![]()

CHAPTER 1

The Influence of the G-7 Advanced Economies and G-20 Group

Overview

When we think of the G-20 countries, whose summit took place in St. Petersburg, Russia, on September 5th through the 6th, 2013, we should think about the group of 20 finance ministers and central bankers from the 20 major economies around the world. In essence, the G-20 is comprised of 19 countries plus the European Union (EU), represented by the president of the European Council and by the European Central Bank (ECB). We begin this book discussing the importance and influence of the G-20, not only does this group comprise some of the most advancing economies in the world, collectively these 20 economies account for approximately 80 percent of the gross world product (GWP); 80 percent of the world’s trade, which includes EUs intra-trade; and about two-thirds of the world’s population. These proportions are not expected to change radically for many decades to come.

The G-20, proposed by the former Canadian Prime Minister Paul Martin,1 acts as a forum for cooperation and consultation on matters pertaining to the international financial system. Since its inception in September of 1999, the group has been studying, reviewing, and promoting high-level discussions of policy issues concerning the promotion of international financial stability. The group has replaced the G-8 group as the main economic council of wealthy nations.2 Although not popular with many political activists and intellectuals, the group exercises major influence on economic and financial policies around the world.

The G-20 Summit was created as a response both to the financial crisis of 2007 to 2010 and to a growing recognition that key emerging countries (and markets) were not adequately included in the core of global economic discussion and governance. The G-20 country members are listed in Figure 1.1.

