![]()

CHAPTER 1

Blue Pill or Red Pill?

What would happen if the world you believed to be true was not? Every interaction with every person, every emotion, every thought, feelings of joy, and pain did not exist? How would you react? How would you feel? The sky not only isn’t blue; it may not exist at all. If the truth painted a very different picture of reality than you expected, would you be willing to accept it, or would you ignore it and return to the world of false reality?

The movie, The Matrix, creates such a scenario. People live in a world like ours, or the one we believe we live in. They see blue skies, they smell the scent of freshly cut grass, and they experience love. However, in reality, none of this exists. None of it is real.

What is real? How do you define “real”? If you’re talking about what you can feel, what you can smell, what you can taste and see, then “real” is simply electrical signals interpreted by your brain.1

Machines, the antagonists in the movie, have created a computer program called The Matrix, and its purpose is to mimic the reality humans believe they are living in. Humans believe they are living their lives, waking up, going to work, having social and spiritual lives. The machines have created a situation where the humans believe this is their reality, that they are free. But they aren’t. In reality, the machines have physical and mental control of the humans. The humans are captured and living in a suspended state that is generally beyond their knowledge and control. They are being harvested as a source of energy for machines that control the world. The Matrix creates this false reality by manipulating electrical signals sent to the brain, thereby altering the perception of what is real. The mind, as they say, cannot tell the difference between what is real and what is imaginary. The Matrix controlled the “reality” the humans perceived. Instead of a bright world of friends and laughter, each individual was isolated and alone in a dark world, existing only in a pod by themselves.

There are a number of humans who are not captured and controlled by The Matrix who know about the situation. One is a fighter named Morpheus. He has a quest to find someone who could destroy The Matrix and free humans from being slaves to the machines. There is a point in the movie where Morpheus finds and develops a relationship with one potential freedom fighter named Neo. Neo is captured, but somehow concludes something is wrong with the world. However, he is not quite sure what it is and how pervasive it is. Morpheus believes Neo can defeat The Matrix. There is a scene early in the movie where Morpheus offers to explain The Matrix to Neo, hoping to have him join their cause, but he knows Neo might not be ready to find out the truth about what is happening to humans including himself. To prepare Neo, Morpheus extends his arms and opens his hands revealing a red pill and a blue pill. He offers Neo a choice of taking either pill saying,

This is your last chance. After this, there is no turning back. You take the blue pill—the story ends, you wake up in your bed and believe whatever you want to believe. You take the red pill—you stay in Wonderland and I show you how deep the rabbit-hole goes.2

So What?

When it comes to business and understanding financial numbers, we are faced with a similar question: What is real? Is something real because we are told it is real? Because it is calculated mathematically using a standard approach or formula? Does creating a better way to perform a task that is, itself, questionable, make the result real?

In business, there are two worlds, just as there were in The Matrix. Each world attempts to describe the financial performance of an organization. There is one world, like the accounting version of The Matrix where accounting numbers dictate, influence, and arguably control management thinking and action. That is a world where costing things such as products, services, activities, and work output is a critical part of the thinking and actions. Never mind the notion that the idea itself may be flawed. In this world, it is a panacea.

Then there is the world of reality—real math, real modeling, leading to a clearer understanding of business structure and operations, and this enables more effective management decision-making. In this context, this world, accounting is a reporting tool, and nothing more. Leaders look to understand the facts of what is going on in their organizations and choose to live and operate outside the accounting Matrix preferring to focus on real operational data and the financial data that result directly from it. They go into the accounting Matrix only when required to deal with the false reality that has been created.

You, like Neo, have a choice. Your blue pill is to put this book down and continue living without the knowledge of how damaging the improper use and interpretation of accounting data can be, and how to improve the effectiveness of your management skills and decision-making. Reading this book is your red pill. By choosing to read this book, you will begin to understand how the improper use and representation of your company’s cash data leads you to realize that your business reality is not, in fact, real at all. You will see that accounting tools, especially in the form of cost accounting, are damaging to your ability to comprehend what is really going on in your business. Like The Matrix without the evil intent, cost accounting is pervasive and affects the thinking and decision-making of people throughout society, both in the business world and outside the business world without their knowledge. Cost accounting alters the perception of reality. The result? The world has seen lives, families, companies, communities, and economies destroyed by poor decisions made by otherwise intelligent leaders with accounting data as a basis.

The purpose of this book is to expose some of these practices, help you understand the implications behind them, and offer you a way out.

Once you understand these ideas, you will not be able to turn back. You will be able to operate within accounting just like Morpheus, Neo, and other freedom fighters operated within The Matrix. They went in and out gathering information they needed to support their cause. You will know that this world, built by accounting data, has significant limitations and does not reflect the true reality. This is your warning. You can take the blue pill and live a professional life unknowing by putting this book down, or you can take the red pill and see the world of business differently.

