![]()

Part 1

THE CONCEPT OF RISK AND

THE ENTERPRISE RISK

MANAGEMENT

![]()

Chapter 1

THE CORPORATE RISK

Oliviero Roggi

Definition of Risk and Uncertainty for Business Purposes

Every corporation as decision maker is naturally subjected to uncertainty and risk of future events. To date, neither logical reasoning nor esotericism has been able to eliminate uncertainty regarding the future. Scholars and practitioners have developed sophisticated models for simulating the future, but none of them have been able to eliminate the uncertainty that is intrinsic in the human condition.

Because uncertainty and risk are the central concepts of this book, there is a need to provide logical and epistemological boundaries of the above mentioned concepts.

Currently, as we will see in this chapter, there is no consensus for a formal definition of risk that includes the complexities of the concept. As such, there is no agreement on the relationship between the concept of risk and uncertainty. Finance scholars from different schools, who are interested in the risk phenomenon, have tried to provide a general definition of risk and uncertainty.

Risk and Uncertainty Concepts at Work in Finance

At the beginning of the last century, A. H. Willet in The Economic Theory of Risk and Insurance, tried to give more content to the definition of risk and uncertainty by illustrating the relationship existing between the two concepts: “Risk and uncertainty are objective and subjective aspects of apparent variability in the course of natural events” (Willet, 1901, p. 24). Furthermore, in trying to offer a better illustration for the difference between the two concepts, he stated

“… It seems necessary to define risk with reference to the degree of uncertainty about the occurrence of a loss, and not with reference to the degree of probability that it will occur”. Risk in this sense is the objective correlative of the subjective uncertainty. It is the uncertainty as embodied in the course of events in external world, of which subjective uncertainty is a more or less faithful interpretation” (Willet, 1901, p. 8).

Frank Knight, in Risk, Uncertainty and Profit, (1921, p. 26) introduces additional elements to the distinction between risk and uncertainty.

“Uncertainty must be taken in a sense radically distinct from the familiar notion of risk, from which it has never been properly separated. The term “risk”, as loosely used in everyday speech and in economic discussion, really covers two things which, functionally at least, in their causal relations to the phenomena of economic organization, are categorically different. The essential fact is that “risk” means, in some cases, a quantity susceptible of measurement, while at other times it is something distinctly not of this character; and there are far-reaching and crucial differences in the bearings of the phenomenon depending on which of the two is really present and operating. It will appear that a measurable uncertainty, or “risk” proper, as we shall use the term, is so far different from an unmeasurable one that it is not in effect an uncertainty at all. We shall accordingly restrict the term “uncertainty” to cases of the non-quantitative type. It is the true uncertainty and not risk, as has been argued, which forms the basis of a valid theory of profit and accounts from the divergence between actual and theoretical competition”.

Knight uses Willet’s theory in which he treats the two concepts independently from each other and states the measurability of risk as opposed to the determinability of uncertainty.

Other authors, such as Archer and D’Ambrosio, echo Willet, specifying the concepts of risk as:

“certainty is the perfect knowledge of a future variable, risk is defined by the objective probability of a variable arising, uncertainty is, according to them, the consequence of attributing a subjective probability of an event occurring” (D’Ambrosio and Archer, 1967).

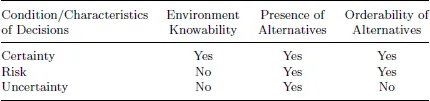

More recently (Roggi, 2009; Gifford, 2010)1 clarified how certainty, uncertainty and risk are applicable to business decisions in terms of the three essential characteristics of a decision:

(1) “Knowability”2 of the environment in which the decision is made;

(2) Presence of alternatives;

(3) Orderable (ranking) alternatives.

According to Roggi (2009), deciding under conditions of certainty means operating under circumstances where the environment is known, there are alternatives for reaching the objective and the alternatives are orderable.

Decisions under conditions of risk are characterized by an imperfect knowledge of the environment and exhaustive identification of the alternatives. In this case, the order is determined through the attribution of a function of objective probability of the stochastic variable.

