![]()

CHAPTER 1

Taking Stock of Yourself

Many retirees fear the stock market. They see it as a rich man’s playground filled with nefarious characters and suspect institutions. They are right. Unfortunately, it is also the best place to invest their money. If you want to achieve reasonable returns, you must be in the stock market; anywhere else—banks, brokers, government—there will be so many people skimming off the top, your profits will barely cover inflation.

I’ll Never Be Able to Understand the Stock Market . . . Will I?

When President Franklin Roosevelt declared, “The only thing we have to fear is fear itself,” he wasn’t talking about the stock market. He was talking about the economy. The economy was a huge complex of entanglements that began to unwind in 1929, and no one knew how to put it back together. The same is true of the stock market: It is a complex entanglement of seemingly rational and irrational price swings. The torrent of information swirling around this capitalist invention is overwhelming. Yet, if you cut through the nonsense and focus on the fundamental forces driving it, it is simple, understandable, and considerably less scary.

There is no magic in the stock market, but there is something more important and more honest—a predictable set of behavior patterns. Understanding them will allow you to control your fears and discover your own unique road to success. Investing is not really about the stock market, the companies it represents, or the evildoers it attracts; it’s about you. Investing is a very personal matter. Once you understand yourself, and it, you will succeed.

Every retiree should play the stock market game, but not everyone will. Some will take their money and go home, hoarding it in coffee cans and under mattresses for fear someone will steal it. While it may be safe from someone, in the end, something will steal it: inflation.

Others will place it in bank accounts and Certificates of Deposit where it is safe from both thieves and inflation. Thus, they have no fear of losing, but no hope of winning. This strategy demands little and yields less.

Players who want more put their money in the stock market. But to make more they must do more. They must learn, then practice what they have learned. Most important, they must know what game they are playing. The stock market is not a single game; it is three different games. Smart players choose the one game they can win, the game they are good at. This reduces their risk, subdues their fear, and raises their confidence level. Risk, fear, and confidence are part of each game. Manage them, and you are on your way to a profitable stock market experience.

The Games People Play

If you want to be a player in the stock market, you better know what game you are playing. While there is only one stock market, there are three games and three kinds of players. They are:

1. Investing

2. Trading

3. Speculating

The most important consideration in choosing a game is you. Who are you? Are you patient, analytical, and logical? Maybe you are impatient, decisive, and self-confident. Perhaps you are none of these. Maybe you’re just somebody who wants to win big without the spreadsheets and fancy charts. Well, if one of those fits you, you are in luck. The stock market awaits.

Investing—A Game of Fundamentals

When most people think about the stock market, they think about investors. While it is true many of the players in the market are investors, many are not. It is crucial we understand the difference between an investor and the other market players.

What Is Investing?

When you invest in the stock market, you are actually buying part ownership in a company. As an owner, you share in the prosperity of the company. If the company grows, the value of your stock grows. If the company is profitable, you may receive a share of those profits, which are paid as dividends. Thus, your investment can grow in two ways: stock value and dividends.

Investors are fundamentalists because they look at the business fundamentals supporting a stock’s price. These fundamentals include company sales, profits, growth rates, markets, competition, and government regulations. All of these measures have an impact on the health of the company as well as the value of its stock.

To be a fundamentalist (at least a good one), you must be willing to plow through reams of corporate statistics and management propaganda to get to the truth of a company’s prospects. The future of the company will determine the future of the stock. If the company is growing in sales and profits, the stock will grow in price and dividends. This is the fundamental assumption underlying all investment decisions. Investors analyze the past in order to project the future.

The Character of an Investor

Not all fundamentalists are good investors because not all fundamentalists are patient. Investing is a slow-moving game; patience is key. Read any book on investing and patience will be liberally sprinkled throughout. All stock prices, in time, will reflect the fortunes of their underlying companies. In time means you must be willing to wait for the market1 to catch up to the fundamentals.

Analyzing companies is a rigorous undertaking. One of the fundamentals concerning investors is the price-earnings ratio (P/E). The price-earnings ratio is determined by taking the amount of earnings a company produces in a year and dividing it by the number of its shares of outstanding stock, SO. This result is the earnings per share EPS. The EPS is then divided into the price of the stock to get the P/E (price ÷ EPS = P/E). If this is too much math for you, investing is not your game.

While P/E is an important factor when it comes to investing, there are others. You’ll need to understand the other important fundamentals such as debt loads, cash flow, net margins, return on assets, price-to-sales ratio, sales growth, and strategic advantage. An investor needs to analyze all these elements in a logical and systematic manner in order to discover why a stock’s price changes. If all these business metrics are a mystery to you and learning them leaves you cold, set your sights on a different game.

