Chapter 1

Overview of Financial Accounting

Introduction

The objective of accounting is to provide information useful for users’ decision making. Two primary areas of accounting are financial accounting and managerial accounting. Financial accounting is intended to provide information to “external” users in meeting their decision making needs and is the exclusive topic of this text. Unlike managers, external users are not involved in the day-to-day decision making within the firm, but need information in making decisions. The two key external user groups with the greatest financial interest targeted to benefit from financial accounting information are current and potential creditors and investors. Since this text assumes the corporate form of business throughout, investors are stockholders. Creditors need to decide whether or not to lend money to the corporation and if so what interest rate should be charged to compensate for the level of risk. Stockholders need information to accommodate buy, hold, or sell decisions. Management has a vested interest in understanding financial accounting information because it impacts the corporation’s stock price, and the corporation’s ability to obtain loans and the related borrowing rates.

Both creditors and stockholders provide resources to the corporation in order to receive future cash flows; creditors in the form of principal and interest payments and stockholders in the form of dividends and proceeds from sale of the stock. Since the corporation has numerous creditors and stockholders, it cannot conceivably provide information to each on an individual user basis. Therefore, financial accounting information is intended to be useful in assessing the future cash flows of the firm. Three things are important regarding the firm’s future cash flows for valuation purposes, their amounts, timing, and uncertainty. Considering each individually, the greater the amounts, the sooner they occur, and the lesser their uncertainty, the more valuable is the debt or stock investment. By meeting the information needs of investors and creditors, financial accounting information is useful in meeting the decision making needs of other external user groups. For example, customers look to financial accounting information in order to assess a firm’s ability to continue providing goods and services in the future; and employees are interested in financial accounting information as it relates to the firm’s ability to pay them salaries and wages in the future.

The financial statements (including disclosure notes) are the primary product of financial accounting and the information provided therein is the exclusive topic of this book. The three primary financial statements include a balance sheet, an income statement, and a statement of cash flows. Most firms also provide a statement of stockholders’ equity. The financial statements of Behrend Corp. are illustrated in Exhibits 1.2–1.5. These financial statements are intended to be useful to external users in assessing the amounts, timing, and uncertainty of Behrend’s future cash flows. These users compare Behrend Corp. with other corporations and over time in making their decisions. This is why the information provided in the financial statements needs to comply with certain rules and guidelines—so that it is comparable across firms and within the firm over time. The rules and guidelines that the financial statement information must comply with are referred to as generally accepted accounting principles (GAAP). GAAP information must be both “relevant” (make a difference) and provide “faithful representation” (actually represent what is supposed to be represented) in order to be useful for decision making. An important part of the financial reporting process is the audit opinion, where independent Certified Public Accountants attest to the fairness of the information provided in the financial statements in conformity with GAAP.

The organization with legal authority to establish GAAP for publicly traded firms in the United States is the Securities and Exchange Commission (SEC). The SEC has primarily delegated the responsibility for setting U.S. GAAP to nongovernmental organizations. The current private sector organization with the responsibility to determine U.S. GAAP is the Financial Accounting Standards Board (FASB). Although U.S. firms comply with FASB GAAP, most non-U.S. corporations report financial statements based upon a similar but not identical set of GAAP that is formulated by the International Accounting Standards Board (IASB). This IASB set of GAAP is commonly referred to as International Financial Reporting Standards (IFRS). At the time of writing this text, the SEC has indicated it may in the future require U.S. firms to comply with IFRS. Financial accounting topics are addressed in this text primarily from a U.S. GAAP perspective, but highlight significant differences between GAAP and IFRS when appropriate.

