![]()

PART I

MEDICARE AND THE SEVEN DEADLY SINS

![]()

1. Abandon Hope All Ye Who Read Further

To:His Most Exalted Satanic Majesty

Lucifer, the Prince of Darkness

King of the Damned

Beelzebub

His Nibs

Master of the Nether Regions

Scourge of the Self-Righteous

Seventh Circle of Hell, Hell

From:Underling Demon 666

Deputy Assistant Special Coordinator for Accelerating

Recruitment (DASCAR)

Department of Illness and Satanic Services (DISS)

North American Division

Washington, D.C.

Re:Market Share Report—United States of America

Per your request, I report herein on behalf of DISS on the progress of our attempts to corrupt the American Republic. Happily, our market share in the United States grows with every passing day. Our growth has been particularly precipitous since we repackaged our product in 1965.

As you know, the recipe we have used for centuries (avarice, gluttony, envy, sloth, lust, anger, and vanity—known collectively hereafter as the ‘‘seven deadly sins’’) has worked perfectly well in most of the known world. These sins were first cataloged by Pope Gregory ‘‘the Great,’’1 and have since been analyzed by such luminaries as St. Thomas Aquinas, Dante, Chaucer, and C. S. Lewis. They have also been featured in recent Hollywood movies and a wide array of advertisements. (My personal favorite is an ad for Las Vegas, your home away from home, that appeared in in-flight magazines. The ad featured a poker chip that bore the legend ‘‘Seven Deadly Sins, One Convenient Location.’’)

Unfortunately, Americans have proved unusually resistant to the charms of the seven deadly sins, even though your status as an American citizen should have been quite helpful in this regard. Through almost two centuries, Americans persisted in doing unto others as they would have done unto themselves, working hard and playing by the rules, staying in school, saving for a rainy day, going to church, donating to charities, volunteering their time to worthy causes, and generally behaving like goody twoshoes at every conceivable occasion. We have long had considerable success with our recruiting efforts among two groups of Americans: members of Congress and lawyers. (To be fair, we had a considerable advantage, given your status as the ‘‘King of Lawyers.’’)2 However, these groups were unable to do serious damage as long as the rest of the population behaved themselves.

As such, it was a stroke of evil genius for your eminence to come up with the idea of creating a government program that would corrupt everything and everyone it touched, by incorporating all seven of the deadly sins, while simultaneously persuading the public that it included none of them.3 The program works insidiously so that the citizenry is unaware of its evils until it is far too late. Indeed, they vigorously defend the program against all criticism, and, ironically enough, believe the program’s critics are allied with us!

I refer, of course, to the Medicare program, whose every feature bears the distinctive stamp of your subtle genius. Chapter 2 provides some background on the Medicare program, how it came about, and where it is headed. Chapters 3–9 catalog how the Medicare program incorporates and reinforces the effects of each of the seven deadly sins. Chapter 10 outlines how Medicare further undermines two distinctively American virtues: thrift and truthfulness. Chapter 11 outlines a number of threats to our plans, and Chapter 12 offers a brief conclusion.

![]()

2. Medicare Overview

This chapter provides an overview of various salient features of Medicare, including its origins, structure, financing, and the like.

Medicare’s Origins

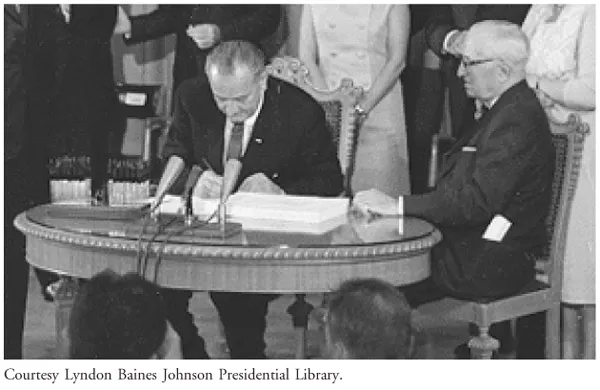

President Lyndon B. Johnson signed the legislation establishing Medicare on July 20, 1965. To mark President Harry Truman’s efforts to enact such a program 20 years earlier, President Johnson chose to sign the bill at the Truman library in Independence, Missouri, with President Truman at his side. A picture of the signing ceremony adorns my wall, to commemorate the launch of your most ambitious plan to destroy the American Republic. The photo is reproduced below for your reference.

