This is a test

- 136 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The European Capital Markets Union

Book details

Book preview

Table of contents

Citations

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access The European Capital Markets Union by Andreas Dombret, Patrick S. Kenadjian in PDF and/or ePUB format, as well as other popular books in Law & Financial Law. We have over one million books available in our catalogue for you to explore.

Information

Capital Markets Union: Process and Priorities – A financial industry perspective

Key messages

– The new European flagship project found in the Capital Markets Union (CMU) is a highly welcome and overdue initiative. Strengthening capital markets as a source of economic financing to complement bank lending, may promote jobs and foster economic growth throughout Europe.

– In its Green Paper, the European Commission has proposed a broad array of possible reform areas that target issuers, investors and intermediaries. As an important first step, this array must be narrowed down to a specific list of attainable priorities while appropriately sequencing short- and long-term measures

– Visible welcome momentum for CMU as a high level priority for Europe has been created. In order to sustain and augment this momentum, the Commission should focus on a number of low hanging fruits that may be easily addressed. The following reform areas have attractive potential for short-term gains:

– Greater standardisation to promote a stable, deeper and less fragmented European corporate bond market. This will provide issuers with better funding options, while giving investors a broader range of more liquid investment opportunities

– Development of a European private placements market to channel funding directly from issuers to medium sized firms

– As financing patterns are not only shaped by borrowers but also by savers: Strengthening minimum and consistent standards for investment advice and comparability between investment products is necessary to channel household savings into capital markets more effectively

– Realising the full benefits of rebalancing financial intermediation in capital markets will involve profound structural change. This requires time. The following reform areas offer great potential but their success requires steadfast perseverance:

– Improving the availability of capital market funding for small and medium-sized enterprises (SMEs)

– Developing a European risk capital market for high growth companies, when bank funding is often inaccessible

– Implementing proposals to rebuild securitisation markets and help free- up banks’ balance sheets for new lending

– Implementing existing proposals to remove impediments to long-term private infrastructure investments

– Many of the measures proposed in the context of the CMU both deepen and integrate financial markets with each process reinforcing one another. Removing obstacles to a single financial market unlocks scale effects and increases competition and risk diversification. For issuers, this means improved access to lower cost funding and expanded options for households to save and invest

– CMU is also concerned with the issue of attracting more international investment into the EU. The alignment of its standards with relevant global standards will thus be crucial to its success

Acknowledgements and disclaimer

The author would like to thank the colleagues from the IIF, Hung Tran and Jessica Stallings, for their input and useful discussions, and Khadija Mahmood for excellent research assistance. The views expressed herein should be attributed to the author and not to the IIF. This Note represents the view of the author and does not necessarily represent IIF views or IIF policy recommendations.

1. Overview: Financial intermediation and CMU

The February 2015 release of the Green Paper on Building a Capital Markets Union (CMU) marked the launch of a new flagship project of the European Commission. The principal objectives of the Commission’s initiative are (i) to strengthen capital markets as a source of financing for the economy in order to (ii) promote jobs and growth in Europe and (iii) to remove barriers towards a true single capital market for all 28 Member States.