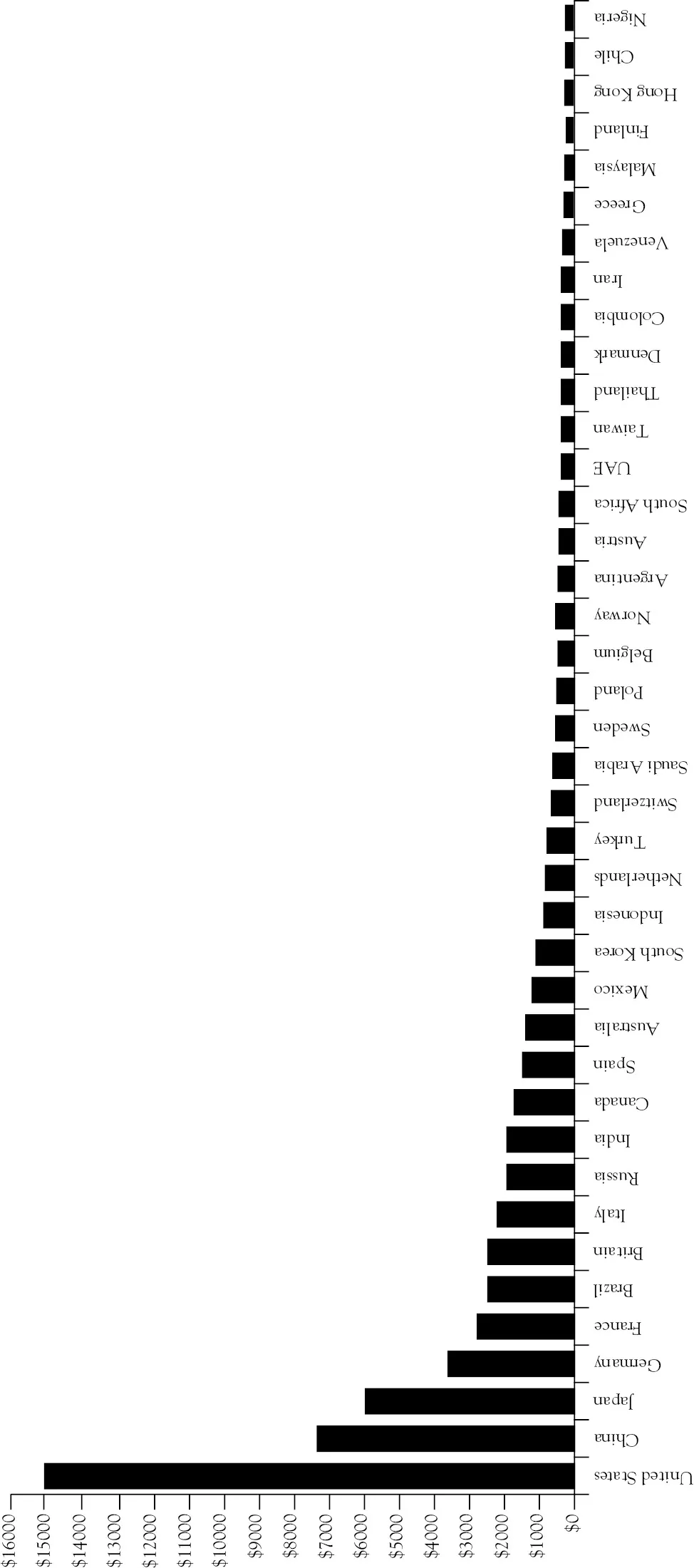

It is important to note that the G-20 members do not necessarily reflect the 20 largest economies of the world in any given year. According to the group, as defined in its FAQs, there are “no formal criteria for G-20 membership, and the composition of the group has remained unchanged since it was established. In view of the objectives of the G-20, it was considered important that countries and regions of systemic significance of the international financial system be included. Aspects such as geographical balance and population representation also played a major part.”3 All 19-member nations, however, are among the top 30 economies as measured in gross domestic product (GDP) at nominal prices according to a list published by the International Monetary Fund (IMF)4 in April 2013. That being said, the G-20 list does not include some of the top 30 economies in the world as ranked by the World Bank5 and depicted in Figure 1.2, such as Switzerland (19th), Thailand (30th), Norway (24th) and Taiwan (29th), despite the fact that economies rank higher than some of the member countries in the G-20. In the EU, the largest economies are Spain (13th), the Netherlands (18th), Sweden (22nd), Poland (24th), Belgium (25th) and Austria (28th). These economies are ranked as part of the EU though, and not independently.

Asian economies, such as China (2nd) and India (10th), are expected to play an important role in global economic governance, according to the Asian Development Bank (ADB), as the rise of emerging market economies are heralding a new world order. The G-20 would likely become the global economic steering committee. Furthermore, not only have Asian countries been leading the global recovery following the great recession, but key indicators also suggest the region will have a greater presence on the global stage, especially considering the latest advances in GDP for countries such as Thailand and the Philippines. These trends are shaping the G-20 agenda for balanced and sustainable growth through strengthening intraregional trade and stimulating domestic demand.6

The G-8 and G-20 Group Influence in the Global Economy

The G-8 and G-20 are coalitions of nations, who address significant international issues. The predecessor of both coalitions was the G-7, a group of seven nations, which banded together in 1975 to oppose the 1973 oil embargo by various Arab nations. The Arabs put the embargo into place as a protest against the intervention of the United States and the United Kingdom during the Yom Kippur War. The Arab nations waged war with Israel, but were unsuccessful because the United States and United Kingdom provided Israel with weapons and military might.

The U.S.S.R., which was by then on the verge of breaking up, supplied the Arab nations with weapons, and because of this move was not included in the G-7. The G-7 was known formally as the Group of Seven Industrialized Nations. It was composed of Britain, United States, France, Canada, Japan, Italy, and Germany. The G-7 was renamed as the G-8 during 1997, when Russia was added to the original seven-country lineup. Ever since its inception, the G-7 and G-8 asserted several political and economic policies, which affected other countries.

The G-7 and G-8 became known in the international scene as the major policy-makers, which could enforce or disrupt political and economic stability. The latest installment of the G-8 is called the G-20, a greater coalition formed in 1999 that included the nations of Brazil, China, Saudi Arabia, Republic of Korea, France, Australia, China, Canada, Germany, Indonesia, Argentina, Turkey, India, Russia, South Africa, Mexico, Japan, United Kingdom, United States, and the European Union.

While the G-20 is supposed to acknowledge all members as equals, it cannot be denied that the countries, which were included in its G-8 predecessor, have an advantage over other countries in terms of political and economic policy-making. So far, the G-20 goals for 2014 are to focus on growth and resilience.

G-20 country growth strategies contain a mix of macroeconomic and structural reforms at the domestic level that suit each country’s circumstances in areas with the greatest potential to lift global growth:

• Increasing quality investment in infrastructure. This will create jobs and boost economic growth and development. The G-20 is focusing on finding ways to boost private sector involvement in infrastructure development.

• Reducing barriers to trade. Many products are not made solely in one country and sold somewhere else, but cross national borders many times as they are created. Domestic measures to cut the cost of doing business and enhance countries’ ability to participate in global value chains can facilitate increased trade activity, fueling economic growth.

• Promoting competition. Reforms to promote competition help economies become more productive and innovative, and can bring prices closer to production costs, benefiting consumers and encouraging business to become more efficient.

• Lifting employment and participation. More and better jobs mean a more productive economy, leading to improved livelihoods and increased economic growth.

