![]()

CHAPTER 1

Why Financial Statements Analysis?

Financial statements are a firm’s or any business’s report card. They summarize the performance of the firm over a specified prior period mainly using quantitative metrics, supplemented by qualitative reporting. Just as a child gets her report card at the end of a term or year, a firm produces its report card for the benefit of those who have a stake in its performance and future. Just as a child’s report card becomes a useless piece of document unless the parent analyzes the information to understand what has gone right and wrong during the year and what steps can be taken to rectify mistakes and improve performance, financial statements of a firm can become meaningless documents unless the management and more importantly, its stakeholders analyze it to understand the story beneath.

The financial statements are (a) the report card of a firm’s performance, (b) symptoms of underlying issues, and (c) portents for the future. These statements are the means to unravel the story, not an end in themselves. They contain a wealth of information—both expressed and implied—and it is up to the stakeholders to utilize this information to the best of their ability for better decision making.

Smart financial statements analysis requires a good understanding of the terminology and design of the financial statements, of tools used for financial statements analysis, and of the business of the firm itself. Many students of business and even people in practice mistake financial statements analysis for simply computing financial ratios and stating obvious observations. Ratios are an essential tool no doubt, but blindly computing those to arrive at standalone observations, which are in turn mistaken for conclusions, can be dangerous.

Objectives of a Firm

Theory of the firm is almost as old as the discipline of economics itself. Ronald Coase, in his celebrated work, The Nature of the Firm (1937), explained that firms are set up by people in response to the limitations of the price mechanism to independently direct production, consumption, and prices in an economy. Price mechanism presumes the parties to an exchange to enter into explicit or implicit complete contracts each time an exchange happens. This is impractical and infeasible as the time, effort, and monetary cost of such contracting will far exceed the benefits of the exchange. However, when such exchanges are patterned together within firms, contracts need to be written only among firms and not individuals. Firms have the ability to draw up longer term contracts, albeit incomplete, with various parties at the same time at a reduced cost and enable exchanges and transactions to take place.

Alchian and Demsetz (1972) emphasized the benefit of teamwork that firms allow. The benefits of this teamwork extend to acquisition of resources as well, both physical and monetary. A corporation is able to raise financial capital from a multitude of small investors who chip in small portions and get the additional benefit of limited liability. The organizational setup of the firm further enables a few elected representatives to take decisions on behalf of all investors in the corporation that significantly reduces transaction costs and time and improves efficiency. It is implied in this setup that the management has a fiduciary responsibility to all the stakeholders of the firm and particularly to the equity holders, to keep their interest paramount in all decision making. This is beautifully elucidated by Jensen and Meckling in their seminal work on agency theory.

The corporate finance discipline defines the primary role of the firm as run by its management, overseen by the board of directors to be maximization of returns for its shareholders. Over time this definition has undergone change to become more inclusive and less materialistic. A firm exists for and thrives because of stakeholders that include the state, the society, and the public at large. Firms have to now look at delivering on a triple bottom-line rather than a single bottom-line. The triple bottom-line includes environmental sustainability and corporate social responsibility besides shareholder returns.

Financial statements analysis is all about measuring and assessing the firm’s performance on the financial returns metrics, assuming the firm is playing its part in being a good citizen. In fact, being a good citizen is not considered a cost that takes away from financial profits or returns. On the contrary, firms see a positive spillover of adopting a responsible attitude toward the environment and society at large on their business and financial metrics. Stakeholders, over time, have become more discerning and sensitive to businesses’ contribution, positive or negative, to the social fabric and environment. They accordingly, reward or penalize firms that finally has an impact on the latter’s financial metrics. Recently, there was a debate in the Indian financial media whether the Life Insurance Corporation of India (LIC), the largest domestic institutional investor should pull out its equity investment from ITC Ltd., the largest tobacco product manufacturer in the country. It was a debate between LIC’s responsibility toward its investors versus toward society.

Activities-of-a-Firm Approach to Financial Statements Analysis

Having understood the rationale for why a firm comes into being and its responsibilities toward its various stakeholders, we turn our attention to how the firm can be understood for the purposes of financial statements analysis. A firm is a complex being. It can be studied and its design and structure can be analyzed and evaluated from various perspectives. Some of the most popular ones include the industrial economics, organization design, portfolio of products or businesses perspectives. However, for our purposes, we look at a firm as the combination of three activities—operational, investment, and financing activities.

