eBook - ePub

Independent Luxury

The Four Innovation Strategies To Endure In The Consolidation Jungle

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Independent Luxury

The Four Innovation Strategies To Endure In The Consolidation Jungle

Book details

Book preview

Table of contents

Citations

About This Book

In recent years, luxury brands have deviated from the principles of craftsmanship, rarity, uniqueness and heritage. Conglomerates such as LVMH and Richemont have grown at an unprecedented pace and show no sign of slowing. This book explains the importance of innovation and argues why independent brands are vital to the survival of the industry.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Independent Luxury by Jonas Hoffmann,Laurent Lecamp in PDF and/or ePUB format, as well as other popular books in Business & Gestione. We have over one million books available in our catalogue for you to explore.

Information

chapter 1

Luxury Landscape:Challenges and Opportunities for Independents

Introduction

This chapter analyzes the luxury landscape and how it affects independent luxury companies. We start by looking at one of the mainstays of the luxury business, the Swiss watchmaking industry, to reveal a stormy outlook for independent watchmakers. We then widen the context to examine the luxury industry as a whole, to get a better picture of the major forces shaping current challenges and opportunities, namely:

1) the leading role of Chinese consumers;

2) the digital revolution;

3) the high concentration of wealth;

4) sustainable luxury;

5) luxury lifestyle;

6) the growth of travel retail;

7) the turbulent geo-economic and geopolitical environment.

A new normal for the coming years

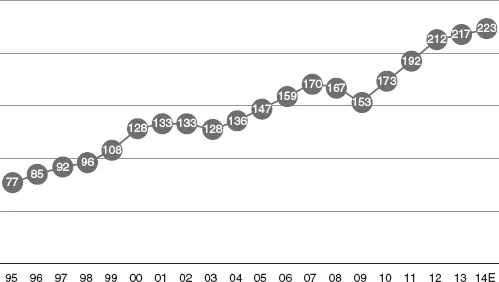

The luxury industry has been on an unimaginable journey since the mid-1990s. The personal luxury goods market alone grew threefold, from a worldwide turnover of €77 billion in 1995 to an estimated €223 billion in 2014.1 Its expansion was broadly constant throughout this period and was particularly impressive in the aftermath of the 2009 financial crisis with double-digit growth in the 2010–12 period (Figure 1.1).

Figure 1.1 Evolution of worldwide personal luxury goods market (1995–2014E – € billions)

Source: Bain & Company and Fondazione Altagamma Worldwide Markets Monitor 2012–14.

The Boston Consulting Group (BCG) estimated “the luxury market, as defined by consumers” to be valued at US$1.3 trillion in 2012.2 Besides personal luxury goods (apparel, leather goods and accessories, watches and jewelry, cosmetics), the BCG adds luxury cars and “experiential luxury.” This includes, among others, works of art, home and furniture, technology, alcohol and food, travel and hotels, spas and yachting.3

As consumption in Europe and the US declined throughout the decade from 2000 and even more in the 2010s, the Chinese became the main luxury consumers. This golden period for the Chinese came to an end in 2012. The change of leadership in China with the ascension of Xi Jinping and the ensuing anti-graft campaign, combined with the continuous gloomy situation in Europe, characterizes a “new normal” for the luxury industry,4 in which double-digit growth figures are gone and the main consulting companies forecast yearly growth in the 3% to 5% range for the years to come.5

In comparison with the gloomy forecast generally for European and Western economies, these figures may sound excellent, but as any marketing tutor would explain, satisfaction depends on expectations, and expectations for the luxury industry have soared over the past years. Consequently, financial markets are “disappointed” and most luxury groups lost stock market value at some point in 2014.6

Companies are struggling to cope with this new reality, especially in sectors such as liquor and watches. These once-favored gift items are no longer in fashion. Plans for retail footprint development have been halted and companies are refocusing their efforts on their most exclusive items where margins are higher.

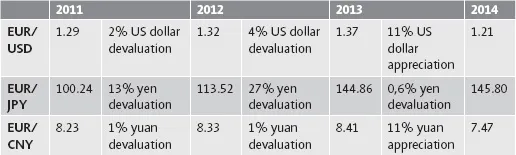

In addition to these lower growth forecasts, currency fluctuations made a striking comeback due to monetary policy changes in Japan, the US, Europe and China. Since most luxury companies consolidate revenues in euros, this impact has been significant. In 2012, 2013 and 2014, growth in personal luxury goods at constant exchange rates was 5%, 7% and 5% respectively, whereas at current exchange rates it has been 10%, 3% and 2%, thus putting an extra burden on smaller companies that have to hedge for this volatility (see Table 1.1).7

TABLE 1.1 Currency variation between euro, US dollar, yen and yuan (2011–14)

Source: www.oanda.com, currency value at 31 December of each year.

