![]()

Chapter 1

ASEAN-5 Economic and Exchange Rate Integration

Tatre Jantarakolicaa and Korbkul Jantarakolicab

a Faculty of Economics, Thammasat University, Bangkok, Thailand, e-mail: [email protected] b College of Innovation Management, Rajamangala University of Technology Rattanakosin, Nakhonpathom, Thailand, e-mail: [email protected] Abstract

For the past decades, issues concerning the impact of economic integration on financial integration, especially exchange rate integration, has been criticized among several regions such as ASEAN. This chapter intends to: (i) test for the exchange rate integration among the ASEAN-5, including Indonesia, Philippines, Malaysia, Singapore, and Thailand, using panel data techniques; and (ii) determine the impact of economic integration on the level of exchange rate integration among the ASEAN-5 countries. The purchasing power parity (PPP) is tested using panel unit root tests on monthly data. The results confirm the PPP among the ASEAN-5 countries due to lower transaction costs from ASEAN agreements. The chapter applies Multivariate GARCH (M-GARCH) models using daily data to determine the level of exchange rate integration among the ASEAN-3, including Malaysia, Singapore, and Thailand. The results of panel cointegration tests using quarterly data of economic integration and exchange rate integration confirm the impact of international trade openness on exchange rate integration. With free trade agreements leading to lower trade barriers, lower transaction costs, and low transportation costs, the economic integration among ASEAN countries practically leads to a higher degree of exchange rate integration. The findings imply that trade liberalization has the strongest effect on the real exchange rate. As such, regulators of ASEAN countries should pay more attention to the exchange rate policies of each other because of the interdependence of their exchange rates.

Keywords: Economic integration; exchange rate integration; ASEAN-5; PPP; panel unit root test; panel cointegration test; M-GARCH

1. Introduction

For the past decades, economic integration among countries in the same region has been addressed and examined in many economic literatures. Controversies concerning advantages and disadvantages of the integration have long been studied and criticized, including the integration of the exchange rates of the countries in the same region or those of countries with the free trade agreement. Euro currency, as single currency among EU countries, can be used as an evidence of the exchange rate integration among the countries in Euro zone. For decades, economic integration among 10 Southeast Asia countries, ASEAN, including Brunei, Cambodia, Lao, Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam, has resulted in the integration of these countries’ economies.

As the founder countries of ASEAN, Indonesia, Philippines, Malaysia, Singapore, and Thailand, also called as ASEAN-5, with the five decades agreement since 1967, invited their neighboring countries, including Brunei, Cambodia, Lao, Myanmar, and Vietnam, to join the free trade agreements among each other. With the goals of being regional single market and production base, ASEAN had set up agreement to continuously lower its tariff with the ultimate target of FTA at 0% tariffs rate. As a results, the tariff among ASEAN-5 have set to 0% since 2010. Petri, Plummer, and Zhai (2012) found that ASEAN market, especially ASEAN-5, had been integrated and converged in term of economic growth, both productivity and unemployment. Trade among ASEAN has increased from about 18% in 1985 to more than 30% in 2015.

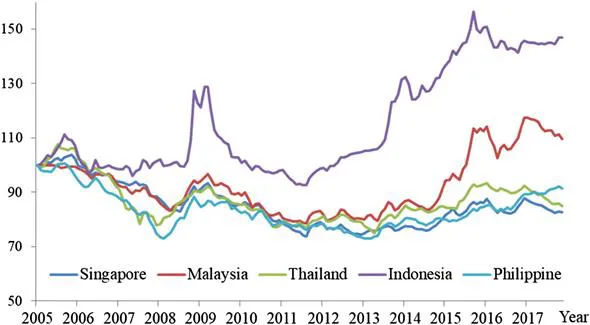

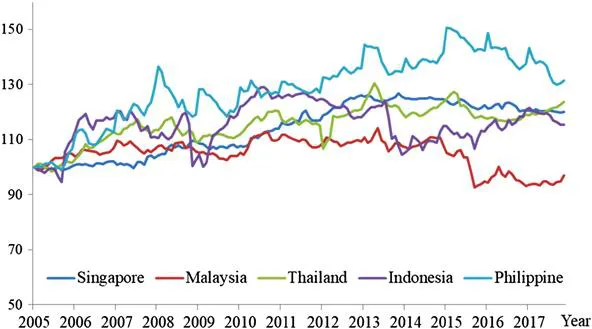

According to the theory of purchasing power parity (PPP), with the lower transaction cost based on ASEAN agreements, law of one price of exchange rate among the five countries should hold. Figure 1 and Figure 2 reveal the comovement among the exchange rate indices of ASEAN-5 countries in US dollar and in real effective term during 2005–2017. However, Manzur (2018) claimed that exchange rate is always and everywhere controversial. Hence, question then arises whether the integration also covers exchange rate integration among the currency of these five countries.

Figure 1: Exchange Rate Indices of ASEAN-5 (USD) 2005–2017.

Figure 2: Real Effective Exchange Rates Index of ASEAN-5 2005–2017.

During 1980s, PPP were often tested by using time series analysis, such as unit root tests and cointegration test of the real exchange rate (i.e., Enders, 1988). These time series tests had later been criticized on the extreme low statistical power which led to unreliable testing results (Edison, Gagnon, & Melick, 1997; Koedijk, Schotman, & Van Dijk, 1998). To overcome the low power problem, the long-horizon ...