eBook - ePub

Investing in a Volatile Stock Market

How to Use Everything from Gold to Daytrading to Ride Out Today's Turbulent Markets

This is a test

- 100 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Investing in a Volatile Stock Market

How to Use Everything from Gold to Daytrading to Ride Out Today's Turbulent Markets

Book details

Book preview

Table of contents

Citations

About This Book

Unsinkable Stocks provides readers with detailed strategies on how to best protect and increase their investment portfolio against the vagaries of turbulent markets and economies. It includes information about the equities, bonds, fund, commodities, real estate, and other investment opportunities and how to organize them into a cogent plan to keep solvent and prosper in today's unpredictable market.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Investing in a Volatile Stock Market by Lita Epstein in PDF and/or ePUB format, as well as other popular books in Personal Development & Personal Finance. We have over one million books available in our catalogue for you to explore.

Information

Topic

Personal DevelopmentSubtopic

Personal FinanceChapter 1

The Right Investment Strategy

Start with the premise that to be successful in any market you need to have a clear idea of which way it’s going to move. But are we talking about changes in the short run or the long run? The answer lies in what kind of trader you are.

If you’re a day trader, you need to think of the direction the market will go during the next twenty-four hours, but if you’re a value investor you’re not that worried about that day’s market moves. A value investor looks for cheap stocks that he or she believes have been beaten down and will likely recover, but that may not be for several years or more. So for value investors, it’s the longer-term horizon for their portfolio that matters. For all investors the first thing you must decide is the time horizon for your investment.

While I don’t believe anyone can perfectly time the market, there’s no question that you can follow the ups and downs and decide when it’s right to sell a security or to add to your holdings. That decision will be different for everyone depending upon his or her style of investing. The key is to follow the old adage, “Buy low and sell high.”

Don’t Buy High and Sell Low

Unfortunately, many people buy high and sell low. Too often novice investors jump into the market when they think it’s safe. They see that the market has been going up for awhile and the bulls are running. By that time these novice investors don’t know that the market may soon be due for a correction. They buy into the market near a high and then panic when the correction occurs — often selling at a loss. The savvy investor will hold on through a correction — if they didn’t sell before the correction happened. The key thing to always remember is that you don’t have a loss in the stock market until you sell. If you hold and wait for the next recovery, you’ll never realize that loss. But it does mean you must have the patience and the guts to wait out the recovery.

Sadly, not all stocks will recover. Sometimes you will need to take a loss, especially if some devastating news comes out about a stock or other security you hold, such as the news that impacted Enron stockholders when Enron collapsed in 2001 or when Lehman Brothers collapsed in 2008. When a stock you hold takes a nosedive in price, you must determine whether it’s a temporary setback driven by the market conditions or if it reflects negative news that could be a permanent loss in the value of the stock.

- If you think your stock fell because of general market news but it’s still a good investment, don’t rush to sell at a loss.

- If you believe the company has significant problems and you don’t want to stick around, take the loss and find a better place for your money.

In this book I introduce you to the various investing styles, from buy-and-hold value investing to momentum trading to rapid day trading. I explore the strategies for keeping your portfolio 100 percent safe with cash to looking for alternatives to stocks, such as gold and foreign currency as possible safety strategies. I also discuss strategies you can use for your portfolio depending upon the styles of investing you feel most comfortable implementing.

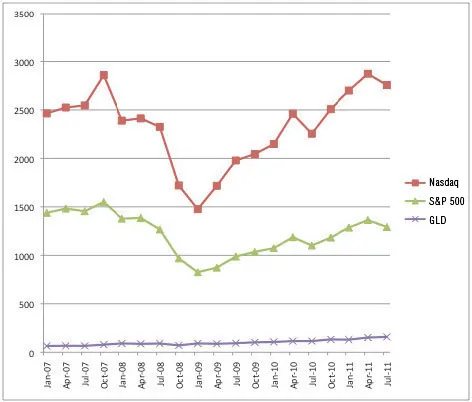

Nasdaq vs. S&P 500 vs. Gold Prices as of 1st of Quarter, January 2007 to July 2011

This chart shows how volatile stocks have been on a quarterly basis versus the Gold ETF, GLD, between the periods of January 2007 through July 2011. Gold has stayed on a slow but steady climb while lines for both Nasdaq and the S&P 500 look like roller coasters.

Know Thyself

Before you even think about an investing style, you need to consider your investing temperament and risk-taking ability. If you’re the type of person who easily panics when the market goes down or someone who just can’t sleep at night if your portfolio loses money, you need to seek safety. You can do that with cash or cash equivalents. You may also want to consider bonds to add a bit of growth to your portfolio. Even cash investment comes with risk — the risk that inflation will eat up your money. We’ll take a closer look at seeking safety in cash in Chapter 3.

Be Aware of Your Risk Tolerance

Only you can know when a particular investment or trading strategy is too risky. If you can’t watch the ups and downs of the marketplace without getting sick to your stomach, you’re best off not getting into this volatile market.