Financial Statements

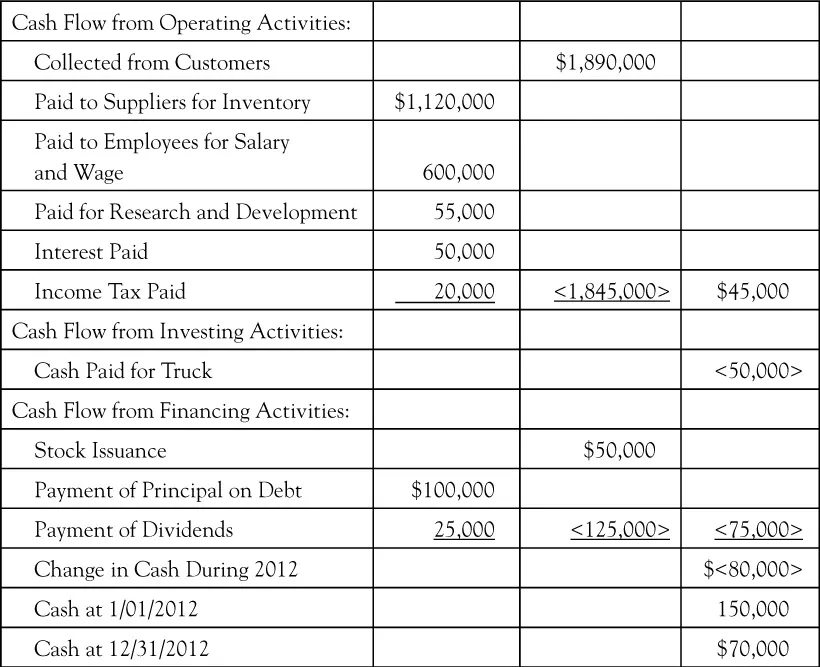

The balance sheet depicts a corporation’s financial position at a point in time. All the other financial statements are for a period of time and explain changes that occur in certain balance sheet items during the period. It is important to note that these “change” statements are for the same period of time, beginning and ending at the comparative balance sheet dates. For Behrend Corp. the change statements are consistently for the year ended 12/31/12. The ending balance sheet of the previous period is the current period’s beginning balance sheet. Comparing Behrend’s year-end 12/31/12 balance sheet (Exhibit 1.5) with its beginning balance sheet at 12/31/11 (Exhibit 1.1) indicates that cash has decreased by $80,000 during the year. This change in cash is illustrated in detail in the statement of cash flows for the period 2012 (see Exhibit 1.4). Likewise, changes in retained earnings and other components of stockholders’ equity that occurred during 2012 are depicted in the income statement and the statement of stockholders’ equity (see Exhibits 1.2 and 1.3). The FASB has defined the basic elements contained in the financial statements. These elements are next discussed as they relate to the particular financial statement.

Exhibit 1.1. Behrend Corp. Balance Sheet at 12/31/2011

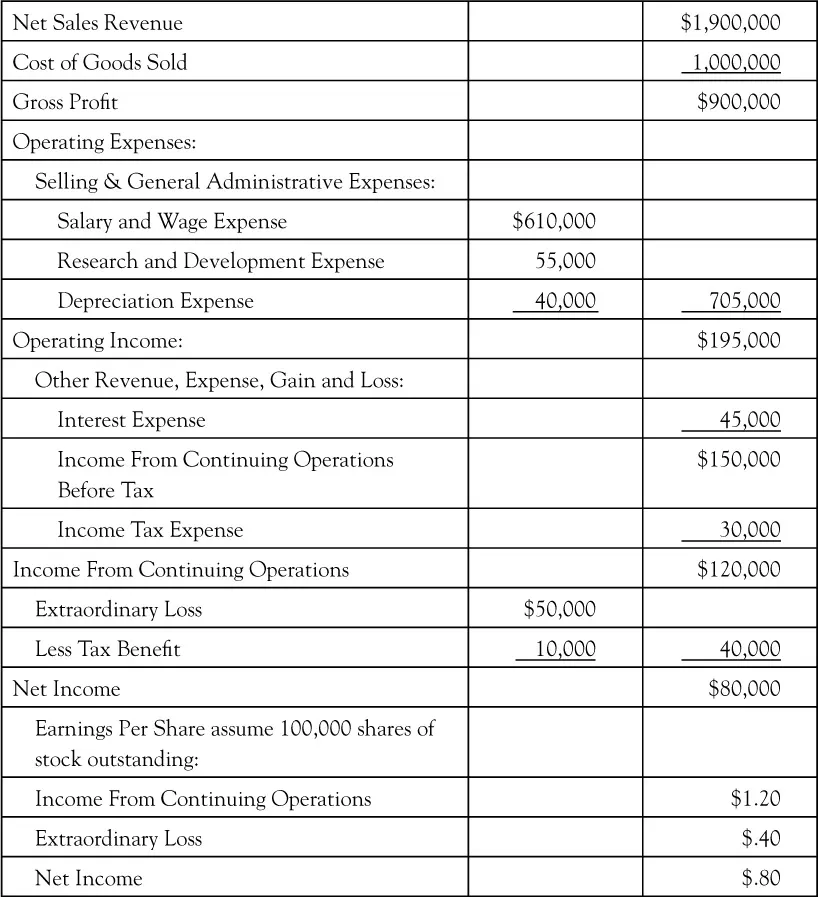

Exhibit 1.2. Behrend Corp. Income Statement for the Year Ended 12/31/2012

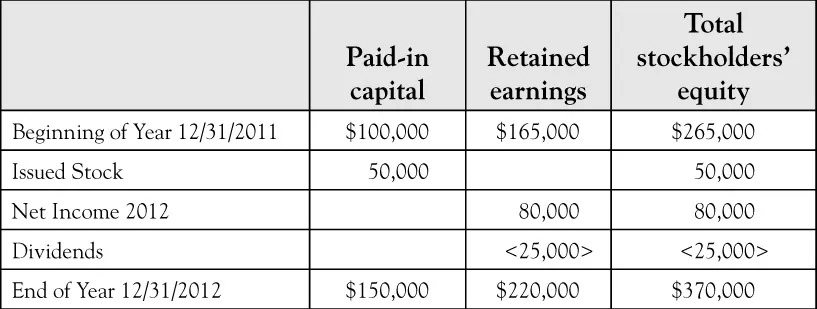

Exhibit 1.3. Behrend Corp. Statement of Stockholders’ Equity for the Year Ended 12/31/2012