Let’s now take a closer look at the Swiss watchmaking industry, a textbook case of the situation facing independent luxury companies.

The Swiss watchmaking industry

Swiss watchmaking is dominated by large groups to which most of the major watch brands belong. The largest of these groups is Swatch which, as of 2014, had brought together 18 different brands under one roof with the acquisition of Harry Winston in 2013.8

HARRY WINSTON

Imagine the scene: a brand and its founder are riding high on success and sales are soaring. Then comes the moment when the founder envisages handing over the business, if possible to a member of the family, or to an investor or group. This is what happened to the Harry Winston brand, bought up by Swatch in January 2013 for a mere CHF913 million.9 This example is interesting on a number of levels. It portrays the different stages in the evolution of a luxury brand created by a visionary, from its beginnings, through handover to his family, to the sale to a major group, not to mention all the financial difficulties faced along the way.

Harry Winston founded his company in 1932 at the age of 36. He was not a stranger to the world of business and luxury; his father, a Ukrainian immigrant, had opened a small jewelry store in New York City at the end of the 19th century. The success of the Harry Winston brand grew regardless of the difficulties of the postwar period, the first cracks appearing only after the death of its founder in 1978 and the handover of the company to his two heirs. Family infighting left its mark on a brand that had been, and still is, recognized as the official jeweler to the British Crown and Hollywood stars. It is difficult to forget the immortal lines of Marilyn Monroe in the movie Gentlemen Prefer Blondes: “Talk to me Harry Winston, tell me all about it.” She was speaking of course not about the man himself, but about a girl’s best friend, her diamonds.

The favorable economic climate at the turn of the millennium with the renaissance of traditional watchmaking and the rise of the luxury industry enabled the Harry Winston brand to bounce back. Its size, however, (neither big nor small) prevented Harry Winston from finding sufficient cash flow to support the company’s growth strategy. When Harry Winston was bought up by the Swatch Group in 2013, one-quarter of the amount paid corresponded to the level of debt alone.

Thus, the brand of the stars (Elizabeth Taylor, Madonna and Sharon Stone, to name but a few), created by a visionary businessman who had avidly watched his father in a little jewelry store in New York City, passed just 80 years later into the hands of the world’s greatest watchmaker. A fitting birthday gift for Harry Winston if the two corporate cultures prove to be compatible.

The second watchmaker we consider is Richemont (or La Compagnie Financière Richemont, to be more precise), which owns 13 watch brands. The third group is Rolex, which owns the Tudor and Rolex brands. Unlike Swatch Group and Richemont, both of which are listed companies on the Zurich stock exchange, Rolex is a non-listed company owned by the Hans Wilsdorf foundation. The fourth major group we look at that is involved in Swiss watchmaking is the French group LVMH, listed on the stock exchange. These four groups can be quite legitimately described as “superpowers.” The first three, for example, were single-handedly responsible for 43% of the total turnover of the watchmaking industry in 2011.10

Alongside these four groups can be found a number of independent family companies. Among the most important are the brands of Patek Philippe (in the hands of the Stern family),11 Audemars Piguet (owned by the Audemars and Piguet families), Chopard (Scheufele family), Breitling (Schneider family) and Bucherer (owned by Jörg G. Bucherer).

Bucherer, which was created in 1888, is still owned and managed by the third generation of the family in the person of Jörg G. Bucherer, chairman of the board of directors, and has around 1600 employees. The company has a chain of stores throughout Europe: 15 exclusive stores in Switzerland, nine in Germany, one in Austria and one of the world’s largest watch and jewelry stores in Paris.

In these temples of luxury, pride of place is given to illustrious brands such as Rolex, IWC, Jaeger-LeCoultre, Chopard and Longines. Other Bucherer Group members include Kurz AG jewelers and Swiss Lion (in Switzerland), and brand-specific boutiques. Since 2001 Bucherer has also had its own brand, Carl F. Bucherer (25,000 timepieces sold per year, equivalent to a turnover in excess of CHF100 million; it manufactures its own movements).12 This watch brand was created by Jörg G. Bucherer, the current heir, in homage to his grandfather, the company’s founder – a touching story with a level of personal involvement that is typical of companies run on family capital.

The large groups, regardless of their financial power, practically control the manufacture of watch movements

The current environment in this market is increasingly complex for new arrivals to penetrate. The large groups, regardless of their fin...

Table of contents

- Cover

- Title

- Copyright

- Contents

- List of Tables

- List of Figures

- Prologue

- Introduction

- 1 Luxury Landscape: Challenges and Opportunities for Independents

- 2 Last Chance for Knysna: Innovation

- 3 Back to the Roots

- 4 Code Breakers

- 5 Eagle in the Aquarium

- 6 Game Changers

- 7 Applying the BA2RE® Luxury Strategy Approach to the Creation and Development of Encelade 1789

- Epilogue

- Notes

- Index