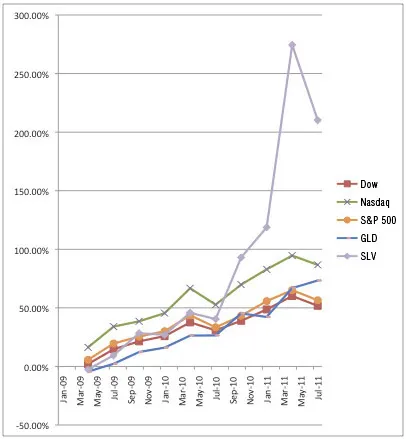

Many people with an appetite for a bit more risk have found safety in gold. No doubt they’ve done well. Between the market bottom in February 2009 and September 2011, the gold ETF GLD climbed from $92.63 per share to $158.06 per share. That’s a 70.6 percent increase in thirty-one months. Silver did even better, rising 124 percent in that same period. Sounds great doesn’t it? In Chapter 4 we’ll look at the pros and cons of gold investing, as well as other commodities.

Other investors seek to try their hand at foreign exchange trading (Forex). Currencies that attract people seeking safety include the Canadian dollar, the Swiss franc, and the Japanese yen. We’ll talk about the world of Forex trading in Chapter 5.

Now you might think that you want to stay away from stocks in this volatile market place, but you’re wrong. Those investing in stocks even in a wildly swinging market have seen incredible gains. Between February 2009 and September 2011, the Nasdaq climbed more than 75 percent, while the S&P 500 rose 54 percent. Not bad, right?

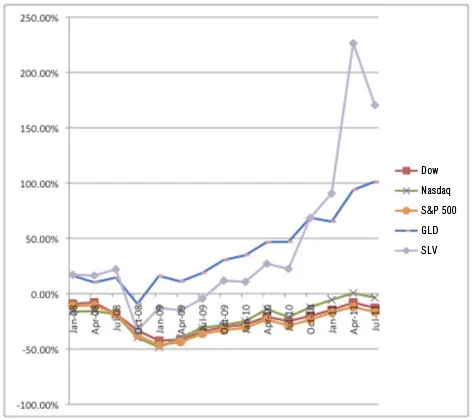

Percentage Growth/Loss Since Stock Market Top, October 2007

While gold (ETF GLD) and silver (ETF SLV) rocket up after the market tops off in October 2007, stocks continue to stay in negative territory as a percentage of growth from what was the top of the market in October 2007. So if you were someone who bought stock in October 2007 or just before that time you probably are still sitting on a loss.

Percentage Growth Since Stock Market Bottom, January 2009

All is not bad news for the stock investor. While silver definitely takes the prize for growth since January of 2009, which was near the bottom of the current marketplace, stocks have shown respectable growth as well.

Exploring Stock Investing Styles

In this book I focus on three different types of stock investing styles that can work well in a volatile market. The first is momentum trading (see Chapter 6). This type of investing includes holding stocks for as little as a few minutes to as long as several months or maybe even a year or more. The length of time you hold a trade will depend on your temperament as well as where you believe the stock is headed.

The second type of stock strategy I discuss is value investing (see Chapter 7). This is the right approach if you’re looking for cheap stocks — stocks that have been beaten down but you believe have a good chance of recovery. That recovery period is likely to be more than one year and could be as long as five or ten years. You must be someone with a lot of patience and be able to live with the risks of a contrarian investor — that you’ll see a loss before you see a gain. The master of value investing is Warren Buffett.

If you’re someone who wants to try to tap into the growth of the market, but don’t want to take the risk of holding on to stocks overnight, you may want to learn more about day trading. While I’m not a big fan of this type of risky investing, I will introduce you to the basics in Chapter 8.

Consider Allocating Your Portfolio

The best way to navigate a volatile market is to pick several strategies and allocate your portfolio among them depending on risk tolerance. I talk more about how to do this in Chapter 9.

Now it’s time to start your journey exploring this volatile world of investing.

Chapter 2

Volatility: The New Normal

Flash crashes, where we see drops in the Dow Jones Industrial Average of 400 to 1,000 points in a day, seem to be happening more often, but just as fast we’re seeing upswings of the same amount. The Dow has swung from a high of 14,165.02 on Oct. 10, 2007, to a low of 6,764.81 on March 6, 2009 before beginning a long climb back. That’s a whopping 7,400.21-point difference.

This massive change in the Dow between the end of the boom and the lowest point in the Great Recession illustrates a point. If you were one of the unfortunate ones who bought near the top of the Dow in 2007, then ra...

Table of contents

- Cover

- Title Page

- Contents

- Introduction

- Chapter 1. The Right Investment Strategy

- Chapter 2. Volatility: The New Normal

- Chapter 3. Seeking Safety in Cash, Cash Equivalents, or Bonds

- Chapter 4. Counting on Gold and Other Commodities

- Chapter 5. Trading Forex for Growth or Safety

- Chapter 6. Riding the Ups and Downs with Momentum Trading

- Chapter 7. Looking for Buys with Value Investing

- Chapter 8. Getting Out of the Market Daily with Day Trading

- Chapter 9. Next Steps for Building Your Portfolio: Allocate It!

- Also Available

- Copyright Page