![]()

VOLUME 4

Pricing Services and Revenue Management

What is a cynic? A man who knows the price of everything and the value of nothing.

Oscar Wilde

Irish author, playwright and poet, (1854–1900)

There are two fools in any market: One does not charge enough. The other charges too much.

Russian Proverb

EFFECTIVE PRICING IS CENTRAL TO FINANCIAL SUCCESS

Importantly, marketing is the only function that brings operating revenues into the organization. All other management functions incur costs. A business model is the mechanism whereby, through effective pricing, sales are transformed into revenues, costs are recovered, and value is created for owners of the business. As noted by Joan Magretta:

A good business model answer [American management consultant] Peter Drucker’s age-old questions: Who is the customer? And what does the customer value? It also answers the fundamental questions that every manager must ask: How do we make money in this business? What is the underlying economic logic that explains how we can deliver value to customers at an appropriate cost?1

Creating a viable service requires a business model that allows for the costs of creating and delivering the service, in addition to a margin for profits, to be recovered through realistic pricing and revenue management strategies.

However, the pricing of services is complicated. Consider the bewildering fee schedules of many consumer banks or cellphone service providers, or the fluctuating fare structure of a full-service airline. Service organizations even use different terms to describe the prices they set. Universities talk about tuition fees, professional firms collect fees, banks impose interest and service charges, brokers charge commissions, some expressways impose tolls, utilities set tariffs, and insurance companies determine premiums; the list goes on. Consumers often find service pricing difficult to understand (e.g., insurance products or hospital bills), risky (when enquiring about an intercontinental flight on three different days, three different prices may be offered), and sometimes even unethical (e.g., many bank and credit card users complain about a variety of fees and charges they consider to be unfair).

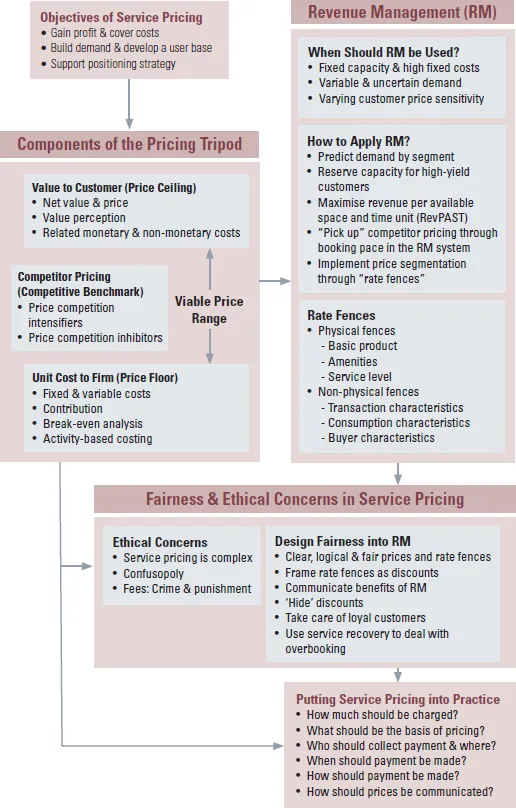

This volume explains how to set an effective pricing and revenue management strategy that fulfills the promise of the value proposition so that a value exchange takes place (i.e., the consumer decides to buy the service). An overview of is provided in Figure 1.

Objectives for Establishing Prices

Any pricing strategy must be based on a clear understanding of a company’s pricing objectives. The most common high-level pricing objectives are summarized in Table 1.

Figure 1: Organizing Framework for Pricing of Services

Table 1: Objectives for pricing of services

| Revenue and Profit Objectives |

| Gain Profit |

| •Make the largest possible long-term contribution or profit. •Achieve a specific target level, but do not seek to maximize profits. •Maximize revenue from a fixed capacity by varying prices and target segments over time. This is done typically using revenue management systems. |

| Cover Costs |

| •Cover fully allocated costs, including corporate overhead. •Cover costs of providing one particular service, excluding overhead. •Cover incremental costs of selling one extra unit or to serve one extra customer. |

| Patronage and User Base-Related Objectives |

| Build Demand |

| •Maximize demand (when capacity is not a restriction), provided a certain minimum level of revenue is achieved (e.g., many non-profit organizations are focused on encouraging usage rather than revenue, but they still have to cover costs). •Achieve full capacity utilization, especially when high capacity utilization adds to the value created for all customers (e.g., a “full house” adds excitement to a theater play or basketball game). |

| Develop a User Base |

| •Encourage trial and adoption of a service. This is especially important for new services with high infrastructure costs, and for membership-type services that generate a large amount of revenues from their continued usage after adoption (e.g., cell phone service subscriptions, or life insurance plans). •Build market share and/or a large user base, especially if there are large economies of scale that can lead to a competitive cost advantage (e.g., if development or fixed costs are high), or network effects where additional users enhance the value of the service to the existing user base (e.g., Facebook and LinkedIn). |

| Strategy-Related Objectives |

| Support Positioning Strategy |

| •Help and support the firm’s overall positioning and differentiation strategy (e.g., as a price leader, or portrait a premium image with premium pricing). •Promote a “We-will-not-be-undersold” positioning, whereby a firm promises the best possible service at the best possible price. That is, the firm wants to communicate that the offered quality of service products cannot be bought at a lower cost elsewhere. |

| Support Competitive Strategy |

| •Discourage existing competitors to expand capacity. •Discourage potential new competitors to enter the market. |

