![]()

CHAPTER 1

What Is a World Price?

THE PROSTHETIC AND ACTUAL WORTH OF COTTON

PRICE SHAPES OUR ECONOMIC life in late capitalist modernity. On opening the economics section of any major newspaper, one will encounter columns of commodity prices. Taken-for-granted facts of modern life, prices are accepted as signals of the world economy. It is with reference to prices that economic processes are made visible, discussed, and intercepted, and that markets are made and understood. However, strikingly enough, world market prices do not correspond to the actual worth of commodities. One cannot buy a single bale of cotton by paying the world price of the commodity. To what, then, do these prices refer? What effect do these prices have on the setting of the actual monetary worth of commodities traded on the ground? How are prices made in world markets?

The relevant literature answers these questions in three ways, but it does not convincingly address the mystery of the price. Microeconomists describe markets as price-making contexts and explain prices as things that are made in the market. Although this approach accepts the sociological determinants of changing supply and demand, it limits itself to describing the change itself, by shifting the curves representing supply and demand without describing how various market price forms are made on the ground, even in the small universe of a single market.

This circularity has in many ways been corrected by institutionalist researchers who underline the social and cultural nature of markets and prices (North 1977; Zelizer 1981; Robinson 1980; Alexander and Alexander 1991; Zafirovski 2000; Geismar 2001; Zajac and Westphal 2004; Velthuis 2005). Inspired by Polanyi’s work and frequently drawing on his central concept of “embeddedness,” researchers have argued that prices are culturally constructed within relations of power in socially and politically embedded markets (White 1981; Granovetter 1985; Fligstein 1996; DiMaggio and Louch 1998; Dobbin 2004; Duina 2004; Lapavitsas 2004; Uzzi and Lancaster 2004). It is hard to disagree with this argument; however, a more challenging task awaits us: to better understand the processes through which prices, as well as the types of prices and their forms of realization in the market place, are made. A convincing theory that explains how prices are made on the ground can further reinforce the institutionalist paradigm’s strength in explaining what allows markets to function.

Recently, exciting new research in the social studies of the price has focused on markets as sociotechnical universes. Several researchers have even gone further and applied the insights of the social studies of science and technology to the agenda of economic sociology. They have approached processes of economization also from the vantage point of price-making (Callon 1998; Muniesa 2000; Maurer 2002; Çalişkan 2003; Chiffoleau and Laporte 2004; Cochoy 2004; Grandclément 2004; Levin 2004; MacKenzie 2006). Incorporating the insights of institutionalism and drawing on new research in the social studies of the price, this chapter presents an alternative way of understanding price-making, based on the empirical universe of the global cotton market.

I argue that, instead of focusing narrowly on price-setting, policymakers and researchers should attend to the conditions of price realization. In world and regional markets, prices are realized in multiple forms, each form having gone through a complex, yet identifiable process. Price realization is not price-setting. In cotton markets, complex trading tools help to realize many categorically diverse market prices.

Realization is the most accurate concept to make sense of prices in global trade. The term has multiple meanings, all of which convey the formative processes of price-making in world commodity markets. It means (1) “to bring something into concrete existence.” For the prices to be realized in this sense of the concept, they have (2) “to be made to appear real,” so that the price can be (3) “conceived vividly as real.” This is the way in which parties of exchange relations become (4) “fully aware of” the price and relate to the worth of cotton bales to (5) “convert [them] into actual money” (Merriam-Webster 1998).

Prices are realized in multiple forms and appearances in cotton markets; yet the price for a bale is uniform for the parties of trade in a single exchange. What I call the “actual price of cotton” refers to the amount of money that a seller accepts from the buyer in exchange for the right of ownership over the commodity. The actual price of cotton is the end result of the process of price realization. Price realization does not occur as a natural process, but depends on a set of technical devices and artificial equipment, which is almost never described in economic theory. Following Callon (2002), I call these artificial devices “prostheses.” Correspondingly, I will call the price forms that result from the deployment of such equipment “prosthetic prices.”

