![]()

PART II

Location

![]()

3

Contracts and Export Behavior

Noble Group Limited is a global supply chain manager of agricultural and energy products, metals, and minerals.1 In January 2004, the firm had arranged to export Brazilian soybeans to soybean crushers in China. The contracts signed in January fixed a price for the transaction, even though the delivery was only scheduled to occur in April of that same year. Unfortunately for the buyers in China, prospects for a bumper soybean crop led to a 20 percent decline in soybean prices between January and April. The associated drop in the price of crushed soybeans implied that the Chinese crushers would be operating at substantial losses were they to honor the high prices fixed in their January contracts with Noble. As a result, Chinese buyers began searching for ways to nullify their January contract with Noble. Perhaps not coincidentally, that same month Chinese port authorities discovered a discoloration among a handful of red beans on a 60,000-ton soybean shipment from Brazil, which they claimed indicated the presence of carboxin, a slightly toxic fungicide. Although such discoloration (at least in small quantities) is not unusual in traded soybeans, the Chinese government proceeded to institute a ban on all soybean shipments from Brazil, thereby effectively voiding the contract that Noble had signed with the Chinese soybean crushers. As a result, Noble was left with millions of dollars’ worth of stranded cargo. Noble eventually found other buyers for its shipments, but the incident cost the company around $25 million in demurrage losses.

This unfortunate incident of Noble Group in China exemplifies the contractual insecurity that producers face in their international transactions, the sources of which were explained in Chapter 1.2 In the three chapters of this part of the book, I will discuss the implications of introducing contractual imperfections in the benchmark models developed in Chapter 2. In this chapter, I will develop simple imperfect-contracting variants of the Melitz (2003) model of exporting and will also discuss empirical evidence suggestive of the role of these frictions as determinants of the structure of international trade flows. In Chapter 4, I will introduce contractual frictions into the two-country model of global sourcing developed in Chapter 2, and will use several variants of this stylized model to shed light on the basics of how imperfect contract enforcement shapes the sourcing decisions of firms. Finally, in Chapter 5, a multi-country version of this global sourcing model will be developed to guide an empirical analysis of the relevance of contractual factors for the global sourcing decisions of U.S. firms.

Contracting in the Melitz Model

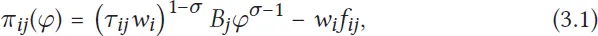

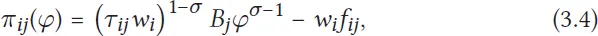

As derived in Chapter 2, in the Melitz (2003) model firms set the volume of output sold and the price charged in each market in a profit-maximizing manner and, as a result, the profits that a firm from country i with productivity φ anticipates obtaining in country j are given by

where

and Ej is aggregate spending in country j.

It is worth pausing to discuss some key and often overlooked assumptions needed for a firm from i with productivity φ to actually realize the profit flow in equation (3.1) when choosing to export in country j. First, it is necessary for the firm to have complete information regarding all variables relevant for profits, including its own productivity level φ and the level of (residual) demand implicit in the term Bj. Second, equation (3.1) implicitly assumes that the firm can expand its production in order to meet foreign demand by costlessly hiring additional labor (or the composite factor of production) at a market wage rate wi which is independent of the firm’s operational decisions. Third, the firm is assumed to be able to costlessly contract with a local distributor or importer (an agent, an employee, or a firm) that will collect the sales revenue in country j and will hand them over to the exporter in i.3

Some interesting recent work in the field of international trade has been devoted to studying the implications of relaxing the first two assumptions mentioned above. On the one hand, Segura-Cayuela and Vilarrubia (2008), Albornoz, Calvo Pardo, Corcos, and Ornelas (2012), and Nguyen (2012) have all fruitfully incorporated foreign demand uncertainty in heterogeneous firm frameworks.4 On the other hand, a voluminous recent literature, which includes the work among others of Helpman, Itskhoki, and Redding (2010) and Amiti and Davis (2012), has studied the implications of imperfect labor markets for the exporting decision, the structure of international trade, and the effect of trade liberalization on labor markets, wage inequality, and unemployment. As interesting as these contributions are, a treatment of these topics is beyond the scope of the current book. Instead, I will hereafter focus on relaxing the third of the assumptions mentioned above, namely, that the contracting between exporters and local distributors or importers is frictionless and allows the exporter to capture the full surplus from the transaction.

Before discussing the implications of contractual imperfections in the Melitz (2003) framework, it is necessary to introduce contracting into the framework and this requires us to be a bit more explicit about the agents involved in the model. For simplicity, in this chapter I will restrict attention to situations in which each export transaction involves only two agents, the exporting firm F in country i and the importer M in country j. One can think of the fixed cost of exporting wifij as partly capturing the cost incurred by the exporter in order to be able to contract with importers from j. For the time being, I will also focus on discussing simple contracts taking the following form: at some initial date t0, the exporting firm F agrees to ship an amount of goods equal to qij, and in exchange the importer simultaneously agrees to pay the exporter an amount sij at some later date t1, perhaps corresponding to the time at which the good is received or perhaps when it has been sold and revenue has been collected. In order to avoid introducing non-essential parameters, I set the discount rate between dates t0 and t1 to 0. Contracts with alternative timings of payments will be discussed below.

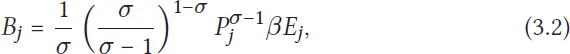

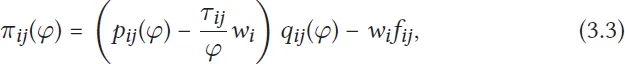

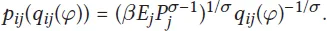

It simplifies the exposition to assume that the opportunity cost of the importer’s time is 0, so that the net surplus associated with firm F with productivity φ exporting in country j continues to be given by

with

as dictated by the demand schedule faced by the exporting firm. In the absence of contractual frictions, the contract will set the quantity of goods

qij (

φ) shipped to country

j and the associated price

pij(

φ) to maximize the joint surplus in (

3.3), thereby leading to the joint profit

flow given by

which coincides with (3.1). Only when this joint profit flow is expected to be positive will the exporter decide to invest in being able to export to j.

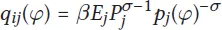

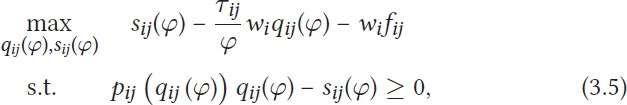

Even if contracting is frictionless, whether the exporter F is able to realize that entire profit flow in (3.4) will depend on the relative bargaining power of the exporter and the importer. Given the zero reservation value of importers, the equilibrium in the Melitz (2003) framework corresponds to the case in which exporters have all the bargaining power, in the sense that they are assumed to be able to credibly make a take-it-or-leave-it offer to importers when contracting with them. To see this more formally, notice that the optimal contract from the point of view of the exporter will solve the exporter’s profit subject to the importer’s participation constraint, or

with

Quite naturally, the exporter will find it optimal to make the importer’s participation constraint bind, thus impl...