![]()

1

Introduction and Overview

BARRY EICHENGREEN AND MASAHIRO KAWAI

Internationalization of the renminbi (RMB, also known as the yuan) is one of the most contentious and widely debated aspects of economic reform in the People's Republic of China (PRC).1 Renminbi “internationalization”—that is, wider use of the RMB in international transactions, both commercial and financial transactions and those undertaken by central banks and other official institutions—can be understood as a natural response to the growing weight of PRC trade and investment flows in the world economy. Top PRC officials have repeatedly declared currency internationalization to be a stated goal of policy, and the People's Bank of China and other government agencies have pursued a variety of initiatives designed to encourage the currency's wider use. Thus, whether wider international use of the RMB is a spontaneous market reaction or a manifestation of the PRC's growing ability and willingness to influence the shape and structure of the global economy is a matter of interpretation.

So, too, is the role of RMB internationalization in the process of the PRC's economic growth and development. Some will say that the cause of RMB internationalization is being advanced mainly in the interest of financial institutions, which see scope for doing international business in the currency as a lucrative source of potential income. Others argue that currency internationalization is supported by PRC firms that see the ability to do cross-border business in their own currency as a useful way of saving costs and maintaining competitive advantage. Those firms do not see why they should have to continue to incur the additional costs of conducting such business in U.S. dollars and having to hedge the resulting exposures.

Similarly, it is argued in some circles that RMB internationalization is a natural corollary of the process of financial development and deepening currently under way in the PRC. As financial markets gain depth, width, and liquidity and are progressively opened to foreign investors, greater international use of the currency will come naturally. The counterpoint is that currency internationalization and the capital account liberalization required to advance it can be or are being used to ratchet up the pressure on PRC regulators to accelerate domestic financial reforms and hasten the process of financial development and opening.

Equally contentious is how quickly international use of the RMB is likely to expand. The PRC is already the world's largest exporter and will soon be the world's largest economy as measured by gross domestic product (GDP). Previous studies such as Chinn and Frankel (2007) suggesting that economic size is an important determinant of the extent of international use of a national currency create a presumption that there should be momentum for more widespread use of the RMB on this ground alone. Other scholars who instead emphasize the issuing country's market liquidity, financial stability, and political structure as determinants of international currency status suggest that the requisite adjustments may take considerably longer. The optimists point to the fact that as much as 28 percent of the PRC's international trade is now settled in RMB and to the rapid growth of RMB bank balances and RMB bond issuance in Hong Kong, China. The pessimists respond that much of the trade is between the PRC and Hong Kong, China—a special case—and that the growth of RMB deposits in Hong Kong, China reflects and is driven by expectations of currency appreciation, an expectation that may not last indefinitely. The optimists note that the last currency to ascend to international status, the U.S. dollar, after World War I, was able to do so quickly once the United States created an independent central bank to enhance market liquidity and once it undertook related institutional reforms. The pessimists object that the dollar lost many of its international gains in the financial crisis of the 1930s. They caution against prioritizing currency internationalization and capital account liberalization over domestic financial development and reform. They worry that allowing capital account liberalization to get too far out ahead of domestic financial reform might raise the risk of just such a crisis.

These are among the issues we seek to address in this chapter. This overview is principally concerned with establishing the facts. Most fundamentally, what is happening in terms of RMB internationalization? How, where, and why is the currency being adopted as an international unit of account, means of payment, and store of value? We are also interested in the economics and political economy of RMB internationalization. How does currency internationalization fit into the larger process of the PRC's economic reform? How does it fit into the PRC's political economy? Who, for example, is lobbying for and against it? What does this mean for the international monetary system?

The PRC is not like other countries. This makes it important to ask, critically, how much can be learned about the prospects and pitfalls of RMB internationalization from the experience of other countries. In particular, the PRC has a much more extensively controlled capital account of the balance of payments, and a more heavily controlled financial system and economy generally, than any other country that has previously aspired to elevate its national unit to international currency status. Thus, previous experience with capital account liberalization and associated financial risks—not simply in earlier reserve-currency countries but in emerging markets whose circumstances the PRC's current circumstances more closely resemble—is directly relevant to the concerns of this paper.