Decisions under conditions of uncertainty are recognized from their failure to satisfy the first and third characteristics, that is, neither the environment nor the order of alternatives are known. Uncertainty is a type of future event and it derives from an imperfect knowability of alternatives and inability of ordering them (Knight, 1921). In this case, for assessment, the decision makers must rely on the subjective distributions of future manifestations of the stochastic variable (see Table 1.1).

However, in the finance literature, the distinction between risk and uncertainty has been lost to the point that the two terms are often used as synonyms. This confusion probably derives from the fact that the probability function once assessed either with objective or subjective methods, the variability is explained with the same statistical tools (sigma, beta, standard deviation, variance, skewness, kurtosis, etc).

Table 1.1: Decisions and Conditions of Certainty, Risk and Uncertainty.

Source: Roggi (2009).

Risk Measurement: Sigma and Beta General Indicators

Over the years, risk measurement has acquired sophisticated models that refer indirectly to the two general indicators described below: the sigma factor and the beta factor.

The Sigma Factor and the Characteristics of Frequency Distribution of Corporate Earnings

The study of probability distribution allows the calculation of the first indicator known as the sigma factor used for risk assessment. The sigma factor (σ) or total risk is measured by the mean square deviation and/or the variance. In addition, the mean, mode and median and kurtosis are associated with this measurement in order to complete a correct reading for the total risk.

Generally in finance, in order to describe the risk of a random variable such as yield, it is necessary to identify three groups of summary and characteristic indicators. These are represented by:

— Position indicators;

— Risk (or dispersion) indicators;

— Shape and symmetry indicators.

All these indicators contribute to the illustration of risk assumed by a decision maker.

In fact, it would certainly be partial to base the decision by only observing the position indicator: the mean for this context will be named “expected value”3 or “mathematical expectation”.

Besides the mean, other characteristics of the frequency distribution are needed. It will be necessary to calculate the dispersion around the mean of the possible earnings and other characteristics mentioned in following pages.

Position indicators (measures of central tendency)

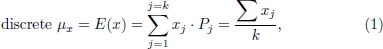

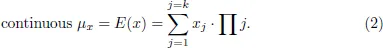

The primary indicator is represented by the expected value: the weighted average of the possible values assumed by the variable, where weight coefficients are represented by the probabilities associated with each value. Substantially, it corresponds to the average result that an entity would obtain by repeating to infinity the experiment involving the random variable estimated. Hence, the “expected value,” known as [E(x)], can be defined as the “arithmetic average of the stochastic variable”.

The expected value of the stochastic variable is obtained:

Risk (or dispersion) indicators — sigma and variance

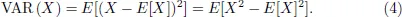

To evaluate yield dispersion around the mean, the concepts of variance and of standard deviation are widely utilized. In statistics, variance is an index of dispersion of the values of a distribution around its mean. It is indicated by the symbol σ2 (where σ is the standard deviation).

And within the scope of descriptive statistics it is:

where µ represents the arithmetic average of the xi values. In the case of a stochastic variable X, variance VAR (X) is defined as:

Beside pure statistical measures, the insurance and banking industries have developed their own specific tools.

The concept of expected maximum loss (EML) has become popular within the scope of risk analysis of a single project and/or an asset portfolio. This measurement estimates the negative effects of divergences from the mean value. It can be defined as the maximum level of loss with the sole exclusion of absolutely exceptional scenarios (Alexander, 1998). This is an assessment of the EML probability, while imposing a certain degree of confidence (normally 1% or 5%).

In comparison to the mean square deviation, which is an indicator of overall risk, there is a significant difference. EML tends to measure only threats and not opportunities offered by the variability of future events. This means that “EML” refers only to the so-called downside risk. A further element of differentiation between the two indicators is represented by the fact that the mean square deviation can be calculated both in the presence of discrete and continuous random variables, while maximum probable loss can be estimated only in the presence of continuous functions. Next to EML, it is also possible to measure an extreme scenario. In that case, EML will be measured and corresponds to the loss occurring in the worst case scenario presented by the analyst. This scenario has infinitesimal probabilities of becoming true (for instance, in the “worst case scenario” for a fir...