Banks dominate financial intermediation in Europe

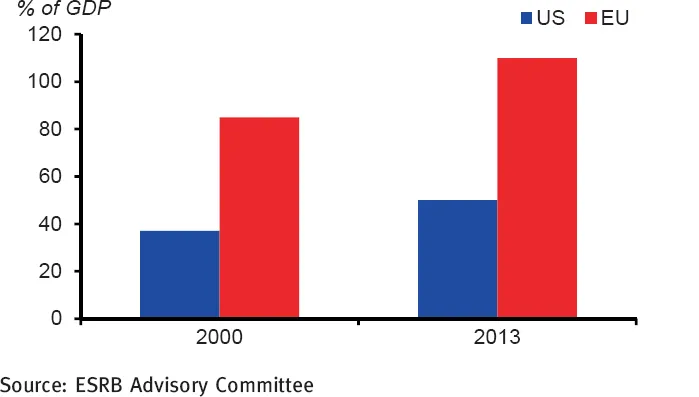

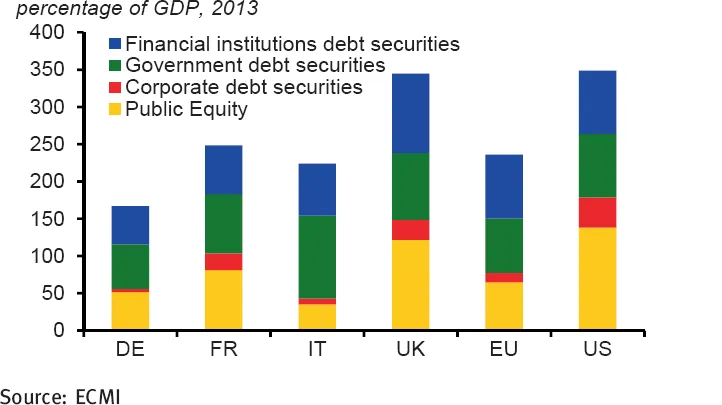

In contrast to the US, banks are the principal mechanism for financial intermediation in the EU (Chart 1). Relative to GDP, bank loans to non-financial corporations in the EU are twice as high as in the United States, and this gap has widened since the on-set of the financial crisis. In contrast, financial intermediation through capital markets in Europe remains underdeveloped; while the amount of debt securities issued by government and financial institutions are comparable to the US, the share of public equity markets in the US is twice as high and the share of corporate bonds is three times as high as in the EU (Chart 2). Access to capital markets differs greatly among EU member states. In terms of bond and equity issuance, the UK capital market structure is roughly comparable to the US, while in Italy and Germany equity and bonds play a much smaller role.

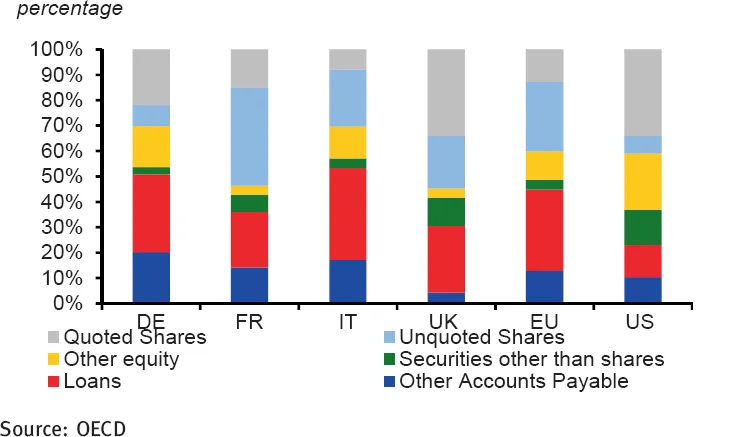

It does not come as a surprise that the financing pattern of non-financial corporations in the EU reflects the dominance of bank loans in Europe, rather than the issuance of securities (Chart 3). This greater dependence on bank lending makes the aggregate European economy more vulnerable when bank lending decreases, as it did throughout the financial crisis.2

