![]()

PART I

NEW FINANCING METHODS

![]()

CHAPTER 1

CROWDFUNDING

Crowdfunding is a financing technique that uses online social networks linked to a web internet-based platform to raise capital. In this chapter, we will discuss so-called “retail crowdfunding.” This involves using social networks to raise capital from the general public either without selling any investment securities or, effective May 16, 2016, by selling investment securities to both non-accredited investors as well as accredited investors pursuant to a registration exemption contained in Section 4(a)(6) of the 1933 Act. In the next chapter, we will discuss crowdfunding as well as other marketing methodologies which permit sales of investment securities solely to accredited investors pursuant to a registration exemption contained in Rule 506(c) under the 1933 Act (so-called “non-retail crowd-funding”). In contrast to retail crowdfunding discussed in this chapter, Rule 506(c) permits unlimited amounts of funds to be raised but limits sales solely to accredited investors.

Effective May 16, 2016, there are now two forms of retail crowdfunding:

•Crowdfunding where the reward to contributors does not include investment securities (“non-securities crowdfunding”), which can raise unlimited amounts of funds and is not subject to the restrictions on securities crowdfunding discussed in this chapter.

•Crowdfunding under Section 4(a)(6) where the reward to contributors includes investment securities (“securities crowdfunding”), which can raise up to $1 million every 12 months and is subject to the restrictions discussed in this chapter.

In this chapter, we will examine two successful non-securities crowd-funding examples in order to better understand how securities crowd-funding will operate in the future. The two examples of non-securities crowdfunding are Pebble Watch, which raised over $10 million, and SCiO, which raised close to $3 million.

The purpose of studying these two examples of non-securities crowd-funding is to make it clear that companies can engage simultaneously in both non-securities crowdfunding and securities crowdfunding under Section 4(a)(6). Therefore, the total fundraising need not be limited to $1 million every 12 months. The significant expense and limitations on securities crowdfunding under Section 4(a)(6), which are explained in this chapter, do not apply to non-securities crowdfunding. Moreover, non-securities crowdfunding avoids potential dilution to the equity ownership of the entrepreneur and can, in certain cases, result in interest by venture capitalists as well as potential buyers for the business. Having a large number of retail equity investors in a business as a result of Section 4(a)(6) crowdfunding, can actually be a negative factor in attracting venture capital firms and other professional investors.

U.S. SECURITIES CROWDFUNDING

Prior to the JOBS Act and the Securities and Exchange Commission’s (“SECs”) securities crowdfunding rules, investment securities could not be part of the reward for crowdfunding contributors. That has now changed.

SEC rules, effective May 16, 2016, permit eligible issuers to sell up to $1 million1 in investment securities through crowdfunding under Section 4(a)(6) during any 12-month period, computed as discussed in this chapter. The business must be owned by an entity organized under, and subject to, the laws of a state or territory of the United States or the District of Columbia, among other requirements.

However, there is nothing in the rules to prevent an international company from forming a U.S. company with its principal offices in the U.S. The SEC declined to impose any limitation on the use of crowdfunding proceeds. Therefore, the funds raised through securities crowdfunding could then be used to finance international operations. However, the SEC Staff will likely require that the company’s officers, partners or managers primarily direct, control and coordinate the company’s activities from the principal office in the U.S.

The transaction must be conducted through an intermediary qualified under Section 4A(a) of the 1933 Act, which is either a registered securities broker (“registered broker”) or registered funding portal, and the transaction must be conducted exclusively through the intermediary’s “platform.” The term “platform” means an Internet website or other similar electronic medium through which a registered broker or a registered funding portal acts as an intermediary in a transaction involving the offer or sale of securities in reliance on the securities crowdfunding exemption. The issuer must also comply with the disclosure requirements hereafter mentioned (described in Section 4A(b) of the 1933 Act) and other applicable provisions of the Section 4(a)(6) securities crowd-funding statutory provisions and rules.