In the price realization process, a rich universe of collective human and nonhuman agents produce prosthetic prices, which inform the making of an actual price of cotton. I define the prosthetic price as a price form produced in the market, but not directly deployed by either buyer or seller in the actual exchange of commodities. Everyday trade in the world cotton market draws on the realization and deployment of a number of key prosthetic prices, such as the World Price of Cotton, the Adjusted World Price, and the A Index. Without understanding how these different prosthetic prices are made, it is impossible to grasp either prices or markets themselves. Without taking into account the specific processes of price realization in world markets, academic accounts of exchange relations and professional reports on market reform remain incomplete at best, wrong-headed at worst.

Without these prostheses, buyers and sellers cannot navigate world markets. The market price as we know it is a product of price realization, and not the end result of unmediated dyadic encounters of exchange. Prices are represented and realized in various frameworks of economization that mediate trading activities and the making of actual prices. These frameworks—such as supply and demand graphs, market reports, futures, and options price tables—are the interfaces of market activity in global trade. Through these frameworks, we can perceive the market, and they contribute to the ways in which market actors carry out calculations and plan their trading practices.

This chapter will show that market prices in their multiple forms are made possible and visible through the tools of price realization and frameworks of economization, and not in the coming together of the two lines of supply and demand as in supply and demand graphs. In the traders’ everyday world, the market price as a prosthetic device precedes the making of the actual price accepted for transactions. This is why Making a Market begins with a detailed analysis of price realization, for one cannot understand the market without addressing the price.

HOW MUCH DOES AN ACTUAL BALE OF COTTON REALLY COST?

In order to give an understanding of the making of the world cotton market and its prosthetic prices, this section will begin with a simple question posed daily by cotton traders: “How is the market doing?” When traders ask this question, they want to learn the price of a commodity. The price and the market are synonymous for many cotton traders.

This parallel between the price and the market is also a central tenet of contemporary microeconomics. The introduction of any economics textbook discusses how the market can be represented as price movements, determined by two “universal laws” of human encounter: those of supply and demand.1 These introductions focus on a hypothetical actor’s intentions regarding the supply of or demand for a certain quantity of a commodity, for a particular period of time, for a specific price. The construction of a linear relation of causality between quantity and price serves as entry point to a discussion of the market, at least in neoclassical economic logic. Having framed the market in the context of these two forces, textbooks go on to explain how to map the market. They do so by first elaborating on the concept of demand.

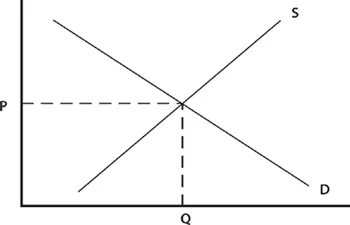

Figure 1 Supply and demand graph

According to the universal law of demand, originally conceived by Antoine Augustine Cournot in 1838, when the price of a certain commodity increases, the demand for this same commodity decreases (Cournot 1897). In contrast, the universal law of supply posits that when the price of a certain commodity increases, the quantity supplied of this same commodity increases. It took scholars several decades to bring together these two laws in one visual framework.

Cournout’s elaboration has been almost entirely forgotten, and in the late nineteenth and early twentieth centuries Alfred Marshall’s name became synonymous with the famous supply and demand curves that college graduates all over the world learn to draw. Marshall worked on these graphs in the 1870s, when the New York Cotton Exchange first traded cotton futures contracts. He improvised novel graphic techniques, mostly invented by physicists, which illustrated the making of the market price (figure 1). Marshall’s graphic representation of the market appeared for the first time in 1890 as a footnote in his ground-breaking work Principles of Political Economy, commonly held to be the founding text of today’s microeconomics; it became one of the best-known scientific images in the following century (Marshall 1982 [1890]).

