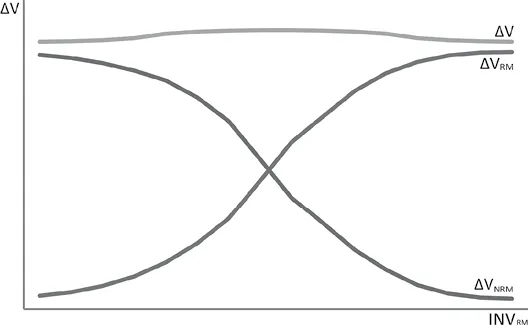

Firms that operate in conditions of an average level of risk in terms of a lack of raw materials and firms that face average sensitivity to risk in terms of a shortage of raw materials will have the highest benefits and the highest firm value creation at middle levels of raw-inventory cases. (Illustrated in Figure 1.2.) An adequate level of raw materials is the result of a balanced influence of positive and negative effects of investing raw materials.

Figure 1.2 Relation between raw-materials level and its influence on value creation in case of average sensitivity to risk in terms of a shortage of raw materials, where ∆V = the value of the sum of consequences of raw-materials holdings at level INVRM, ∆VNRM = the value of consequences of a shortage of raw materials, and VRM = the value of consequences of holding raw materials

Source: Author’s proposal.

Firms operating at the highest level of risk in terms of a shortage of raw materials and firms operating at the highest sensitivity to risk in terms of a shortage of raw materials will have higher benefits and higher firm value creation at the highest levels of raw-inventory cases. (Illustrated in Figure 1.3.)

Raw-materials levels in such firms serve as a buffer (hedging) against the negative consequences of a lack of uninterrupted realization of production and uninterrupted realization of sales. In some branches, an interruption of realization of production could be very costly because of technological procedures (Myers 1974; Michalski 2012d; Moyer, McGuigan, and Ketlow 1990). An interruption of production could be linked with not only the costs of human capital but also with the danger of destruction of equipment (for example, in CHP, electrical, steel, and similar industries). For some businesses, an interruption of sales and an inability to respond quickly to clients’ demand could seriously damage their performance—not only might they lose par...

Table of contents

- Cover

- Value-Based Working Capital Management

- Copyright

- Contents

- List of Figures

- List of Tables

- List of Equations

- Acknowledgments

- Introduction

- 1 Working Capital Management in the Business Context

- 2 Understanding and Measuring Financial Liquidity Levels

- 3 Intrinsic and External Values of Liquidity and Optimization

- 4 Net Working Capital Management Strategies

- Conclusion

- Bibliography

- Index