![]()

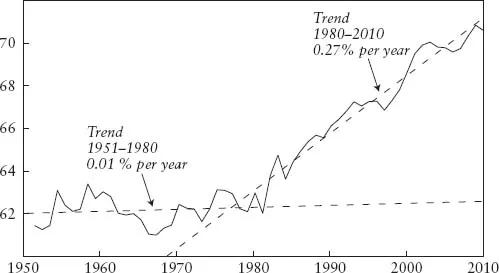

Over the past quarter-century, rates of saving in the United States have fallen precipitously, and in the aftermath of the 2008-09 financial crisis, the nation's saving rate has turned negative. Even before the onset of the crisis, net national saving amounted to only 2 percent of the nation's income, while the average was 11 percent in the three decades before 1980. In effect, Americans have been engaged in a long-running spending spree, consuming their incomes at an unsustainable rate in both the public and private sectors. The shift toward a consumption-based economy is evident in the rising share of gross domestic product (GDP) allocated to consumption. The consumption share, which had long been virtually constant at 62-63 percent of GDP, began to rise in the early 1980s, and it is currently in excess of 70 percent (figure 1-1). This profligacy has been evident at both the government and the individual household level. In the public sector, the lack of saving and investment has been reflected in an erosion of the nation's public infrastructure and, but for a brief period in the late 1990s, increasing levels of public indebtedness. At the household level, the average saving rate declined to 1 percent of income before surging to about 5 percent amid the panic of the financial crisis. Even this heightened rate of household saving, hailed as a major turnaround, is less than half the rate achieved in the decades prior to 1980. At the beginning of the 1980s, the United States was the world's largest creditor nation, with a net international investment position of $360 billion, equal to 15 percent of national income. By 2010, it was the world's largest debtor. The nation's international liabilities have come to exceed its assets by more than $3 trillion—about 5 percent of the nation's net wealth, or 25 percent of national income.

Figure 1-1. Personal Consumption as a Percent of GDP, 1951-2010

Sources: Bureau of Economic Analysis (2011a, table 1.1.5) and author's calculations.

This shift in behavior has received mixed reviews, both international and domestic. On the one hand, U. S. consumer markets have been the engine for global economic growth because other countries could rely on exports to the United States to drive the expansion of their economies. The strength of the U.S. market, for example, supported reliance on export-promotion policies as a primary means of recovery from the 1997-98 Asian financial crisis. The expansion of exports to the United States also provided an important impetus for the economic awakening of vast portions of the world's poorest countries, marked particularly by the gains in China and India. Yet outside observers have long been uneasy about the magnitude of the payments imbalance between the United States and the rest of the world, and they were often critical of Americans’ low saving rate during a period in which they nevertheless took full advantage of strong U.S. markets for consumer goods.

Within the United States, the strength of domestic consumer markets was a major contributor to a long episode of sustained economic growth and job creation; the unemployment rate fell to levels that were previously thought to be unsustainable. From many perspectives, the performance of the U.S. economy in the 1990s did seem like the best of times. However, the boom also concealed some of the underlying problems. Governments, in particular, became highly dependent on transitory tax revenues from the capital gains associated with the surge in equity and real estate markets. The collapse of revenues in the recent financial crisis has left all levels of government with large shortfalls reflected in huge budget deficits (negative saving) in the short run and curtailment of public investment over a longer period. Households also came to rely on debt financing for significant portions of their consumption, supported in turn by rising home prices. That support vanished in the wealth losses of 2008-09. Going forward, many Americans will have to focus on rebuilding their financial balance sheets, something that will require more saving and less consumption for a sustained period.

This book provides a review of both the causes and consequences of the decline in American saving. To begin, the magnitude of the two-decade-long fall in household saving has been truly astonishing; it is even more surprising in view of the fact that the large cohort of baby boomers should have been in their peak saving years. The reasons for that reduced saving have generated considerable controversy within the research literature, as have the measures used to calculate saving. But equally significant is the fact that many of the predicted consequences of low saving have not been evident. For example, a fall in saving would be expected to curb the nation's rate of capital accumulation and slow the pace of economic growth, but that has not been the case: domestic investment was strong and the rate of productivity growth accelerated in the years between the mid-1990s and the onset of the financial crisis. A low rate of saving should imply reduced rates of household wealth accumulation. Yet the net worth of American households grew at unprecedented rates, and as recently as 2008 several analyses suggested that those approaching retirement were in significantly better financial condition than prior generations.

Why has saving declined, and why have the consequences been so benign? Those are the key questions that this book seeks to address. The issues have been made even more complex by the severity of the 2008-09 financial crisis. The crisis itself cannot be traced to low saving, but adjusting to a more balanced path to economic growth with a higher, more sustainable rate of saving than in the past will be more difficult and painful because of the depth of the global economic decline. The original objective was to shift a portion of U.S. production out of the domestic market for consumption goods and into the export markets in an equally fast-growing global economy. Over several years and with a coordinated change in the policies of other countries, the rebalancing of the U.S. economy could have been accomplished without significant disruption. Today, households are saving more, but it is against the backdrop of a domestic economy propped up by large government deficits and a global economy in which many nations see increased exports as the offset to weak domestic demand. The achievement of a future of strong and balanced economic growth has become much more difficult.