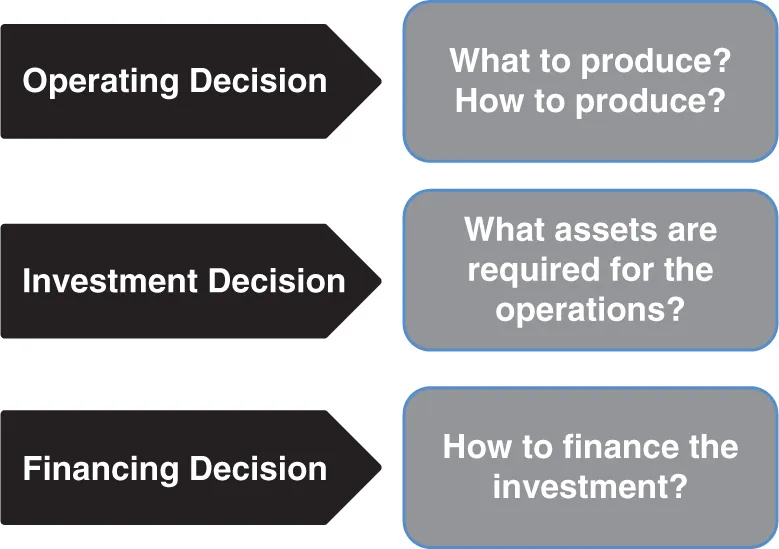

Any firm, however complex, can classify each of its activities into one of these three categories. In fact, that is the premise of the cash flow statement, one of the key financial statements published by firms. A firm comes into being with an idea of providing products or services to a set of potential customers, through a unique value proposition. How to provide the product/ service determines the operating activities of the firm. Once that is decided, the firm needs to plan what kind of a setup it needs in place to be able to operate. This determines its investment activities. Once that is decided, the firm needs to plan the quantum of funds it needs and the sources it will tap. This determines its financing activities. Figure 1.1 portrays this logical connect between operating, investment and financing decisions of a firm.

Figure 1.1 The activities of a firm

This is a simple idea of how a business starts and comes into being. Once a business establishes itself and grows, these activities continue over its lifetime. The firm has to keep making investments in order to grow, continue operating efficiently in order to earn profits, and finally, source funds either internally or externally in order to keep the ball rolling. We use this framework to understand and analyze its financial statements.

The Principal Financial Statements

There are four1 essential financial statements drawn up by firms under Ind-AS—the set of rules Indian companies have to adhere to while drawing up their financial statements—especially those that are listed on the stock exchanges. These are the Balance Sheet as at the end of the accounting period (also called the Statement of Financial Position), the Profit and Loss statement for the period (also called the Income Statement), the Cash Flow Statement for the period, and the Statement of changes in equity for the period.

Formats of financial statements in each country are dictated by the laws of the land, specifically the regulatory authorities that decide on accounting conventions and those that may be regulating the sector itself. In India, the accounting regulations are governed by the Ministry of Corporate Affairs and the Institute of Chartered Accountants of India. The Ind-AS are designed on the IFRS2 conventions.

The balance sheet provides a summary of the financial position of a firm as on a particular date; what the firm owns (assets) and what it owes (liabilities). Any firm essentially sources funds from two main sources—owners and lenders—to invest in assets. These funds are called shareholder equity and debt funds (or inside and outside liabilities), respectively. At the beginning of the life of a firm, therefore, the total book value of its assets is equal to the total book value of its shareholder funds and outside liabilities. This is famously known as the accounting equation or accounting identity and forms the basis for all financial accounting, the world over.

At the inception of a firm, Assets = Shareholder equity + Outside liabilities.

This relationship is sacrosanct and ensures that the balance sheet is always balanced. Figure 1.2 lays out the essential components of a typical balance sheet. The layout does not specifically follow any convention such as U.S. GAAP or IFRS but is meant to simply illustrate the accounting identity and the components of a standard balance sheet.

Figure 1.2 Layout of a balance sheet

As the firm begins its operations, it earns revenues and incurs expenses. These get recorded in the profit and loss statement (hereafter referred to as P&L) and at the end of a period, the P&L shows the profit or loss the firm’s operations have earned as illustrated in Figure 1.3.

Figure 1.3 Layout of the P&L statement

Notes: EBITDA stands for Earnings before interest, taxes, depreciation, and amortization; EBIT stands for Earnings before interest and taxes. Depreciation and amortization are estimates of the extent of usage of tangible and intangible assets respectively during the accounting period.

The net income is the residual left after all the stakeholders have been paid their dues and this belongs to the shareholders (owners). If this is a profit, it enhances their equity and if the firm’s operations result in losses, they erode the owner’s equity. Therefore, once a firm begins operations, shareholder equity becomes an output of the accounting equation rather than an input.3 The accounting equation now becomes:

Shareholder equity = Assets − Outside Liabilities

The statement of cash flows (hereafter referred to as CFS) lays out the inflows and outflows of cash into and from the firm over an accounting period, categorized into the three activity buckets defined earlier in Figure 1.1. The net cash inflow or outflow during the period is added to the cash balance at the beginning of the period to give the ending balance of cash for the period as presented in Figure 1.4.

Figure 1.4 Layout of the cash flow statement

To the extent the elements in the balance sheet and P&L have cash implications, they find a place in the CFS. For example if the firm ...