Most people are familiar with the party game Six Degrees of Kevin Bacon: “I’m friends with Sally who has a cousin who designs sets for a director who works with Kevin Bacon.” The point of the game is to link any person to Kevin Bacon through six steps or less, and it illustrates the larger “Six Degrees of Separation” theory that every person in the world is only six contacts away from knowing every other person in the world.

I have made millions by making a different set of connections and connecting the dots to an overlooked pot of gold. One of my most valuable techniques for picking stocks is to look for the “unlikely suspects.” These are the companies that thrive as a supplier or the ancillary beneficiary of a trend, societal change, or economic or political driver.

While social scientists have studied how we as people are interconnected, little research has been dedicated to the significance of the relationship chain in financial trends. Economists have drawn up complicated equations for many economic models, but how an obvious trend causes other trends is relatively uncharted territory for even the professional investor. As a result, mapping out causal connections in trends might be one of the best kept secrets to identifying and profiting from these trends. The party game’s goal is getting to Kevin Bacon in six steps. In financial trend spotting, finding a service or product that’s separated—whether by two, three, or six steps—from a clear trend can lead to a great investment. For that matter, identifying a company even farther separated, whether 10, 15, or 20 degrees, can sometimes be profitable.

The best part is that it isn’t rocket science.

Take the case of corn ethanol. With the rapidly growing interest in ethanol as a more environmentally friendly substitute for gasoline in the last few years, corn prices have skyrocketed. Many investors have jumped to make money off this trend. By now, the prices of corn have already jumped, leaving less potential to profit off the trend. Rather than trying to get in on something that has already become highly valued, you can make better money by applying the Six Degrees of Making Bacon principle, and investing in more affordable options that will benefit from the new-found popularity of corn. While everyone and their brother will be investing in the trend itself, you’ll be surprised how many people don’t think to invest beyond the trend.

If demand for corn has risen dramatically, farmers are going to be trying to meet that demand. What products or services do they need in order to increase production of corn? For one, they’re going to be buying new tractors and other farming equipment, as well as more pesticides and fertilizer. So you might want to look at companies like AGCO Corporation or John Deere, which make tractors, combines, sprayers, and other equipment. Or check out companies like Monsanto, which produces Roundup, a pesticide often used on corn and soybeans (another source of biofuels). Syngenta is another example: among other things, they develop high-performing seeds, including corn seed, and are creating a hybrid corn specifically for improved biofuel. Then there are middlemen like Archer Daniels Midland, which stores, transports, and processes agricultural products, as well as train manufacturers like American Railcar, which makes and services trains used to carry agricultural products. The list could go on and on.

Drawing Connections

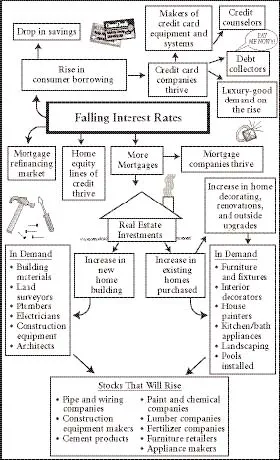

I find the easiest way to play the Six Degrees game is to draw diagrams. It’s fun to uncover how an obvious trend has a ripple effect. You can usually find products, services, and companies worldwide in every direction that are positively affected by a trend.

Don’t just think in a linear way. The ripple effects of just one trend can take you numerous steps in many different directions. In order to play the Six Degrees of Making Bacon, all you need is a bit of creativity.

Let’s look at an example. Beginning in January 2001, interest rates started to drop. When the Federal Reserve Board lowers the federal funds rate, the prime rate follows the trend downward, as do mortgage rates. The trend of falling interest rates invariably lights a fire under the housing market. When mortgage interest rates are low, people can afford to buy houses that they couldn’t buy when the interest rates were higher.