We also inquire into the implications of RMB internationalization not just for the PRC but for other countries and, more broadly, for the international monetary and financial system. The effects of economic policies and conditions in the PRC will be stronger on countries that come to rely extensively on the RMB in their international transactions. Their commercial banks will come to rely more heavily on RMB funding. Their central banks are likely to place a heavier weight on the RMB when managing the exchange rate and foreign exchange reserves. It is therefore useful to attempt to determine which countries, or what kind of countries, we are talking about. Are we talking mainly about Asian countries? In that case the RMB is more likely to develop into a regional than a global currency.

This brings us to the implications of RMB internationalization for the structure of the international monetary system. Does the emergence of the RMB imply a world of competing international currencies or a system of overlapping regional currency blocs? Is a system in which both the U.S. dollar and the RMB play major global roles likely to display better or worse stability properties than our current dollar-based system? Will it make for the smoother and more stable provision of global liquidity over time? Will it make for more disciplined policies on the part of the reserve-currency countries, since none of them will possess a monopoly of safe-haven status? Will it make for more volatile exchange rates between the major currencies, as investors making use of liquid markets in both currencies shift erratically between the dollar and the RMB?

Finally, what are the implications of RMB internationalization for the geography of international financial business and financial centers? Will this business be conducted offshore in a financial center such as Hong Kong, China or London? Or will it migrate back onshore, whether to Shanghai or Beijing? What are the implications of the PRC's approach to RMB internationalization, which relies on these offshore centers as laboratories for testing out reforms, for these longer-term developments?

Clearly, there is much to debate and discuss.

The State of Play

In line with its traditional approach to economic and financial reform, the PRC has pursued a strategy of gradualism in seeking to internationalize the RMB. In the first stage, it has encouraged cross-border use of the currency for trade settlement. As firms exporting to the PRC have acquired RMB receipts, they were allowed to maintain those receipts in the form of RMB bank deposits in Hong Kong, China and, subsequently, other offshore financial centers. The banks and firms acquiring those balances were then permitted to use them for a gradually widening range of investments in the PRC. Meanwhile, the People's Bank of China negotiated bilateral currency swap lines with foreign central banks to provide them with RMB liquidity in order to further encourage foreign authorities to permit their banks and firms to do business in RMB. Most recently, PRC authorities have announced the intention of experimenting with more comprehensive capital account liberalization over a limited geographical domain by creating a Shanghai Free Trade Zone that will be largely open to financial transactions with the rest of the world.

Renminbi Trade Settlement

In the first step in the process of RMB internationalization, the PRC focused on promoting use of the currency for trade-related purposes. In July 2009, the PRC launched a pilot scheme that allowed use of the RMB in settlement of trade with Association of Southeast Asian Nations (ASEAN) member states as well as Hong Kong, China and Macau, China in five PRC cities: Shanghai, Guangzhou, Shenzhen, Dongguan, and Zhuhai. In mid-2010, coverage of the scheme was expanded to twenty provinces, permitting firms in those provinces to settle their trade in RMB. Since then, authorization to settle trade in RMB has been extended nationwide, so that essentially all trade by the PRC can now be settled in RMB.

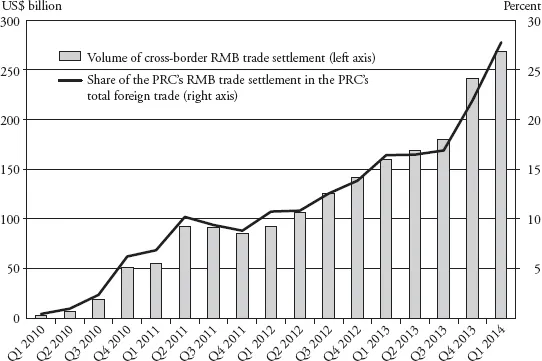

Take-up has been rapid. From a mere 1 percent of the PRC's total foreign trade in the second quarter of 2010, by the second quarter of 2014 RMB trade settlement had ballooned almost twenty-eight-fold, reaching 27.8 percent of the PRC's total trade (see figure 1-1). Since the inception of the scheme, however, more than 80 percent of these trade settlements have been with Hong Kong, China, raising some questions about the generality of use of the RMB in trade settlement with the PRC.

