![]()

PART I

EXCHANGE RATE ECONOMICS

Theoretical

![]()

Chapter 1

Chaos in the Dornbusch Model of the Exchange Rate

Paul De Grauwe and Hans Dewachter

1.Introduction

Ever since the empirical breakdown of (linear) structural exchange rate models, the predominant view on exchange rate dynamics has been based on the “news” model. In this model the only sources driving the exchange rate are random events.1

Recent research has revealed some problems with the “news” model. First, there appears to be more structure in the time series of the exchange rate than the pure stochastic model can account for. This additional structure has been found in most exchange rates. See, for example, Cutler, Poterba and Summers (1990) who report significant autocorrelations in the exchange rates at different lags.

Second it appears that many, if not most, movements in the exchange rates cannot easily be accounted for by observable “news.” In an analysis of high-frequency exchange rate data, Goodhart (1990) documents that very often the exchange rate does not respond to observable news, and that many exchange rate movements cannot be associated with news.

This recent empirical research suggests that in addition to random shocks, there are other driving forces in the exchange market that are important to understand its dynamics. In this paper, we will focus on a (non-linear) speculative dynamics, in which the behavior of “chartists” and “fundamentalists” plays a prominent role. The analysis will be performed in the context of a structural model, the Dornbusch model, which has become the most popular textbook model of the exchange rate.2 It will be shown that this model together with a simple non-linear speculative dynamics is capable of generating a complex behavior of the exchange rate which is unpredictable, even in the absence of random shocks. Such behavior has been called “chaotic.”3 In addition, the model will be used to analyze the behavior of the exchange rate when random events (“news”) occur with low frequency.

The remainder of the paper is organized as follows:

In Section 2, we present the model. Section 3 reports the basic properties of the model. It will be shown that the model is able to generate chaotic motion. In Section 4, we report the results of monetary policy shocks. Section 5 points out the importance of low-frequency stochastic shocks for some regions in the parameterspace of the model. Finally, Section 6 briefly discusses the properties of the price level and the interest rate.

2.The Model

2.1.The Dornbusch Model

The version of the Dornbusch model that will be used in this paper consists of the following building blocks:

a) The money market equilibrium condition

where Pt is the domestic price level in period t, rt is the domestic interest rate, Mst is the (exogenous) money supply, Yt is the (exogenous) level of domestic output.

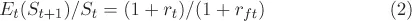

b) The open interest parity condition

where St is the exchange rate in period t (the price of the foreign currency in units of the domestic currency), Et(St+1) is the forecast made in period t of the exchange rate in period t+l, rft is the foreign interest rate.

2.1.1.Goods market equilibrium

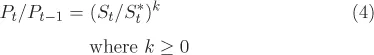

The long run equilibrium condition is defined as a situation in which purchasing power parity (PPP) holds, i.e.:

where

is the equilibrium (PPP) exchange rate,

the foreign and

the domestic steady state value for the price level in period

t.

The short-term price dynamics is assumed to be determined as follows:

That is, when the exchange rate exceeds its PPP-value,

, the domestic price level increases. Put differently, when the currency is undervalued this leads to excess demand in the goods market tending to increase the price level. The opposite occurs when the exchange rate is below its PPP-value (an overvalued domestic currency). Note that we assume full employment so that adjustment towards equilibrium is realized through price changes.

2.2.The Speculative Dynamics

We assume that there are two classes of speculators. One class is called “chartists,” the other “fundamentalists.” See Frankel and Froot (1986) for a first attempt at formalizing this idea. A recent microeconomic foundation of this assumption is provided by Cutler, Poterba, and Summers (1990). Empirical evidence about the importance of these types of speculators is found in Allen and Taylor (1989) and Frankel (1990).

The “chartists” use the past of the exchange rates to detect patterns which they extrapolate into the future. The “fundamentalists” compute the equilibrium value of the exchange rate. In this model, this will be the (steady state) PPP-value of the exchange rate. If the market rate exceeds this equilibrium value they expect it to decline in the future (and vice versa). Another way to interpret this dual behavior is as follows. The “chartists” use the past movements of the exchange rates as indicators of market sentiments and extrapolate these into the future. Their behavior adds a “positive feedback” into the model.4 As will become clear, this is a source of instability. The fundamentalists have regressive expectations, i.e., when the exchange rate deviates from its equilibrium value they expect it to return to the equilibrium. The behavior of the fundamentalists adds a “negative feedback” into the model, and is a source of stability.

A second feature of the speculative dynamics assumed in the model is that the weights given to “chartists” and “fundamentalists” are made endogenous. More specifically, it will be assumed that when the exchange rate is close to the equilibrium (fundamental) rate, the weight given to the fundamentalists is at its lowest, whereas the chartists then have a maximal weight. When the market rate deviates from the equilibrium rate, the weight given to the fundamentalists increases with that deviation. That is, when the exchange rate continues to deviate from its fundamental value, fundamental analysis becomes increasingly important. There comes a point that it will overwhelm technical analysis in forecasting future exchange rates.

This assumption can be rationalized by introducing the idea that expectations made by fundamentalists are heterogenous, i.e., each fundamentalist makes a different calculation of the equilibrium rate (see also Cutler, Poterba and Summers, 1990). If we assume that these calculations are normally distributed around the true equilibrium rate, we can conclude that when the market rate is equal to the true equilibrium rate, the high and low forecasts made by fundamentalists will offset each other (so that also their buy and sell orders will be offsetting). As a result, when the market rate and the fundamental rate coincide, the fundamentalists have a low weight in determining the movements of the exchange rate. These then will be dominated by the chartists. When, however, the market rate starts deviating from the fundamental rate, say it increases, those who have made a low forecast for the equilibrium rate will increasingly dominate the market. If the market rate has increased sufficiently, all fundamentalists will consider that market rate to be too high, and will expect it to go down in the future. Their weight in the formation of market expectations will be high, so that the weight given to the chartists becomes correspondingly small.

We now implement these two assumptions about the speculative dynamics as follows. We write the change in the expected future exchange rate as consisting of two components, a forecast made by the chartists and a forecast made by the fundamentalists:

where Et(St+1) is the market forecast made in period t of the exchange rate in period t + 1; Ect(St+1) and Eft(St+1) are the forecasts made by the chartists and the fundamentalists, respectively; mt is the weight given to the chartists and 1 – mt is the weight given to the fundamentalists.

We assume that the chartists extrapolate recent observed exchange rate changes into the future, using a moving average procedure, i.e.:

where the coefficients d, e, and f are the weights of the moving average.

Admittedly this is a very crude assumption, and chartists typically use more sophisticated rules (in our further research we hope to study the implications of using more sophisticated chartists’ forecasts). The use of simple rules, however, is not necessarily a disadvantage if we can show that ...