So we draw our first set of connections:

If you bet on housing to be a big market as we headed into the twenty-first century, you were right. The value of residential real estate in the United States rose by about ten trillion dollars from 2000 to 2005, with the average home costing over 60 percent more than it had at the end of 1999. So just one degree away from the trend of falling interest rates, you would have found a great way to profit. But now take it several steps farther. Cheap mortgages mean more people will take a mortgage, which means there will be a spurt in the new-home market. Home builders are ready to rock when those rates fall.

Now take it farther still. When home building is on the rise, what other products and services are positively affected? Building materials, construction crews, home design companies, for starters. When mortgage companies do well, who else does well? Sub-prime lenders, secondary mortgage buyers, and banks, among others.

Once you start the game it’s hard to stop. In our country of hungry consumerism, low interest rates also tempt people to stop saving altogether. In fact, they start to borrow at low interest rates and to “cash-out refinance” so they can buy goods they’ve always wanted (but really can’t afford)—a new SUV, a cruise, a Jacuzzi on the back deck, expensive shoes. How do they do most of their borrowing? In the form of credit cards. This is good news for the credit companies as well as the companies servicing the credit companies—including not just credit card equipment makers but credit counselors and the debt collection companies.

It is no coincidence that the stock of American Express grew steadily in these five years, almost doubling in price, and I recommended its stock consistently on Fox News from 2001 to 2003. It’s also no coincidence that Mastercard had a highly successful IPO in 2006, with a nearly 300 percent gain in its stock price.

So now you have drawn yourself a map showing how one trend can spawn so many others. But how can this map be used to make bacon? How does this information help the savvy trend spotter actually make money? Identify publicly traded companies who specialize in the fields that are some degrees separated from an obvious trend source, and consider investing in these companies.

For example, on my AOL blog, I recommended West Corporation in November 2005, back when it was trading just below $40.89. This company collects receivables for other corporations. Knowing that America’s debt was getting out of hand, after being spurred on by the rise in home-equity loans, I believed West Corp.’s collection services would be in increasing demand. Sure enough, in late 2006, West Corp. was bought by Quadrangle, and each investor received $48.75 per share. Someone who had bought $2,700 in West Corp. stock back in November 2005 would have sold at $3,219—for a gain of $519, or nearly 20 percent. Not a bad return for a year!

Take another example. During the housing boom, I invested in New Century Financial, which offers sub-prime residential loans. Sub-prime mortgages are high-risk. They are higher-rate mortgages offered to people with bad credit, and the majority of them come with an adjustable rate (they are often referred to as “ARMs”). As interest rates started to rise, I sold New Century, knowing that the increase would be worst for sub-prime borrowers, who tend to be poorer and who often are unable to shoulder the rise in their ARM. Sure enough, at the time of this writing, many of these people are defaulting on their sub-prime mortgages, and New Century has filed for bankruptcy. I’m glad I got out when I did.

In response to the housing boom, I also bought shares of the high-end retailer Restoration Hardware, which sports attractive—and overpriced—home furnishings and accessories. I also made money in Black & Decker, which was selling all those drills and saws to entrepreneurial contractors and do-it-yourselfers.

One of the great things about buying stocks that rise and fall with the housing market is that it’s a way to “play” the real estate market, without having to spend the money (and take on the mortgage) for actual property. In the end, I made more money in the housing-boom market than most “house flippers” ever imagined—all without ever buying a piece of real estate!

There’s No End to the Six Degrees Game

Once you start thinking this way, you’ll easily spin your own webs of trends. For example, think about demographics. The aging of Baby Boomers means more future health care needs, such as hospitalization, pharmaceuticals, artificial joints, and even ambulance transport. I own stock in Rural/Metro, a small ambulance company based in Arizona—a place full of senior citizens. In time, I am sure that stock will double. I also recommended Sunrise Senior Living in early 2006, right after a delayed earnings announcement caused its stock price to dip. I predicted it would drop from $35 to $25 but then climb back up to $45. Since then, it dropped to nearly $26, but has already come back above $40. Why? Because it is a smart company offering specialized assisted-living services to seniors. With the aging of the U.S. population, I believe Sunrise is destined for decades of strong growth.