Like many contemporary economists, Marshall used agricultural markets to explain how the illustration worked: corn farmers would supply a smaller number of bushels of corn per month if the price decreased. Similarly, buyers would want to buy less corn if the price per bushel increased. The price is the point where the two lines representing supply and demand intersect. This meeting point in the graph locates the market price of corn, accepted by the free will of the potential demander and supplier as the monetary worth of a bushel of corn for a specific period of time. This is the point of making the price, and the market, too.

Yet a set of questions lurks behind this seemingly simple graph which claims to represent and explain one of the most complex human encounters. Is it possible to make visible the multiple price forms in supply and demand curves? What kind of market price is P? What effect does it have on the making of actual prices on the ground? How is actual price-making carried out in concrete market settings? Finally, what is the significance of having such a hypothetical price?

One may begin to answer these complex questions with a simple question: how much is cotton? If one were to ask a trader in Memphis, Tennessee, about the price of cotton, he would first want to know what kind of cotton.2 The first step in determining a price is to locate the object of exchange precisely, the second is to circumscribe the object’s rather vague character, which may resist the normalization of its exchange. Since cotton has become a global commodity, traders manage cotton’s vagueness by using a measurable and negotiable constant, such as Strict Low Middling (SLM). Thus, one has to replace the vague term “cotton” with a constant and pose a more informed question: “How much is a bale of SLM?”3

The trader would then remind the buyer that SLM is sold only by metric ton (MT), not by bale,4 and ask for further specifications regarding the kind of SLM to be purchased. An acceptable inquiry would include at least a number of primary cotton classification components such as color (cotton is not necessarily white), length, micronaire, and strength. Micronaire (mic.) refers to the coarseness of the fiber. Coarser cotton produces yarn for denim manufacturing, and finer cotton yarn for shirts. The strength of the fiber is measured in grams per Tex (GPT). The stronger the fiber is, the less costly the production of yarn. The color of cotton is measured in reference to its level of brightness and yellow tint. Trash content (T) refers to the amount of noncotton material in a bale, such as leaves. The more trash there is in the cotton, the more costly it is to process.

Speaking the language of the market, then, enables the hypothetical buyer to pose a more informed question to the hypothetical trader, representing the will to buy a set quantity of a certain type of cotton: “How much is 1,000 MT of SLM 1 1/16 inches, 3.4–4.9 mic., white, T/4, min GPT of 24?”

At this point, the trader poses his final question: “Do you want a quote or a firm offer?” By doing so, the trader wants to learn whether the buyer is after his price of SLM, or whether he is just inquiring about the general prices. If the buyer were to ask for his price, then the trader would quote a price representing the range within which he is willing to negotiate. In this case, the trader would then ask two more questions: “When do you want us to deliver?” and “Do you want us to send you a CIF firm offer?” A CIF firm offer means that cost, insurance, and freight are included in the price. The trader’s response to the final two questions is very important, because his answer will set the price, and if accepted by the buyer, it will be the last moment of an actual price realization process.

Because the goal here is to locate the actual price of cotton, the buyer has to request a firm offer: “Please make us a firm offer for 1,000 MT SLM 1 1/16 inches, 3.4–4.9 mic, white, T/4, min GPT of 24, CIF New York City for November 2003 delivery.”5 In addition to specifying exactly what “cotton” means, the inquiry determines the time and place of delivery. After reading the fax or e-mail request, the cotton supplier makes a firm offer valid only, for example, for the next two hours. His fax or e-mail would probably read: “Basis 515 points on, for the next two hours.”

This is the actual price of cotton: the trader can supply 1,000 metric tons of SLM for “515 points on for the next two hours.” But what does this really mean? In order to understand actual cotton prices, one needs further expertise in the language of the market. Leaving the spot markets where actual bales of cotton are exchanged, we now have to reexamine the price (“515 points on”) in the context of the cotton futures market where not cotton itself, but the right to own cotton at a future date is the commodity.

In the futures market, traders buy and sell the claim on the value of cotton at a predetermined future date, by exchanging futures contracts of 100 bal...