PRICING STRATEGY STANDS ON THREE FOUNDATIONS

The foundations of pricing strategy can be described as a tripod, with costs to the provider, competitors’ pricing, and value to the customer as the three legs (Figure 2). In many service industries, pricing used to be viewed from a financial and accounting standpoint, and therefore cost-plus pricing was used. Today, however, most service firms have a good understanding of value-based and competitive pricing. In the pricing tripod, the costs a firm needs to recover usually set a minimum price, or price floor, for a specific service offering, and the customer’s perceived value of the offering sets a maximum price, or price ceiling.

Figure 2: The pricing tripod

The price charged by competing services typically determines where the price can be set within the floor-to-ceiling range. The pricing objectives of the organization then determine where actual prices should be set, given the possible range provided by the pricing tripod analysis. Each leg of the pricing tripod will be examined in detail later.

Cost-Based Pricing

Pricing is typically more complex in services than it is in manufacturing. As there is no ownership of services, it is usually harder to determine the financial costs of creating a process or intangible real-time performance for a customer than it is to identify the labor, materials, machine time, storage, and shipping costs associated with producing and distributing a physical good. In addition, due to the labor and infrastructure needed to create performances, many service organizations have a much higher ratio of fixed costs to variable costs than is typically found in manufacturing firms. Service businesses with high fixed costs include those with expensive physical facilities (such as hospitals or colleges), or a fleet of vehicles (such as airlines or trucking companies), or a network (such as railroad, telecommunications, and gas pipeline companies).

Establishing the Costs of Providing Service. It is helpful to review how service costs can be estimated, using fixed, semi-variable, and variable costs, as well as how the notions of contribution and breakeven analysis can help in pricing decisions (see Marketing Review 6.1). These traditional cost-accounting approaches work well for service firms with a large proportion of variable and/or semi-variable costs (e.g., many professional services).

MARKETING REVIEW 1

Understanding Costs, Contribution, and Break-Even Analysis

Fixed costs are economic costs a supplier would continue to incur (at least in the short run) even if no services were sold. These costs typically include rent, depreciation, utilities, taxes, insurance, salaries and wages for managers and long-term employees, security, and interest payments.

Variable costs refer to the economic costs associated with serving an additional customer, such as making an additional bank transaction, or selling an additional seat on a flight. In many services, such costs are very low. For instance, very little labor or fuel cost is involved in transporting an extra passenger on a flight. In a theater, the cost of seating an extra patron is close to zero. More significant variable costs are associated with activities such as serving food and beverages or installing new parts when undertaking repairs, as they often include providing costly physical products in addition to labor. Just because a firm has sold a service at a price that exceeds its variable cost does not mean the firm is now profitable, since there are still fixed and semi-variable costs to be recouped.

Semi-variable costs fall in between fixed and variable costs. They represent expenses that rise or fall in a stepwise fashion as the volume of business increases or decreases. Examples include adding an extra flight to meet increased demand on a specific route, or hiring a part-time employee to work in a restaurant on busy weekends.

Contribution is the difference between the variable cost of selling an extra unit of service and the money received from the buyer of that service. It goes to cover fixed and semi-variable costs before creating profits.

Determining and allocating economic costs can be a challenging task in some service operations due to the difficulty of deciding how to assign fixed costs in a multi-service facility such as a hospital. For instance, certain fixed costs are associated with running the emergency department in a hospital. Beyond that, there are fixed costs of running the hospital. So, how much of the hospital’s fixed costs should be allocated to the emergency department? A hospital manager might use one of several approaches to calculate the emergency department’s share of overhead costs. These could include (1) the percentage of total floor space it occupies, (2) the percentage of employee hours or payroll it accounts for, or (3) the percentage of total patient contact hours involved. Each method is likely to yield a different fixed-cost allocation. One method might show the emergency department to be very profitable, while the other might flag it as a loss-making operation.

Breakeven analysis allows managers to know at what sales volume a service will become profitable. This is called the breakeven point. The necessary analysis involves dividing the total fixed and semi-variable costs by the contribution obtained on each unit of service. For example, if a 100-room hotel needs to cover fixed and semi-varia...