Similarly, Cantel Medical produces sterilization and sanitization systems as well as other medical supplies for hospitals, dentists, and doctors. With these products likely to be in greater demand owing to an aging population, it’s no surprise that Cantel’s price rose nearly 25 percent in the six months after I picked it. Then there’s Bio-Reference Lab, which offers clinical laboratory testing services in the Greater New York area. I picked this stock in April 2006, after its price had quadrupled over the previous five years. Despite that growth, I predicted there was still room for more upside for this highly profitable company. Within eight months, the stock price was up another 50 percent.

You may have missed the housing boom or gotten in late on the baby boomer trend, but you can take comfort in the fact that we are about to embark on one of the biggest trends of the past fifty years. This trend encompasses transportation, agriculture, chemicals, manufacturing, biotechnology, and even real estate. I’m referring to the Green Revolution—the developments that will take place in clean technology, alternative energy, and environmental enhancements and remediation. You don’t have to make your money by investing directly in an ethanol plant or in a solar power company. You can invest in John Deere, for example, which will be needed to produce more tractors to help harvest the preferred crop used for biofuel—whatever crop it ultimately turns out to be. Better yet, as more crops are used for fuel instead of feed, the cost of beef and chicken will likely rise and consumers may turn more to other forms of protein, such as fish. So why not look for companies specializing in fish products?

The Green Revolution isn’t the only trend on the horizon. The great part about this game is that it is a tool for constantly identifying new opportunities.

Not Every Company Connected to a Trend Is a Winner

You can play this game to great profit, provided the connections you make in linking one category to another are sound and you select companies in the best positions to thrive from the trend. Don’t assume that just because, say, nails are needed for the home-building boom, Nails and Screws, Inc. necessarily will prove to be a good investment. Don’t throw your money into every company involved in any of the six (or more) degrees separated from a trend. Just because the trend is a winner doesn’t mean a particular company is capable of or positioned for taking advantage of that trend.

There are two crucial things to keep in mind when following all the trend tips I’ll introduce for deciding whether a company you think will be positively affected by a trend is worth pouring your money into:

First, whenever possible, invest in a company you know and like. If you are constantly impressed when you visit a Lowe’s, then it’s likely that others feel the same way. On the other hand, if you find yourself frustrated and dissatisfied when you visit a Home Depot, then I doubt that you are alone. In early 2006, I wrote a scathing AOL blog entry about my experience shopping in a Home Depot, where I could never find anyone to help me with what I was looking for. Most people I know had the same experience. I predicted this would eventually hurt the company, and I was right. Several months later, the stock had dipped nearly 23 percent. To be sure, Home Depot was also hurt by the softening housing market, but its rival Lowe’s, which was hurt by the housing market as well, dropped less and made up more ground faster. In my blog pick, I praised Lowe’s customer service, and I’m certain that quality of service has had much to do with Lowe’s better results.

Next, study the company financials, which you can find painlessly on the internet—both in the company’s own reports to investors and on many reliable financial sites. Remember what I said about always doing your homework. It is important that you educate yourself about how to read a balance sheet and an income statement. It is also important to go to the source. Look directly at the company’s balance sheet, which can be found in its annual report to investors and also on the SEC’s sec.gov website (in the form of the annual 10-K and the quarterly 10-Q filings). There are many good books and online sites that can educate you in the basics of investing and analyzing the strength of a company. In the appendixes you’ll find more information to help you understand the specifics of this analysis.

The key metrics that I examine when assessing a company are the company’s financial fundamentals, profitability, rate of growth, stock value, and management. Here’s a quick overview of rules of thumb to follow.

BASICS OF ASSESSING THE STRENGTH OF A COMPANY

- Financia...