eBook - ePub

Central Banking Systems Compared

The ECB, The Pre-Euro Bundesbank and the Federal Reserve System

- 240 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Central Banking Systems Compared

The ECB, The Pre-Euro Bundesbank and the Federal Reserve System

About this book

This new study provides a comprehensive survey of the recently established European financial system in comparison to previous European systems and the US Federal Reserve. This well-written contribution to financial economics should be of interest to academics as well as professionals concerned with financial systems around the world.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1 Historical background and basic institutional features

This chapter presents a short historical background of each central bank, starting with the European Central Bank (ECB), followed by the pre-euro Bundesbank and the Federal Reserve System. The basic institutional structure of each central bank is presented as a prerequisite to an understanding of the issues of independence, transparency and accountability, which are discussed in Chapter 2.

THE EUROPEAN CENTRAL BANK

Historical background

The idea of creating a single European currency with a single European central bank pre-dates the Maastricht Treaty (1992), which outlined the organisation, powers and functions of the European Central Bank. In the post-war period, at The Hague Summit of December 1969, the Heads of State or Government of the six original Member States of the Community (France, Germany, Italy and the Benelux countries – Belgium, the Netherlands and Luxembourg), declared in a communiqué that the Community should work, in stages, towards the goal of achieving an Economic and Monetary Union:

They have reaffirmed their wish to carry on more rapidly with the further development necessary to reinforce the Community and its development into an economic union. They are of the opinion that the process of integration should end in a Community of stability and growth. With this object [sic] in view they have agreed that on the basis of the memorandum presented by the Commission on 12 February 1969 and in close collaboration with the Commission a plan by stages should be drawn up by the Council during 1970 with a view to the creation of an economic and monetary union . . . They have agreed that the possibility should be examined of setting up a European reserve fund, to which a common economic and monetary policy would lead.(Point no. 8 of the final Communiqué of the Conference of the Heads of State or Government on 1 and 2 December 1969 at The Hague,

Appendix 1 of the Werner Report 1970)

The Werner Committee, established in 1970 with a view to proposing a road map to achieve such a goal, recommended that the Treaty of Rome establishing the European Economic Community (1957) be amended to set fixed and irreversible exchange rates between the currencies of the Member States, followed by the creation of a European System of Central Banks, which would be responsible for setting a single monetary policy for the Community:

The constitution of the Community system for the central banks could be based on organisms of the type of the Federal Reserve System operating in the United States. This Community institution will be empowered to take decisions, according to the requirements of the economic situation, in the matter of internal monetary policy as regards liquidity, rates of interest, and the granting of loans to public and private sectors.

(Werner Committee 1970: 7)

Although the Community adopted various resolutions in the early 1970s to implement gradually the recommendations of the Werner Report (e.g. 22 March 1971, 19–21 October 1972),1 and in fact had launched the first stage of the step-by-step process, the demise of the Bretton Woods international monetary system, coupled with the German view that European economic and political union was a prerequisite to the formation of a monetary union, forced the Community Council of Finance Ministers (Ecofin Council) to postpone sine die the creation of a legal framework to launch a single currency with the establishment of a European central bank. It was not until the late 1980s, after measures to create a single market were adopted in line with the provisions of the Single European Act (1986) and after it was agreed, in the wake of German reunification, to introduce a ‘political union’ pillar in the Common Foreign and Security Policy in the Maastricht Treaty, that the general outline of the Delors Report on Economic and Monetary Union (Delors Committee 1989) was adopted as the basis for the negotiations that eventually led to the provisions of the Maastricht Treaty to establish a European Central Bank with a single currency.

The text of the Treaty and its Protocols dealing with ‘Economic and Monetary Policy’ was the result of negotiations undertaken at the Intergovernmental Conference on Economic and Monetary Union (EMU). This conference, composed of representatives of the then 12 Member States of the Community, opened in Rome on 15 December 1990 and closed with an agreement one year later in Maastricht. The speedy outcome of these negotiations, held in parallel with the Intergovernmental Conference dealing with Political Union, was the direct result of the impetus provided by the French President, François Mitterrand, and the German Chancellor, Helmut Kohl, to deepen European integration in view of the fall of the Berlin Wall in November 1989, leading to the eco- nomic and political reunification of Germany in 1990. The major draft treaties on EMU – including draft statutes on the European Central Bank – were submitted by the Commission (European Commission 1991), by the governments of France (France 1991) and Germany (Deutschland 1991), by the Committee of Governors of the Central Banks of the European Communities (1990), and by the Monetary Committee of the European Communities (1990). The Deutsche Bundesbank (1990) also submitted a position paper on EMU. At the very start of the negotiations, the British Conservative government, under John Major, who could not accept the idea of creating a single European currency that would replace, inter alia, the British pound, submitted a proposal for the creation of a ‘hard ECU’, which would become the common currency of Europe, managed by a new institution, the European Monetary Fund (HM Treasury 1991). The ‘hard ECU’ would coexist with the other national currencies and was not intended to replace them. Since the British proposal was never seriously considered by the other Member States, the UK government had to request an ‘opt-out’ clause from the final stage of EMU so as to be able to sign the Maastricht Treaty.