Those present included various congressional leaders, including the person standing on the far right side of the picture, Representative Wilbur Mills. As the chairman of the House Ways and Means Committee, Mr. Mills shepherded the Medicare bill through Congress, and was the person most responsible for Medicare’s basic design features.

Despite our best efforts, Mr. Mills was deeply concerned about the fiscal implications of making the government the primary payer for health care services for the elderly. Mills’s fiscal conservatism and his commitment to budgetary restraint led him to design Medicare’s financing in a way that forced policymakers to periodically confront the growing costs of the program.1 We opposed this financing plan, out of the fear that early cost overruns would cause Congress to wise up and kill the program in its infancy. However, we were pleasantly surprised by the passivity of Congress and the American public in the face of a program that was dysfunctional from the get-go.

Such concerns were far from the mind of President Johnson when he signed the Medicare bill. Instead, his signing statement reflects the deeply moralistic overtones of his campaign for Medicare, and his hopes for the future:

No longer will older Americans be denied the healing miracle of modern medicine. No longer will illness crush and destroy the savings they have so carefully put away over a lifetime so they might enjoy dignity in their later years. No longer will young families see their own incomes, and their own hopes, eaten away simply because they are carrying out their deep moral obligations to their parents, and to their uncles, and to their aunts. . . . No longer will this nation refuse the hand of justice to those who have given a lifetime of service and wisdom and labor to the progress of this progressive country.2

Of course, the irony is that President Johnson gave little thought to the long-term cost burdens imposed by the Medicare program. Yet, as you anticipated, these burdens fall disproportionately on working families—who now, in President Johnson’s own words, ‘‘see their own incomes, and their own hopes eaten away,’’ this time because they are paying the exorbitant taxes necessary to sustain the Medicare program.

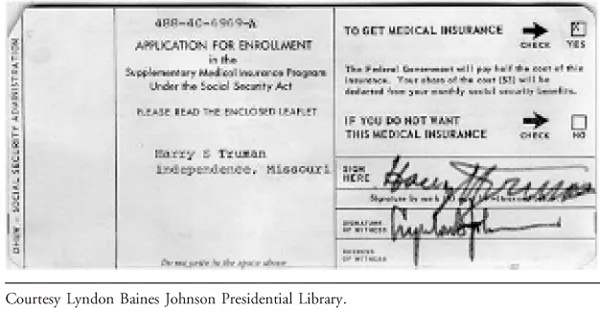

President Johnson’s optimism about the program notwithstanding, a better indicator of the long-term fiscal consequences of Medicare was the simple fact that President Truman was the first person to receive a Medicare card for hospitalization benefits. It is hard to make the case that ex-presidents are in need of any sort of subsidy from ordinary working Americans to pay for their hospitalization expenses—but that is exactly what Medicare did (and does). As if this reverse–Robin Hood scheme for hospitalization (robbing from the working poor to give to the wealthy) was not bad enough, President Truman also ‘‘doubled down’’ and simultaneously applied to enroll in the voluntary part of Medicare that covers physician treatment (supplementary medical insurance or SMI). There was no attempt to hide the reverse–Robin Hood scheme; the form that President Truman signed made it clear that the federal government ‘‘will pay half the cost of this insurance.’’ Once again, it is hard to make the case that ex-presidents are in need of any sort of subsidy from ordinary working Americans to pay for the cost of seeing a physician—but that is exactly what Medicare did (and does). For your reference, I have included a copy of President Truman’s application for SMI, which was witnessed by President Johnson after the signing ceremony.