_______________

1The Matrix. Dir. Andy Wachowski and Larry Wachowski. Warner Bros. Pictures, 1999. DVD.

2Ibid.

![]()

CHAPTER 2

The Foundation

Let’s begin with a foundation on which we can agree. There are two financial things every company must do both to survive and be in compliance with the law. It doesn’t matter the size of the company, its industry, or whether it is for profit or not for profit. The company must generate cash and it must report its earnings to the government for a number of reasons including, but not limited to taxes, providing financial performance data if the company is public, and as proof of financial transactions for nonprofits. Failure to do either or both of these will limit your company’s ability to exist long term. I trust you will agree with me on these two ideas. Let’s look at each of these individually.

Generating Cash

Generating cash, cash flow, is the lifeblood of any company. All companies need positively flowing cash to ensure they are able to survive and, ideally to grow.

Generating cash comes from two primary sources. One source is investors who infuse cash in various ways including debt and money for equity. The other is to make more money than you are spending by selling products and services. The former may involve getting capital to address a tactical or strategic need. A key consideration is that this money is expected to be paid back in some way. Although it may provide needed sources for survival or growth, it comes at a price. The latter is a requirement and necessary capability for all companies.

Reporting Earnings

The government requires companies to report their earnings. In the United States, some may have to report to governing agencies such as the Securities and Exchange Commission (SEC) and, at a minimum, to the Internal Revenue Service (IRS). To ensure everyone does so in a standard, consistent way, there are rules and guidelines established by these agencies. The primary objective of the reports is to represent what the company did, according to the agency guidelines, over a fixed analysis period. Doing this will help the company describe how well it performed during the analysis period. This information may also be used by the investment community as a way to understand and assess company performance. Whether looking at reports prepared for the SEC or looking at statements for loans, this information becomes a basis for how lenders assess the financial viability of your company. The most commonly used are the income statement, the balance sheet, and the statement of cash flows. Often, we focus on the income statement—the description of profits and losses.

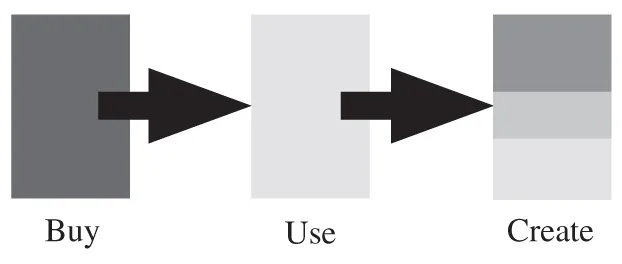

Abstractly, the way your business operates is seen in Exhibit 2.1. In this diagram, you see that the company buys resources and performs work, and the desire is that this process leaves the company in the position to make more money than it spent. When this happens, you had a generally positive analysis period. There may be unmet expectations about how much money was made, but in general, the objective is to be profitable—to make more money.

We consider the income statement to determine whether we made money. The basic idea is that if the revenues you generate are greater than costs you have, you have made money. Logically, this makes sense. If you make $100 and you spend $60, you have $40 left. This information allows you to make decisions such as how much you have to spend on other things. The problem is the income statement does not tell you how much money you made. In fact, the whole notion of profit may have little to do with making money at all.

Exhibit 2.1 When we buy a resource, we have a defined amount we will have access to. It is from what we buy that we do work to create output in various forms. Sometimes the output is products or services, it may be information, and it could be offices created from space we lease

![]()

CHAPTER 3

Profit has Little to do with Making Money

Everyone talks about profit, and we assume that profit and making money are synonymous. The question is: Are they? Making money represents the amount of money you generate. It is cash and timing based. How much money you make is determined by the net cash you bring in over a given time period. Determining how much cash you generated should be tied directly to when you spend and receive cash. You cannot talk about how much money you made this year by considering what you’re going to spend next year and what you received last year. This notion is critically important. If you want to know how much money you have or expect to have you must consider the cash that comes in and leaves during the time period considered. It doesn’t make sense to think about managing cash flow when the timing of cash transactions is eliminated from consideration. Remember this line.

We generally calculate profit using the profit equation. This general equation is well-known to all in business and in many other aspects of life. That equation is

The assumption, again, is that profit is synonymous with making money. For profit to represent making money, though, the timing and cash flows have to be in alignment. They aren’t. There are six reasons why:

1. Revenue recognition

2. The practice of costing

3. The definition of costs

4. Believing efficiency and waste reduction lowers costs

5. Misunderstanding inventory value

6. Depreciation

Each of these will be mentioned briefly here. However, because of the depth of the issue involved, each topic has earned its own chapter.

Revenue Recognition

The first idea that challenges whether profit can represent making money is revenue recognition. The rules of financial accounting a...