Once you have determined a company has a prosperous future, you buy, and you hold. Holding stock is where the patience comes in. You have done all the heavy lifting. Now you must restrain yourself from reacting to the “wiggles and waggles” (as investor and author Peter Lynch2 called them) of the stock’s price. You are looking for long-term gains, not daily or weekly profits. Unless something changes in the fundamentals, there is no reason to sell. Over the past 100 years, the stock market has returned an average of 10–12 percent each year, but it hasn’t returned 10–12 percent every year. Along the road to that 10– 12 percent average, it has had many short-term fits and starts. You’ll need the patience and courage to ignore these wiggles and waggles.

The successful investor’s strategy is buy value, not price. Buying value requires a logical approach to the stock market backed by a mathematically rigorous analysis of the targeted company. Add the courage to ignore the stock market’s irrational price gyrations and the patience to wait for it to catch up to your analysis, and you have the makings of a successful investor.

Is Investing a Winning Game?

To answer that question, let’s look at Hansen Beverage. Hansen produces a line of health-conscious juices, teas, and sodas. Its reported sales at the end of 2003 were $110.4 million, with profits of $5.9 million. The price of the stock at that time was $5 per share. By the end of 2004, its sales increased to $180.3 million (63.3 percent) and its profits increased 245.8 percent to $20.4 million. The price of the stock increased to $18 per share (260 percent). Given the promising product line of health drinks and its history of sales growth, an investor might buy the stock at the end of 2004 ($18).

Would that have been a winning play? Absolutely! At the end of 2005, Hansen’s sales continued to increase to $348.9 million (93.5 percent) and profits increased to $62.8 million (207.8 percent). The price of the stock also increased to $80 per share (344.4 percent). A retiree investing just $5,000 of his nest egg in Hansen would have $22,222 within a year.

Trading—A Game of Agility

Investing is all about why a stock does what it does, but stocks don’t always do what they should. They often do what the market wants them to do. When that happens, stock prices sometimes go up when they should go down, and down when they should go up. For times like these, we have traders.

What Is Trading?

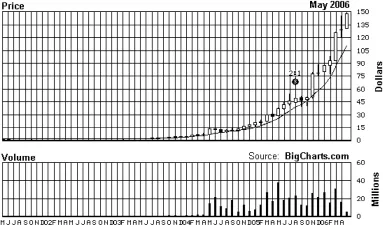

Traders (or chartists) don’t care why a market does what it does or does what it shouldn’t; they are only concerned with what it does and when it does it. To discover this what and when, chartists look to the stock chart to spot price movements. Figure 1 is the stock chart for Hansen Beverage.

FIGURE 1: Stock Chart for Hansen Beverage (HANS) — Five year Monthly. The stock chart is actually two charts. The top chart measures the periodic changes in price. The bottom chart measures the amount of shares traded in each period. The charts can present different timeframes and periods. This chart is a five year timeframe with monthly periods.

Chartists have their own buy/sell signals. The most powerful is the trend. Once a stock begins a trend, the chartist buys (uptrend), sells (downtrend), or waits (sideways trend). These trends and other buy/sell signals control the entrance and exit of traders into the stock market.

Unfortunately, these trends can be fleeting or fitful, providing chartists with an abundance of false signals.3 No sooner does our poor chartist buy (or sell), than the stock reverses. Woe is her. She uses agility to protect herself from this market volatility, but agility is not enough; she wants confirmation her signal of choice is valid. Higher volume of shares traded provides confirmation. The increased volume suggests a large number of players have bought the shares. She doesn’t know why, she only knows they have, and this makes her confident it is okay to join the crowd.

Confirmation also comes in the form of an elaborate system of technical indicators like the MACD, DMI, RSI, OBV, etc.4 These are mathematical manipulations of those basic indicators, price and volume. They are designed to clarify the trends and movements of the stock’s price. They make it easier for the trader to see what the stock is doing.

The Character of a Trader

Traders are the jackrabbits of the stock market—quick to move and easily spooked. Their agility is their strength; they use their vast array of technical indicators to signal when it is time to buy and sell stocks. Thus, they must be unquestioning, confident, committed, decisive, and focused. Yet, they can be fearful, paranoid, hesitant, undisciplined, and simplistic.

Note the contradictions: confident–fearful, decisive–hesitant, focused–undisciplined. The strength of trading is it is a system designed to overcome these contradictions. For instance, trading allows an undisciplined person to be successful in the stock market because he buys based on a set of disciplined signals. He doesn’t have to analyze the company, understand business, or anticipate customer preferences. He only has to watch the chart and react to the signals.

Yet, if the trader is undisciplined and doesn’t follow where the technical indicators lead, success will elude him. Therein lies the contradictions: He can be paranoid when it comes to the markets, but he must trust in the indicators. He can be too...