From Trade Surplus To The Dispute Over The Exchange Rate: Quantitative Analysis Of Rmb Appreciation

Quantitative Analysis of RMB Appreciation

- 472 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

From Trade Surplus To The Dispute Over The Exchange Rate: Quantitative Analysis Of Rmb Appreciation

Quantitative Analysis of RMB Appreciation

About This Book

Since 2005, China has been accused of causing the trade deficit and manipulating the exchange rate. At the same time, there have been arguments against the RMB appreciation. The reason for this conflict is the lack of quantitative research or elaboration on many extremely important indicators.

To correctly describe the industrial chain and value-added process around the world, it is necessary to identify data by using new methods and separating the processing trade from the non-processing trade based on the Global Trade Analysis Project (GTAP) data. This book establishes a Global Multi-department Computable General Equilibrium (GMCGE) model based on the continuous global input-output database. It focuses on the Computable General Equilibrium (CGE) model that constructs a consistent interaction mechanism within the economic system and fully reflects the general equilibrium characteristics and thus tries to avoid the limitations of the partial equilibrium model. It shows how the GMCGE framework can distinguish the processing trade from non-processing trade in the input-output data, and at the same time ensure the endogenous equilibrium of the social accounting matrix (SAM) after distinction.

Since 2005, China has been accused of causing the trade deficit and manipulating the exchange rate. At the same time, there have been arguments against the RMB appreciation. The reason for this conflict is the lack of quantitative research or elaboration on many extremely important indicators.

To correctly describe the industrial chain and value-added process around the world, it is necessary to identify data by using new methods and separating the processing trade from the non-processing trade based on the Global Trade Analysis Project (GTAP) data. This book establishes a Global Multi-department Computable General Equilibrium (GMCGE) model based on the continuous global input-output database. It focuses on the Computable General Equilibrium (CGE) model that constructs a consistent interaction mechanism within the economic system and fully reflects the general equilibrium characteristics and thus tries to avoid the limitations of the partial equilibrium model. It shows how the GMCGE framework can distinguish the processing trade from non-processing trade in the input-output data, and at the same time ensure the endogenous equilibrium of the social accounting matrix (SAM) after distinction.

Readership: Academics, undergraduate and graduate students, professionals interested in China's economic development, trade surplus and RMB appreciation.

Frequently asked questions

Information

Chapter 1

Overestimated Trade Surplus

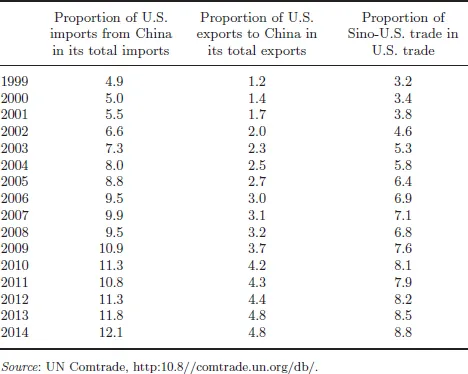

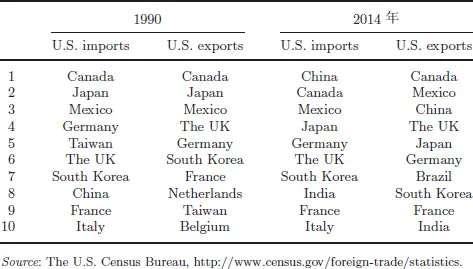

1.1. Rapid Development of the Sino-U.S. Bilateral Trade

1.2. Why Trade Deficit in U.S. Statistics is Higher than that in Chinese Statistics?

Table of contents

- Cover

- Halftitle

- Title

- Copyright

- Preface

- Contents

- Chapter 1. Overestimated Trade Surplus

- Chapter 2. On Trade Surplus from Property Rights

- Chapter 3. Interpreting the Economic Scale of China

- Chapter 4. Foreign Trade Dependence and Trade Weighted Method

- Chapter 5. The Standard in Judging the Exchange Rate

- Chapter 6. Stabilizing the Currency and Manipulating the Exchange Rate

- Chapter 7. Origin and Development of the High Savings Rate

- Chapter 8. Computable General Equilibrium Model for Exchange Rate Research

- Chapter 9. Effect of the Exchange Rate on Employment

- Chapter 10. The Impact of the Exchange Rate Adjustment on Import and Export

- Chapter 11. Range and Path of the RMB Appreciation

- Chapter 12. Economic Sanctions and Free Trade

- Chapter 13. The Debate is Far From Over

- References

- Index