1 Price dynamics and the macroeconomy

1.1 Introduction

This book stresses the inclusion of the “nancial market into a macroeconomic framework. We mainly focus on the AD side of the AD…ASframework to macromodeling and leave out a more elaborate treatment of the Phillips curve. The price and wage dynamics are generally kept simple, yet a brief outline of how price dynamics can be treated in the context of the different variants of macromodels we are presenting will be provided.

New Keynesian macroeconomics is usually based on forward-looking rational expectations behavior, at least in its baseline version. It has a new type of IS curve, a new type of Phillips curve, and it uses Taylor-type interest rate rules in place of LM curves. In its baseline deterministic core with only forward-looking behavior the economy is considered in equilibrium, see Gali (2008). The dynamics are only of interest when stochastic terms are added to the model. Some of the authors of this book have investigated the merits and pitfalls of this approach elsewhere.1

In this book we go signi“cantly beyond the standard structure of New Keynesian macromodels, regarding not only “nancial assets but also stock-”ow dynamics which is rarely discussed in the New Keynesian literature. In this “rst chapter of the book we want to give a simple introduction to the nominal…realinteraction as we see it.

1.2 Keynesian AD-AS analysis>

A Keynesian model of aggregate demand ”uctuations should allow for under-(or over-) utilization of labor as well as of capital in order to be general enough from the descriptive point of view. As Barro (1994), for example, observes, IS…LMis (or should be) based on imperfectly ”exible wages and prices and thus on the consideration of wage as well as price Phillips curves. This is precisely what we will do, in an introductory manner, in the following analysis. We use the observation that medium-run aspects count in both wage and price adjustment as well as in investment behavior, here still expressed in simple terms using the concept of an in”ation as well as an investment climate. These climate terms are based on past observation, whereas we have model-consistent expectations with respect to short-run wage and price ination. Thus the modi“cation of the traditional AS…AEmodel that we shall introduce treats expectations in a hybrid way. There is myopic perfect foresight on the current rates of wage and price in”ation on the one hand and, on the other hand, an adaptive updating of economic climate expressions with an exponential weighting scheme.

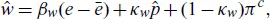

In light of the foregoing discussion, we therefore assume here two Phillips curves (PCs) in the place of only one. In this way we provide wage and price dynamics separately, both based on measures of demand pressure e — ē, u — ū, in the market for labor and for goods, respectively. We denote by e the rate of employment on the labor market and by ē the NAIRU level of this rate, and similarly by u the rate of capacity utilization of the capital stock and by ū the normal rate of capacity utilization of “rms. Demand pressure in”uences wage and price dynamics, that is, the formation of wage and price in”ation, ŵp̂. They are both augmented by a weighted average of cost-pressure terms based on forward-looking, perfectly foreseen price and wage in”ation rates, respectively, and a backward-looking measure of the prevailing in”ationary climate, symbolized by πc. Cost pressure perceived by workers is thus a weighted average of the currently evolving price in”ation rate p̂ and some longer-run concept of price in”ation, πc, based on past observations. Similarly, cost pressure perceived by ”rms is given by a weighted average of the currently evolving (perfectly foreseen) wage in”ation rate ŵ and again the measure of the in”ationary climate in which the economy is operating. We thus arrive at the following two Phillips curves for wage and price in”ation, here formulated in a fairly symmetric way.

Structural form of the wage-price dynamics:

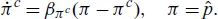

In”ationary expectations over the medium run, πc, i.e., the inflationary climate in which current wage and price in”ation is operating, may be adaptively following the actual rate of in”ation (by use of some exponential weighting scheme), may be based on a rolling sample (with hump-shaped weighting schemes), or on other possibilities for updating expectations. For simplicity of exposition we shall here make use of the conventional adaptive expectations mechanism. Besides demand pressure we thus use (as cost pressure expressions) in the two PCs weighted averages of this economic climate and the (foreseen) relevant cost pressure term for wage setting and price setting. In this way we get two PCs with very analogous building blocks, which despite their traditional outlook turn out to have interesting and novel implications.2

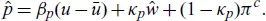

As for the real side, note that for our current version, the in”ationary climate variable does not matter for the evolution of the real wage ω = w/p, the law of motion of which is given by:

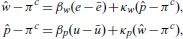

This follows easily from the obviously equivalent representation of the above two PCs:

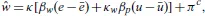

by solving for the variables ŵ – πc and p̂ – πc. It also implies that the two cross-markets or reduced form PCs are given by:

which represent a considerable generalization of the conventional view of a single-market price PC with only one measure of demand pressure, the one in the labor market. This traditional expectations-augmented PC formally resembles the above reduced-form p-equation if Okun•s law holds in the sense of a strict positive correlation between u – ū, u = Y/Yp and e – ē, e = Ld/L, our measures of demand pressures on the market for goods and for labor. Yet the coef“cient in front of the traditional PC would even in this situation be a mixture of all of the βs and κs of our PCs and thus represents a synthesis of goods and labor market characteristics.

With respect to the investment climate, we proceed similarly and assume that this climate is adaptively following the current risk premium ∊(= r –(i – p̂)), the excess of the actual pro“t rate over the actual real rate of interest (which is perfectly foreseen). This gives3

which is directly comparable to

We believe that it is very natural to assume that economic climate expressions evolve sluggishly towards their observed short-run counterparts. It is, however, easily possible to introduce also forward-looking components into the updating of the climate expressions, for example based on the p* concept of central banks and related potential output calculations. The investment function of the model of this section is given simply by i1(∊m) in place of i1(∊).

Our model so far incorporates sluggish price adjustment as well as sluggish wage a...