Chart 1: Bank lending to non-financial corporations

Chart 2: Capital market structure

Chart 3: Composition of non-financial corporations’ liabilities

Structuring the approach towards building CMU

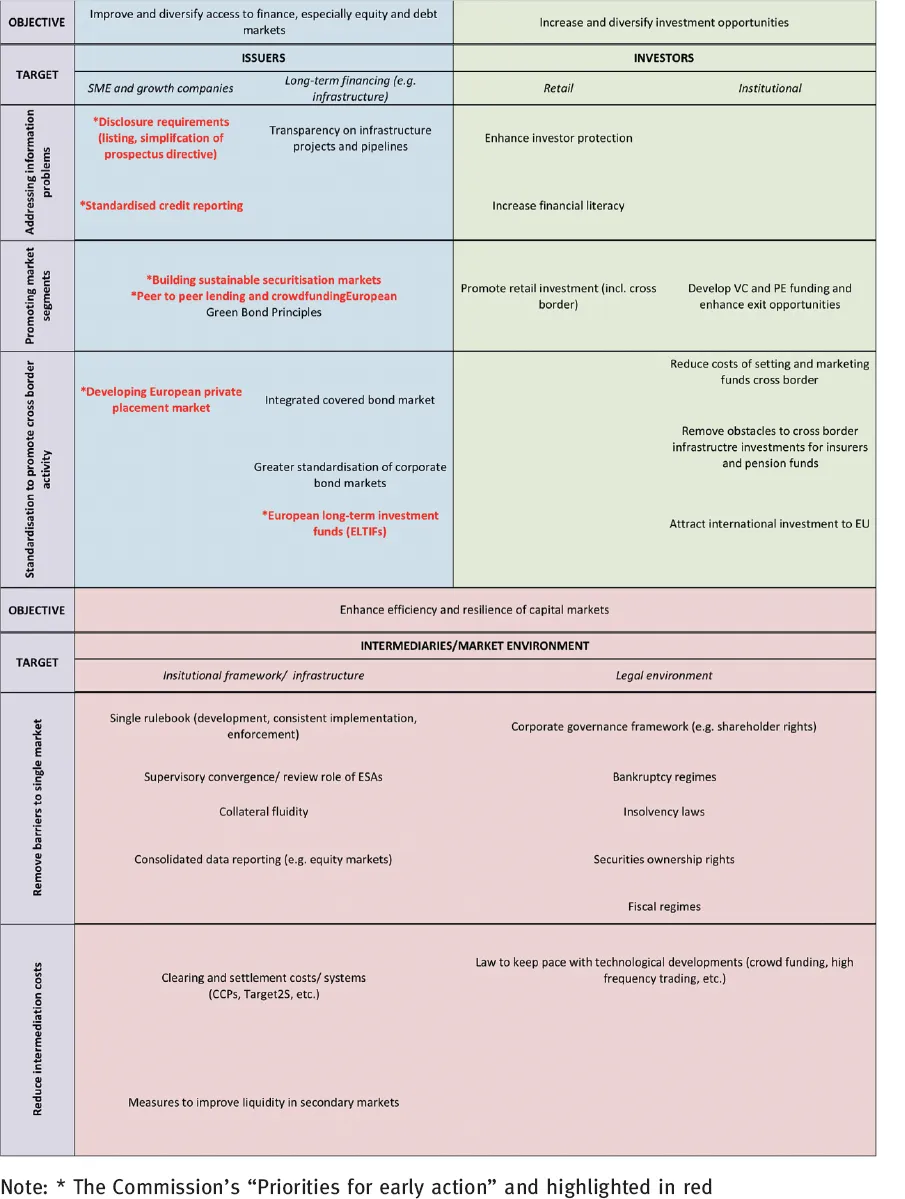

CMU does not seek to replace banking as the principal source of financing. Its objective is to complement bank based financing with stronger, market based intermediation. To achieve this, the European Commission has proposed a broad range of possible reform areas in its Green Paper (Figure 1). The Green Paper can therefore be viewed as a map of possible policy areas to address in the concept’s construction rather than as a strict blueprint for establishing a European CMU.

The policy initiatives proposed by the Commission in the Green Paper can be grouped into three main areas: (i) improving access to capital markets, particularly equity and bond funding for SMEs, growth companies and long-term financing needs (e. g. infrastructure), (ii) increasing and diversifying investment opportunities for both retail and institutional investors, and (iii) enhancing the link between investors and investment opportunities through improved financial intermediation processes. The third area includes both improvements to financial market infrastructure and the institutional framework, as well as changes to the broader market and legal environment. An important first step will be to reduce this broad scope to a focused list of attainable priorities, and appropriately sequence short- and longer-term measures.

Figure 1: Green Paper – Schematic overview of proposed reform areas

It should be noted that the manners by which corporates fund themselves and households save change slowly over time. Financial intermediation patterns are part of a complex ecosystem driven by underlying forces that go far beyond the scope of CMU. These include the extent of home ownership, national pension systems or even legal traditions and regimes. This means that long-term structural change will be necessary in many areas to realise the full potential benefits of CMU. CMU also provides, however, an opportunity to pluck some low-hanging fruits and thereby cause a short-term impact. This paper suggests and focuses on three short-term priorities for early action.

The publication of the Green Paper marked the beginning of a consultation period and an invitation to stakeholders to participate in the debate. The feedback should help in developing an action plan to be finalised and released during the second half of 2015. The building blocks for a fully functioning CMU are expected to be in place by 2019.

CMU and Banking Union – conceptually different but working in complement with one another

CMU differs in several aspects from the other EU flagship project, Banking Union, whose two main initiatives, the Single Supervisory Mechanism (SSM) and the Single Resolution Mechanism (SRM) are currently being implemented. Indeed, the similarity of the two terms (along with the term Monetary Union) suggests a potentially misleading analogy. The primary objective of Banking Union is to centralise a banking policy framework while providing supervision and resolution on a European level. Banking Union is thus focused on creating a new institutional framework and not on developing banking in the EU. The primary objective of CMU is to strengthen capital markets as a source of financing; the creation of new institutions is thus not at the project’s core.3 However, as CMU progresses, the process might reveal that institutional changes, e.g. revised and expanded authorities of the European Securities and Markets Authority (ESMA), might be necessary to achieve these objectives. Furthermore, unlike Banking Union, CMU is not subject to crisis management considerations or limited to financial markets but rather part of the broader long-term EU agenda of structural reform designed to promote jobs and foster economic growth. Finally, while Banking Union centres on the Eurozone (although non Eurozone members have the option to join), CMU extends to the entire EU. Thus, CMU continues a long history of promoting the...

Table of contents

- Cover

- Title

- Copyright Page

- Table of Contents

- About the Contributors

- Andreas Dombret and Patrick Kenadjian Introduction

- Benoît Cœuré Capital Markets Union in Europe: an ambitious but essential objective

- Christian Ossig Capital Markets Union: Process and Priorities – A financial industry perspective

- Dirk Schoenmaker From Banking Union to Capital Markets Union

- Dr Andreas Dombret What can capital markets deliver? – A central banker’s view

- Anshu Jain What can the capital markets deliver? A market participant’s view

- Andrew Bosomworth From Capital Markets Confederation to Capital Markets Union

- Philipp Hildebrand Capital Markets Union – Who Will Invest?

- Alexandra Hachmeister European Capital Markets Union: Strengthening Capital Markets to foster growth

- Wim Mijs Banks set for pivotal role in new growth ecosystem

- Cyrus Ardalan A Vision for Capital Markets Union

- Sir Jon Cunliffe What has to change?

- Patrick Kenadjian The European Capital Markets Union: how viable a goal?

- Fußnoten