Monetary analysis refers to detailed examination of the monetary and credit aggregates, in efforts to understand and perhaps control the growth of one or more of those aggregates. In that sense, serious monetary analysis probably dates from the work of Friedman and Schwartz (1963), on the one hand, and Jacques Polak (1957), on the other. It came into its own, at least to some extent, in the adoption of monetary targets in many western countries in the mid-1970s. In the Anglo-Saxon countries, those targets lasted only a decade, after which monetary analysis became something of a minority sport. On the other hand, monetary targets continued to be used in continental European countries through the 1980s and much of the 1990s and, among some emerging and developing countries, they have survived much longer. However, the use of large-scale asset purchases or quantitative easing in the USA and the UK since 2009, and in the eurozone since March 2015—which can arguably be understood most easily in terms of the effects on private and central banks’ balance sheets and on the monetary aggregates—has reopened the question of the role for monetary analysis.

This volume is designed to investigate how analysis of monetary and credit aggregates is used in modern central banks, and how that analysis feeds through, if at all, into policymaking. In the next chapter, economists from the Bank of England explain the kind of monetary analysis undertaken there, with illustrations covering the effects of quantitative easing (QE) and the insights on the financial crisis to be obtained from the sectoral decomposition of the monetary analysis. In Chap. 3, two economists from the European Central Bank (ECB) offer a flow-of-funds perspective on the ECB’s unconventional policy measures: they analyse the ECB’s use of its balance sheet, introducing the ideas of ‘balance sheet of last resort’ and ‘contingent easing’, and the transmission of balance sheet measures across different sectors in the economy. In Chap. 4, economists from the International Growth Centre (IGC) established in 2008 by the UK’s Department for International Development and the (central) Bank of Tanzania consider the path being taken by that country, from a conventional reserve money programme where monetary analysis was fundamental towards a strategy based on interest rate control and eventually, perhaps, inflation targeting (IT). In this respect, Tanzania serves as an example of the trends operating in a variety of developing and emerging countries (the Egyptian case is discussed briefly below); the intensive support which it receives from the IGC has also made its story more accessible.

This editorial introduction is designed to provide the intellectual and historical background. It therefore discusses, in turn, the high-powered money multiplier analysis preferred by Friedman and Cagan, the Polak model which underpins the IMF’s financial programming, and the flow-of-funds perspective used in various European central banks, particularly in the 1970s and 1980s; the rationale for monetary targets and their abandonment, with particular attention to USA and France, which are not covered elsewhere in the volume; the changes in monetary policy strategies in emerging and developing countries, from widespread monetary targeting, bolstered by data availability problems, towards IT which appears not to need much monetary analysis underpinning (with a small subsection on the Egyptian example); and the role of QE in bringing monetary analysis back into use and fashion, in some quarters at least.1

1 Approaches to Monetary Analysis

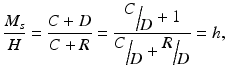

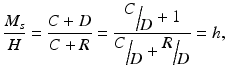

One starting-point for monetary analysis (on the supply side) is the high-powered money multiplier analysis associated with Friedman and Schwartz (

1963) and their associates such as Cagan (

1963). In its simplest form, this approach assumes that the public (i.e., the private sector) chooses to hold fixed proportions of cash

C to bank deposits

D, while the banks choose to hold a fixed ratio of reserves

R to their deposits. On that basis, a simple relationship can be derived between total money supply, that is, cash plus deposits, and ‘high-powered money’ or the ‘monetary base’

H, which is the sum of cash held by the public plus the banks’ holdings of cash and reserves at the central bank

R:

where

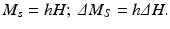

h is the high-powered money multiplier, and

If we know

C,

D, and

R, we can calculate

M,

H, and

h; if we know

h and Δ

H, we can calculate Δ

M.

Early versions of this high-powered money multiplier were mechanical, that is, C/D, R/D, and therefore h were taken as fixed, but empirical analysis soon showed that they were not constant. Later versions of the approach therefore allowed h to vary with interest rates: when interest rates were higher, the public would prefer to economise on non-interest-bearing cash in favour of deposits (of which some were interest bearing); while banks would try harder to economise on non-interest-bearing reserves when they could make loans at higher interest rates. Later versions also separated demand and time deposits, and included the ratio in which the public holds demand deposits relative to time deposits.

This approach provided an important framework for discussions about the Great Depression in the 1930s: Friedman and Schwartz argued that the many US bank failures which occurred in the early 1930s reduced the amount of high-powered money and caused the two key ratios to rise, but the Federal Reserve failed to increase the stock of high-powered money enough to offset the fall in the high-powered money multiplier. There seems little doubt that that experience helped to shape the reaction of the monetary policymakers to the Global Financial Crisis of 2007–2008, encouraging them to act to increase bank reserves.2

Friedman and his associates also argued that the multiplier could be used to exert control on the money supply via control of the monetary base, with the multiplier constant, or at least stable and predictable. This recommendation of monetary base control was a central part of the ‘monetarist’ policies urged upon policymakers in different countries in the 1960s and 1970s.

A second, and rather different, starting-point for monetary analysis is what is widely referred to as the Polak model, first set out in Polak (

1957) and the basis for decades of IMF ‘financial programming’. While the context for Friedman’s contribution was in effect a closed economy, Polak was trying to produce a framework which could be used to give policy advice to countries with a fixed exchange rate suffering from recurring balance of payments problems (and therefore turning for help to the IMF). The basic equations of the model are these

3:

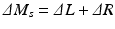

where

M s indicates money supply,

M d money demand,

L domestic credi...