Introduction

Asia is increasingly becoming the world’s epicenter of economic growth and value creation. As Asians live longer and prosper, the demand and supply of health, well-being, and happiness underlie Asia’s new wealth-generating model, a break from the old export model. In a world still recovering from the 2008 global financial crisis , governments and businesses must understand these dynamics if they are to form impactful public policies and multiple-year growth strategies.

The world economy comprises essentially four components: economic agents (producers, consumers , organizations, government), structure (production, distribution, and consumption ), goods, and services . The old economy system revolves around allocating scarce resources – land , labor , and capital . The entrepreneur exploits comparative advantages across boundaries, producing goods and services cheaply in one place and selling them at higher prices elsewhere until there is no feasible productivity gain. This value creation is a diminishing return to scale.

In the new economy , resources and values are redefined and seemingly abundant. Technological advances like automation , innovations like niche markets , and intellectual property like software applications are the new knowledge-based resources that are more valuable than the traditional resources of land , labor , and capital. Value creation in the new economy is increasing return to scale, where the variable cost of producing another unit approaches zero, as in copying digital software .

There have been many examples in history of seminal changes disrupting the global economy, such as rail and electricity . Many structural disruptive forces are at work now. With its billion-plus population, China presents threats (and opportunities) to many global industries in the short to medium term. So does India in the long term. Donald Trump’s election as US president in November 2016 has presented disruptive strategic threats (and opportunities) to Asia and the rest of the world, including his stated desires to reverse the globalization and environmental policies of his predecessor, Barack Obama. 1 Many technological innovations from the sharing economy to the Internet of Things (IoT) disrupt the status quo by offering new, better, and cheaper products and services . Regulatory changes create big headwinds (and tailwinds) for traditional industries like banking , energy , automobiles , and healthcare .

Economic transformation will diverge in different Asian countries because of their different starting points, technology gaps, and degrees of institutional rigidities. According to the Lewis Turning Point (LTP) concept, economic development begins with an agriculture-based economy, transits to higher productivity manufacturing , and then high-value service-oriented sectors.

Asia’s economies have undergone tremendous structural transformation from rural agriculture bases to urban industrial bases over the past half century. And Asia’s share of global economic production has doubled. But the benefits have been unevenly distributed. Japan , South Korea , Taiwan , and Singapore have become high-income industrialized nations. China , Thailand , and Malaysia are still trapped in middle-income status with dual economies, a mix of rural agriculture and urban manufacturing . Other countries like India, Indonesia , Vietnam , and Myanmar are still low-income economies in the early stages of industrialization with lopsided agricultural bases. Different degrees of economic transformation present diverse business opportunities. Two-speed economies – pre- versus post-LTP, rural versus urban, low versus higher income – will be discussed throughout this book.

Unlike the market-based system , the state-owned economic system produces goods and services according to a centralized hierarchical command. Inefficiencies and shortages are common because resource allocations are not based on supply and demand through the pricing mechanism. Transforming these state-owned enterprises (SOEs) into market-based enterprises will usually increase productivity , transparency, and commercial space for sustainable economic growth.

The Global Macroeconomic Setting

The world economy has been trapped in subpar growth and low

inflation since the trough of the

global financial crisis a decade ago.

2 Current projections for global real GDP

are 2.6 percent for 2016 and 2.8 percent for 2017 with moderate prospects of

inflation .

3 In Asia, strong growth in

India and the 10 countries of the

Association of Southeast Asian Nations (ASEAN) partially offsets the weakness in

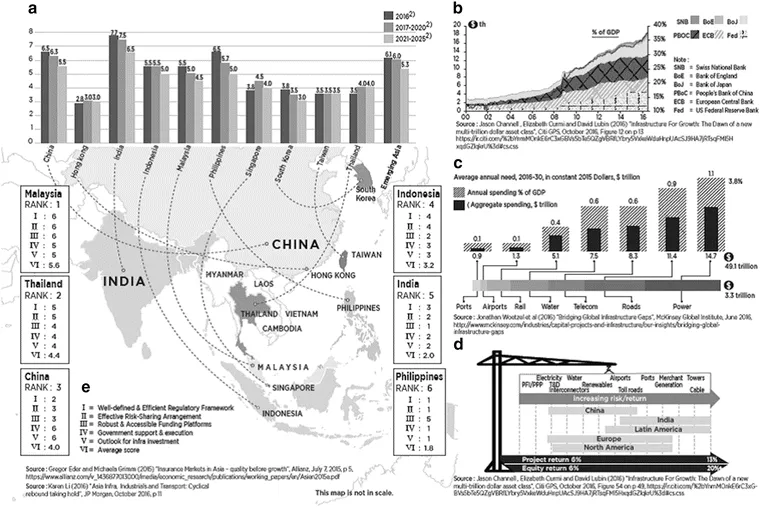

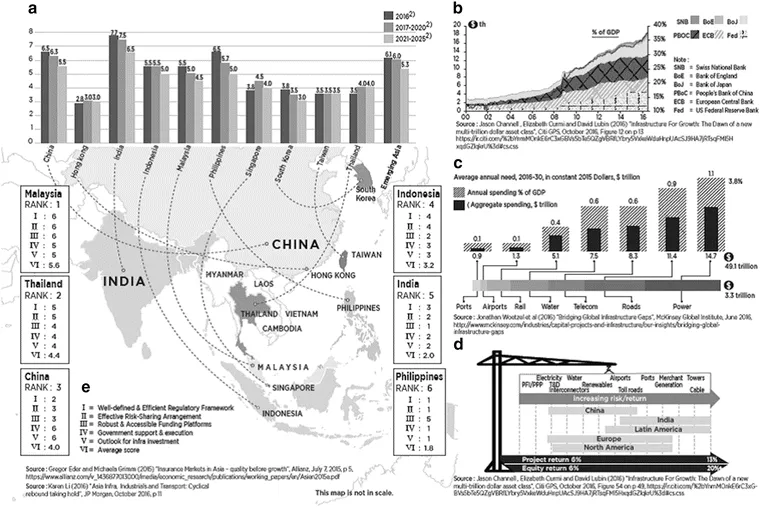

China . As shown in Fig.

1.1a,

India is projected to lead Asia with over 7.5 percent annual growth from 2016 to 2020 while China and

Malaysia will slow down. Asia will lead the world with a projected 6 percent annual GDP

growth in 2016–2020. And the gap with the rest of the world is widening.

4 Asia’s two closest competitors, Latin America and Eastern

Europe , will grow at only half that pace.

5 Weak oil and commodities prices, ultra-low interest rates, and increased fiscal spending have not boosted the global economy back to pre-2008 levels.

First, this is partially due to persistent deleveraging in the private sector debt overhang in the advanced economies after years of plentiful liquidity and asset reflation. On aggregate the world is wealthier from asset reflation by massive “quantitative easing” (QE) policies. Worldwide private financial assets...