This degree of candor about the subsidies created by the Medicare program is unusual. Proponents of reverse–Robin Hood schemes usually know better than to advertise the extent to which the benefits received by upper-income beneficiaries come out of the pockets of lower-income taxpayers. Yet, Medicare’s proponents were not embarrassed (as most people would have been) by this fact. Indeed, they actually celebrated the reverse–Robin Hood nature of the program, reasoning that it was only the first step toward having the federal government provide health insurance for the entire population (i.e., ‘‘universal coverage’’) through a system of ‘‘social insurance’’ where everyone pays for everyone else’s health care coverage.3

Medicare Beneficiaries

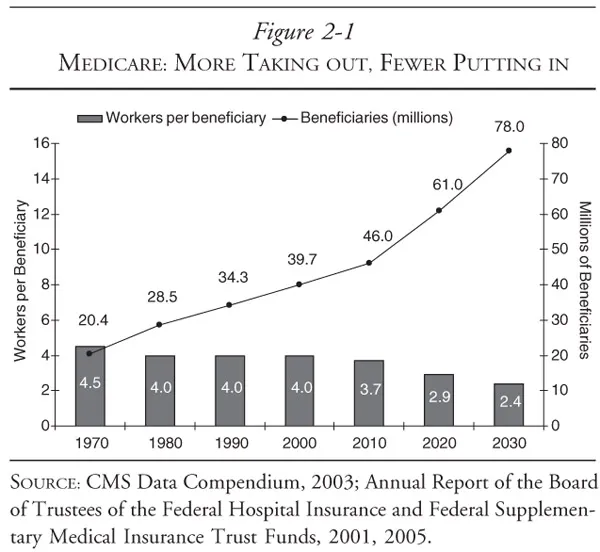

Generally, Medicare is available for people age 65 or older, younger people with disabilities, and people with permanent kidney failure. Medicare currently provides health care coverage for approximately 42 million Americans, although this figure is expected to rise rapidly as the baby boom generation retires. Of course, as you anticipated, the population as a whole is not expected to increase as dramatically—meaning that the number of workers per beneficiary will drop substantially. Figure 2-1 sshows how these two trends interact with each other.

These demographic mismatches create obvious challenges for financing Medicare—challenges that we are planning to exploit to our full advantage.

Medicare’s Structure and Benefits

Medicare has four parts: Part A (hospitalization benefit), Part B (outpatient services), Part C (managed care), and Part D (pharmaceuticals).

As noted earlier, Parts A and B date to the beginning of the Medicare program. Part C was added to the program in 1997, as part of a balanced budget act (oh, the irony!), and is on its second incarnation. Part C was originally called Medicare + Choice, but Congress renamed it Medicare Advantage in 2003. Part D was enacted into law as part of the Medicare Prescription Drug Improvement and Modernization Act of 2003, also known as the Medicare Modernization Act, or MMA for short. Part D provided a preliminary prescription drug benefit (a drug discount card), with the full benefit package becoming available in January 2006.

Neither Part A nor Part B pays for all of a covered person’s medical expenses, since there are various deductibles, copayments, and noncovered expenses. The most important exclusion is that Medicare does not cover long-term nursing care. Overall, Medicare pays for roughly 45 percent of the health care expenditures of its beneficiaries.4

Financing Medicare

Different parts of Medicare are financed in different ways, and each has different copayments and deductibles. Part A is almost entirely funded by a 2.9 percent tax imposed on all wages. Selfemployed individuals pay the full tax of 2.9 percent directly, whereas 1.45 percent is withheld from the wages of employed individuals and the employer directly pays a matching amount. To be sure, the full burden of this tax is borne by the worker, regardless of how it is nominally split between the employer and employee—but it was yet another example of the extent of your evil genius to hide the true cost of the program from the chumps who are paying for it.

Of course, both the tax rate and the amount of wages subject to the Medicare tax have increased dramatically since the program was initiated in 1965. For high-wage workers, Medicare taxes can exceed the taxes imposed to keep Social Security (another of our programs) going.

Medicare beneficiaries with 40 or more quarters of Medicarecovered employment pay no premiums to receive benefits under Medicare Part A. People who are eligible for Medicare based on their age, but who do not have the necessary number of quarters of Medicare-covered employment may participate in Part A if they pay a hefty monthly premium. Beneficiaries who are hospitalized pay an initial deductible, plus copayments for all hospital days following day 60 within a benefit period.

