This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

This book provides an original approach to the determinants of stock exchange integration. With case studies of successful integration projects in Europe, North America, Latin America as well as intercontinental cross-border mergers, it provides a complete analysis of all existing integration projects between stock exchange markets.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Stock Market Integration by E. Dorodnykh in PDF and/or ePUB format, as well as other popular books in Business & International Business. We have over one million books available in our catalogue for you to explore.

Information

1

A Literature Review of the Stock Market Integration

Abstract: This chapter provides a detailed analysis of stock exchange integration in an international perspective, studying the relationships between various stakeholders of stock exchange industry. Indeed, the interests represented by the various stakeholders are mutually different and sometimes conflicting and that can even affect the integration decisions of stock exchange market. This part entirely summarizes the literature review on stock market integration and the main transition steps towards the complete fusion between stock markets. New evidence on the integrative models suggests that once the trend of integration is firmly established within a market, it is logical to expect a phase of experimentation, in which various integration projects could start. The complete review of all integrative models is presented, reconstructing the underlying logic of stock exchange integration.

Keywords: alliance; hostile takeover; network; stakeholder; stock exchange industry

Dorodnykh, Ekaterina. Stock Market Integration: An International Perspective. Basingstoke: Palgrave Macmillan, 2014. DOI: 10.1057/9781137381705.

1.1 The role of stock market integration in global financial integration

Financial market integration is a central theme in international finance, and it is considered as a key factor in delivering competitiveness, efficiency and growth. In fact, financial integration increased significantly during the end of the last century, and it is, generally, associated with common globalization (Bhagwati, 2004). Many authors confirm that the development of information and communications technology facilitated international globalization and pushed financial markets to promote international risk diversification, to enhance assets allocations and to stimulate investment growth (Arouri et al., 2010; Bekaert et al., 2005). Furthermore, the great interest provided by the literature on financial market integration is justified by the positive effects that integrated markets could provide. Various authors have studied these effects related both to economic and to financial aspects. For instance, Harvey (1995) argues that the improvement in market efficiency is consistent with increasing integration with world markets. Meanwhile, Prasad et al. (2003) highlights that international financial integration can promote growth in developing countries and also helps countries to reduce macroeconomic volatility, where Beck et al. (2000) support the view that better functioning financial intermediaries improve resource allocation and accelerate total factor productivity growth with positive repercussions for long-term economic growth. Furthermore, Armanious (2007) shows how an increasing globalization of the world economy should obviously have an impact on the behaviour of national stock markets, which in turn will push the stock exchanges to merge together in order to make economic growth. However, Nicolini and Dorodnykh (2013), studying 53 international stock exchange markets worldwide, provide that globalisation of financial markets is quite far from being a homogeneous phenomenon. In fact, the stock markets from Western Europe, Northern Europe and North America are more ‘locally than globally’ integrated.

A much broader number of studies have tried to understand the role of increased competitive atmosphere in stock exchange industry. According to Marek and Haiss (2008), competition has increased between national exchanges for order-flow and listings, now companies decide to be listed on stock exchanges abroad as well as in their home country. Pagano et al. (2001) highlight this trend, showing that between 1986 and 1997 many European companies were listed abroad (mainly on US exchanges), while the number of US companies listed in Europe decreased. Moreover, Sarkissian and Schill (2004) report that about 20 per cent of internationally listed stocks are listed in more than one foreign market, suggesting the increased connections between markets. Thus, the new competitive environment and the abandonment of national barriers have created a series of international initiatives aimed at establishing a new architecture of integrated stock markets. Thus, to analyse the nature of pre-trading integration and the determinants of stock exchange integration, the following broad definition of financial stock exchange integration is used in this research in accordance with Baele et al. (2004) and Schmiedel and Schonenberger (2005). The market for a given set of financial instruments and/or services is fully integrated if all potential market participants with the same relevant characteristics (1) face the same set of rules when they decide to deal with those financial instruments and/ or services; (2) have equal access to the above-mentioned set of financial instruments and/or services; and (3) are treated equally when they are active in the market.