Alternative Saving Measures

The discussion begins in chapter 2 with a review of the official national income and product accounts measures of saving in the United States, which are those that show the precipitous fall of saving in both the private and the public sectors. Yet those measures are not universally accepted, and some critics challenge the concept of saving that is used in the national accounts. They argue that the definitions of saving and investment are too narrow, in that they ignore investments in consumer durables, health, education, research and development, and other intangibles. Furthermore, the treatment of capital gains/losses—their exclusion from saving but inclusion as a component of wealth change—is a source of considerable confusion and controversy. To a large extent the confusion reflects the failure to distinguish between the macroeconomic perspective, with its emphasis on measuring the nation's total production and its distribution, and the microeconomic perspective, with its focus on measuring the economic well-being of individual households. Although the rise in household wealth associated with the boom in equity and home prices appeared as saving at the individual level, it did not represent an increase in resources that could be used to finance capital investments.

Similarly, we could broaden the range of expenditures that we classify as investment and thereby raise the reported saving rate. Many of those suggestions have merit but stumble on difficulties in measurement. For example, the pursuit of a college degree should be seen as an investment activity, but studies of how students spend their time suggest that there is also a significant consumption component, and we are uncertain about how to separate the two. One objective of chapter 2 is to provide a conceptual framework for thinking about the adequacy of saving and investment and to evaluate the implications of the differing proposed measures of saving. An important conclusion is that the broader definitions of saving and investment proposed would not fundamentally change the narrative of a secularly diminished rate of saving in the United States.

The national accounts data can be used to separate national saving into its public and private components and, in the private sector, to distinguish between the saving of households and businesses. As we shall see, the various components of saving show quite different secular and cyclical patterns. However, some analysts argue that the divisions are meaningless since households are the owners of businesses, which save and invest as the households’ agents, and taxpayer households ultimately bear the burden of paying for the government's activities. They argue, for example, that efforts to increase national saving by reducing the dissaving of government will simply be offset by compensating actions by households. The issue of which measures of saving are most appropriate is of great importance in explaining why saving has declined and of even more importance in determining what, if anything, can be done about it. This issue is an important aspect of the next chapter, and it arises again in the discussion in later chapters of the reasons for the decline in saving and its consequences.

Why Has Household Saving Fallen?

Chapter 3 focuses more directly on the question of why the rate of household saving has fallen. The decline, which first emerged in the 1980s, accelerated during the 1990s, and saving remained very low right up to the onset of the financial crisis. The chapter both examines the evidence on potential reasons for the falloff from the macroeconomic perspective and analyzes microsurvey data from individual households. At the aggregate level, the analyses have tended to highly confirm a strong influence from unusually large capital gains on wealth and easier access to credit. The capital gains were concentrated in corporate equities and the housing market. Innovations in the mortgage market greatly increased the ease with which homeowners could extract equity from the appreciating value of their homes.

The sharp rise in the household saving rate in the aftermath of the financial crisis supports the role of wealth effects and credit availability, but too little time has passed to fully distinguish those effects from the short-term trauma of the crisis itself. The change to a higher rate of household saving has also been somewhat inopportune since it has occurred along with a collapse in domestic investment and difficulty in expanding exports. After several decades, it has not been easy to shift away from a consumption-oriented economy. Therefore, the rise in household saving has been more than offset by an extraordinary increase in public dissaving as the government struggles to rebalance the economy.

The study is less successful in using the microsurvey data to identify the socioeconomic characteristics of households that changed their saving behavior. While it is possible to show the broad nature of the wealth gains across households of varying characteristics, efforts to separate those gains into their saving and valuation components—active versus passive saving—are afflicted with large measurement errors. Similarly, households cannot recall their consumption outlays with sufficient accuracy to measure saving as income minus consumption.

International Saving Patterns

Variations in the international experience are taken up in chapter 4. Reductions in the barriers to trade across borders and the expansion of international capital transactions have promoted a much more open global economy in which the patterns of saving and investment in other countries have major implications for the United States. The examination of cross-national experiences also yields richer data with which to explore the determinants of saving behavior. Consideration of the global pattern of saving and investment highlights the magnitude of the U.S. imbalance. The global perspective has been the basis of the claim by some U.S. economists that the problem is not that the United States saves too little, but that others save too much. Both phenomena played important roles in contributing to the pattern of a consumption-based boom in the United States, large external imbalances between the United States and Asia, asset market bubbles, and the excesses that led to the 2008-09 financial crisis. At the same time, consideration of saving and investment trends in individual countries or groups of countries highlights the diversity of experiences. Among the high-income countries, special attention is devoted to Canada, Japan, and Europe for the insights that they might offer to the United States. China and India illustrate the much different experience within emerging markets and their increasing influence on trends in the global economy.