Sales may be made through the intermediary to any investor, whether or not they are an accredited investor. However, the total amount sold to any single investor (including accredited investors) across all issuers (as defined hereafter) in reliance on the Section 4(a)(6) securities crowd-funding exemption (Section 4(a)(6)) during the 12 months preceding the Section 4(a)(6) transaction, including the current sale, must not exceed:

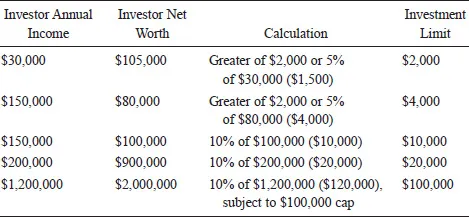

•If either the annual income and net worth of the investor is below $100,000,3 the total amount sold to that investor may not exceed the greater of $2,000 or 5% of the lesser of the annual income or net worth of that investor; or

•if both the annual income and net worth of the investor are $100,000 or more,4 the total amount sold to that investor may not exceed 10% of the lesser of the annual income or net worth of that investor, subject to a $100,000 cap.5

The SEC has provided the following examples of how to compute the investment limit which appiles to the aggregate amount of securities sold to any investor under Section 4(a)(6) within a 12-month period across all issuers relying on Section 4(a)(6).6

Table 1.1 Investment Limits

A natural person’s annual income and net worth may be calculated jointly with the annual income and net worth of the person’s spouse.7 However, when a joint calculation is used, the aggregate investment of the spouses may not exceed the limit that would apply to an individual investor at that income or net worth level. The company is permitted to rely on the intermediary to ensure that investor limitations are not exceeded, provided the issuer does not know that the investor has exceeded those limits or would exceed the investor limits as a result of purchasing the securities.

The term “issuer” includes all entities controlled by or under common control with the company, including their respective predecessors. Therefore, in computing the $1 million limitation, sales by subsidiaries or predecessors of the company will count against that limitation.

The term “securities” includes promissory notes, common stock and preferred stock of corporations and equity interests in limited liability companies, limited partnerships, and other entities. In addition, the term “securities” includes warrants or other rights to purchase stock or other equity interests, guarantees, and a variety of other arrangements which may constitute an “investment contract.” The U.S. courts have interpreted the term “investment contract” very broadly and, in general, it includes any arrangement in which there is an investment of funds in a project where the profits arise solely or primarily from the efforts of others.

As noted, the SEC rules permit the same company to engage in both securities and non-securities crowdfunding simultaneously and the non-securities crowdfunding does not count toward the $1 million dollar limit. By engaging in both forms of crowdfunding, a company could raise substantially more than $1 million within a 12-month period.

The use of crowdfunding with securities as rewards under Section 4(a) (6) is very new and it may take some time for the funding techniques to be fully developed. Therefore, it is important to understand how crowdfunding worked before the SEC permitted securities to be issued by crowdfunders.

U.S. NON-SECURITIES CROWDFUNDING

Crowdfunding platforms exist in approximately 30 countries throughout the world, with the U.S. having by far the most platforms.8

The most successful non-securities crowdfunder was neither Pebble Watch nor SCiO. Ryan Grepper, age 39, raised a whopping $13.28 million from 62,642 backers in mid-2014 for what he called the Coolest Cooler, a new kind of cooler which comes with a built-in blender, waterproof Bluetooth speaker, USB charger and a predicted price tag of $399.9

It is not necessary to raise a enormous amount of money through crowdfunding in order to create a valuable business. Palmer Luckey, at age 19, raised $2.4 million from Kickstarter in non-securities crowdfunding in 2012 for his Oculus Rift, a new type of virtual reality headset. Between 2012 and 2013, his entity received private equity financing. On March 25, 2014, Facebook acquired Oculus Rift for $2 billion.10

According to the Massolution, 2015CF Crowdfunding Industry Report (“Report”)11 prior to the adoption of the Section 4(a)(6) crowd-funding rules, crowdfunding was generally lending-based, reward-based, donation-based, lending-based, royalty-based, equity-based (outside the U.S.), and hybrid.12 The Report states that reward-based crowdfunding is a model where funders receive a “reward,” such as a token or a manufactured product sample, and it defines donation-based crowdfunding as a model where funders donate to causes that they want to support, with no expected compensation or return on their investment. Lending-based refers to peer-to-peer lending. According to the 2015 Report, approximately $1.6 billion in financing was raised worldwide through crowdfunding platforms during 2014, with over half of that amount raised in the U.S.

More than a decade before the passage of the JOBS Act in 20...