The Lies About Money

Achieving Financial Security and True Wealth by Avoiding the Lies Others Tell Us-- and the Lies We Tell Ourselves

- 336 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Lies About Money

Achieving Financial Security and True Wealth by Avoiding the Lies Others Tell Us-- and the Lies We Tell Ourselves

About This Book

Ric Edelman, #1 bestselling author of Ordinary People, Extraordinary Wealth, and the personal finance classic The Truth About Money, offers more great wisdom for investors—and a valuable insert of sample portfolios that outline everything you need to know about building the perfect portfolio. Ric Edelman has helped more people achieve financial success than any other practicing financial advisor. Now, Ric reveals the deceptive and manipulative business practices occurring in your retail mutual funds—practices that are causing you to suffer higher fees, greater risks, and lower returns than you realize. In The Lies About Money, he offers you a detailed yet easy-to-follow plan that lets you take back control of your investments—and your financial future.Here, Ric shares his most valuable lessons gained through two decades of working directly with individuals and families. He reveals the lies that have infiltrated your retail mutual funds and retirement accounts and teaches you how to invest your money in your employer retirement plan; how to save for college; and for those who are retired, how to generate more income without sacrificing security. He shows you that proper money management has nothing to do with "hot tips" and everything to do with scientific analysis, bolstered by solid academic research and historical data. Along the way, Ric shows you the secrets to investment success—a long-term focus, the importance of diversification, and the crucial need for (and methods of) portfolio rebalancing.With insight and strategies that will change people's lives, The Lies About Money offers the truth that everyone is looking for.

Frequently asked questions

Information

Chapter 1

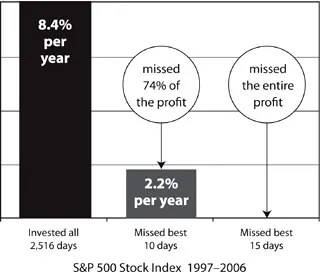

The Most Proven, Successful Investment Strategy There Is

The Importance of Saving Regularly

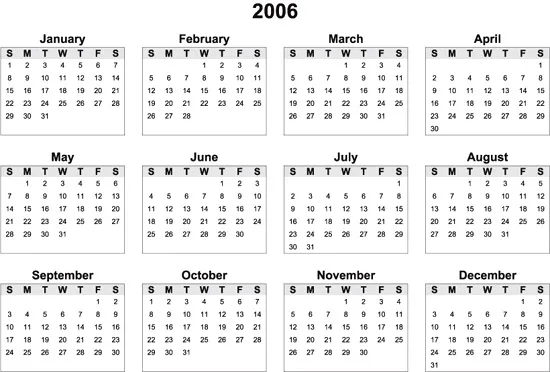

Why We’re Long-term Investors

Table of contents

- Cover

- Title Page

- Copyright Page

- Dedication

- Acknowledgments

- Contents

- Introduction

- Chapter 1: The Most Proven, Successful Investment Strategy There Is

- Chapter 2: The Academics Behind the Strategy

- Chapter 3: Why You Should Use Mutual Funds

- Chapter 4: The Demise of the Retail Mutual Fund Industry

- Chapter 5: How to Beat the Retail Mutual Fund Industry at Its Own Game

- Chapter 6: The Greatest Invention Since Mutual Funds

- Chapter 7: Creating the Investment Portfolio That’s Right for You

- Chapter 8: Three Important Insights to Insure Your Investment Success

- Chapter 9: Applying This Strategy to Your Employer Retirement Plan

- Chapter 10: Applying This Strategy When Saving for College

- Chapter 11: Applying This Strategy When Investing for Income

- Chapter 12: Three More Important Insights to Insure Your Investment Success

- Chapter 13: Implementing This Strategy with Life Insurance

- Chapter 14: Implementing This Strategy with Variable Annuities

- Chapter 15: Should You Adjust Your Portfolio Because Baby Boomers Are Retiring?

- Epilogue: Lessons Learned

- Sources

- For Further Reading

- About the Author

- Index

- Portfolio Insert

- Foot Note