- 672 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Truth About Money 3rd Edition

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Part I

Introduction to Financial Planning

There’s a quiz at the end of this part!

To see how much you already know, skip to the end of this part and take the quiz now. Then, read the part and take the quiz again. You’ll discover how much you’ve learned!

Overview – The 11 Reasons You Need to Plan

Thirty-five years ago, the financial planning profession did not even exist, yet today, hundreds of thousands of people claim to be financial planners (and some of them actually are!). What is financial planning, anyway, and is it really necessary?

After all, your parents didn’t plan for their future— so why should you? The reason your parents didn’t plan is the same reason you haven’t packed for Europe: You’re not going! Likewise, our parents and grandparents never planned for their future for the simple reason that they weren’t going to have one. Why worry about developing cancer at age 88 if you are going to be dead of tuberculosis at 45? Since people weren’t expecting to live past 65, there simply was no need for planning.

Today, of course, things are different. And among these differences is the need for financial planning. Here are 11 reasons why you need to plan.

Reason #1: To Protect Yourself and Your Family Against Financial Risks

Notice the word financial. As a financial planner, I cannot protect you from the risks you face in life— no planner can— but I can protect you from suffering the financial loss that may result when any of those risks become reality. What are those risks? The four major ones are injury, illness, death, and lawsuits, and you’ll learn how to manage and reduce those risks in Part XI.

Lawsuits? You bet! For perspective, the odds that your house will burn down are 1 in 1,200— yet according to Forbes magazine, the odds are just 1 in 200 that you will be sued at some point in your lifetime. (To learn how to protect yourself from the financial threat of a lawsuit, see Chapter 75.)

Reason #2: To Eliminate Personal Debt

For some people, a proper goal is to become worthless. If you owe lots of money to credit cards, auto loans, and student loans, becoming worthless would be a real improvement. You must move from owing money to owning money.

Indeed, total consumer debt in this country (excluding mortgages) exceeds $1.4 trillion, according to cardweb.com. Its research reveals that Americans hold an average of 8 credit cards each, with an average balance of $8,400 per card.

You’ve heard the joke about “running out of money before you run out of month,” but it’s not so funny to run out of money before the end of your life! You must make sure you don’t outlive your income, and that means you’ve got to accumulate assets so you can support yourself for a lifetime. That’s impossible to do if you have debts, so you must eliminate them. Chapter 51 will show you how.

Reason #3: Because You’re Going to Live a Long, Long Time

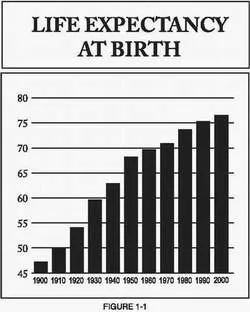

At the time of the American Revolution, life expectancy at birth was 23 years. By 1900, Americans were expected to live only to age 47. Thus, throughout most of our nation’s history, almost everyone worked; there was no such thing as retirement.

Today, though, life expectancy tables from such diverse groups as the IRS, life insurers, the National Institutes of Health and the Centers for Disease Control and Prevention all say roughly the same thing: A child born in 2004 has a life expectancy of 77 years (up from 47 in 1900); a 77-year-old today is expected to live to 88; an 88-year-old to 94; and people who reach 100 are expected to live to 103. Soon, half of all deaths in the U.S. will occur after age 80. These life expectancies are a big part of why we need to plan.

How Old Will You Be in 2100?

The ridiculous part of all those life expectancy tables is that they all assume that life expectancies will remain at current levels. But that is not likely to be the case. Indeed, research suggests that people will continue to live longer and longer. In fact, even those as old as 45 today might be alive in the 22nd Century.

Why are these figures important? Well, to determine how much money you’ll need in retirement, you need to project how long that retirement might be. Based on the actuarial data provided by various government agencies, most financial planners assume their clients will live to age 90, and conservative planners (my firm included) use age 95 (because the longer you live, the more money you’ll need).

YOUR LIFE EXPECTANCY

People who are this age today: 0 Are expected to live to this age: 77

People who are this age today: 15 Are expected to live to this age: 78

People who are this age today: 25 Are expected to live to this age: 79

People who are this age today: 35 Are expected to live to this age: 80

People who are this age today: 45 Are expected to live to this age: 81

People who are this age today: 55 Are expected to live to this age: 82

People who are this age today: 65 Are expected to live to this age: 83

People who are this age today: 75 Are expected to live to this age: 87

People who are this age today: 85 Are expected to live to this age: 91

FIGURE 1-2

However, even “conservative” figures like age 95 could be too low. Based on the relatively new fields of gerontology, microbiology, and biotechnology, some believe that in the year 2050, people could be expected to live to age 140. No typo there: That’s one hundred forty years of age.

This is not science-fiction. In 2050, your kids could still be having kids. For example, in 2050, I’ll be 92. Will I make it? Well, that’s still nine years younger than the age my Grandmom Fannie reached— and she was born in 1899. Let’s face it: For many of us, 2050 is a done deal.

If that’s not startling enough, try this: It’s now being suggested that lots of us who are here today could see the year 2100. The implications for society boggle the mind. Let’s look closer at what such long life spans could mean.

You’ll Have Multiple Marriages

First, you would be likely to have four or five spouses during your lifetime. Like all the other futurisms to follow, this one is not as far-fetched as it may first appear. After all, 75% of all married Americans eventually find themselves single again— either through divorce or death of their spouse— and most people who were married once eventually remarry. Thus, we’re already a multiple-marriage society. It’ll just become more so: More people will do it and more people will do it more often. (After all, can you imagine marrying someone at age 20 and living with that same person for the next 120 years!? Honey, I love you, but…)

You’ll Have Multiple Careers

Second, you will have five or six careers. You’ll go to school, get a degree, develop expertise in a given field, devote yourself to it for 20 or 30 years, then quit and start again, doing something entirely different. Think that’s crazy? Millions of military retirees, police officers, firefighters, and schoolteachers already do this. They “retire” at 40 or 50 with 20 or 30 years of service and, with their monthly pension checks in the mail, they head off to new challenges. This strategy will become more common in the new millennium and the phrase “double-dipper” will give way to “quintupledipper” as people have five or six 20-year careers in their lifetime. The notion of “retirement” as we know it today will fade away. For more on this, read Rule 88 of The New Rules of Money.

You’ll Extend Your Rites of Passage

As our lifetimes become extended, so too will our rites of passage. As recently as 1960, marrying in your late teens was common; the phrase “old maid” applied to women who failed to marry by age 20. You were expected to have children (plural) before you were 25, Jerry Rubin ...

Table of contents

- Cover Page

- Title Page

- Dedication

- Table of Contents

- Foreword

- The Rules of Money Have Changed. Again.

- Part I Introduction to Financial Planning

- Part II Understanding the Capital Markets

- Part III Fixed Income Investments

- Part IV Equities

- Part V Packaged Products

- Part VI The Best Investment Strategies

- Part VII The Best Financial Strategies

- Part VII The Best Strategies for Buying, Selling and Owning Homes

- Part IX Taxes, Taxes, Taxes

- Part X Retirement Planning

- Part XI Insurance

- Part XII Estate Planning

- Part XIII How to Choose a Financial Advisor

- Sources

- Index

- Acknowledgments

- About the Author

- Copyright

- About The Publisher

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access The Truth About Money 3rd Edition by Ric Edelman in PDF and/or ePUB format, as well as other popular books in Business & Business Development. We have over one million books available in our catalogue for you to explore.