Exhibit 1.4. Behrend Corp. Statement of Cash Flows for the Year Ended 12/31/2012

Exhibit 1.5. Behrend Corp. Balance Sheet at 12/31/2012

Balance Sheet

The balance sheet presents a corporation’s financial position at a point in time by reporting its assets (things of worth) versus its liabilities plus stockholders’ equity (claims to the assets). The balance sheet accounting equation is expressed as: ASSETS = LIABILITIES + OWNERS’ EQUITY (A = L + OE). The financial statements result from the accumulation, classification, and summarization of numerous individual transactions and events. Each transaction or event that impacts the financial statements is termed to be “recognized.” The accounting equation is always in balance. As discussed later, each transaction or event recognizes its dual (at a minimum) effects, which in turn maintains the equality of the accounting equation. This is referred to as “double entry” accounting.

Assets are defined as “probable future economic benefits as a result of past transactions or events.” Liabilities are the opposite of assets and are defined as “probable future economic sacrifices as a result of past transactions or events.” These are the most important definitions of financial statement elements because all other elements are defined in terms of assets and liabilities. For example, the remaining balance sheet element is equity, which is defined as “the residual interest in the assets that remains after deducting its liabilities.” A classified balance sheet separates “current” from “long-term” assets and liabilities. A current asset is one that will be realized in cash or used up within the next year or the “operating cycle”—whichever is longer. A current liability is one that will be satisfied by using current assets. The operating cycle is the period that begins with the corporation’s acquisition of goods held out for sale or the providing of services and ends with the collection of cash from customers in the normal course of business. Although there are exceptions, current liabilities are generally those that will be satisfied within one year or the “operating cycle”—whichever is longer. Since most businesses have an operating cycle of less than one year, unless indicated otherwise, this book assumes classification of assets and liabilities as current or long-term based upon the one-year period.

The balance sheet is used to gauge a firm’s debt paying ability. The term “liquidity” is used in two ways. The liquidity of individual assets is determined by their nearness to cash—therefore, cash is deemed to be the most liquid of all assets. Investments in marketable debt and equity securities can be easily and quickly converted to cash and are considered highly liquid. Comparing inventory with accounts receivable, inventory is deemed less liquid because, relative to accounts receivable, it is one step removed from cash receipt—the sale has not yet occurred. Liquidity is also used to describe a firm’s short-term debt paying ability. Current assets (CA) must be considered relative to current liabilities (CL) in making this liquidity assessment. Frequently used liquidity measures are working capital, the current ratio, and the quick ratio. Working capital is calculated as: CA – CL. Although working capital provides an important numeric measure of a firm’s short-term debt paying ability, it is difficult to compare the amount of working capital across firms of different size. Ratios provide relative measures that accommodate comparison across firms. Both the current ratio and the quick ratio use CL as the denominator but their numerators are different. The current ratio is computed as CA/CL, whereas the quick ratio’s numerator includes only the most liquid of current assets, called quick assets. Quick assets (QA) are CA excluding inventory and prepaid expenses and typically include cash, short-term investments, and accounts receivable. The quick ratio is computed as QA/CL.

A common measure of a firm’s capital structure is the debt-to-equity ratio. The debt-to-equity ratio includes all debt (D) or total liabilities in the numerator and total stockholders’ equity (E) in the denominator. The debt-to-equity ratio is calculated as D/E. The D/E ratio generally influences a firm’s long-term debt paying ability (solvency). Although a numeric measure of a firm’s solvency can be considered its net assets, or stockholders’ equity A – L = OE, the debt-to-equity ratio provides a more comparable measure across firms. The D/E ratio can be used to gauge a firm’s “leverage” or degree to which assets are financed through debt versus equity. The degree of leverage can also be used to assess the firm’s “financial flexibility.” Financial flexibility is the firm’s ability to respond to unexpected needs and opportunities. Generally, the higher the D/E ratio, the more difficult it is for the firm to make interest and principal payments on its debt, particularly during bad times, or to quickly borrow funds in order to take advantage of business opportunities when they arise.

Income Statement

Comprehensive income is defined as all changes in net assets (equity) during the period except those resulting from contributions by owners and distributions to owners. Comprehensive income has two components, “net income” and “other comprehensive income.” The income statement of Behrend Corp. for the year ended 12/31/2012 is illustrated in Exhibit 1.2. Net income or loss is the difference between the sum totals of revenues plus gains versus expenses plus losses. Revenues are defined as “increases in net assets from providing goods or services that constitute the firm’s ongoing central operations.” Expenses are “decreases in net assets from providing goods or services that constitute the firm’s ongoing central operations.” Like revenues and expenses, gains and losses also respectively provide increases and decreases in equity, but they result from nonowner “peripheral or incidental” transactions rather than “ongoing cent...