Postmodern Portfolio Theory

Navigating Abnormal Markets and Investor Behavior

James Ming Chen

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Postmodern Portfolio Theory

Navigating Abnormal Markets and Investor Behavior

James Ming Chen

About This Book

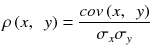

This survey of portfolio theory, from its modern origins through more sophisticated, "postmodern" incarnations, evaluates portfolio risk according to the first four moments of any statistical distribution: mean, variance, skewness, and excess kurtosis. In pursuit of financial models that more accurately describe abnormal markets and investor psychology, this book bifurcates beta on either side of mean returns. It then evaluates this traditional risk measure according to its relative volatility and correlation components. After specifying a four-moment capital asset pricing model, this book devotes special attention to measures of market risk in global banking regulation. Despite the deficiencies of modern portfolio theory, contemporary finance continues to rest on mean-variance optimization and the two-moment capital asset pricing model. The term postmodern portfolio theory captures many of the advances in financial learning since the original articulation ofmodern portfolio theory. A comprehensive approach to financial risk management must address all aspects of portfolio theory, from the beautiful symmetries of modern portfolio theory to the disturbing behavioral insights and the vastly expanded mathematical arsenal of the postmodern critique. Mastery of postmodern portfolio theory's quantitative tools and behavioral insights holds the key to the efficient frontier of risk management.

Frequently asked questions

Information

1. Finance as a Pattern of Timeless Moments

Perpetual Possibility in a World of Speculation: Portfolio Theory in Its Modern and Postmodern Incarnations

2. Modern Portfolio Theory

2.1 Mathematically Informed Risk Management

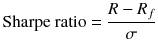

2.2 Measures of Risk; the Sharpe Ratio

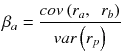

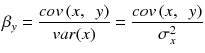

2.3 Beta

Table of contents

- Cover

- Frontmatter

- 1. Finance as a Pattern of Timeless Moments

- 1. Perpetual Possibility in a World of Speculation: Portfolio Theory in Its Modern and Postmodern Incarnations

- 2. Bifurcating Beta in Financial and Behavioral Space

- 3. Τέσσερα, Τέσσερα: Four Dimensions, Four Moments

- 4. Managing Kurtosis: Measures of Market Risk in Global Banking Regulation

- Backmatter