Initially, RMB trade settlement was skewed toward import settlement, as opposed to settlement of PRC exports. For instance, at the end of 2010 the ratio of RMB receipts and payments was 1:5.5 (People's Bank of China 2012). One interpretation of this bias is that it likely reflected the lack of availability of RMB abroad and the incentive to hold RMB offshore in anticipation of the currency's appreciation. In other words, it reflected speculative motives rather than the convenience of invoicing and settling trade in the PRC's currency.

Figure 1-1. Renminbi Trade Settlement

Source: CEIC, China Premium Database (www.ceicdata.com/countries/china); International Monetary Fund, Direction of Trade Statistics.

More recently, however, the ratio has narrowed. From 1:1.7 in 2011, it fell to 1:1.3 in the first half of 2013 (People's Bank of China 2013). This trend is in line with the turnaround in expectations of a RMB appreciation since the latter part of 2011. Such consistent expansion in the use of RMB in trade settlement, despite diminished expectations of RMB appreciation in recent years, suggests that RMB internationalization is now being driven by fundamental changes rather than just by speculative motives.

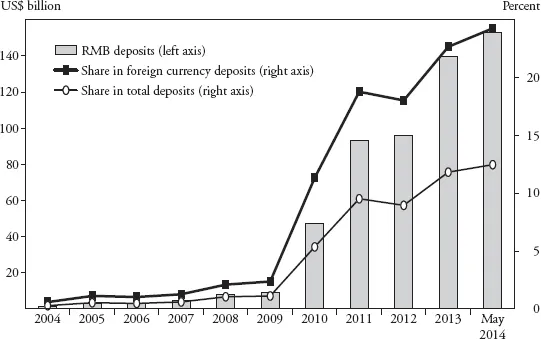

Together with the expansion in RMB trade settlement, RMB deposits in Hong Kong, China have risen dramatically. Although Hong Kong, China banks were allowed to open RMB accounts as early as 2004, it was only in mid-2010, when the RMB settlement scheme was introduced, that RMB deposits in Hong Kong, China took off. Since then, the RMB has been allowed to flow back and forth between Hong Kong, China and the PRC for purposes related to trade settlement, as noted earlier. From about $9.2 billion at the end of 2009 (representing 1.1 percent of total deposits in Hong Kong, China), RMB deposits surged to $47.3 billion by the end of 2010 (5.4 percent of total deposits), $93 billion (9.5 percent) by the end of 2011, and then to $96 billion (about 9 percent) by the end of 2012 (see figure 1-2). The rate of increase slowed in 2012, but this may be less a reflection of any diminished attractiveness of the currency than investors in Hong Kong, China shifting away from RMB deposits into other RMB-denominated financial assets. Consistent with this interpretation, the value of RMB deposits in Hong Kong, China subsequently resumed its rise, reaching $140 billion (12 percent of total deposits) at the end of 2013 and then $153 billion (12.5 percent) at the end of May 2014.

Figure 1-2. Outstanding Renminbi (RMB) Deposits in Hong Kong, Chinaa

Source: Hong Kong Monetary Authority, Monetary Statistics (various years; www.hkma.gov.hk/eng/market-data-and-statistics/monetary-statistics/monetary-base/2014/).

a. The data refer to December of that year, unless otherwise specified.