Part B is financed with money allocated from general tax revenues and premiums paid by beneficiaries. All services provided pursuant to Part B are generally subject to a deductible and copayment, but certain medical services and related care are subject to special payment rules. Originally, the cost of Part B was evenly split between the government and the beneficiary. Consistent with our plan to use the Medicare program to destroy the fiscal solvency of the United States, we lobbied to have this ratio shifted to 75:25, with taxpaying citizens bearing the larger share and beneficiaries bearing the smaller share. We have ruthlessly demagogued any effort to change the ratio back to the original allocation.

Part C combines Parts A and B, and so its financing combines them as well. Part D is financed with a combination of premiums from beneficiaries, and substantial contributions from general tax revenues. However, Part D is an interesting hybrid, since lowincome seniors pay lower premiums and have lower cost sharing to receive benefits.5 In the past, Medicare beneficiaries could qualify for such treatment only if they were ‘‘dual eligibles’’—that is, they were eligible for both Medicare and Medicaid. (As you recall, Medicaid is the medical insurance program for the poor that Medicare’s opponents offered in 1965 as an alternative to our product. Rather than serve as a substitute, however, this similarly pernicious program6 was bundled and enacted alongside our product.7)

We have routinely opposed means testing of Medicare, on the grounds that it would undermine public support for the program. The MMA also introduced limited means testing for Part B, and we ultimately decided not to oppose that provision because the rest of the MMA helped advance our mission. We could also see the writing on the wall; the financial projections for Medicare had gotten so bad that even the Clinton administration seriously considered means testing. A strategic retreat on means testing for Part B also helped preclude a serious debate over means testing for Part A, where the adverse consequences for our plans would be much more severe. (This memo returns to means testing in chapter 11.)

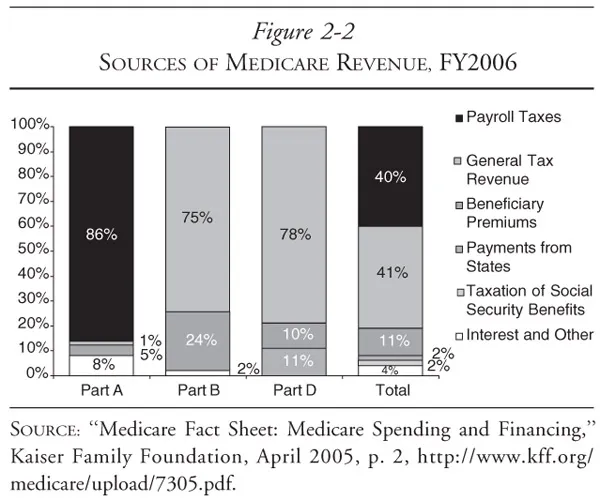

Despite these variations, what Parts A–D have in common is that they are overwhelmingly (i.e., between 75 percent and 90 percent) financed by taxpayers who are not receiving benefits from the Medicare program. Figure 2-2 shows the distribution of the costs of Medicare.

As we had hoped, this perverse allocation of the costs of Medicare has not attracted much attention, since we positioned Medicare as a sacred intergenerational trust—effectively distracting almost everyone from the staggering amounts of money being spent. No one but the devil could ever come up with such a clever plan—let alone persuade the American public that this regressive financing structure was desirable!

Medicare’s Administrative Structure

When it was created, Medicare was administered by the Social Security Administration. Although the SSA is still responsible for enrolling beneficiaries and collecting Part B premiums, operational control of Medicare was transferred to the Health Care Financing Administration in 1977. HCFA was renamed the Centers for Medicare & Medicaid Services (CMS) in 2001.

Medicare purchases medical care from more than a million providers of goods and services, including hospitals, skilled nursing facilities, home health agencies, clinical laboratories, HMOs, medical equipment suppliers, and physicians. To do so, it processes over one billion fee-for-service claims per year, making it the nation’s largest single purchaser of health care. At present, Medicare pays roughly 17 cents of every dollar spent on health care in the United States.8 In terms of the supply side, Medicare is responsible for roughly 31 cents of every dollar received by U.S. hospitals, and 24 cents of every dollar spent on physician services.9

When Medicare was created in 1965, it paid hospitals based on the cost of the care they provided, and physicians based on their ‘‘usual, customary, and reasonable’’ charges—thus adopting the payment systems that prevailed in the private coverage market. This open-ended reimbursement system had the immediate and continuing inflation...