The development of the integration path among international stock exchange markets could be seen in the study of Polato and Floreani (2009), who argue that nowadays two stages of consolidation process could be enucleated. In a first stage, the consolidation engaged mainly European markets. The main references are the Euronext exchange and the Nordic exchange, but in recent years the phenomenon is expanding, involving the US exchanges. In a more economic perspective, Sabri (2002) shows that the increasing linkages are extended, first, from developed stock markets to other emerging stock markets and, next, from stock markets to other financial and banking systems. According to Nicolini (2010), nowadays investors in ‘core – Europe’1 tend to diversify their portfolios not only between national markets, but also between different types of business sectors. It implies the high level of financial integration, where the stock exchange integration has contributed significantly due to the fact that equity markets represent firms of the most important sectors in an economy of different countries. However, the process of equity market integration is gradual and takes many years, with occasional reversals. For instance, Carrieri et al. (2007) provide that stock exchange fusion is usually part of a major reform effort that includes the financial sector, the economy as well as the political process, where liberalization and deregulation in the money and capital markets of developed as well as developing countries push the equity markets to become more integrated.

Thus, if the previous research studies provide the main features of the new regulatory and technological framework that make the integration between stock exchanges feasible mainly from a macroeconomic perspective, this study investigates the stock exchange behaviours in the integration processes, trying to figure out the main drivers that lead them to be part of a new (international) market institution. In this way, the consequences of integration processes among financial markets become especially important. The relevance of consequences related to the integration between stock exchanges for different stakeholders is confirmed by many scholars. For the financial institutions and investors, market integration allows economies of scale and scope and long-term gains from international diversification (Kim and Singal, 2000; Goetzmann et al., 2005; McAndrews and Stefanadis, 2002; Neumann et al., 2002; Carretta and Nicolini, 2006; Syllignakis and Kouretas, 2011). An integrated market supports the intermediaries and the issuers that benefit from higher efficiency and transparency, and they will avoid the duplication of costs related to the market infrastructure (Pagano and Padila, 2005; Varadi and Boppana, 2009). Furthermore, the investors benefit from more diversified portfolios, higher market liquidity and decreased volatility (Polato and Floreani, 2010; Dorodnykh and Youssef, 2012). In other words, the integration of the stock markets seems to be desirable for all its participants.

In a more financial perspective Erdogan (2009) and Hasan et al. (2010) conclude that the stock exchange industry is as a key component of financial markets, where the global exchange integration activities may well promote the efficiency of cross-border capital flows, solve capital raising problems and, thus, have the potential to create value for their shareholders. High numbers of productive consequences related to the integration of stock exchange markets increase and furthers the economic growth. However, interdependent stock markets in terms of financial linkages can also trigger contagion through potential spillover effects and regional shocks. Actually, as many authors confirm, countries with internationally traded financial assets and liquid markets tend to be subjected to contagion (Allen and Gale, 2000; Lagunoff and Schreft, 2001; Claessens and Forbes, 2004). Evaluating the dynamics of the equity market integration is, therefore, important for monetary policy makers. New evidence on the consequences that integration can have on financial markets has been provided by the recent financial crises, highlighting the role of stock exchange integration in terms of financial contagion and the main difficulties of adequate risk diversification opportunities. Finally, Schmukler and Zoido-Lobatón (2011) argue that imperfections in financial markets can generate bubbles, irrational behaviour, herding behaviour, speculative attacks, and crashes among other things. In this way, even though domestic factors tend to be key determinants of crises, there are different channels through which stock exchange integration can be related to crises.

1.2 Stakeholders of stock market integration

The integration process is a result of relationships between various stakeholders of the stock exchange industry. Meanwhile, the traditional definition of a stakeholder is related to ‘any group or individual who can affect or is affected by the achievement of the organization’s objectives’ (Freeman, 1984). Friedman and Miles (2006) state that the organization itself should be thought of as grouping of stakeholders and the purpose of the organization should be to manage their interests, needs and viewpoints. Taking this complexity of stock market integration, Di Noia (1998) points out that traditionally, stock exchanges have been seen either as public entities (like the continental European exchanges), or as formally private entities, regulated by public rules. However, many exchanges, formerly cooperatives of intermediaries, which were both members and owners, have changed their ownership structure (demutualization) to become standard corporations while others, formerly public, have been privatized. Therefore, since many exchanges are self-regulated, conflicts of interest may arise. Besides, changing roles within the securities industry have complicated the interaction of the various vested interests, where stakeholders are not just the organizers of market and stock brokers, but also investors, issuers, market regulators and all other groups engaged in the trading process.