Renminbi-Denominated Investment

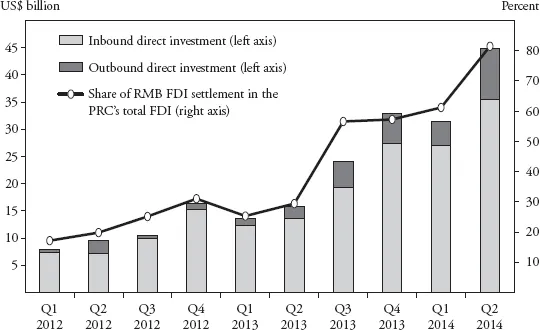

Although the PRC authorities have continued to control inward and outward foreign direct investment (FDI), the controls in question have been relaxed in recent years. In addition, both the approval process in the use of the RMB for outward FDI by PRC enterprises and the actual use of the RMB for inward FDI in the PRC have been streamlined with the announcement of the Renminbi Outward Direct Investment scheme in January 2011 and the creation of the Renminbi FDI scheme in October of the same year. Since data were made available in early 2012, RMB-denominated and -settled FDI has risen rapidly as a trend, accounting for about a third of the PRC's total FDI flows in mid-2013, close to 60 percent at the end of 2013 and over 80 percent at the end of June 2014 (figure 1-3).

Figure 1-3. Renminbi-Denominated and -Settled Foreign Direct Investment

Sources: People's Bank of China (2013); CEIC, “China Premium Database” (www.ceicdata.com/countries/china); Bloomberg (electronic database, various years).

FDI = foreign direct investment.

The strictest controls are on portfolio investment flows, yet these controls have also been relaxed in recent years to expand the range of investors and the type of financial assets that are permitted to engage in cross-border transactions using the RMB. Since April 2006, preapproved institutional investors from the PRC have been allowed to invest in RMB-denominated financial instruments offshore, such as in Hong Kong, China. In August 2010, foreign central banks and certain types of foreign financial institutions were allowed to invest in the PRC's onshore interbank bond market. Then, in December 2011, the Renminbi Qualified Foreign Institutional Investor (RQFII) scheme was introduced to allow prequalified offshore institutions—including foreign central banks—to invest, subject to quota, in the PRC's onshore interbank bond market and equity market. Finally, the quota for RQFII was raised in April 2012, and onshore nonfinancial institutions were allowed to issue RMB bonds in Hong Kong, China in May 2012.

Renminbi Bond Issuance

In addition to relaxing restrictions on inward and outward capital flows, official support by the PRC authorities has fostered the growth of an offshore RMB-denominated (dubbed “dim sum” by bond traders) bond market in Hong Kong, China. Although the first dim sum bond was issued as early as 2007, it was not until August 2010, when the U.S. corporation McDonald's became the first foreign private company to issue an RMB bond, that the offshore RMB-denominated bond market attracted significant international attention. Issuance then rose from $0.9 billion in 2010 to $4.6 billion in 2011, to $7.1 billion in 2012, and $9.7 billion in 2013. Issuance in the first seven months of 2014 stood at $10.5 billion (figure 1-4), continuing the earlier upward trend. Major issuers of RMB bonds are financial institutions (figure 1-4a), and a large portion of these issuances are made by firms from the PRC; Hong Kong, China; and the rest of the world (figure 1-4b).

Renminbi Currency Swaps and Direct Trading

Since late 2008, the PRC has concluded a series of bilateral RMB-denominated currency swap arrangements with the goal of providing foreign monetary authorities access to RMB liquidity and in return encouraging them to authorize use of the currency by domestic banks and firms. The Republic of Korea was the first counterparty to such an agreement. Its December 2008 bilateral swap arrangement with the People's Bank of China was for 180 billion Chinese yuan (CNY), with a maturity of three years. Prior to its expiration in 2011, the PRC and the Republic of Korea renewed the arrangement, doubling the amount of the swap to CNY360 billion. Where the Republic of Korea led, a variety of other PRC trading partners have followed. As of the end of October 2013, the PRC had signed twenty-five bilateral RMB-denominated swap arrangements with twenty central banks (table 1-1).2

Since 2010 the PRC has also promoted direct trading of the RMB with non–U.S. dollar currencies, to eliminate the need for foreign counterparties to first buy and sell dollars in order to move between third currencies and the RMB. It agreed on such direct currency trad...