Strengthening development is an important part of achieving strong, sustainable and balanced growth, and ensuring a more robust and resilient economy for everyone. According to the International Monetary Fund, emerging markets and developing economies contribute more than two thirds of global growth.

For 2014, G-20 members are building the resilience of the global economy by:

• delivering on the G-20’s core financial regulation reforms;

• modernizing the international tax system to keep pace with the changing ways people and companies do business;

• reforming global institutions to ensure countries that are reshaping the global economy have a greater voice and keep the institutions relevant;

• strengthening energy market resilience, improving the operation of global energy markets for greater efficiency, and transparency;

• fighting corruption.

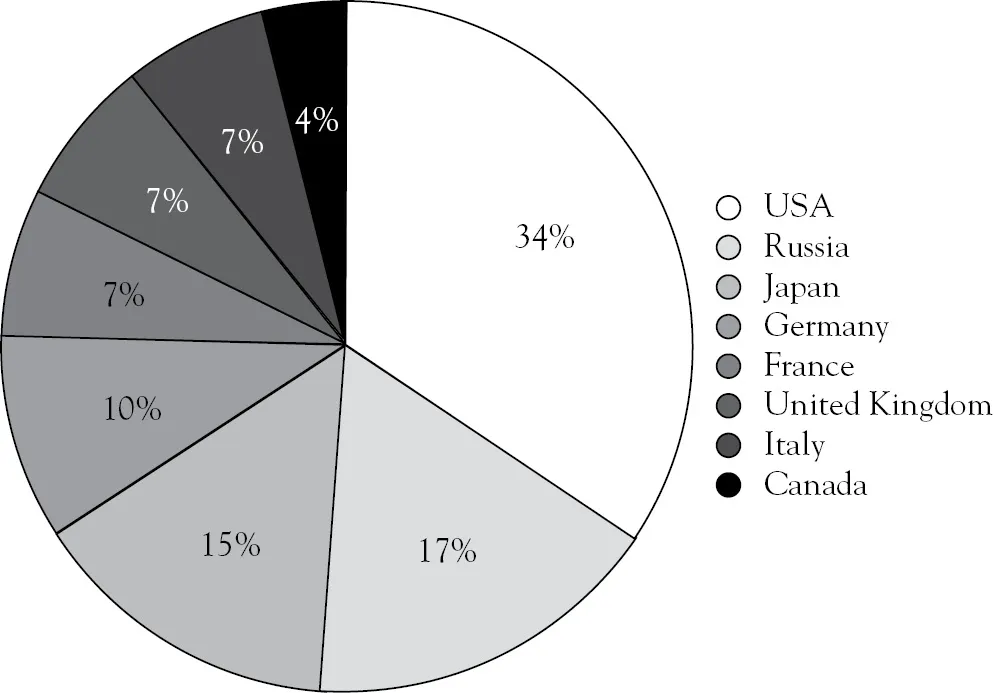

Prior to the G-20 enjoying the influence it has today in global economic policy-making, the G-8 group was the leading global economic policy forum. Figure 1.3 illustrates the breakdown of the G-8 countries by population. The U.S. population is about 300 million people, which is roughly a third of the population of all of the G-8 countries combined—equal to Japan and Russia combined, and to Germany, France, Italy, Canada, and the United Kingdom combined.

As the world economy continues to be increasingly integrated, the need for a global hub, a forum where the world economy issues and challenges could converge, is a major necessity. In the absence of a complete overhaul of the United Nations (UN) and international financial institutions, such as the IMF and the World Bank, the G-20 is the only viable venue to mitigate the interests of these leading nations. Since this group has overshadowed the G-8, it has become a major forum for global decision making, central to designing a pathway out of the worst global financial crisis in almost a century. It did so by effectively coordinating the many individual policies adopted by its members and thus establishing its importance in terms of crisis management and coordination during an emergency.

The G-20 has failed, thus far, to live up to expectations as a viable alternative to the G-8, although it continues to be at the heart of global power shifts, particularly to emerging markets. Efforts to reform the international financial system have produced limited results. It has struggled to deliver on its 2010 summit promises on fiscal consolidation and banking capital, while the world watches the global finance lobbyists repeatedly demonstrate their ability to thwart every G-20’s attempts to regulate financial flows, despite the volatility associated with the movement of large amounts of short-term funds. Hence, its goals for 2014 were met with skepticism.

Larger economies, such as Germany and Spain, have been concerned with the lack of effective regulation of financial flows. Emerging markets such as the BRIC (Brazil, Russia, India, and China) countri...