The Delors Committee which, in the late 1980s, had the mandate to study and propose concrete recommendations on how an economic and monetary union should be established, recommended the adoption of a single currency with a European System of Central Banks responsible for formulating and implementing monetary policy in the single currency area (Delors Committee 1989). This new central bank was to be organised with a federalist structure, ‘in what might be called the European System of Central Banks (ESCB)’ (Delors Committee 1989: 25). Although the proposed central bank appeared to be based on the model of the US Federal Reserve System (Delors, the President of the European Commission from 198594, often used the term ‘EuroFed’ to refer to the ESCB), the structural organisation, the assigned functions, the monetary policy instruments and the primary objective of the ECB/ESCB – as laid out in the Maastricht Treaty, in its Protocol dealing with the central bank, and in secondary legislation – are rooted in the model of the pre-euro Deutsche Bundesbank. However, the ECB modus operandi dealing with monetary policy strategy and communication policy is a combination taken from the Bundesbank and Federal Reserve models.

The organisation, powers and functions of the European Central Bank are outlined in Articles 105 to 115 of the Treaty on European Union (1992, also known as the ‘Maastricht Treaty’ and hereafter referred to as the ‘Treaty’) and in Protocol number 18 on the ‘Statute of the European System of Central Banks and of the European Central Bank’, hereafter referred to as the ‘Statute’.2 This Protocol, which contains 53 articles, in combination with the ‘Treaty’ articles, defines the role of the European Central Bank in formulating and executing monetary policy for the single currency area, a power that this supranational body does not share with any Community or national institution. The Council of Ministers of Economics and Finance of the European Union (composed of the Finance Ministers from each of the 15 EU Member States and hereafter indicated as the ‘Ecofin Council’) retains its powers in formulating broad guidelines on macroeconomic policies for EU Member States (Article 99), in conducting multilateral surveillance in policy areas such as the ceilings on public deficit and debt ratios (Article 104 and European Commission 1999b: Part F), in harmonising the tax laws of the 15 Member States of the European Union, and in formulating the euro exchange rate policy, which is a shared responsibility with the European Central Bank.

Basic institutional features: ECB, Eurosystem and ESCB

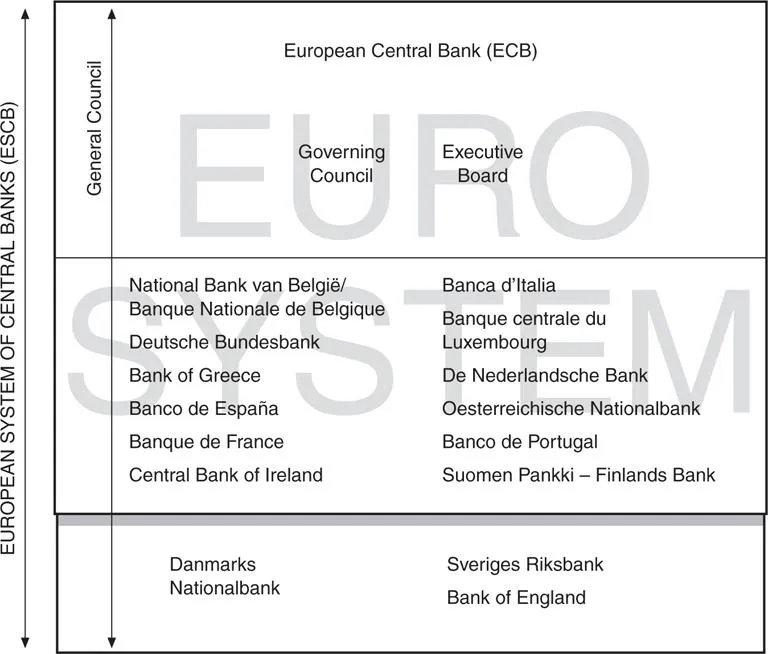

The European Central Bank (ECB) with the 15 national central banks of the EU Member States is known, according to the ‘Treaty’, as the European System of Central Banks (ESCB). The ECB, with the national central banks of the EU Member States that have introduced the single currency (originally 11, now 12, Member States), is known as the Eurosystem. The Governing Council of the ECB, analogous to the pre-euro Bundesbank’s Central Bank Council or to the Federal Open Market Committee of the Federal Reserve System (see below), is the highest decision-making body of the Eurosystem and is responsible for monetary policy decisions in the eurozone (see Figure 1.1 and Box 1.1). The ECB Governing Council is composed of a six-member Executive Board, which is analogous to the pre-euro Bundesbank’s Directorate or to the Board of Governors of the Federal Reserve System (see below), and the current 12 Governors of the National Central Banks of the Member States participating in the eurozone,which is analogous to the Presidents of the pre-euro Land Central Banks in Germany or to the Presidents of the district Federal Reserve Banks in the US (see below). The members of the Executive Board are appointed for a non-renewable term of eight years by a common accord of the Heads of State or Government of the Member States constituting the eurozone, on a recommendation from the Eurogroup Finance Ministers after consulting the European Parliament and the ECB Governing Council.3 One member of the Executive Board is designated President of the ECB and another is designated Vice-President of the ECB. The members of the Executive Board must have professional qualifications. The Governors of the National Central Banks of the 12 Member States participating in the eurozone, are appointed for a minimum term of five years by their respective national governments or parliaments.