Canada is of interest because it shares many of the institutional and cultural features of the United States, yet at least in the 1970s and 1980s, saving rates there evolved quite differently. More recently, however, the Canadian household saving rate fell as sharply as that of the United States, but saving within the corporate sector rose by an amount more than sufficient to offset the reduced rate of household saving, leaving private saving unchanged. Canada also stands out for the progress that it has made in bringing its public sector budget into balance. Both Canada and the United States have experienced little or no change in demographic structure over the past two decades, and while Canadian home prices rose less than those in the United States, the two countries shared large valuation gains on corporate equities and a common downward trend in real rates of interest. Also, the mortgage market innovations that led to the growth of the subprime mortgage market in the United States were largely absent from Canada.

The magnitude of the fall in saving within Japan is even larger than that in the United States, but the explanations of the declines have little in common. Japanese researchers attribute the reduced saving to population aging, which is largely absent in the United States and Canada; moreover, Japan has experienced major losses, not gains, in asset markets. Like Canada, Japan has had a major increase in corporate saving, but its public sector dissaving resembles that of the United States. The Japanese investment rate also plummeted after its financial crisis and never recovered. Europe illustrates yet another distinct experience. Saving rates there have fallen less than in other high-income economies. The extent of population aging in Europe lies between that of North America and Japan, and the magnitude of the increase in the wealth-income ratio is quite variable and its correlation with saving less than in the United States.

The acceleration of economic growth in China and India has been accompanied by remarkable increases in domestic rates of saving. It seems evident that the rapid rates of income growth there have exerted a strong positive impact on saving. Until recently, the increased saving was matched by an equally rapid expansion of domestic capital formation. Since the Asian financial crisis of 1997-98, however, several countries within East Asia, including China, have experienced a significant moderation of investment and the emergence of large current account surpluses that are the principal offsets to the U.S deficits. The diversity of international experience would seem to offer a rich set of data to distinguish among the competing hypotheses for saving behavior, but the comparisons are complicated by the varying quality of data and major differences in the underlying institutions that determine saving. It seems unlikely that a single model or a simple set of explanations can account for the wide variations in country experiences, but the international review does not yield any glaring contradiction of an explanation of the reduced U.S. rate of saving that emphasizes wealth changes and the liberalization of credit. The added feature is the importance of income growth-particularly in developing economies—as a positive influence on saving.

The Consequences of Low Saving

To date, the low rate of saving has had surprisingly benign effects on Americans, but that may be in the process of changing. Historically, economists and other public commentators have expressed concern about the implications of low rates of saving in three different dimensions, which are addressed in more detail in chapter 5. First, within the macroeconomic context, saving has been emphasized as a necessary means of financing capital accumulation and economic growth. This view was reinforced by studies such as Feldstein and Horioka (1980), which pointed to the high correlation between domestic saving and investment as evidence of the limited development of international capital markets and a restricted ability to finance large external imbalances. This closed-economy interpretation led to concerns that reduced domestic saving or large budget deficits would crowd out investment and negatively impact the nation's economic growth. In today's world, however, the Feldstein-Horioka finding is of reduced relevance; investment can be financed with equal ease with either domestic or foreign saving, and there is little evidence that low rates of domestic saving have crowded out investment.

Instead, a low rate of saving relative to investment is reflected in a large external deficit with the rest of the world. The sustainability of the external deficit is the second dimension of concern to consider when examining the implications of low rates of saving. In effect, the United States borrows from abroad or sells assets to finance its current spending. In the process, it has accumulated a high level of net external indebtedness, about 25 percent of GDP. This level of debt is already beyond the magnitude at which other countries encountered financing problems. Perhaps the U.S. position as a reserve currency and its tradition of strong enforcement of commercial contracts gives it some additional leeway. Thus far, in terms of interest rate premiums on U.S. government debt, there is no evidence of a significant foreign concern with a U.S. default.

Estimates of the large adjustments required in exchange rates and an extraordinary public sector deficit both suggest, however, that restoration of a more balanced financial position would bring about major reductions in the terms of trade and American standards of living. The magnitude of the recession and the drop in domestic demand has resulted in a substantial reduction in the external deficit, but the United States continues to have difficulty reinventing a significant export capability.

Finally, low rates of household saving over an extended period should raise fears about the adequacy of households’ preparation for retirement. However, again there is surprisingly little evidence of a growing problem. The economic position of the elderly has improved substantially during the period of falling national saving. A surprisingly large number of Americans make no significant financial preparation for retirement, relying instead on ownership of a home and Social Security benefits in their retirement years. Among higher-income groups the lower rate of saving did not translate into reduced wealth for retirement because of the remarkable price appreciation in asset markets. Capital gains were more than sufficient to offset the reduced saving. Many research studies prior to the financial crisis suggested a rather benign financial outlook for older Americans.

Again, however, the situation may be changing in the aftermath of the financial crisis. It brought the asset market boom of the last twenty years to an end, and asset prices are regressing toward a more normal historical level. Ultimately, the new equilibrium level of asset prices will depend on the extent and timing of recovery in the macroeconomic economy. In addition, the magnitude of the fiscal deficit is likely to require the scaling back of transfers to the elderly in the future, making them more dependent on their own financial resources. Surveys from the post-crisis period that cover the financial situation of retired and near-retired individuals have yet to become available; however, a combination of large wea...