Following this line of reasoning, Schmiedel and Schonenberger (2005), Carretta and Nicolini (2006), suggest that the conflicts of interest might be crucial for the integration decision. Thus, it is necessary to study the individual behaviour of stakeholders in different integrative processes, where the analysis of the effects caused by these individual interests can define the basic criteria, by which stakeholders define their own strategies and can affect the strategic decisions of stock exchange market. Indeed, the interests represented by the various stakeholders are mutually different and sometimes conflicting. Moreover, recent changes that occurred in stock market structure affect not only stakeholders, but also their principal features, varying their role in integration processes and creating new conflicts of interests. Following Nicolini (2010), it is possible to formulate the following main stakeholders of stock exchange industry: Market Operator, Issuers, Market Members, Investors, Regulatory Authorities, Clearing and Settlement Infrastructure. Moreover, the change from the monopolistic models to a competitive exchange industry has made possible the participation of new stakeholders like the ATS (Alternative Trading System) and Technology Providers.

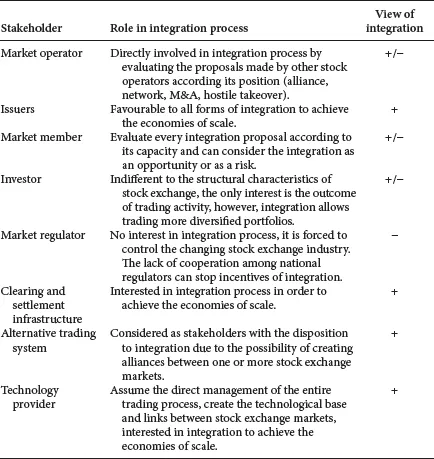

Table 1.1 summarizes the main stakeholders of stock market industry and their role in stock exchange integration.

TABLE 1.1 Main stakeholders of stock exchange integration

1.2.1 Market operator

The market operator or the owner is the principal stakeholder of the stock exchange market with its main aim to achieve a profit from the market management, and it is also responsible for the market regulation. Historically most exchanges were not-for-profit organizations, owned by their members. Over the past few years, there has been a trend among stock markets to consider an alternative governance structures to these traditional mutual or cooperative models. As was reported by Chesini (2007), in most cases, the exchanges have been transformed into for-profit shareholder-owned enterprises, when the mutual organization becomes a corporation with shares that are listed on a stock exchange. Moreover, according to Steil (2001), since an electronic auction system is a valuable proprietary product, it is feasible for the owner to operate it and sell access to it as a normal for-profit commercial enterprise.

The present regulation of market operator concerns essentially allow access of market participants to the trading system, including financial reliability, market behaviour (no manipulation), pre- and post-trading disclosure, transparency rules, and, finally, rules on listing of securities on the market. Thus, the exchange owners should satisfy all the interested entities: intermediaries, issuers, institutional investors, and private investors (Di Noia, 1999). However, after the demutualization process or the so-called change of corporate structure from non-profit to for-profit organisation, market operators have faced the dual role in terms of their regulatory and supervisory functions to ensure the enforcement of their trading rules. Thus, this central position of the market operator in the exchange industry can easily affect the strategic behaviour of other stock market participants.

From the strategic point of view, the monopolistic market operator tries to prevent the entry of new operators in order to enjoy the advantages of its central position. On the contrary, the market operator under the condition of competition tries to create an integration and, thereby, to reduce the level of competition by expanding its market share. For instance, Nicolini (2010) reports that the market operators play the most important role in integration alliances, since they can propose an alliance to other trading venues or to evaluate the proposals made by other stock operators. Hereby, in some cases, the market operator has to accept the merger if it is a necessary condition for its own survival. Meanwhile, the hostile takeover represents the most aggressive initiative for the majority of market operators, stimulating a defensive reaction due to the danger of losing control. Finally, for Neumann et al. (2007), the role, covered by the market owner almost in all integration processes, makes the market operator an indispensable player of the stock exchange industry, where an integration can be viewed as a guarantee of the economies of scale and scope.

1.2.2 Issuers

An issuer is a legal entity that develops, registers and sells securities for the purpose of financing its operations. Issuers can be domestic or foreign governments, corporations and investment trusts that are legally responsible for the issued obligations, reporting financial conditions, material developments and any other operational activities as required by the regulations of their jurisdictions. Among important characteristics of issuers in terms of listing on stock exchange, Di Noia (1999) indicated that issuers are direct customers and purchasers of exchanges’ services, who usually pay fees in order to be listed on an exchange. Therefore, the interests of issuers are addressed mainly to the stage of listing. Moreover, issuers have the oppo...

Table of contents

- Cover

- Title

- Introduction

- 1 A Literature Review of the Stock Market Integration

- 2 Evidences from the Recent History

- 3 Determinants of Stock Market Integration

- Conclusions

- References

- Index