Monetary policy decisions are taken by a simple majority of the members of the Governing Council, with the President having a casting vote in case of a tie.4 This rule reinforces the view that each member has an equal weight, independent of national origin. The vote of a member of the Governing Council from Luxembourg has the same weight as the voteof a member from Germany, meaning that the Governing Council does not practice ‘qualified majority’ voting on monetary policy decisions, in contrast to the rules used by the Council of Ministers of the European Union.

Figure 1.1 The eurosystem and the European System of Central Banks.

Source: European Central Bank, Annual Report 2001.

Note: As of 1 January 2001, Bank of Greece is part of the Eurosystem. Hence, with a sixmember Executive Board and 12 Governors of the eurozone National Central Banks, the Governing Council of the ECB, the monetary policy decision-making body, is composed of 18 members. The Eurosystem is composed of the ECB and the 12 National Central Banks of the Member States composing the eurozone. The European System of Central Banks (ESCB) is composed of the ECB and all 15 EU National Central Banks, with a General Council composed of two Executive Board members (President and Vice-President of the ECB) and the Governors of all 15 EU National Central Banks.

The Governing Council of the ECB is responsible for the eurozone’s monetary policy and the Executive Board of the ECB is responsible for implementing monetary policy in accordance with decisions taken by the Governing Council. The Eurosystem adheres to the principle of decentralisation. This principle stipulates that, to the extent deemed possible and appropriate, the ECB shall have recourse to the eurozone National Central Banks (NCBs) to carry out operations that form part of the tasks of the Eurosystem. Whereas the principle of decentralisation applies to operations only (e.g. the basic open-market operations, called the ‘main refinancing operations’, are executed by each euro NCB with the credit institutions located on its national territory), the monetary policy decisions remain centralised (e.g. the interest rate of the main refinancing operations is decided by the ECB Governing Council and the overall amount of short-term liquidity provided each week to the credit institutions in the Eurosystem is decided by the ECB Executive Board). This principle is very similar to the one that was applied to the allocation of responsibilities and functions between the Central Bank Council/Directorate of the pre-euroBundesbank and the Land Central Banks (see below).

Box 1. 1 Composition of the 18-member ECB Governing Council

The European Central Bank was established on 1 June 1998, therefore allowing some seven months during which the operational decisions and the testing of the communication and payment systems could be undertaken before the launching of the single currencya and the single monetary policy on 1 January 1999. The Governing Council holds a monetary policy meeting once a monthb, with all but two of the meetings per year held at its headquarters in Frankfurt am Main, Germany. Since 2000, the eurozone National Central Banks (with the exception of the Bundesbank) host each year, on a rotating basis, the two meetings held outside Germany.

The members of the Executive Board appointed in June 1998 and their respective responsibilities are as follows:

W. Duisenberg (The Netherlands), President, who was pressured by France to promise to resign before his eight-year term expires so as to make room for a French candidate. He is responsible for External Relations, Secretariat, Protocol and Conferences, and Internal Audit. In early 2002, he announced his resignation effective July 2003.

C. Noyer (France), Vice-President with a four-year term. He is responsible for Administration and Personnel, Legal Services and is one of the ECB’s two members who sit on the Economic and Financial Committee, a consultative Community body; L. D. Papademos (Greece) was appointed Vice-President for a regular eight-year term to replace Noyer whose term expired on 31 May 2002.

E. Domingo-Solans (Spain), with a six-year term. He is responsible for Information Systems, Statistics and Banknotes.

S. Hämäläinen (Finland), with a five-year term. She is responsible for Operations and Controlling.

O. Issing (Germany), with an eight-year term. He is responsible for Economics and Research, a very important position since he presents the economic analysis to argue the case for or against any change in monetary policy at the monthly monetary policy meetings of the Governing Council. He is also one of the ECB’s two members who sit on the Economic and Financial Com...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Illustrations

- Abbreviations and Acronyms

- Preface

- 1 Historical background and basic institutional features

- 2 Objectives, independence, transparency and accountability

- 3 Monetary policy: strategy, instruments and actions

- 4 Economic policy coordination in the eurozone

- Appendix

- Notes

- References

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Central Banking Systems Compared by Emmanuel Apel in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.